[ad_1]

Program/iStock via Getty Images

Introduction

I give the Vanguard S&P 500 ETF (VOO) a strong buy rating. The index has performed at incredible levels for over a hundred years, pays a dividend, and is the measuring bar for Wall Street. The most stress-free investment for good returns in the United States Equities market is VOO.

VOO is an ETF from Vanguard that tracks the S&P 500. The S&P 500 is approximately the 500 most prominent publicly traded companies in the United States. For more specific inclusion rules,

- The company should be from the U.S.

- Its market cap must be at least $8.2 billion.

- Its shares must be highly liquid.

- At least 50% of its outstanding shares must be available for public trading.

- It must report positive earnings in the most recent quarter.

- The sum of its earnings in the previous four quarters must be positive.

VOO and SPDR S&P 500 Trust ETF (SPY) are the two leading S&P 500 ETFs. I prefer VOO over SPY for one simple reason; it has a lower fee. VOO has an annual fee of a low 0.03% which is a third of the 0.09% annual fee that SPY charges. While both investments are very liquid, SPY is quite a bit more liquid and, for this reason, can be popular with investors who need that.

Historical Returns

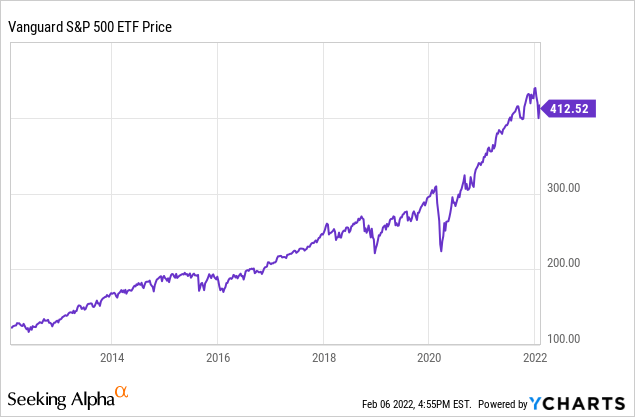

Over the past 90 years, the S&P 500 has had just under an average return of 10% per year. Over the last ten years, it has had an average return rate of 23.5%. It isn’t easy to pick good enough stocks to beat these numbers consistently.

Below is a ten-year chart of the stock:

Buy, Hold, and Don’t Think

The most effortless investment to make is buying into VOO, letting the investment sit, and not thinking about it. For an even better investment, have a reoccurring investment into the stock, so you buy the stock when it is high, when it is low, and when it is in the middle; that way, you can have a good price average while continuing to increase your investment.

You do not have to think about your investment in VOO because the index automatically rebalances itself with changing events. Every quarter, it rebalances itself based on how companies perform. Additionally, it varies based on new companies. If a significant new company comes onto the scene, it will be bought and become a part of the index once it meets the inclusion criteria. Similarly, if an old brand begins to perform poorly and shrink in value, it will be sold out of and removed from the list once it fails to meet the inclusion criteria. The small fee you pay is the price for someone else to track the index and adjust the investments accordingly.

What Warren Buffett Has to Say

Warren Buffett has made many public comments about the S&P 500 index. One famous comment he made was a bet in 2008 that a group of hedge funds would not outperform the index. The five funds chosen by the person opposite of the bet returned 36% over that period, a number well below the S&P 500’s 126% returns. Outside of the first year where each fund beat the index, the S&P 500 crushed the funds every year.

Another well-known saying from Warren Buffett about the index is that “for most people, the best thing to do is to own the S&P 500 index fund.” Warren made this statement knowing the difficulties of picking good companies and the stress-free environment of simply buying into the index and looking away. Even if an investor wants to pick some individual companies, having an investment in VOO is still a great idea.

Risks

An investment in VOO is affected by any changes in a specific sector in the United States market. If something happens to the travel industry, then the stock will not perform very well because the industry will bring down the returns of the whole stock. Additionally, VOO correlates to the broader United States economy. If the United States goes through a recession or slows growth, VOO will be negatively impacted.

Because VOO is a good benchmark for the market as a whole, if it is performing poorly, then the rest of the stock market is also probably performing poorly. In bull markets, VOO grows slower than high-growth companies, but in bear markets, VOO losses value slower than those same companies. On the contrary, VOO grows faster than value companies in bull markets, but in bear markets, VOO losses value quicker than those same companies. The index is a perfect middle between growth and value.

Conclusion

VOO is an investment that should be a part of every investor’s portfolio. In particular, it is perfect for investors just starting or investors who do not want to spend much time thinking about their stocks. An investment in VOO may not be glorious, but it will get the job done.

[ad_2]

Source links Google News