[ad_1]

Source: Getty Images – Paul Souders

Investment thesis

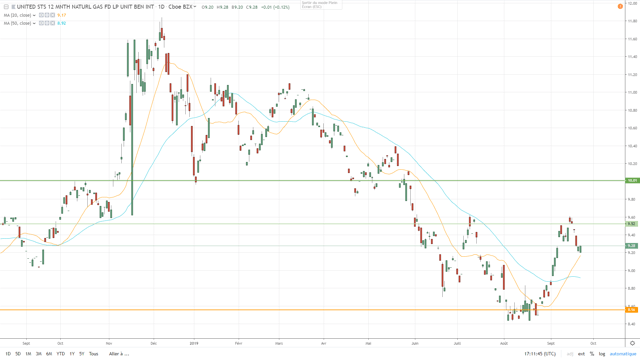

Since our last publication on the United States 12 Month Natural Gas Fund LP (UNL), our bearish recommendation on the ETF has slightly emerged, with UNL declining 1.09% to $9.28 per share.

Going forward and given that natural gas demand is set for further weakness in the following two weeks, amid autumn shoulder season kicks and mild expected temperatures for the end of September, we maintain our view on UNL with a target price of $9 per share.

Source: Tradingview

With natural gas demand expected to weaken in the following weeks, injections into storage are set to accelerate

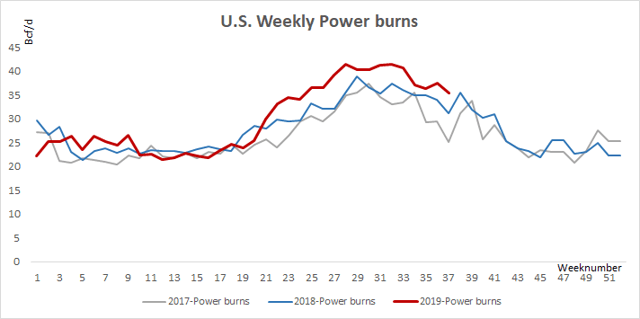

As we enter the autumn season and with the recent rebound of U.S. natural gas markets, demand for the flammable commodity is set to weaken in the following weeks, as power demand decreases with the reduction of cooling degree-days.

Indeed and while power generation has remained sustained for most of the summer season, natural gas demand has plunged 14.5% to 35.4 Bcf/d since its latest historical high reached in the beginning of August 2019.

Source: EIA, Oleum Research

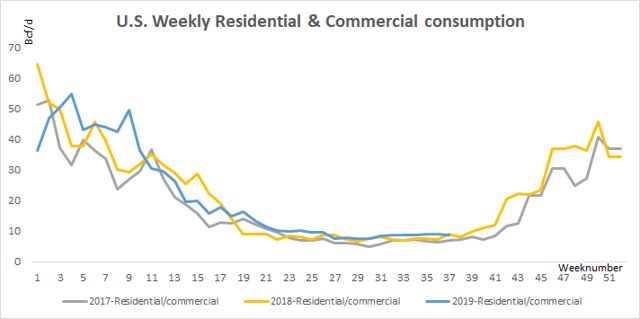

Concomitantly, the flammable demand derived from the residential and commercial sector will likely remain flat in the near future, as any deviation from the temperature mean will likely be too slim to generate a sustained heating demand.

Source: EIA, Oleum Research

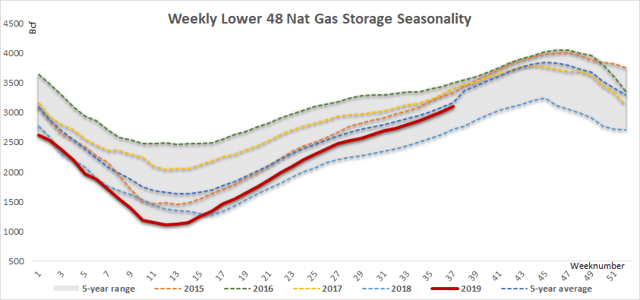

That being said and given that injections into storage, lifted 2.78% (w/w) to 3 103 Bcf, outpaced by 2 Bcf the five-year average injection rate of 82 Bcf, excessive U.S. gas supply will likely continue to pressure the complex and its proxy, UNL.

Source: EIA, Oleum Research

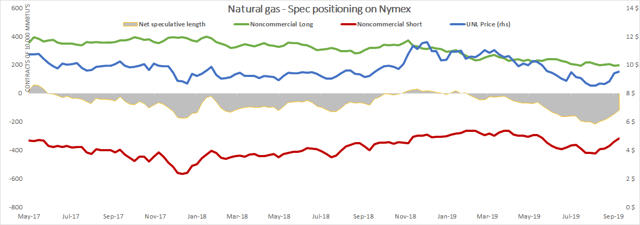

Speculator positioning

On the week ending September 17, speculators enhanced robustly their bets on Nymex natural gas futures, up 19.25% (w/w), reaching net negative length of 118 573 contracts, the CFTC shows.

Source: Commodity Futures Trading Commission (CFTC), Oleum Research

This strong advance is mostly attributable to solid short liquidations, down 7.46% (w/w) to 316 514 contracts and is partly sustained by fresh long accumulations, up 1.43% (w/w) to 197 581 contracts.

In the previous five weeks, speculators have significantly boosted their positioning on the flammable complex, reducing their short bets by 25.17% or 106 359 contracts.

Besides, short open interest has returned to average levels, evolving at 25.21% versus the excessive 30.2% reached August 6, that indicates a considerable stretch to the downside.

That being said and in spite of the recent appreciation of the speculative sentiment on the natural gas complex, bets are neutral for the time being and do not provide sufficient strength for a sustainable rebound in UNL shares.

Since the beginning of 2019, net spec positioning on natural gas futures lifted 15x, whereas UNL’s YTD performance lost 10.43% to $9.27 per share.

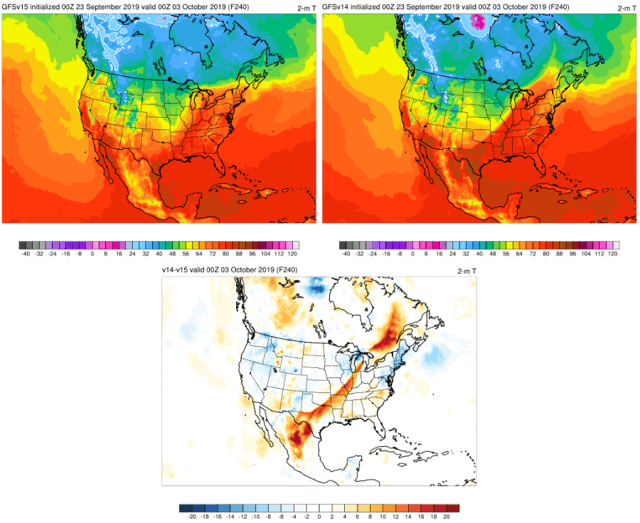

Autumn shoulder season kick in and mild temperatures weigh on UNL shares

According to the National Weather Service, two opposite air masses will linger on the U.S. states on the September 30 – October 6 period, one mild and cold trend in the West and a more comfortable to hotter system in the East and Southeast.

Yet and while the weather trended further hotter for late September, with a strong upper ridge over the South and East, demand for natural gas will remain light for this time of the year, amid mild temperatures nearing 70°F in large majority of the country.

Source: National Weather Service

In this context characterized by a strong U.S. natural gas supply that is set to boost injections into storage, a neutral speculative sentiment on the flammable complex and a mild weather outlook for the end of September and beginning of October, the complex remains under pressure.

That being said, we maintain our bearish view on UNL, with a target price of $9 per share, corresponding to its 50 period moving average.

We look forward to reading your comments.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News