[ad_1]

gesrey/iStock via Getty Images

Inflation is like sin; every government denounces it and every government practices it. – Frederick Leith-Ross

Introduction

Unless you’ve been living under a rock, you’d be well aware that the theme of inflation is something that has hogged the limelight and upended the world these past few months.

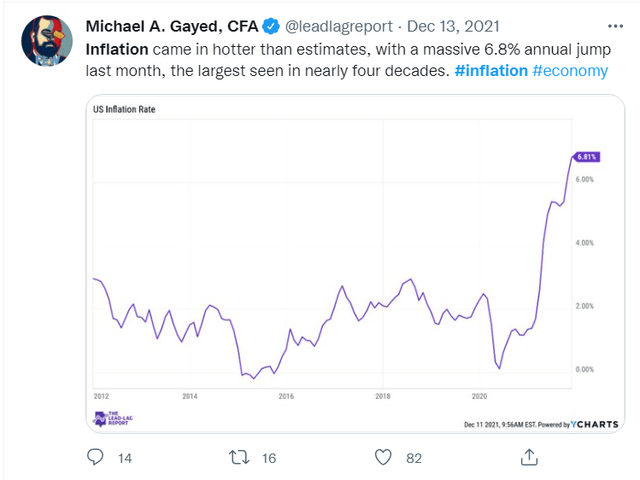

YCharts

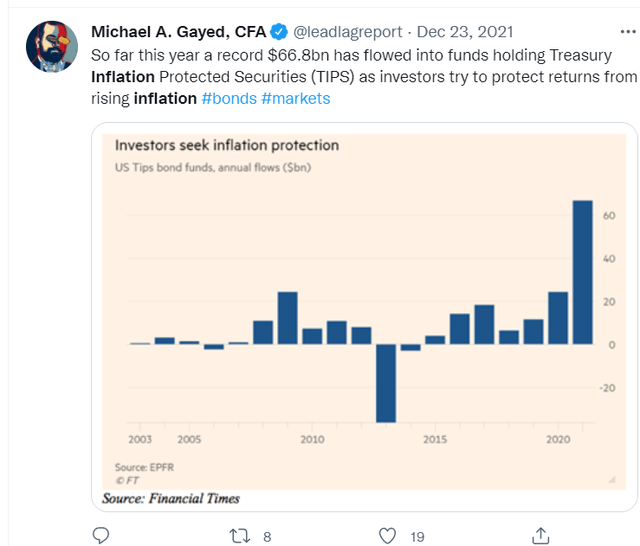

As flagged in The Lead-Lag Report, if you thought the November reading of 6.8% (incidentally a four-decade high) was bad enough, what do you say about the CPI reading for December, which was even higher at 7%? Clearly, this is a serious talking point, and market participants have been looking to position themselves accordingly. We’ve seen this play out in the bond market where Treasury Inflation-Protected Securities (TIPS) garnered a sizeable chunk of nearly $70bn of investment flows. As you can see from the image which I also shared in The Lead-Lag Report, traditionally, this is a segment that has only really seen fund flows $25bn or lower! This gives you a sense of the appetite we’ve seen.

Twitter

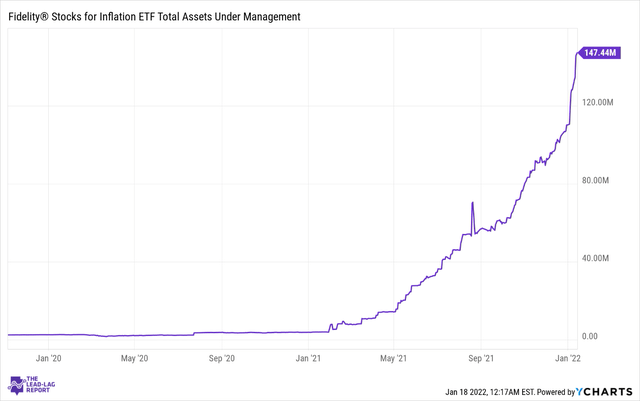

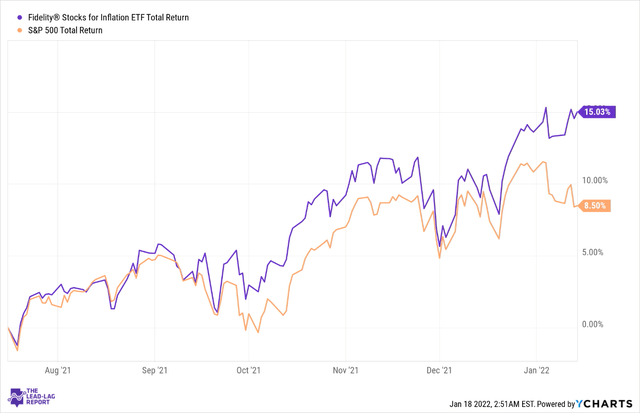

In the equity markets, you can see this being reflected in one of the inflation-themed products – The Fidelity Stocks for Inflation ETF (FCPI). Just to contextualize the level of interest, do consider that a year ago, this was an ETF that had only seen an AUM of less than $5m. You can see how things have exploded, particularly in the second half of last year, with the ETF now having garnered AUM that is nearly 30x the AUM seen last year!

YCharts

FCPI – Yes or No?

Clearly, FCPI is in vogue but is it too late to jump in and what other factors should you be aware of?

Firstly, do note that there’s a bit of ambiguity with regards to how FCPI’s tracking index is constructed. FCPI tracks the Fidelity Stocks for Inflation Factor Index and here, a ruled-based “proprietary” methodology has been used to select the concerned stocks. The goal is to track large and mid-cap US stocks with “attractive valuations, high-quality profiles, and positive momentum signals, emphasizing industries that tend to outperform in inflationary environments”. As you can see from the previous line, even though this is supposed to be an inflation-themed ETF on paper, the primary emphasis appears to be factors like “valuations”, “quality”, and “momentum”; inflation, if anything appears to be a secondary consideration.

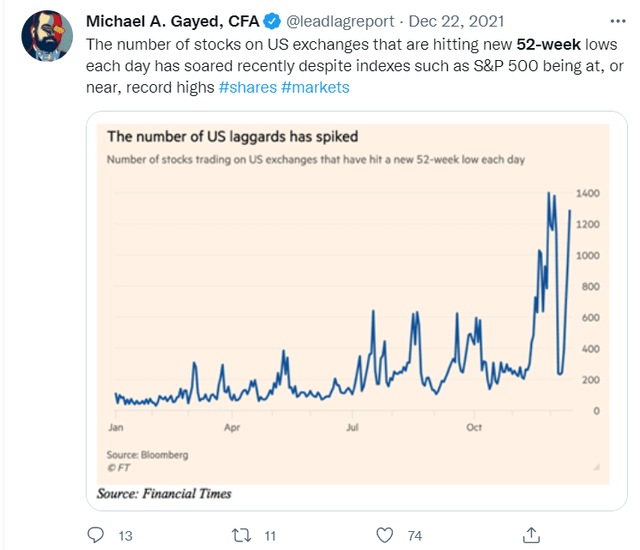

Then if I dig further into the portfolio, I can see that this is something that is dominated by large-caps and tech names. If you’re a subscriber to The Lead-Lag Report, you’d note that I’ve been highlighting themes of mean-reversion within various segments of the market. Around a month ago, I had flagged how the large-cap and tech-dominated S&P500 was soaring, even as other stocks were plummeting to 52-week lows.

Twitter

These last few weeks what you’re now seeing is an unwinding of this theme with the erstwhile leaders losing steam. Besides, as pointed out in the leaders-laggers section of The Lead-Lag Report, a ratio measuring tech stocks as a function of the S&P500 too has begun to drastically reverse and dropped below its 20DMA for the first time since June last year! This shouldn’t be overly surprising. We know that these large-cap tech names have had a tremendous ride over the last few years and are trading at valuations that leave very little room for error. The Fed has now outlined its path for a series of interest rate hikes in 2022, and this means the discount rate used to measure the worth of these companies’ free cash flows will be a lot higher.

Twitter

I also believe there’s a broader risk to be considered here; if you follow me on Twitter, you’d note that I’ve never been too complimentary about how the Fed has gone about managing the current malaise. Through their ultra-loose monetary policies, Fed officials have been a key facilitator of the problem, and once the genie was out of the bottle, they’ve been scrambling around like headless chickens trying to ramp it in, to no avail.

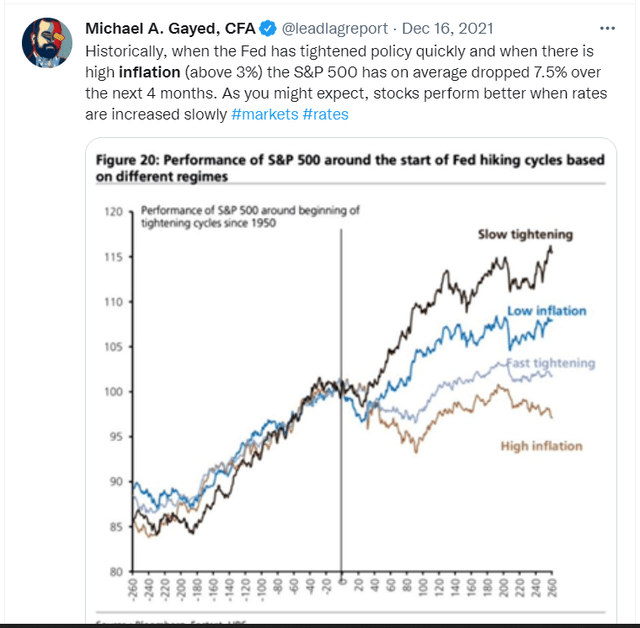

I believe you’re now potentially staring at a risk where they focus so much on inflation that they end up tightening so aggressively and the precarious growth fountain comes apart at the seams. I’m not necessarily convinced that they need to resort to 4+ rate hikes in 2022. As shared in a tweet on my timeline, when we’ve previously had high inflation and the Fed has tightened too quickly, we’ve seen considerable drawdown in stocks, and I believe something like FCPI with the kind of stocks that it has, could suffer.

Twitter

Finally, principally, you do also have to question the merits of currently pursuing something like FCPI, which looks overstretched and is trading at lifetime highs, more so when inflation pressures are likely to peak soon with the high base effect not too far away. In fact, as shared with followers of The Lead-Lag Report, most economists believe that inflation will likely dip to less than 3% by the end of this year.

Twitter YCharts

To conclude, with high inflation around, FCPI has proven to be a fairly rewarding investment product, delivering returns of almost 2x the S&P500 during the last 6 months, but I believe pursuing this theme at this stage would be sub-optimal as it looks like the tide could turn by H2-22.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

[ad_2]

Source link Google News