[ad_1]

Investment thesis

In our last release on the United States 12 Month Natural Gas Fund LP (UNL), our bearish view has not materialized, as Hurricane Dorian boosted fears of renewed supply disruptions in the commodity sector.

Yet, with an unfriendly-price seasonality and strong injections into storage in the month of September, we maintain our bearish stance on the complex and UNL.

Besides and even if net speculative bets surged in the last two weeks, the natural gas positioning continues to be stretched to the downside.

Finally, the weather pattern is likely to somewhat support the flammable commodity for the first half of the month; nevertheless, the passage of Hurricane Dorian will likely offset it, as natural gas demand in the Southeast is expected to remain subdued.

Source: Tradingview

The storage picture is slightly supportive, but weakening demand will have to counterbalance it

During the month of August, natural gas futures and UNL lifted moderately, as strong power burns supported demand for the flammable commodity.

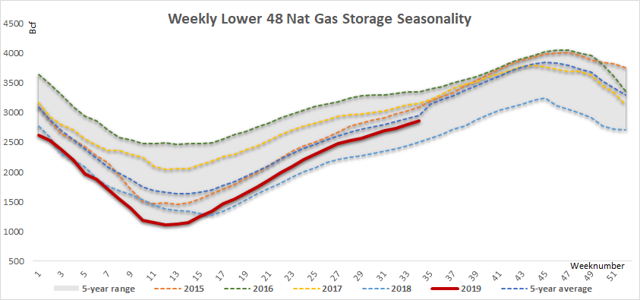

Injections into U.S. storage decelerated slightly in the last weeks, and even if the storage picture still stands at a slim deficit compared to the five-year average, down 3% or 89.8 Bcf, 2019 excessive U.S. supply pushed stocks in surplus of 14.1% or 353 Bcf versus 2018 level.

Source: EIA, Oleum Research

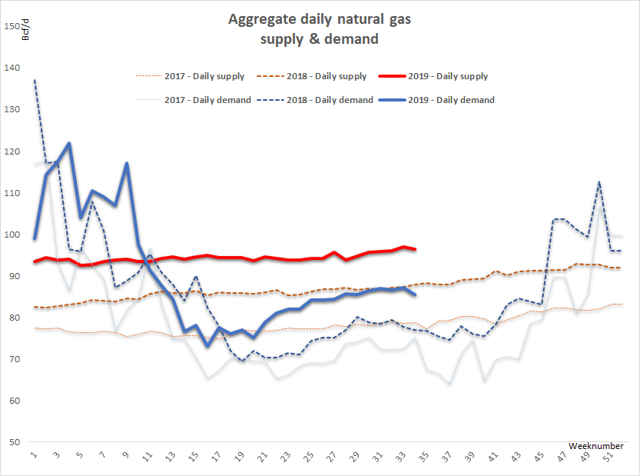

Concomitantly, and in spite of the slim decrease of U.S. natural gas output registered by the complex on the week ending October 22, down 0.6% (w/w) to 96.3 Bcf/d, demand is likely to enter a deceleration path with the approach of the shoulder season.

Indeed, according to the EIA, natural gas needs slid 2% (w/w) to 85.4 Bcf/d, following a deep plunge in power demand, down 9.1% (w/w) to 37.1 Bcf/d. That being said, demand is now evolving 11.3% below supply and the equilibrium is now expected to tighten, until the start of the withdrawal season. Besides, supply should continue its ramp up, as new pipeline capacity comes online.

Source: EIA, Oleum Research

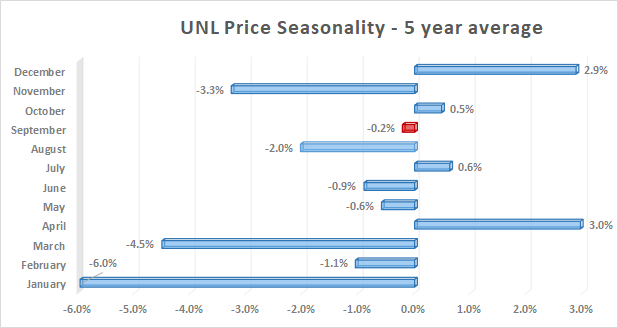

Price seasonality remains somewhat unfriendly for September and is sustained by strong seasonal injections into storage

Seasonality for the month of September is unfriendly for UNL, given that the ETF retreated slightly, down 0.2% in the last five years. Yet, this marginal pullback remains the weakest of the year, and the marginal volatility on the month indicates that market participants are doubtful about the direction of the flammable commodity.

Source: Nasdaq, Oleum Research

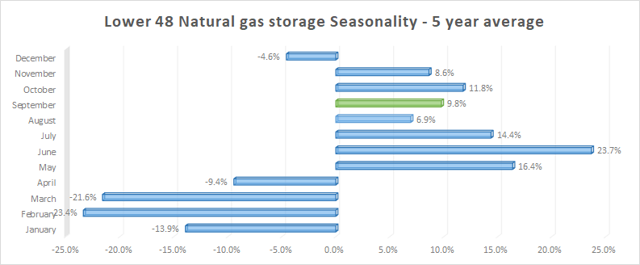

Besides, monthly average injections in the last five years indicate that September seasonality should sustain UNL’s bearishness, given that natural gas storage in the U.S. advanced in average 9.8% during the month.

Source: EIA, Oleum Research

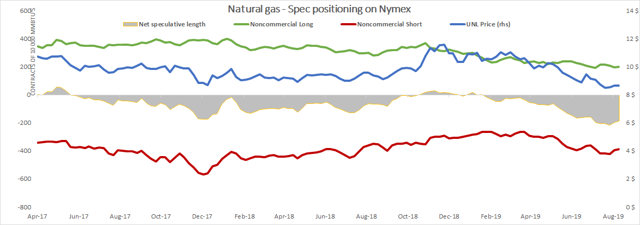

Speculative bets

In the last two week, speculators lifted robustly their bets on the flammable commodity, up 13.42% to 187,019 net short contracts. With that advance, speculative length seems to be losing its downward momentum, indicating that speculators are likely to reverse their positioning.

Indeed, during the week ending August 27, the net length appreciation on Nymex natural gas futures has been attributable to both long accretions, up 2.92% (w/w) to 201k contracts and short covering, down 1.37% (w/w) to 388k contracts. That being said, on the corresponding week, UNL has not followed this move, declining marginally, down 0.23% (w/w) to $8.65 per share.

Source: Commodity Futures Trading Commission (CFTC), Oleum Research

In the meantime, short open interest continues to be stretched to the downside, even if it eased moderately since our last take on UNL. The indicator is still below the 20-week average (26.44%), establishing at 29.5%, pointing towards a modest advantage for the bearish momentum.

Since the beginning of the year, net spec length declined by a whopping 23x to 187k contracts, whereas UNL’s YTD performance dipped 14.5% to $8.84 per share.

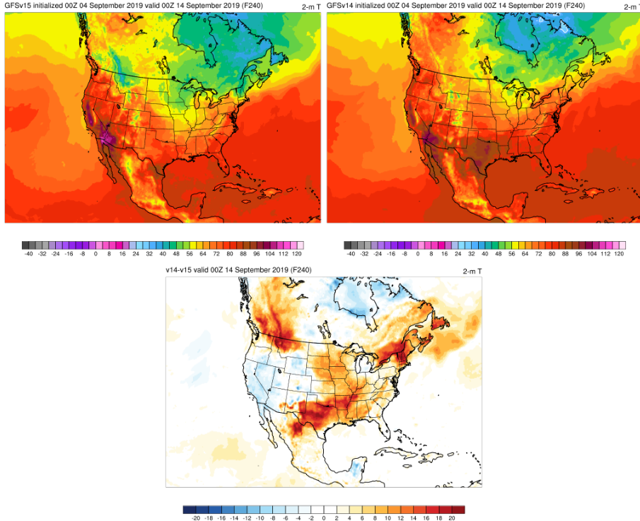

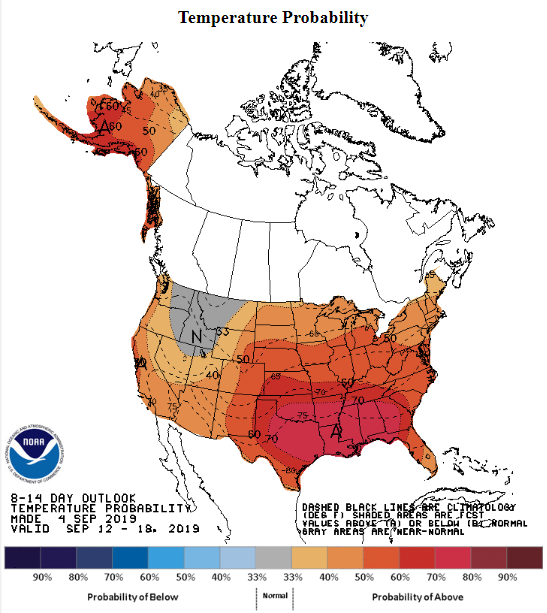

In spite of uplifting weather guidance, the passage of Hurricane Dorian will likely sap demand, providing headwinds to UNL shares

Going forward, weather guidance remains supportive for the natural gas complex and UNL, thanks to the hotter than average temperatures expected to develop over the country. With heat expanding out of the West and into parts of the Central and Eastern United States, cooling demand is likely to remain sustained, as temperatures are likely to stay north of 80°F until the second half of September.

Yet, the progression of Hurricane Dorian could partly offset this bullish development. Indeed, the passage of Dorian in Florida will probably lead to lower demand putting a lid on prices and drive the market lower over the near term.

Source: National Weather Service

That being said, we maintain our bearish view on the complex, given that demand is likely to weaken and that supply remains near historic highs. Besides and even if hotter than normal temperature will somewhat sustain UNL, our view is sustained by the unfriendly seasonal pattern for the month of September and by the passage of Hurricane Dorian which should further erode demand in the near term.

We look forward to reading your comments.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News