[ad_1]

For investors in the Invesco DB Oil ETF (DBO), it’s been a strong month with the current performance sitting at a solid 10% return. With most of these gains coming over the last two days on the back of the attacks in the Middle East, this price appreciation makes sense. However, it is my belief that the underlying fundamentals for crude oil as well as DBO’s methodology make for an excellent long trade at this time.

Understanding DBO

Before diving into the fundamental factors of the crude market, let’s take a pause and talk about what exactly DBO is. If you’re familiar with the oil ETF and ETN space, you’re likely aware that there are a lot of different methodologies and approaches to the oil markets. DBO brings its own unique exposure to the table which warrants a deep dive of the actual mechanics of the instrument.

DBO follows a methodology which gives exposure to the DBIQ Optimum Yield Crude Oil Index (Excess Return). This index is constructed by Deutsche Bank and essentially seeks to provide the best roll yield to holders of the fund. To understand why this is such a big deal, look no further than the famous (or infamous) USO ETF.

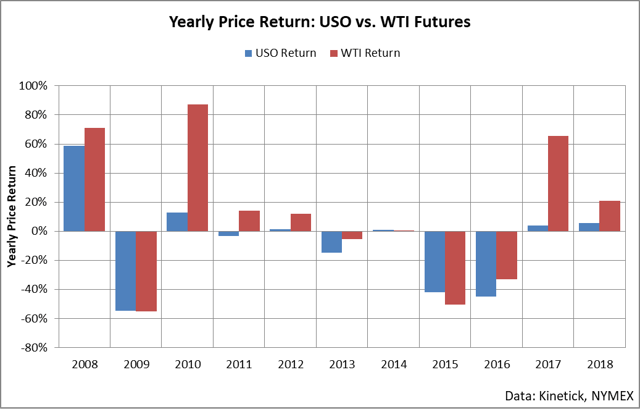

USO is by far the most popular crude oil ETF and it follows an incredibly simple methodology: every two weeks before the front month contract expires, sell out of the front month and buy into the second month. This process means that for several weeks of the month, USO isn’t actually following the front month contract of crude oil but rather is holding the second month contract. Due to a funny tendency of futures markets called “roll yield”, USO tends to massively underperform its benchmark as seen in the following chart.

DBO is basically an instrument designed to try to avoid (and even reverse) this relationship. Put simply, roll yield is the gain or loss that arises from holding an investment in a futures contract that isn’t the front month contract. Roll yield on a long position is positive during backwardation (front contract higher than back contracts) and negative during contango (front contract under back contracts) due to the general market tendency for back-month contracts to approach the front month as time progresses.

USO’s largest flaw is that it just rolls exposure across the front two months of futures and in the front two months, the market has been in contango around 78% of all months during the last decade. For this reason, USO has massively underperformed the actual price of oil and this is where the appeal of DBO’s methodology comes into play.

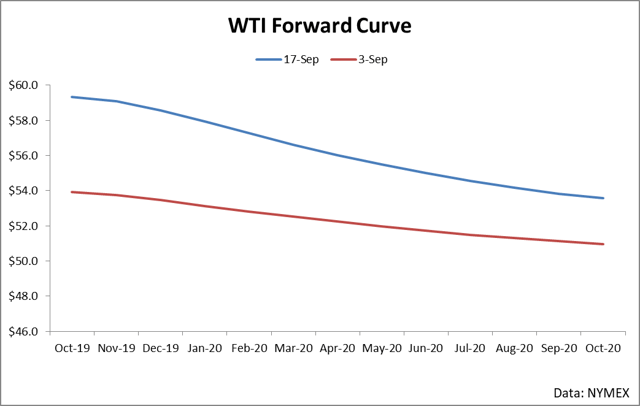

DBO intentionally tries to maximize roll yield. What this means is that it looks for the largest spread of backwardation across a window of the forward curve and buys the futures contracts to capture this relationship. As you can see in the current forward curve, there’s an incredible amount of backwardation in the curve to capture.

The current market structure means that DBO has several dollars of backwardation to play with and that DBO’s returns are likely to shine as long as this market state remains. Since DBO is able to hold and roll exposure across several dollars of backwardation, as time progresses, this spread will narrow and the contracts held at lower prices will tend to appreciate towards the front month price giving positive yield.

This in and of itself can be a strong reason to invest in DBO at the moment. The excellent roll yield means that even if the price per barrel for front-month crude oil literally just returns 0% over almost any timeframe, shares of DBO will see positive return because the holdings at lower prices will drift up towards spot. However, I believe that specific crude fundamentals indicate that the price per barrel of crude oil is headed higher going forward.

Crude Fundamentals

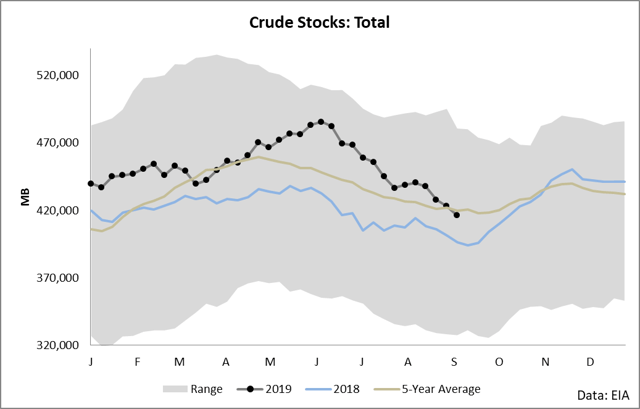

When I examine crude oil, I like to start with a glance at the comprehensive balance as expressed through a 5-year range of inventories. A 5-year range gives the result of all of the supply and demand factors balanced into one comprehensive number and goes a long way towards explaining the general fundamental state of the market.

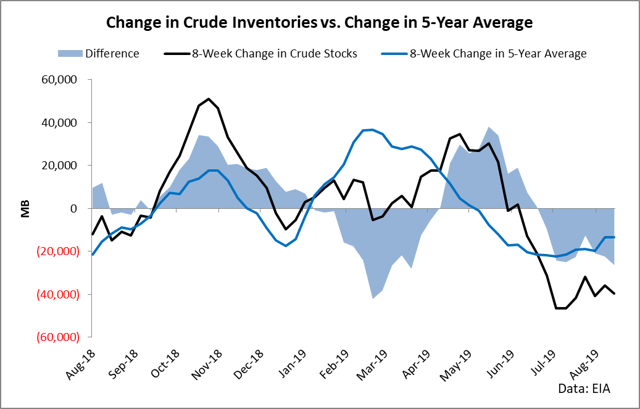

As you can see, the fundamental balance is tight. With recent inventory levels dropping below the 5-year average, the market is currently sending a signal that demand is surpassing supply. Another way to look at this data is to examine the trend of the 5-year average versus the trend of crude inventories. Specifically, I have found great use in looking at the average difference between a two-month change in inventories and a two-month change in the 5-year average.

As you can see, since around the middle of June, crude inventories have been drawing down at a greater rate than historic norms. This relationship means that even including the summer driving seasonal effects, crude draws are vastly outpacing what is considered to be normal. This relationship means that the market has been highly bullish fundamentally since mid-June, but will this bullishness continue into the future?

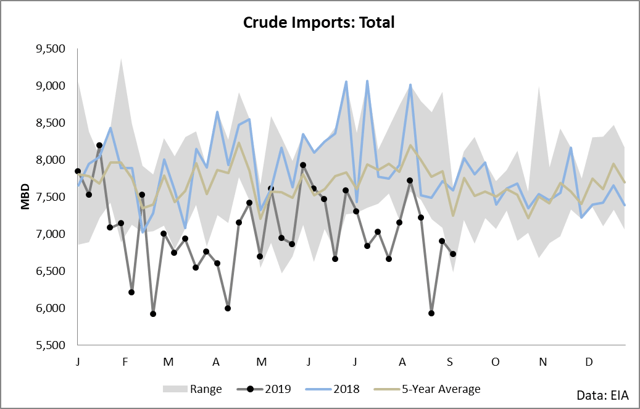

It is my belief that the fundamental tightness seen since June (and indeed most of this year) will continue. The reason for this is largely due to the source of the tightness: imports. Specifically, crude imports have come in at historically low levels as seen in a variety of metrics. In most weeks, imports have come in below the 5-year low.

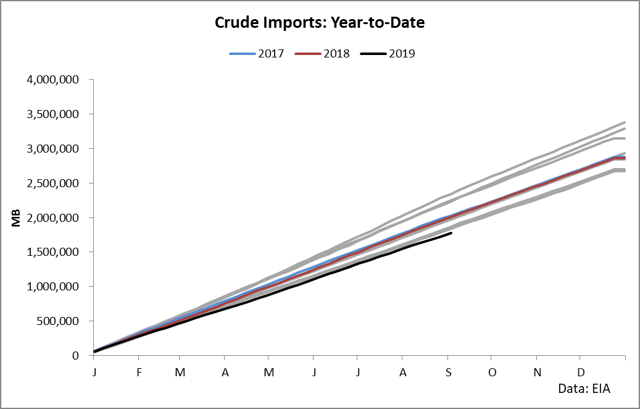

On a year-to-date basis, the outright level is the lowest in many years by a fair margin.

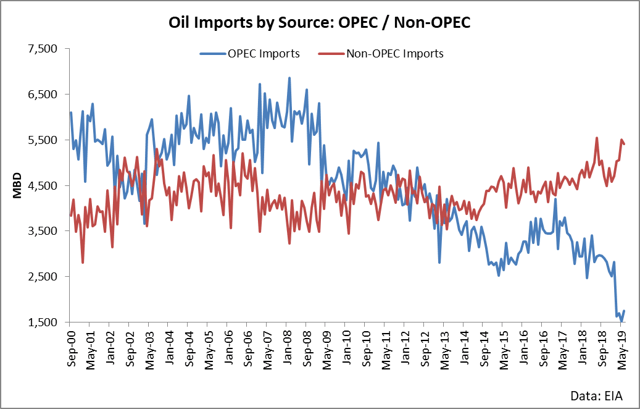

And the source of the decrease in imports can be solidly identified: OPEC.

As long as OPEC cuts continue (which they will until March of 2020), the fundamental tightness seen in crude markets will remain and prices will generally trend higher. And all of this analysis is before the attacks in the Middle East.

This weekend, a key Saudi export facility was taken offline through sophisticated attacks. Around 5 million barrels per day of export capacity (roughly 5% of world demand) was rendered offline and the price of crude skyrocketed on Monday as a result. Saudi Arabia has indicated that most of this capacity can be back online within a month, but the effects will be tangibly felt on global balances. In the long run, the facility will come back to full operational capability but in the short run, this furthers the bullish fundamental already at work throughout the year.

Given the fact that DBO is able to capture healthy backwardation for its rolling strategy as well as bullish fundamentals coupled with targeted attacks of a key export facility, buying DBO makes for an excellent trade. It’s time to buy DBO.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News