[ad_1]

Investment thesis

Since our last take on the S&P GSCI Unleaded Gasoline Index Spot (SPGSHU), our view on the complex has not materialized, as the global growth slowdown weighs on gasoline demand.

Going forward and with the persistence of market uncertainties, weakness is likely to linger on the SPGSHU Index, amid ample gasoline stocks, unfriendly seasonality for this time of the year, and weakening demand for the motorized blend.

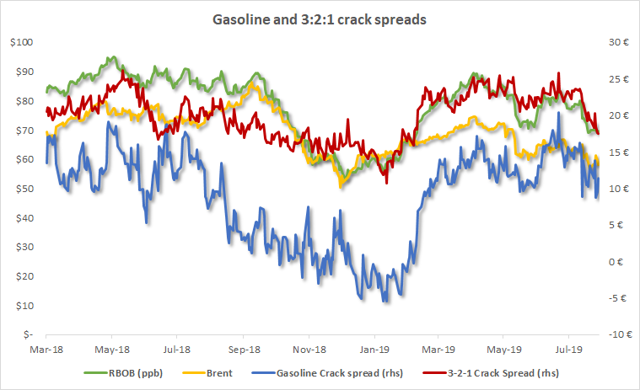

Weakening gasoline and 3:2:1 cracks indicate further bearishness

In the last month, gasoline cracks decreased steeply, after the blend reached a $20.35 per barrel high in the beginning of July, the spread is now down 44% to $11.39 per barrel, following a sturdier decline of RBOB futures than its crude oil counterpart, the Brent benchmark.

Concomitantly, the 3:2:1 crack spread declined slightly less, continuing to bring downward pressure on gasoline futures and its proxy, SPGSHU. Indeed, during the week ending August 9, the crack decreased robustly, down 10.3% (w/w) to $19.4 per barrel and is now evolving near its lowest level since February 2019.

Source: Oleum Research

With these developments, RBOB and its proxy SPGSHU declined 5.89% to $69.9 per barrel and 11.1% to $336.09 per share, respectively.

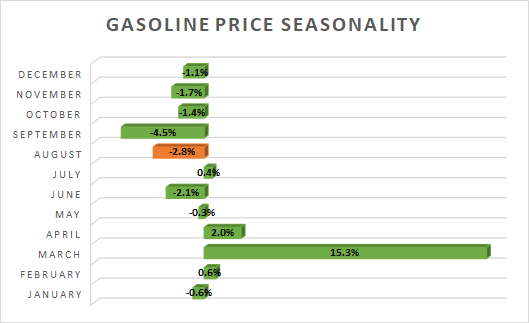

Gasoline price seasonality and storage surplus remain unfavorable for the complex

In the last 10 years, the month of August proved to be unfriendly for the gasoline complex, with an average decline of 2.8% over the month and is likely to provide additional headwinds on the SPGSHU Index.

Source: Oleum Research

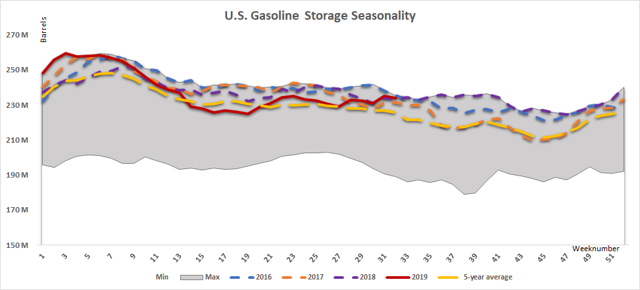

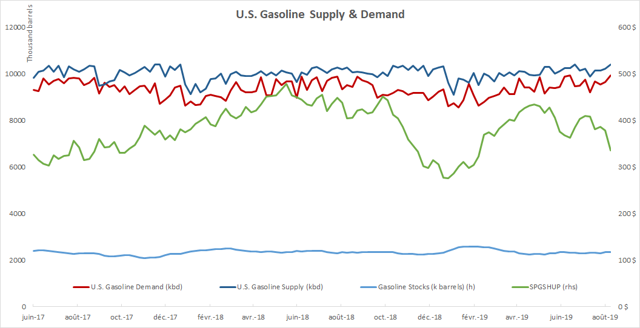

Furthermore, according to the EIA, current gasoline stocks continue to evolve in a moderate surplus compared to the 5-year average, up 3.6% or 8,198k barrels and marginally above last year storage, up 0.3% or 632k barrels.

Source: EIA

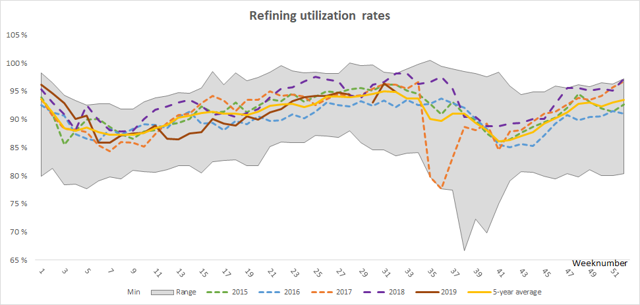

That being said, the rapid tick up of refining utilization rates, which are now running close to full capacity (94.8%), should continue to sustain U.S. gasoline supply and support our bearish view on the complex.

Source: EIA

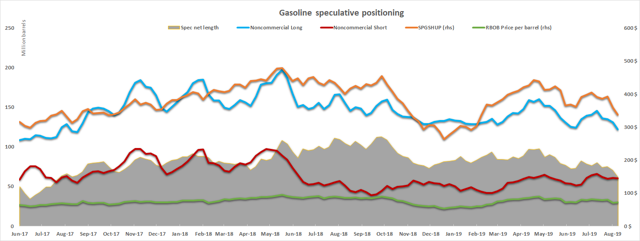

Speculator bets

In the last month, speculators slashed significantly their positioning on Nymex gasoline futures, down 22.52% to 61,965 net long contracts, as longs liquidated their bets in the last four consecutive weeks, putting significant pressure on SPGSHU.

Besides, this downward trend is not yet ready to steady, given that the reduction of long positioning accelerated steeply on the week ending August 13, down 6.99% (w/w) to 122,067 contracts and was marginally sustained by short covering, down 1.08% (w/w) to 60,102 contracts.

While the net speculative bet picture continues to sustain the complex, the weakness seen last week indicates that the downward momentum might be strengthening, as long open interest positioning dips below the 30% threshold, a value not reached since August 2018 when RBOB prices were trading below $70 per barrel.

Given the above, we expect speculators to continue to pressure the gasoline complex, which should mechanically pressure the SPGSHU.

Demand for the blend stalls following declining manufacturing and freight activity

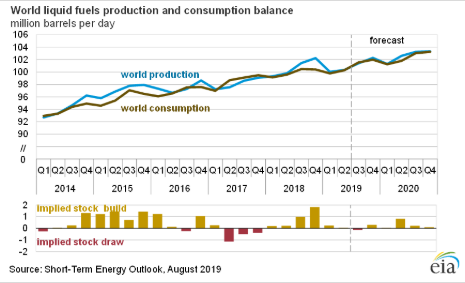

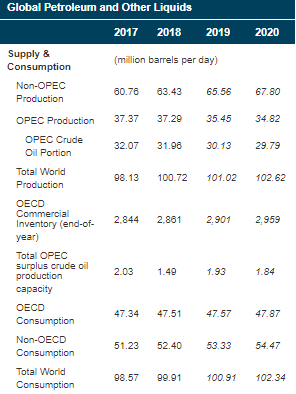

Global economic slowdown and trade war dispute between China and the U.S continue to weigh on crude and gasoline demand. In spite of the slight uptick of global liquid fuels consumption observed in the end of the 2Q2019, stocks of gasoline remain ample and world’s liquid production counterbalanced it entirely.

Total world fuel consumption is broadly unchanged compared with 2018 and the demand for transportation fuels stabilized, following resting manufacturing and freight activity.

Source: EIA

In the U.S. and in spite of a slight acceleration of gasoline demand in the last weeks, the complex remains oversupplied, indicating further potential weakness on the complex.

Source: EIA, Oleum Research

Closing thought

The overall picture of the gasoline complex and SPGSHU is not bright, and we expect additional downward pressure in the coming weeks, as gasoline and 3:2:1 cracks deteriorate, price seasonality remains unfriendly for this time of the year, gasoline storage is ample, and the blend’s demand curbs, as the global economic outlook deteriorates.

We look forward to reading your comments.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News