[ad_1]

Igor Nikushin/iStock via Getty Images

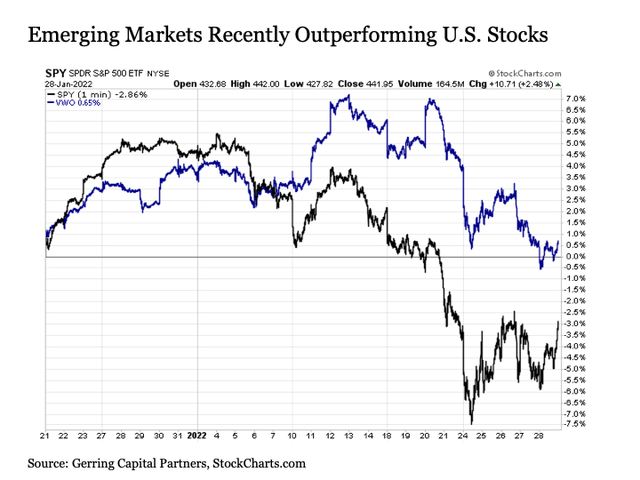

Emerging market stocks have recently been a relative underperformer. Stocks have clearly been struggling over the last several weeks. But a notable bright spot since just before Christmas has been the relative outperformance of emerging market stocks. While U.S. stocks have been lower in recent weeks, emerging markets are incrementally positive.

StockCharts.com

Could this be foreshadowing the development of a more prolonged trend of emerging market leadership as we continue through 2022? Not only does this appear unlikely for a number of key reasons, but the risks confronting many emerging markets going forward threaten to have spillover effects impacting investors across asset classes.

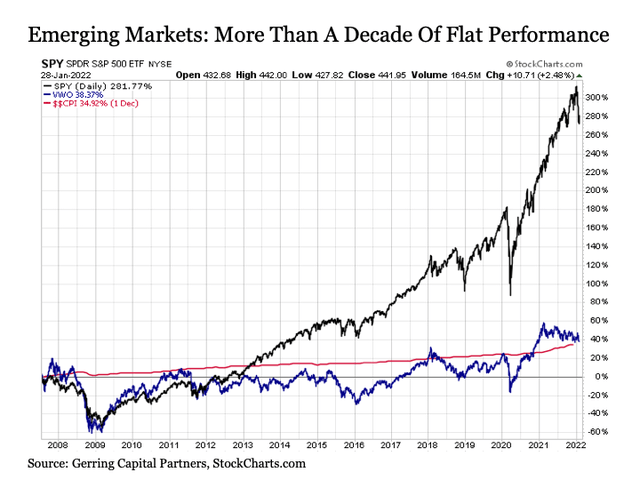

Nearly fifteen years of nothing. While emerging markets may be showing some signs of relative life as of late, the longer-term historical trend has been stuck on the ground. While U.S. stocks as measured by the S&P 500 Index have skyrocketed since the onset of the Great Financial Crisis nearly fifteen years ago, emerging market stocks have continuously languished with cumulative total returns that are only marginally positive and that have barely kept pace with inflation over this time period. In other words, an emerging market allocation has effectively yielded investors a real return of zero over the past fifteen years, which is particularly disconcerting considering how much risk comes with the category.

StockCharts.com

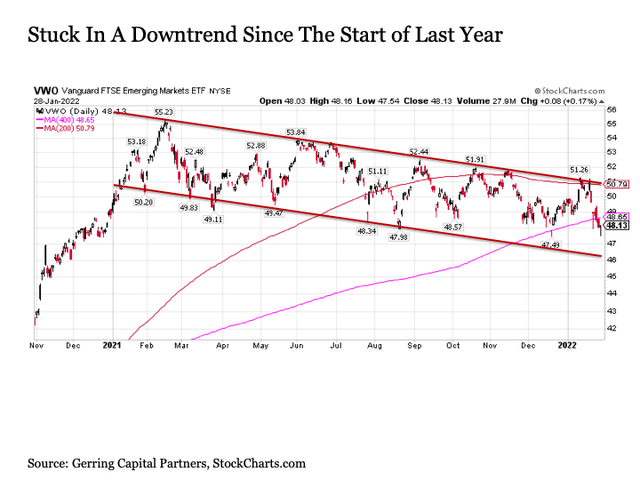

Stuck in a downtrend. Adding to the ugliness is the fact that emerging markets have been stuck in a grinding downtrend dating back to the start of 2021. In the process, emerging markets have pierced technical support at both their long-term 200-day moving average (red line) and ultra long-term 400-day moving average (pink line).

StockCharts.com

Of course, the optimist could look at these two charts and consider the following. Given the extraordinary underperformance versus U.S. stocks dating back a decade and a half along with the prolonged weakness over the last year, perhaps the time has come for geographic rotation out of the U.S. and into emerging market stocks?

While such an outcome is certainly possible – I’ve seen much crazier things lately like an already bankrupt company octupling in price for essentially no reason, a mostly washed up gaming retailer explode by +18,693% from trough to peak, a fundamentally challenged movie theater company jump by over +3,700% in the midst of a pandemic when nobody was going to the movies, and the CEO of one of the largest companies in the U.S. make a flippantly blatant marijuana reference over social media related to the supposed secured private takeover funding of his company only to continue largely undiminished in his job, so anything is possible these days – it is not likely if reality and fundamentals have anything to say about it.

For the purposes of this discussion, I will be focusing on the Vanguard FTSE Emerging Markets ETF (VWO). Why not the iShares MSCI and Core MSCI Emerging Markets ETFs (EEM) (IEMG)? Because I am inclined to exclude South Korea (EWY) as being part of the emerging market universe, as I view this more as a developed market today. FTSE excludes South Korea while MSCI currently allocates roughly 11.5%. To provide context for the discussion that will follow, here are the top country weights to emerging markets in the VWO as of the end of last year:

China 34.8%

Taiwan 19.7%

India 15.5%

Brazil 5.0%

South Africa 3.7%

Saudi Arabia 3.6%

Russia 3.1%

Thailand 2.6%

Mexico 2.3%

Malaysia 2.0%

Indonesia 1.6%

In summary, ~70% of your emerging market investment is allocated to just three countries in China, Taiwan, and India. Adding in just Brazil, South Africa, and Saudi Arabia gets us to 80%. And throwing in Russia, Thailand, and Mexico pushes us over 90%. Just nine countries make up nearly all of your emerging market allocation. In other words, a typical broad emerging markets allocation is much more concentrated and much less diversified than the average investor might think.

So why should investors exercise pause when considering a broad emerging markets allocation going forward. The following are a few key reasons.

1. China

China (FXI)(GXC)(ASHR) is by far the largest economy and market across emerging markets. The second largest economy in the world behind only the U.S. at $16.9 trillion in GDP according to International Monetary Fund (IMF) estimates for 2021, it’s is more than double the size of the economies of Taiwan, India (EPI)(PIN), Brazil (EWZ), South Africa (EZA), Saudi Arabia (KSA), and Russia (RSX) combined. Moreover, it makes up more than one-third of an investor’s total allocation to the broad emerging market ETF allocations like VWO. In short, what happens in China plays a big part in determining overall emerging market stock performance.

The China economy has already been struggling with slowing economic growth due to deepening challenges related to property construction, energy shortages, and the dampening effects of COVID including the recent Omicron variant. Such challenges are expected to persist at least over the next one to two years, as the IMF recently slashed its growth forecast for China for the year ahead.

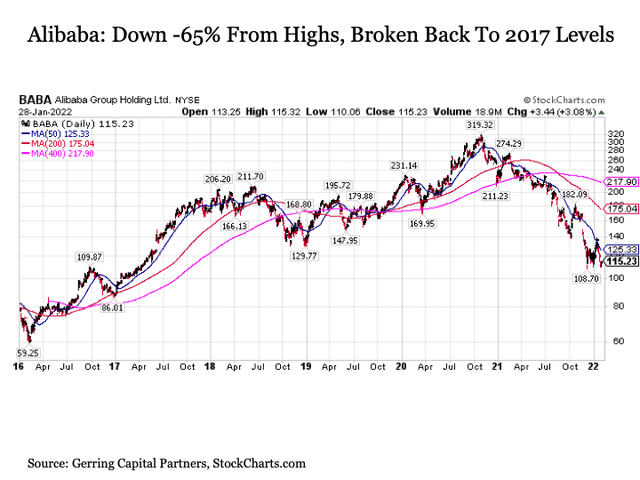

The greater deterrent to a dedicated allocation to China at the present time, however, is the increasing shift by the government away from more market-oriented principles and back toward command economy policies. This has included crackdowns on a variety of industries and segments of society in the pursuit of “common prosperity”. My preference has always been to seek to allocate capital where it will be treated best, and private capital is currently being treated with increasing disregard in China. One has to look no further than the shares of one-time high flyer Alibaba (BABA) to see how shifts in China’s policy is impacting financial markets. And one gets the sense that this shift emphasis marks the beginning and not the end of how policy toward private market activity is likely to evolve in China going forward.

StockCharts.com

Another downside risk related to China leads to the next concern for emerging markets.

2. Taiwan

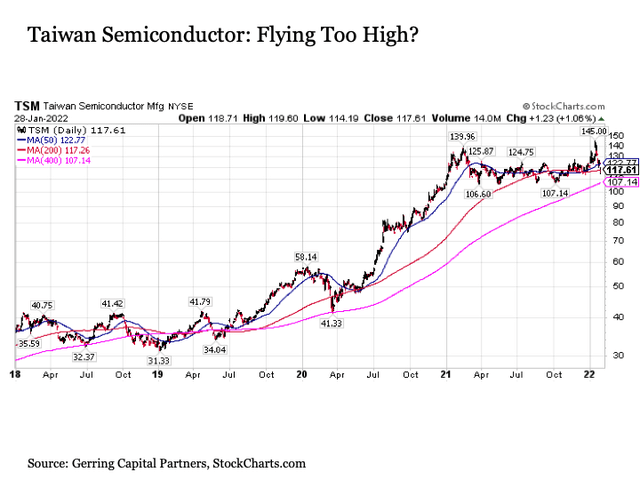

While I have considered allocating specifically to Taiwan (EWT) as recently as 2020, it ranks toward the top of my list of concerns associated with emerging markets generally at the start of 2022.

The first issue is the very top heavy nature of Taiwan’s market today. Taiwan Semiconductor (TSM) makes up roughly one-quarter of the entire market weighting of the second largest country across emerging markets. As a result, TSM is the largest holding the VWO at 6.80%, as company shares exploded into the stratosphere in the wake of the COVID crisis.

StockCharts.com

The issue at present is that even though the company has been grinding sideways for nearly a year now, it is still trading at 30 times earnings. The problem here is that the company has historically traded with an average multiple in the 13 to 17 times range. I know we have a global semiconductor shortage, but how much of the benefit to TSM’s business and future earnings is already reflected in a semiconductor company (arguably among the most cyclical industries across the economy) that is trading at more than double its average historical multiple? In short, I like the company, but not sure how I feel about the stock at these prices.

The second and arguably much bigger concern associated with Taiwan’s hefty allocation across broader emerging markets is the geopolitical threat that China might make aggressive moves toward a country that it still considers its own. The fact that China has essentially trampled all over the agreement as stated in the Hong Kong Basic Law nearly three decades early with nothing more than essentially a shoulder shrug from the global community suggests that Taiwan is now the logical next destination for China to assert itself. The threat of global military conflict breaking out over the China-Taiwan situation ranks among my highest downside risks for global markets and the economy over the next two to three years, and roughly 55% of a total emerging markets allocation would be dedicated to the two countries at the center of this issue.

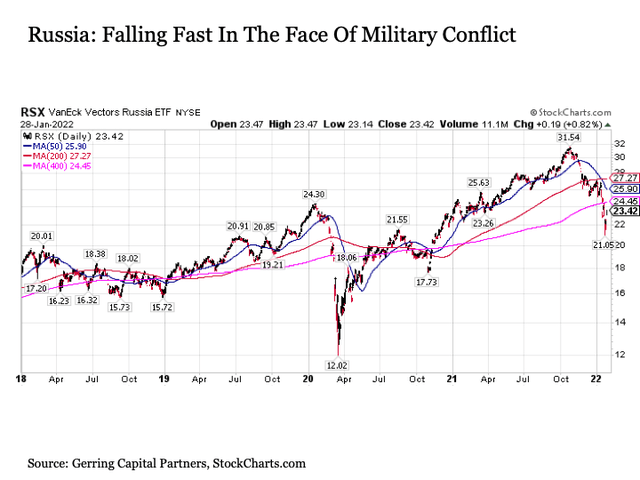

3. Russia

Staying on the topic of geopolitical risks, another major emerging market, Russia, is at the heart of the other major unfolding plot of potential military aggression. I should note that in all of my years of investing, I have never allocated directly to the Russia stock market, nor do I anticipate allocating to it at any time in the foreseeable future for reasons of quality and transparency. Russian stocks have already been struggling mightily since October, having fallen by roughly one-third from peak to trough along the way. And if Russia were to follow through with its threatened invasion of Ukraine, considerable further Russian market downside should be anticipated, which would serve to drag on the broader emerging market index.

StockCharts.com

4. The Fragile Four – Brazil, South Africa, Mexico, and Indonesia

These four countries together make up another one-eighth (12.6%) of broader emerging markets, and each are struggling to varying degrees with the common dilemma of already weak and deteriorating economic growth, spiking inflation, and significantly deteriorated fiscal health. It’s dubious enough when the largest economy in the world and keeper of the global reserve currency in the United States starts borrowing and printing money like there’s no tomorrow, but it’s another thing altogether when emerging markets with a history of financial instability engage in similar practices. Each of these countries have seen real GDP growth slow markedly, if not turn outright negative, inflation has surged dramatically, if not more than double in many cases, and government debt to GDP ratios have jumped measurably.

Another threat confronting these four countries is the relatively high levels of dollar denominated debt. Already economically challenged, the fact that the U.S. Federal Reserve is on the brink of starting to aggressively tightening monetary policy including the potential for interest rate hikes beginning as early as March threatens to put meaningful additional pressure on these already wobbly economies.

5. From Top To Bottom

While we have addressed issues confronting countries that make up more than 70% of the entire emerging market universe, it’s not as though the picture is any better for the rest.

The economic bind confronting Turkey (TUR) (0.5% weight in the VWO) is well documented, and the fact that the Turkish central bank is being compelled to lower interest rates with hyperinflation already north of 35% is not a situation that sets up to end well at all.

Then there are the economies of Chile (ECH), Colombia (GXG), Hungary, Peru (EPU), the Philippines (EPHE), Romania, and Thailand (THD) – together make up another roughly 5% of broader emerging markets – that all face the very same problems as their larger emerging market counterparts to varying degrees. And once again, the U.S. Federal Reserve moving swiftly to tighten monetary policy does none of these economies any favors in the midst of these challenges.

Bottom line. Now is not the time to allocate to emerging markets. They have chronically underperformed the United States stock market for over a decade now, and they are an unlikely destination for investors to rotate even if U.S. markets turn decidedly south in their own right in 2022. Deteriorating economic growth, soaring inflation, and deeply eroded sovereign financial health appear to become more profound challenges confronting many of these emerging markets in the year ahead, and the added threat of imminent geopolitical risk only adds to the complications for any such allocations. Add in the fact that the U.S. Federal Reserve is set to start raising rates with the dollar denominated debt exposures with a number of these economies. And it’s not as though valuations are all that inexpensive across many of these markets either.

Even if one were inclined toward bottom fishing in emerging markets, it is likely still best to wait for the time being, as the situation appears set to become even more challenging with little to no bottom inflection point in sight for many of these markets.

For all of these reasons, it remains prudent to, at minimum, underweight emerging market stocks in a broad asset allocation strategy (I should note that I have been zero weight for some time) for the foreseeable future at least until such time that fundamental economic and market conditions start to show preliminary signs of improvement.

[ad_2]

Source links Google News