[ad_1]

(Source – Pexels/Pixbay)

The First Trust Global Auto ETF (CARZ) has had a difficult time since inception as global demand for automobiles has gone essentially nowhere in the developed world. Many automotive companies in the fund went nearly bankrupt in 2008, and investors have been very cautious to look back into the fund.

Recent performance has been particularly weak as global manufacturing has been on the decline and recent vehicle sales have been weak. Since hitting a high of $45 in 2018, the fund has fallen all the way to $30 today (44%). Many of the companies have high debt burdens, low-profit margins, and little to no revenue growth. To make it worse, the U.S.-China trade war and growing global U.S. tariff threat add even more potential downsides.

That said, I think that long-term oriented value investors may want to slowly accumulate a position in the fund. The fund has a weighted average “P/E” ratio of 8.8X and a “P/B” ratio of 0.8X. I agree that the worst is likely yet to come, but the secular decline in autos is likely to end with the bull market. Global consumers are strengthening despite the decline in manufacturing. Finally, growing inflationary pressures may ease the debt burden of many of these companies.

For the time being, I would not personally go long on the fund unless I had a hedged position. That said, the crash may just be an excellent buying opportunity.

The First Trust CARZ ETF

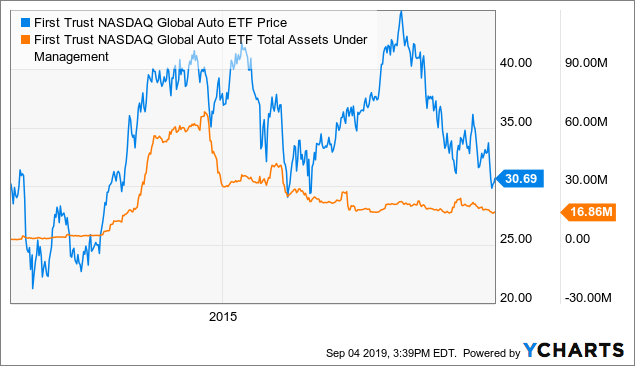

The ETF has been trading since May 2011 and is actually at about the same price as when it was incepted. The fund has 32 holdings from around the world (with particular weight to Japan, the U.S. and Germany) and a fine expense ratio of 0.7%. Importantly, the fund only has $17M in AUM today, making it a relatively higher closure risk, so large investors should take note of poor liquidity. Let’s take a closer at that AUM trend to see what fellow investors are up to:

Data by YCharts

Data by YChartsThis chart confirms the cornerstone of my long thesis; investors have completely rejected the automotive industry (excluding TSLA). We can see that the fund saw a brief spike in interest in 2013-2014, only to decline to a very low interest today. In my opinion, the best ETFs are usually the ones that investors have forgotten (and vice versa).

Regarding exposure, the ETF is very highly exposed to the global economy with a 0.70 correlation to the S&P 500. Because many of its holdings are overseas, it also has a relatively small -0.2 correlation to the U.S. dollar. Overall the fund is pretty idiosyncratic compared to others, but still very dependent on the global economy.

Let’s take a closer look at the fundamentals of its holdings

Debt A Concern, But Valuations More Than Compensate

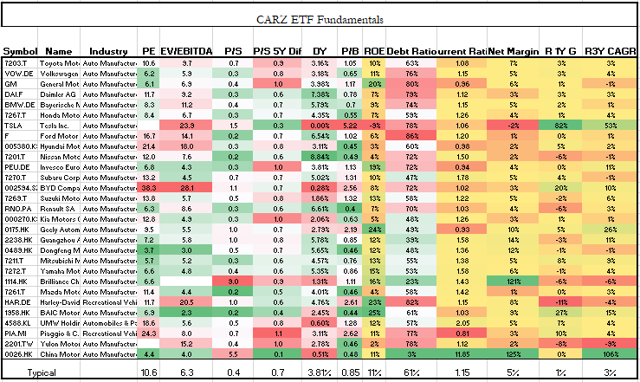

The fundamentals of automotive companies have been weak for quite a while, but today these stocks trade at a huge discount that compensates for those fundamentals. Take a look at the financial breakdown for the stocks in the fund:

Note “Typical” indicates the harmonic mean for valuation statistics and median for others. Also, Porsche and Aston Martin excluded due to poor data quality.

(Source – Unclestock)

Most of these companies trade at a very low valuation with the typical company trading at 10.6X earnings and 6.3X EBITDA. Even more, the companies are undervalued on a historical basis as the typical company is trading at a price-to-sales ratio 30% lower than is typical over the past five years. Clearly, investors expect very poor top-line performance.

Regarding revenue, these companies have seen very low sales growth. This is particularly true for the larger companies (that make up the majority of the ETF’s AUM). Tesla is the only company with a high top-line growth that makes up a meaningful portion of the fund’s total AUM. It is probably worth noting I would like the ETF more without TSLA as it is the only company in it that is extremely overvalued.

Debt levels are pretty high for many of the companies, but about the same as I find in most sectors of the economy. Fortunately, if inflation rises (which I will talk about in the next section), auto-producers will benefit more than almost all other sectors and a portion of the debt burden will be eased.

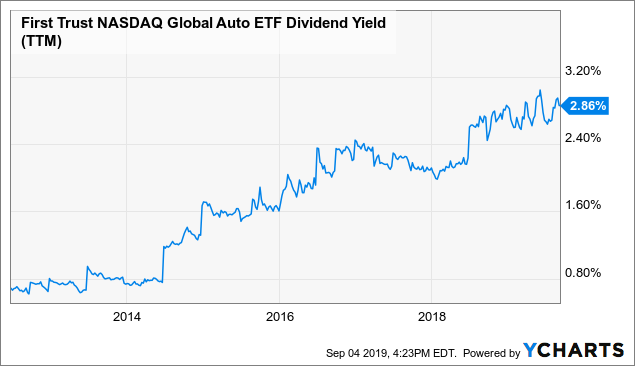

Finally, the fund currently pays a dividend of 2.86%, which is historically quite high for the ETF. Take a look at the dividend yield of CARZ over the past five years.

Data by YCharts

Data by YChartsOf course, 2.86% is nothing to write home about, but it is often best to buy funds when their dividend yield is at a historical high.

Among these companies, it appears that Honda (HMC) is one of the best as it has a very manageable debt burden and is trading at a nice discount. The opposite is true for TSLA.

It is safe to say that these companies are overvalued from a long-run perspective. Let’s look closely at the macro backdrop to get an idea of shorter-term performance and of new potential secular trends.

Global Vehicle Sales Weak, But Not For Long

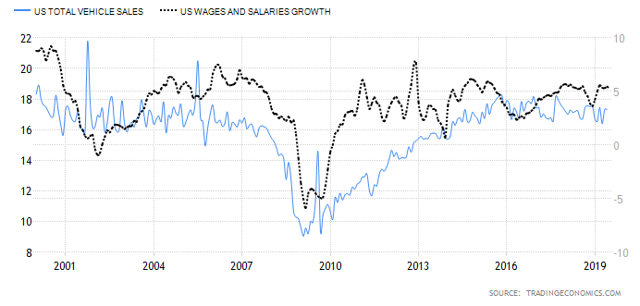

Vehicle sales and wage/household credit growth are ultimately tied together. However, vehicle sales have been slightly downtrending in the U.S. while wage growth and household credit have finally begun to expand. Take a look at total vehicle sales vs. wage growth in the U.S.:

(Source – Trading Economics)

I actually would be surprised if vehicle sales repeat 2008. Remember, the 2000 recession had next to no impact on the vehicle sales market and, in my opinion, the economy today looks more similar to 2000 than in 2008.

I have found that investors expect the next recession to look just like 2008 and have been pricing assets accordingly. Global unemployment is low and continues to fall despite weak manufacturing and even recessions in some countries. Real wage growth is positive and consumer spending continues to rise.

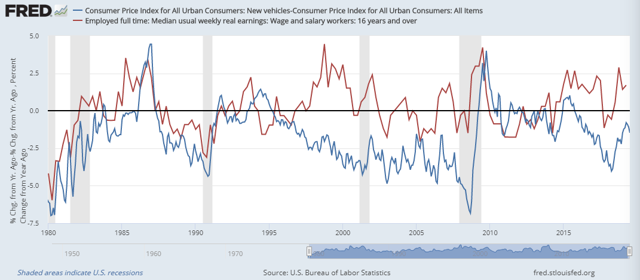

Take a look at the YoY real price change of new vehicles vs. that of wages:

(Source – Federal Reserve Economic Database)

As you can see, there is a slight leading relationship between real wages and cars. Of course, there are secular trends such as the 2000s where auto production moved rapidly overseas and caused prices to fall that broke the relationship, but it has come back in action today.

Real vehicle prices have taken a plummet recently while consumers’ ability to buy cars has risen. Though it is not shown in this chart, this is also seen in Japan and Europe.

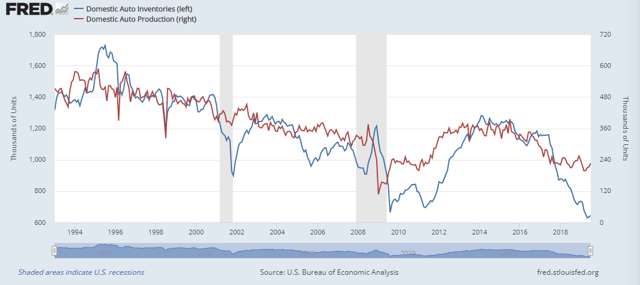

In fact, the need for new cars will likely actually rise dramatically over the next 10 years. In 2015 there were over 1.2M vehicles in inventory in the U.S., today that figure has dropped to 630M, which is lower than it was during the height of the last recession. Take a look below:

(Source – Federal Reserve)

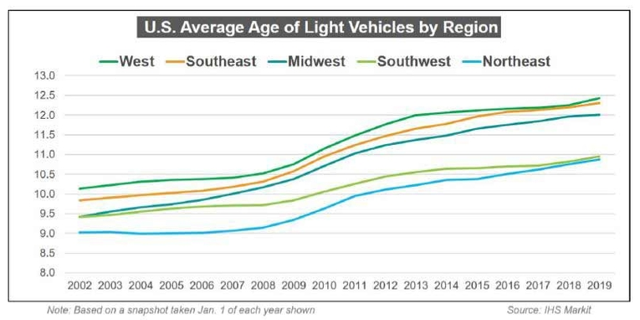

To add a catalyst to this low inventory figure, take a look at the average age of cars across the United States:

(Source – Autonews/IHS Markit)

In Europe, the average car is also about 11-12 years old (an all-time high). While cars do last longer today, they sure don’t last forever and it is likely that vehicle sales will climb dramatically in years to come as old cars are replaced.

Interest rates are very low across the developed world while incomes are rising, so there is little that can stop this trend. Even more, Generation Z makes up more than 20% of the U.S. population; they will also be needing cars over the next decade.

While vehicle sales are weak in the U.S., China, and Europe, they will climb in the coming years (at least for the U.S. and Europe). Vehicle sales in Brazil, Russia, and Australia (the next top three buyers) have been rising in recent months. If anything, in the short-run falling industrial metal and energy prices due to the economic slowdown will boost operating margins for car manufacturers. Eventually, top-line revenue growth will pick up as all of these vehicle demand factors come into play.

The Bottom Line

Overall, car companies are trading at a huge discount, not because future demand for cars will be weak, but because past demand has been weak and has crushed investor sentiment. Over the past 10 years, the “automotive economy” has been in a depression and its investors have lost. In my opinion, the CARZ ETF may see more downside, but that downside only allows for steeper discounts to and otherwise heavily discounted industry.

I expect margins to improve due to lower commodity prices and vehicle demand to continue to be weak for a year or so and then begin a large rise as consumers feel more financially secure and replace old cars.

If you do not believe there will be a recession, then you can go outright long the ETF. Doing so carries the trade-war/tariff risk (which could prove my thesis wrong) and the general equity market risk. Frankly, I am bearish on the global economy and expect the trade war to continue, but I am still interested in a hedged position in the ETF.

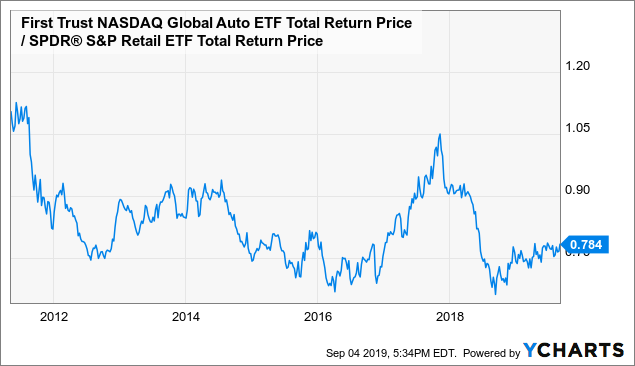

One way to hedge the global economy and the trade war is by pairing the position with a short U.S. retail via the SPDR S&P Retail ETF (XRT). I don’t believe that the retail sector will gain from improving consumer strength and like the fact that CARZ and XRT share similar exposure to tariffs. By using a pairs trade, the huge risk is mitigated. Take a look at the ratio performance below:

Data by YCharts

Data by YChartsOverall, this pairs trade seems like a safe bet and the recent trend favors CARZ.

Interested In Closely Following Global Events?

“The Country Club” is a dedicated service that focuses on single-country and regional ETFs with the goal of helping our subscribers diversify globally and get a better grasp on how world events will affect their portfolio. We will certainly be providing subscribers further updates on this idea.

Subscribers receive exclusive ideas, model portfolios, and a wide range of tools including our exclusive “Country Club Dashboard” which allows them to visualize global financial and economic data. If you haven’t already, please consider our 2-week free trial and get your passport to global markets today!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News