[ad_1]

ETF Overview

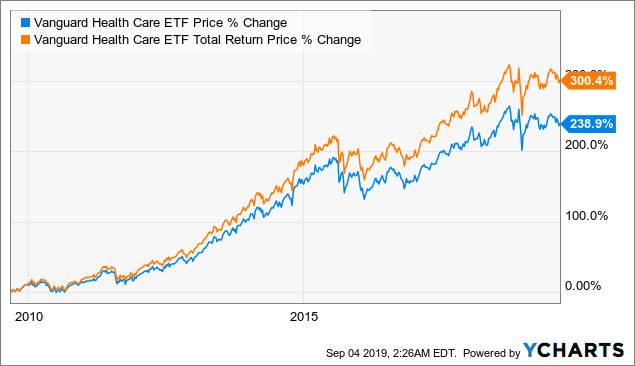

The Vanguard Health Care ETF (VHT) owns a portfolio of U.S. large-cap healthcare stocks. The ETF tracks the performance of the MSCI U.S. Health Care 25/50 Index. Stocks in VHT’s portfolio should benefit from ageing demographic trends in the U.S. and the world. The ETF is a nice defensive choice as demands for treatment and healthcare services do not diminish even in an economic recession. VHT appears to be slightly undervalued and we believe it is a good holding for investors with a long-term investment horizon.

Data by YCharts

Data by YCharts

Fund Analysis

The fund should benefit from an ageing U.S. population

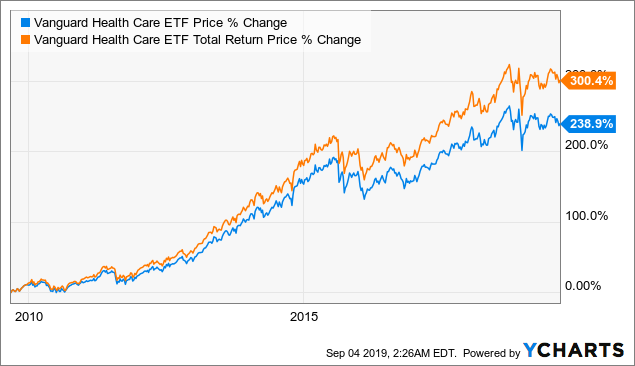

Stocks in VHT’s portfolio should benefit from an ageing population in the United States. According to U.S. Census Bureau, the number of Americans ages 65 and older is projected to more than double from 46 million today to over 98 million by 2060. The 65 and older age group’s share of the total population will increase to nearly 24% from 15% today.

Source: United States Census Bureau

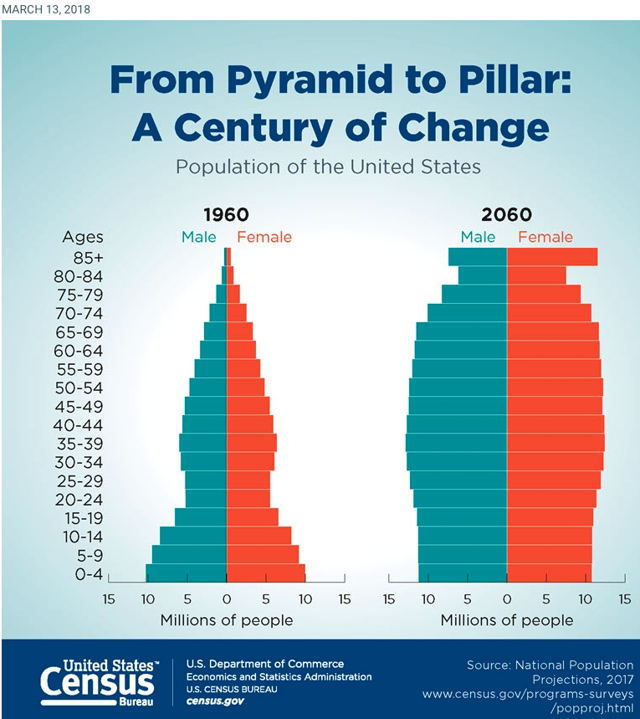

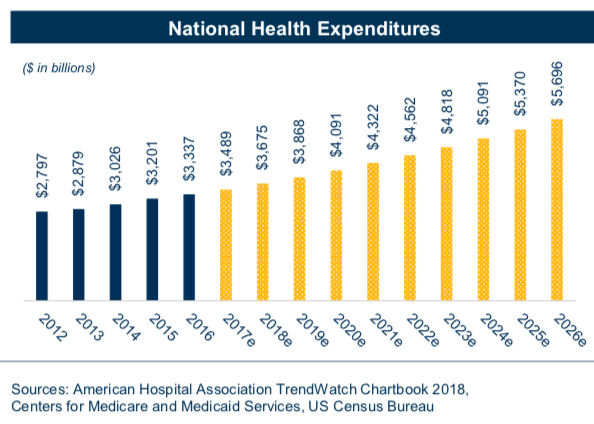

As we know, people who are older will spend more on health services than those who are younger. As can be seen from the chart below, national health expenditures are expected to grow significantly from $3.7 trillion in 2018 to $5.7 trillion in 2026. This long-term strong demand will act as a tailwind to the healthcare industry. Therefore, we believe stocks in VHT’s portfolio will benefit from strong demand for healthcare services in the U.S.

Source: Physicians Realty Trust Investor Presentation

Other parts of the world are also ageing as well

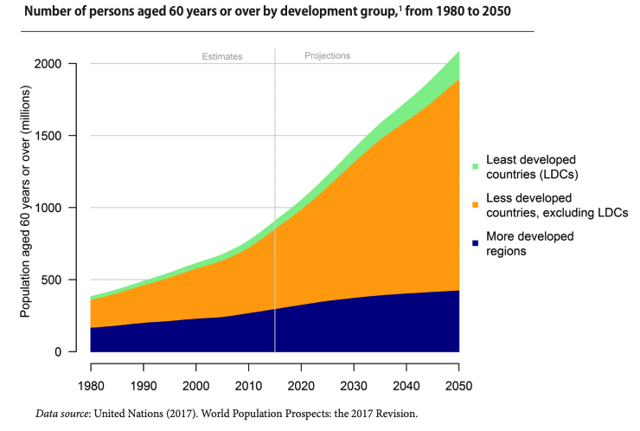

Besides an ageing population in the U.S., the world’s population is also ageing. According to a report by the United Nation, the number of people aged 60 years or over will double by 2050 from now (see chart below). This presents tremendous opportunities for these healthcare stocks in VHT’s portfolio to grow their businesses internationally. As can be seen from the chart below, most of the growth in 60 years or older population is expected to come from less developed countries. This growth is primarily led by an ageing population in China (China’s one child policy in the past has resulted in an imbalance of older population).

Source: United Nations

VHT is a good defensive investment choice

Healthcare industry is a good defensive choice especially during an economic downturn because demand for healthcare services will not diminish. Therefore, VHT’s portfolio of healthcare stocks is a nice investment choice especially during periods of economic uncertainties. In addition, stocks in VHT’s portfolio are stocks with competitive positions over its smaller peers. As can be seen from the chart below, all of the top-10 holdings in VHT’s portfolio receive narrow or wide moat status according to Morningstar’s research. These top 10 stocks represent about 42.5% of VHT’s total portfolio.

|

as of 9/3/2019 |

Morningstar Moat Status |

% of ETF |

|

Johnson & Johnson (JNJ) |

Wide |

8.5% |

|

UnitedHealth Group (UNH) |

Wide |

5.9% |

|

Merck & Co. (MRK) |

Wide |

5.3% |

|

Pfizer (PFE) |

Wide |

5.2% |

|

Abbott Laboratories (ABT) |

Narrow |

3.8% |

|

Medtronic (MDT) |

Wide |

3.4% |

|

Amgen (AMGN) |

Wide |

2.9% |

|

Thermo Fisher Scientific (TMO) |

Narrow |

2.7% |

|

AbbVie (ABBV) |

Narrow |

2.4% |

|

Eli Lilly and Co. (LLY) |

Wide |

2.4% |

|

Total: |

42.5% |

Source: Created by author

VHT appears to be slightly undervalued

VHT’s portfolio of stocks has an average forward P/E ratio of 16.25x (see table below). This is more than 2x multiples lower than S&P 500 Index’s 18.34x. VHT also has a slightly higher dividend yield of 2.06%. In addition, VHT’s portfolio of stocks also has a slightly higher average sales growth rate of 8.7% than S&P 500 Index’s 7.10%.

|

VHT |

S&P 500 Index |

|

|

Forward P/E Ratio |

16.25x |

18.34x |

|

Dividend Yield (%) |

2.06% |

1.87% |

|

Sales Growth (%) |

8.70% |

7.10% |

Source: Morningstar, Created by author

Let us now take a look at the top-10 holdings of VHT’s portfolio. We have come up with a table below that compares the forward P/E ratios of these top-10 companies with their 5-year average P/E ratios. As can be seen from the table, the weighted-average forward P/E ratio of VHT’s top-10 holdings is 15.49x. This is slightly below their 5-year weighted-average P/E ratio of 16.29x. Therefore, we think VHT is slightly undervalued.

|

as of 09/03/2019 |

Forward P/E |

5-year Average P/E |

% of ETF |

|

Johnson & Johnson |

14.08 |

16.38 |

8.50% |

|

UnitedHealth Group |

13.81 |

17.19 |

5.90% |

|

Merck & Co. |

16.31 |

15.49 |

5.30% |

|

Pfizer |

12.22 |

13.47 |

5.20% |

|

Abbott Laboratories |

23.04 |

20.05 |

3.80% |

|

Medtronic |

19.31 |

17.18 |

3.40% |

|

Amgen |

13.59 |

13.85 |

2.90% |

|

Thermo Fisher Scientific |

20.92 |

18.17 |

2.70% |

|

AbbVie |

6.87 |

11.73 |

2.40% |

|

Eli Lilly and Co. |

17.27 |

19.79 |

2.40% |

|

Weighted Average |

15.49 |

16.29 |

42.50% |

Source: Created by author

Risks and Challenges

Continual trade tensions between the U.S. and China

If the current trade tensions between the U.S. and China prolong for decades, stocks in VHT’s portfolio may not be able to benefit from an ageing population in China in the next few decades.

Currency risks

Since many stocks in VHT’s portfolio have sizable businesses internationally, these stocks’ revenues and profits can also be impacted by foreign exchange rates. A strong USD can hurt these companies’ profits.

Investor Takeaway

We like VHT’s portfolio of stocks as these stocks should benefit from an ageing demographic trend in the world. The fund appears to be slightly undervalued. VHT’s defensive characteristic makes it a fine investment choice, especially because we are likely already in the latter stage of this economic cycle.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

[ad_2]

Source link Google News