[ad_1]

DKosig/iStock via Getty Images

iShares MSCI World ETF (NYSEARCA:URTH) is an exchange-traded fund that provides global equity exposure, including U.S. equity exposure. The fund is relatively low cost for iShares funds, with an expense ratio of 0.24%, and the fund is an effective global diversifier (basically a source of “global equity beta”). Assets under management were $1.94 billion as of February 4, 2022, reflecting reasonably high popularity. URTH is perhaps the simplest way of achieving a relatively balanced exposure to global equities.

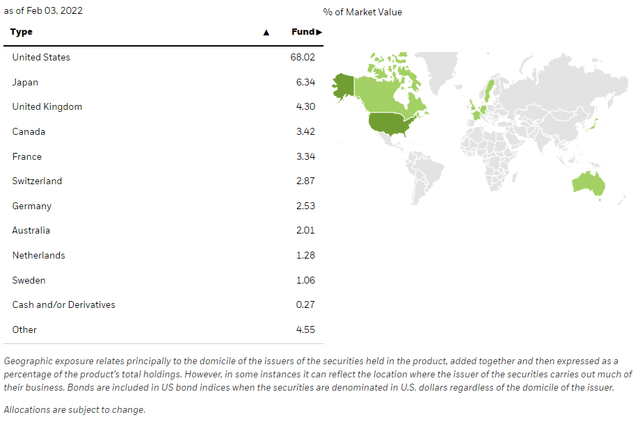

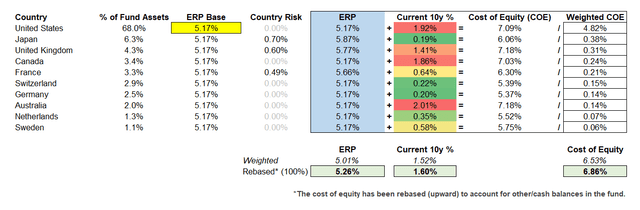

This also makes URTH useful to track, as any material misvaluation (on the upside or downside) could be instructive for global investors. While URTH’s portfolio has multiple geographical exposures, the United States still represents a high portion of the fund, currently at circa 68% (see below).

iShares.com

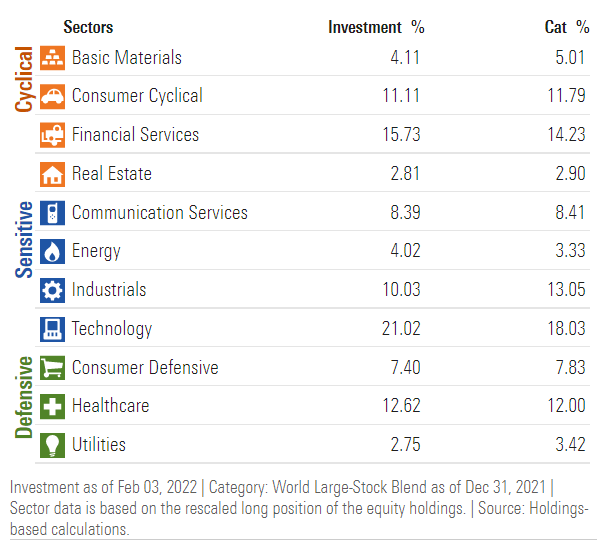

The fund invests in accordance with MSCI World, which is market-cap weighted and therefore naturally favors more developed equity markets like the United States. The World index “captures large and mid-cap representation across 23 Developed Markets” countries, covering “approximately 85% of the free float-adjusted market capitalization in each country”. Because of the heavy U.S. exposure, URTH is also significantly exposed to technology stocks; currently about 21% (see below).

Morningstar.com

Using Morningstar’s method of categorizing sector exposures, URTH’s portfolio is currently 43.46% exposed to economically sensitive sectors (including technology), 22.77% to defensive sectors (e.g. utilities), and 33.76% to cyclical sectors (like consumer cyclical stocks, real estate, banks, etc.). It is the sensitive and cyclical exposures that tend to enable funds to perform well during stronger phases of the business cycle. But you also have to balance this with underlying portfolio returns on equity; if the ROE is strong, funds can power through even the weaker phases of the business cycle.

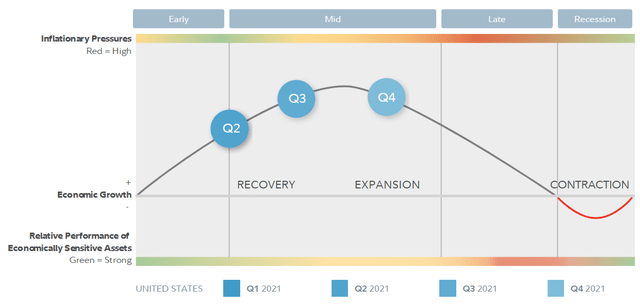

Currently, according to Fidelity research, the United States is currently in an expansionary phase of the business cycle (as of Q4 2021).

Fidelity.com

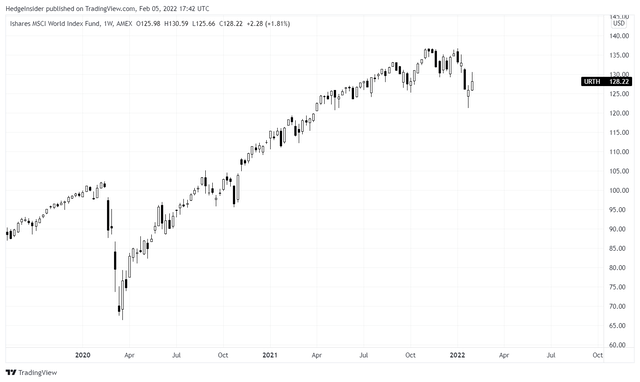

URTH has sold off recently though, into Q1 2022 (see below for recent price action using weekly candlesticks).

TradingView.com

I might argue that while markets are supposed to be forward-looking, recent risk-off sentiment would seem characteristic of markets getting ahead of themselves. There is plenty of uncertainty at the moment this year, as fiscal stimulus will not be as strong as in 2020/21. The so-called “credit impulse” (lending scaled by GDP) is also tailing off per data from the Bank of International Settlements. For example: U.S. bank credit to the private non-financial sector was 51.3% scaled by GDP in Q2 2021, as compared to 54.8% in Q2 2020. Still, BIS data also shows that the credit impulse is positive on a global scale; for “all reporting economies”, 101.5% in Q2 2021 vs. 98.2% in Q2 2020 (the effects of moves in the credit impulse can lag by 9-12 months).

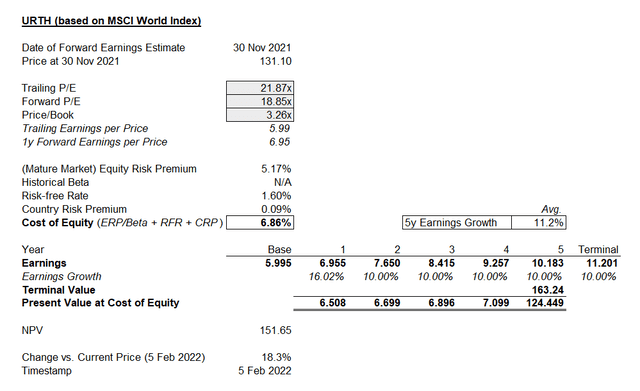

So, while the U.S. might be maturing in its current business cycle, and while domestic business credit growth may be slowing, it is probable that the global economy will continue to coast through 2022. And the underlying ROE of the MSCI World Index remains strong, with a forecasted forward ROE of 17.29%. That is calculated by taking the price/book ratio as of November 30, 2021 and dividing it into the forward price/earnings ratio of 18.85x as of the same date.

A forward price/earnings ratio of 18.85x is not too bad; when inverted, this indicates a forward earnings yield of 5.31%. The U.S. 10-year yield is currently 1.916%, so there is plenty of room here to justify URTH’s current valuation. However, to value URTH we would need to gauge the current fair cost of equity in light of the fund’s overall geographical allocations.

I have calculated the fair cost of equity as being 6.86% (see below), using data from Professor Damodaran (for the current equity risk premium estimate of 5.17%, plus country risk premiums), and World Government Bonds for 10-year yields for each country (the best proxy for so-called “risk-free rates”).

Author’s Calculations

Morningstar consensus analyst estimates currently peg three- to five-year average earnings growth rates at circa 13.46% (expected). We can use that as inspiration, together with other data already cited, to gauge URTH’s valuation. Because the forward price/earnings ratio implies earnings growth of circa 16%, I am going to assume 10% average earnings growth thereafter for the moment (over the next few years) to bring the five-year average down to about 11% (just under Morningstar’s number).

Author’s Calculations

The net result is that URTH looks like it is undervalued, with potential upside of about 18.3%. That is in spite of both the equity risk premium and risk-free rates rising recently. With an elevated cost of equity (for URTH, I previously estimated the fund’s fair cost of equity at 6.16% in November 2021 vs. my current estimate for February 2022 of 6.86%), URTH still seems to offer upside.

This can be in part explained by the fact that the fund is globally diversified, hence you are in a sense capturing low expected returns (via low risk-free rates) in various mature markets like Japan and Germany (outside the United States). And yet, the fund is still invested in high-ROE countries like the United States. What it means by implication is that markets like U.S. equities should remain attractive to typically lower-return countries like Japan and Germany. From a portfolio perspective, URTH’s valuation looks bullish for global stocks.

Therefore, while markets have turned down into the beginning of Q1 2022, I would say that this is mostly due to weaker sentiment. While I do think there is a reasonable case for negative earnings surprises (not just in pockets of the market, but more broadly) in the future, I do not think there is currently good reason to try to “front-run” potential economic chaos. Investors “buying the dip” at this juncture are likely to be rewarded, as valuations (in aggregate) are simply not high or expensive enough to justify a protracted bear market, or significant further decline.

In summary, I would maintain a bullish bias on URTH and global stocks.

[ad_2]

Source links Google News