[ad_1]

As seen in the following momentum table from Seeking Alpha, shares of the ProShares VIX Short-Term Futures ETF (VIXY) have turned decisively red for the year after a brief pop earlier this month.

In this article, I will make the case that the long-term trend of VIXY remains intact and that investors should consider shorting the instrument to capture the downside in volatility as well as the long contango roll.

The Instrument

When I write about ETFs and ETNs, one of the first things I like to do is dig into the mechanics of the instrument. The basic mechanics of an instrument can have large ramifications as per the structure of returns, and seeking to understand the instrument from the onset makes sense before generating any sort of investment recommendation.

In the case of VIXY, it is a fairly straightforward implementation of the S&P 500 VIX Short-Term Futures Index. That is, it follows a methodology which gives exposure to one of the more popular volatility indices created by S&P Global. The S&P 500 VIX Short-Term Futures Index provides a constant exposure to CBOE’s VIX futures through rolling exposure across the front two months of VIX futures contracts. This method of rolling has powerful ramifications due to the nature of futures markets in that prices further out on the curve tend to trade towards the spot price as time progresses, which results in a source of return called “roll yield”.

Since futures prices in later months tend to approach the front of the curve as time approaches expiry, the structure of the market is very important for understanding roll yield. When a market is in backwardation (front-month prices are higher than back-month prices), roll yield on a long position will be positive because the long contracts held at lower prices tend to trade up in value as time progresses. Conversely, when a market is in contango (front-month contract priced lower than back-month contracts), roll yield on a long position will be negative because the long contracts held at higher prices will generally decrease in value as time progresses.

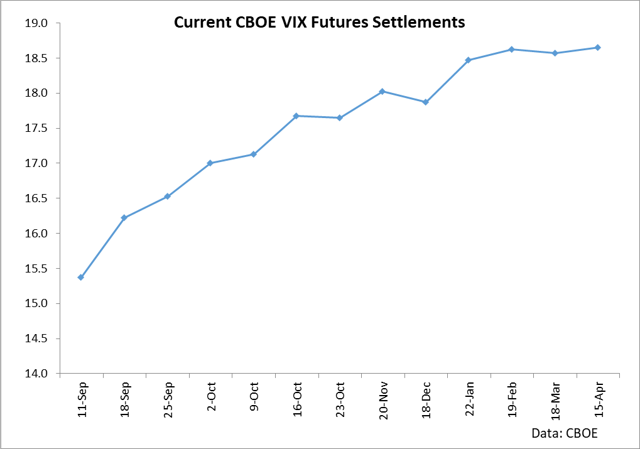

Here is the current market structure of VIX futures – as you can tell, VIX futures are currently strongly in contango.

When the market is in contango, it means that the strategy which VIXY follows is currently losing money due to a negative roll yield, since the contracts held in October VIX futures will be generally decreasing in relationship to the front of the curve as time progresses. Unfortunately for long holders of the instrument, VIX futures are almost always in contango, which means that roll yield is almost always negative for the instrument. This is precisely why VIXY has fallen by 95% over the last 5 years, as well why it is likely to continue this performance going forward.

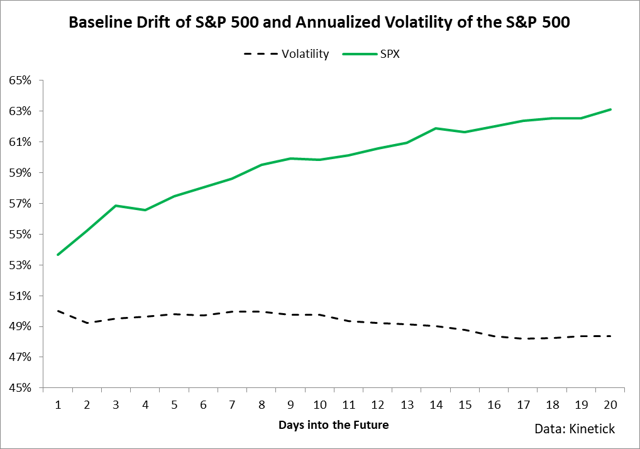

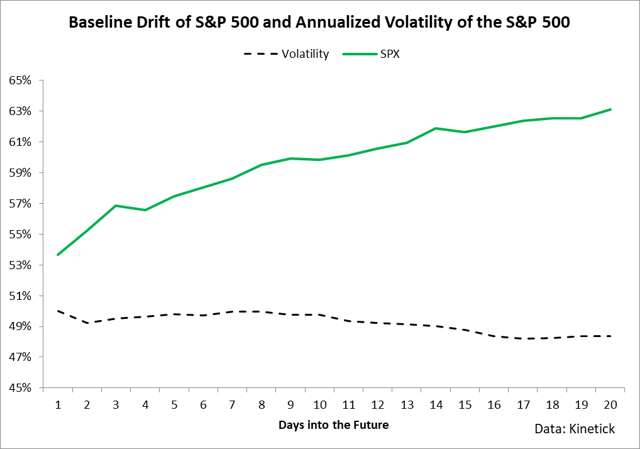

The reason why roll yield is such a huge factor in the returns of basically every volatility ETF and ETN is pretty simple: volatility rarely travels anywhere. For example, here is the baseline historic probability of an upwards movement in the S&P 500 and the annualized volatility of the S&P 500 over a 20-day window using data since 1992.

This chart shows that in general, the S&P 500 increases in about 61% of all 20-day periods. However, when it comes to annualized volatility, it is basically flat over most 20-day windows with a slight downwards drift. For holders of VIXY, the implications are pretty clear: trading long volatility is a long-term losing game for the most part. There certainly are periods in which volatility surges (which we’ll discuss in the next section), but for the most part, selling volatility generally wins. However, the key limiting factor of this analysis is that it is a simple look at the actual annualized volatility of the S&P 500, whereas VIXY is tracking VIX futures which expire and subject the holder to roll yield. When you couple roll yield onto an underlying index which basically goes nowhere over long periods of time, constant losses result.

More Downside

Even more than the fact that VIXY is currently seeing a negative roll, specific events in the S&P 500 itself give me reason to be short volatility. Specifically, these reasons really boil down to the data contained in the chart above in the last section. If you notice, there is a general trend in the data: the S&P 500 tends to rise, while volatility tends to be flat / fall. In other words, the S&P 500 and its level of volatility seem to be inversely correlated to an extent.

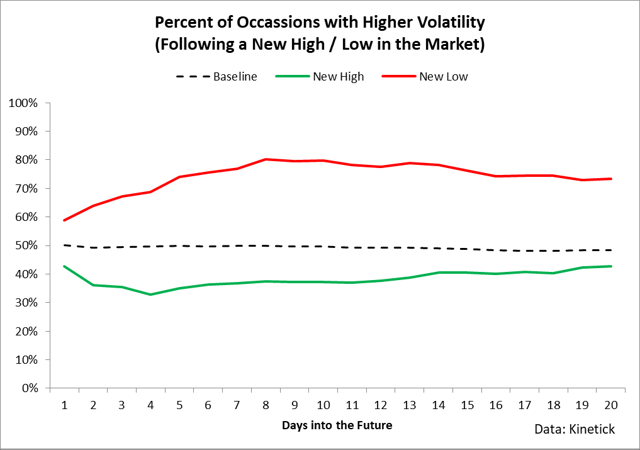

We can quantify this relationship in a lot of different ways, but a reliable method I’ve used in trading volatility is that of tracking the S&P 500 hitting new highs and new lows. In the following study, I’ve taken the baseline drift concept of the previous chart and asked the data, “What happens to volatility when the market hits a fresh 1-month high or 1-month low?” The answers to this question can be seen below.

When the market hits a new high, volatility tends to be subdued for the next month. When the market hits a new low, volatility tends to surge over the next month. This facet of the market has been consistently seen throughout the entire dataset. At present, the S&P 500 is hitting new monthly highs. These new monthly highs indicate that going forward, we are probably going to see lower levels of volatility, which means that the outright level of the VIX will likely fall, leading to a decline in the VIX futures prices and a decline in VIXY, which holds VIX futures. When this is coupled with the fact that we have a negative roll for long positions, it really makes sense to sell or be short VIXY.

Caution

When it comes to shorting volatility, there’s always the chance of an outsized move against you. The trade works most of the time (as seen by a 95% decline in VIXY’s shares over the last 5 years), but it can occasionally explode against you during periods of financial panic. That said, I would suggest that if you are going to pursue the short volatility strategy using VIXY, take advantage of VIXY’s options chain and consider either a deep in-the-money put option (to make your delta basically be -1) or some sort of bear spread, depending on your specific risk management framework.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News