[ad_1]

marchmeena29/iStock via Getty Images

Thesis

We first wrote our bull thesis on Schwab U.S. Dividend Equity ETF (SCHD) on July 16, 2021. The key argument then was that its yield spread was 1.68% at that time against 10-year Treasury bonds, close to the widest level of the historical spectrum. Therefore, it offers an attractive entry point.

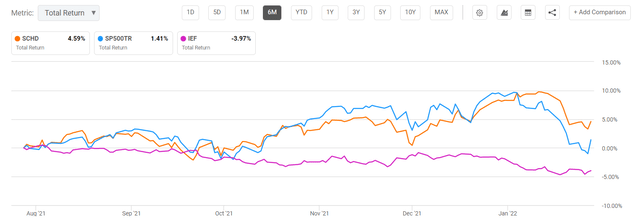

Indeed, as you can see from the following chart, the fund has delivered a leading performance both relative to the overall market and the Treasury bond by a good margin. Its total return has been more than 4% above the total market and more than 8% above the 10-year Treasury bond.

Author based on Seeking Alpha data

Now with the recent sharp interest rates hikes and SCHD’s own price appreciation, some readers asked if the bull thesis needs to be updated or not. You will see in this analysis that our bull thesis remains. Looking forward, we expect it to keep leading the overall market given its healthy yield spread above Treasury rates and attractive valuation.

Valuation has become even more attractive now

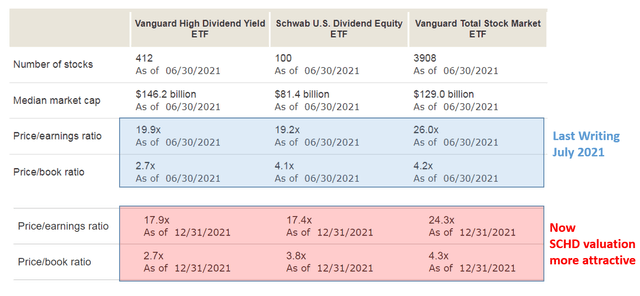

As a large-cap value fund, SCHD features a less expensive valuation compared to the currently elevated overall market. As can be seen from the following chart, when we wrote our bull thesis back in July 2021, the fund features a PE ratio of 19.2x, compared to 26x of the overall market represented by the Vanguard Total Stock Market Index Fund ETF Shares (VTI). It is a pretty significant 26% discount. It also featured a small discount relative to a similar competing fund, the Vanguard High Dividend Yield Index Fund ETF Shares (VYM).

Now, despite SCHD’s leading price appreciation, its valuation has actually become even more attractive compared to the overall market. As you can see from the folding table, its valuation is now 17.4x PE, compared to the 24.3x PE from the overall market. Both its own valuation and the valuation of the overall market have compressed by 9.8% and 6.5% respectively since then. And the discount between SCHD and the overall market has become even large, more than 28%.

Author and Vanguard Group

Yield spread has narrowed, but still at an attractive level

As detailed in our original article, for bond-like equity funds such as SCHD which pays regular dividends, a major indicator we rely on (and with good success) has been the yield spread. More specifically:

The yield spread is defined as the TTM dividend yield minus the 10-year Treasury bond yield.

The spread was effective because it provides a measurement of the risk premium investors are paying. A large spread provides a higher margin of safety, and vice versa, therefore serving as an effective valuation and market timing indicator.

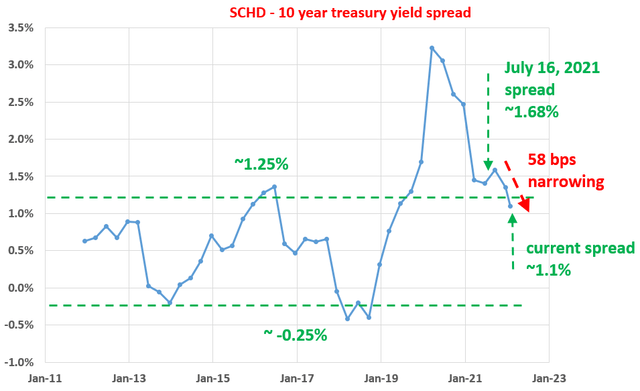

The following chart shows the yield spread between SCHD and the 10-year Treasury. As can be seen, the spread is bounded and tractable. The spread has been in the range between about 1.25% and -0.25% the majority of the time. Suggesting that when the spread is near or above 1.25%, SCHD is significantly undervalued relative to 10-year Treasury bond (i.e., I would sell Treasury bond and buy SCHD). In other words, sellers of SCHD are willing to sell it (essentially an equity bond) to me at a yield of 1.25% above the risk-free yield. So it is a good bargain for me. And vice versa.

As of our last writing, the yield spread is 1.68% as shown, close to the widest end in its historical record, suggesting very manageable risks in the near term. And as aforementioned, the fund has delivered both price appreciation and total return leading both the overall stock market and bond market by a good margin since then.

As of this writing, the spread has narrowed down by quite a bit to 1.1% as you can see. The sharp narrowing was both due to its own price appreciation and also the sharp rate hikes in Treasury bonds. However, despite the sharp narrowing, the current yield spread of 1.1% is still close to the widest level of the historical spectrum. Such a wide yield spread still provides a healthy cushion for investors against further interest rate rises ahead.

Such a healthy yield spread, and attractive valuation discussed above, are the main reasons why we still maintain our bull thesis.

Author

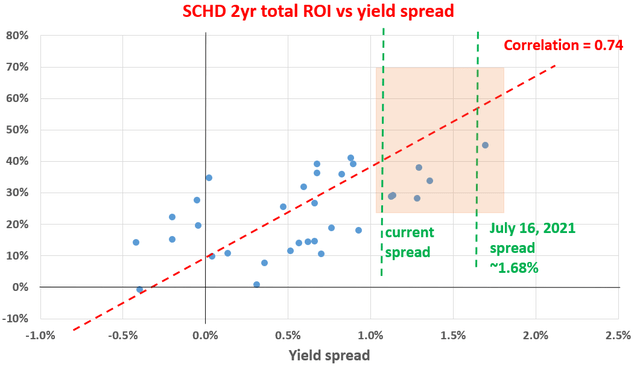

Furthermore, the wide spread also suggests favorable odds for a price appreciation in the near term. The next chart shows the two-year total return on SCHD (including price appreciation and dividend) when the purchase was made under different yield spread. As detailed in our earlier article:

You can see there is a clear positive trend, indicating that the odds and amount of the total return increases as the yield spread increases. More specifically, the correlation coefficient is 0.74, suggesting a strong correlation. Particularly as shown in the orange box, when the spread is about 1% or higher, the total returns in the next two years have been all positive and very large (ranging from 28% to ~50% total return).

And again, as of this writing, the yield spread is 1.1%, close to the widest level of the historical spectrum, suggesting favorable odds for a sizable price appreciation and a solid total return in the near future.

Author

Conclusions and final thoughts

The SCHD is an excellent fund all around. It can serve as the core or complement in any diversified portfolio at a rock-bottom cost. It has delivered excellent performance in the past, and we are confident that its performance will continue given the diversified and high-quality U.S. companies it holds. In particular:

- Despite its leading price appreciation since our last writing, its valuation has actually become even more attractive when compared to the overall market. Its valuation is now 17.4x PE. Compared to the 24.3x PE from the overall market, you get a discount of more than 28%.

- Moreover, its yield spread is 1.1% as of this writing. Admittedly, it has narrowed sharply by 58 basis points since our original bull thesis was published. However, despite the sharp narrowing, the current yield spread of 1.1% is still close to the widest level of the historical spectrum. Such a wide yield spread still provides a healthy cushion for investors against further interest rate rises ahead and also suggests good odds for solid returns in the near term.

Thx for reading and look forward to your comments!

Marketplace launch coming soon

If you enjoyed this, watch us for what’s coming! We are launching a Marketplace service in partnership with Envision Research on Feb 1. Mark your calendar. The first 25 annual subscribers get a 30% lifetime discount off the best price. We will provide a suite of exclusive features (our best ideas, direct access to us for Q&A, model portfolios, etc.) to help you strike an optimal balance between short-term income and long-term aggressive growth.

[ad_2]

Source links Google News