[ad_1]

TomasSereda/iStock via Getty Images

This monthly dashboard series reports sector metrics in the S&P 500 index. It is also a top-down analysis of all ETFs tracking this index. Among them, the iShares Core S&P 500 ETF (IVV) is the second most popular behind the SPDR S&P 500 ETF (SPY) regarding assets under management and average daily volume. It is also cheaper in management fee, with a 0.03% expense ratio vs. 0.09% for SPY.

Shortcut

The next two paragraphs in italic describe the dashboard methodology. They are necessary for new readers to understand the metrics. If you are used to this series or if you are short of time, you can skip them and go to the charts.

Base Metrics

I calculate the median value of five fundamental ratios in every sector: Earnings Yield (“EY”), Sales Yield (“SY”), Free Cash Flow Yield (“FY”), Return on Equity (“ROE”), Gross Margin (“GM”). All are calculated on trailing 12 months. For all these ratios, higher is better and negative is bad. EY, SY and FY are medians of the inverse of Price/Earnings, Price/Sales and Price/Free Cash Flow. They are better for statistical studies than price-to-something ratios, which are unusable when the “something” is close to zero or negative (for example, companies with negative earnings). I also calculate two momentum metrics for each group: the median monthly return (RetM) and the median annual return (RetY).

I prefer medians rather than averages because a median splits a set in a good half and a bad half. Capital-weighted averages are skewed by extreme values and the largest companies. As a consequence, these metrics are designed for stock-picking rather than index investing.

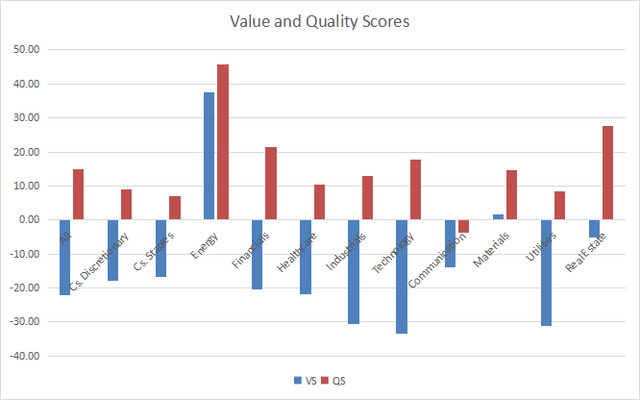

Value and Quality Scores

Historical baselines are calculated as the averages on a look-back period of 11 years for all metrics. They are noted respectively EYh, SYh, FYh, ROEh, GMh. For example, the value of EYh for technology in the table below is the 11-year average of the median Earnings Yield of S&P 500 tech companies.

The Value Score “VS” is the average difference in % between the three valuation ratios (EY, SY, FY) and their baselines (EYh, SYh, FYh). The same way, the Quality Score “QS” is the average difference between the two quality ratios (ROE, GM) and their baselines (ROEh, GMh).

VS may be interpreted as the percentage of undervaluation or overvaluation relative to the baseline (positive is good, negative is bad). This interpretation must be taken with caution: the baseline is an arbitrary reference, not a supposed fair value. The formula assumes that the three valuation metrics are of equal importance, except in energy and utilities where the Free Cash Flow Yield is ignored to avoid some inconsistencies. A floor of -100 is set for VS and QS when the calculation goes below this value. It may happen when metrics in a sector are very bad.

Current data

The next table shows the metrics and scores as of last week’s closing. Columns stand for all the data defined above.

|

VS |

QS |

EY |

SY |

FY |

ROE |

GM |

EYh |

SYh |

FYh |

ROEh |

GMh |

RetM |

RetY |

|

|

All |

-22.18 |

14.88 |

0.0380 |

0.2936 |

0.0272 |

18.18 |

48.45 |

0.0461 |

0.4661 |

0.0309 |

14.70 |

45.68 |

-4.64% |

19.94% |

|

Cs. Discretionary |

-17.77 |

8.91 |

0.0432 |

0.4702 |

0.0284 |

25.67 |

34.36 |

0.0474 |

0.6844 |

0.0327 |

20.71 |

36.62 |

-8.52% |

16.28% |

|

Cs. Staples |

-16.82 |

7.03 |

0.0351 |

0.4375 |

0.0207 |

28.10 |

38.77 |

0.0455 |

0.5143 |

0.0237 |

23.41 |

41.22 |

0.39% |

14.27% |

|

Energy |

37.52 |

45.64 |

0.0324 |

0.4483 |

0.0343 |

8.35 |

48.37 |

0.0169 |

0.5380 |

-0.0181 |

4.73 |

42.12 |

17.57% |

73.52% |

|

Financials |

-20.52 |

21.43 |

0.0774 |

0.2998 |

0.0445 |

13.59 |

80.79 |

0.0676 |

0.4717 |

0.0737 |

10.35 |

72.41 |

2.74% |

35.66% |

|

Healthcare |

-21.69 |

10.55 |

0.0324 |

0.2160 |

0.0319 |

19.30 |

63.76 |

0.0388 |

0.3150 |

0.0385 |

16.24 |

62.36 |

-7.21% |

11.62% |

|

Industrials |

-30.46 |

12.99 |

0.0334 |

0.3325 |

0.0253 |

24.98 |

37.48 |

0.0479 |

0.6033 |

0.0302 |

20.08 |

36.89 |

-6.92% |

24.01% |

|

Technology |

-33.38 |

17.81 |

0.0305 |

0.1654 |

0.0275 |

27.28 |

63.10 |

0.0415 |

0.2981 |

0.0388 |

20.28 |

62.40 |

-11.74% |

18.71% |

|

Communication |

-13.97 |

-3.82 |

0.0385 |

0.4963 |

0.0349 |

15.19 |

55.32 |

0.0495 |

0.5309 |

0.0402 |

16.62 |

54.80 |

-4.49% |

-2.53% |

|

Materials |

1.76 |

14.52 |

0.0456 |

0.4480 |

0.0341 |

20.38 |

37.47 |

0.0447 |

0.6348 |

0.0257 |

16.39 |

35.78 |

-4.30% |

15.75% |

|

Utilities |

-31.14 |

8.41 |

0.0403 |

0.3556 |

-0.0670 |

10.10 |

43.71 |

0.0527 |

0.5805 |

-0.0439 |

9.72 |

38.73 |

0.19% |

16.55% |

|

Real Estate |

-5.09 |

27.53 |

0.0241 |

0.0911 |

0.0058 |

8.96 |

66.48 |

0.0198 |

0.1172 |

0.0068 |

5.84 |

65.44 |

-5.16% |

43.03% |

Score charts

The next chart plots the value and quality scores by sectors (higher is better).

Value and Quality in sectors (Chart: author; data: Portfolio123)

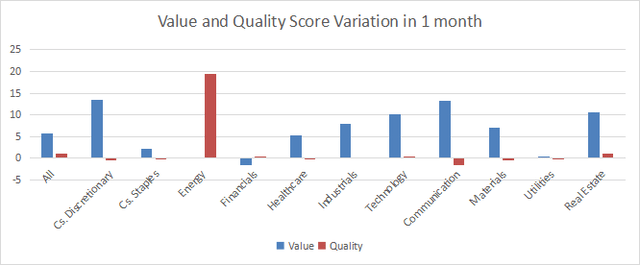

Score variation since last month:

Value and Quality variations (Chart: author; data: Portfolio123)

Chart: author; data: Portfolio123

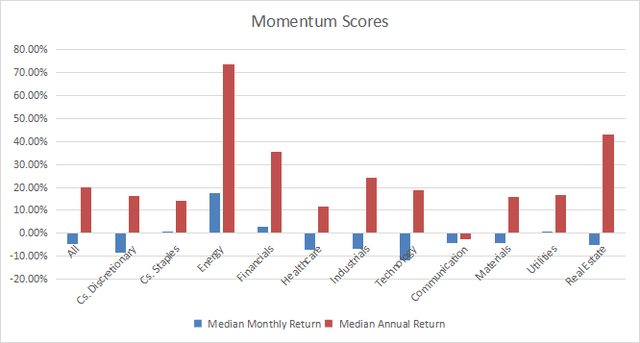

The next chart plots momentum data.

Momentum in sectors (Chart: author; data: Portfolio123)

Interpretation

A hypothetical S&P 500 “median” company is overvalued by about 22% relative to average valuation metrics since 2010. The quality score is about 15 points above the baseline. We can translate median yields in their inverse ratios:

Price/Earnings: 26.32 – Price/Sales: 3.41 – Price/Free Cash Flow: 36.76

They have improved since last month due to a drop in prices.

From a fundamental point of view, energy is the most attractive sector with the best value and quality scores. Several sectors improved in value score since last month due to lower prices. Energy is the only one with an improvement in quality score, and it is almost unchanged in value score, despite being the best sector in price momentum (not only monthly, but also annual). Materials is the only other sector above the baseline in both value and quality scores (though less impressive than energy). Real estate looks good too: overpriced by 5% relative to 11-year averages, but far above the baseline in quality. The metrics we are using here are not the most relevant in this sector, but comparing their aggregate at different points in time makes sense. Consumer staples, consumer discretionary, communication are moderately overvalued (by 14% to 18%). It may be partly justified by good quality scores, except in communication. Other sectors are overvalued by 20% to 34%. Technology, utilities and industrials look the most overpriced. However, technology has an excellent quality score. In fact, all sectors except communication are above their quality baseline.

The S&P 500 has gained 19.6% in 12 months, the momentum measured in median return is 19.9% and the equal-weight average is 21.4% (measured on RSP). It means the S&P 500 performance was not skewed by big tech companies. Return is significantly lower for the S&P mid-cap 400 index (+10.4% for MDY) and is in negative territory for the Russell 2000 (-4.4% for IWM). If performance was quite homogeneous in a large universe, mid and small caps have been seriously lagging.

We use the table above to calculate value and quality scores. It may also be used in a stock-picking process to check how companies stand among their peers. For example, the EY column tells that a large consumer staples company with an Earnings Yield above 0.0351 (or price/earnings below 28.49) is in the better half of the sector regarding this metric. A Dashboard List is sent every month to Quantitative Risk & Value subscribers with the most profitable companies standing in the better half among their peers regarding the three valuation metrics at the same time.

[ad_2]

Source links Google News