[ad_1]

Investment case

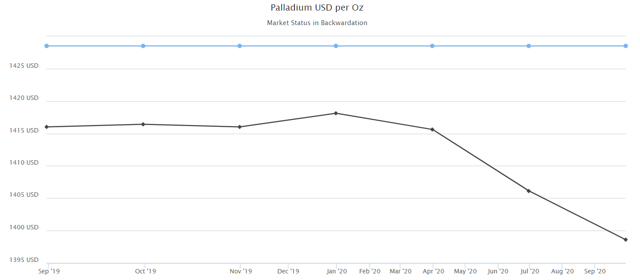

While the Aberdeen Standard Physical Palladium Shares ETF (PALL), which replicates the performance of palladium prices, has come under intense downward pressure since mid-June on escalating US-China trade frictions, we believe that the recent weakness offers a buying opportunity at this level, because the fundamental picture of the palladium market remains tight despite the weakening of auto trends. The backwardation in Nymex palladium corroborates this view.

Even in a bearish scenario in which Chinese auto sales continue to weaken in H2 2019, the palladium market would still experience a deficit, which would therefore warrant ultimately a stronger equilibrium price to correct the supply/demand imbalance.

In this context, we believe that PALL will rally stronger in the near term. For August, we expect a high of $153 per share, representing an upside of 12% from its current level.

Source: Trading View, Orchid Research

About PALL

For investors seeking exposure to the fluctuations of palladium prices, PALL is an interesting investment vehicle because it seeks to track spot palladium prices by physically holding palladium bars, which are located in JPM vaults in London and Zurich. The vaults are inspected twice a year, including once randomly.

The fund summary is as follows:

PALL seeks to reflect the performance of the price of physical palladium, less the Trust’s expenses.

Its expense ratio is 0.60%. In other words, a long position in PALL of $10,000 held over 12 months would cost the investor $60.

Liquidity conditions are poorer than that for platinum. PALL shows an average daily volume of $3 million and an average spread (over the past two months) of 0.33%.

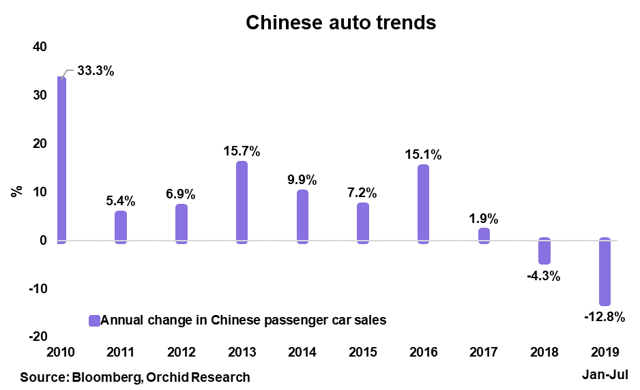

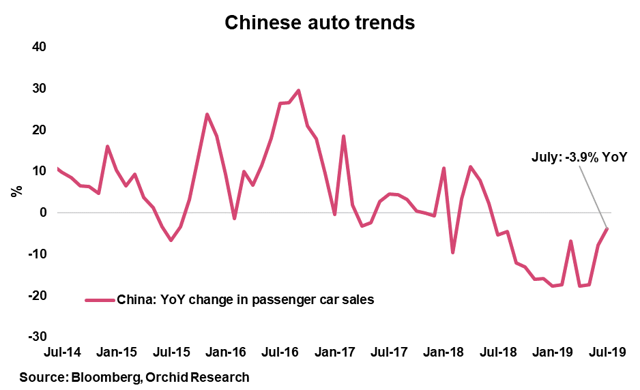

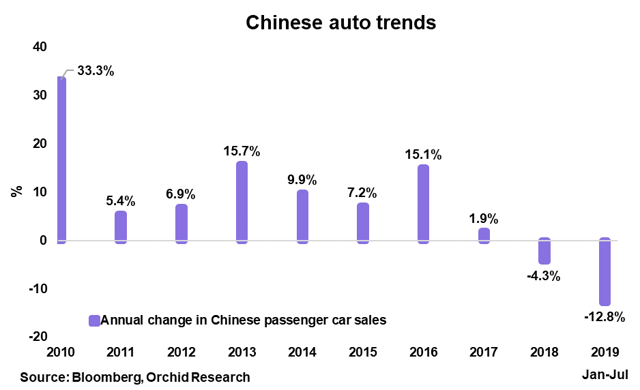

The Chinese auto market – the world’s largest passenger vehicle market – continued to struggle in July. The China Association of Automobile Manufacturers (CAAM) shows that passenger car sales dropped 3.9% YoY in July (-7.8% YoY in June), marking the 13th month of uninterrupted decline.

Source: Bloomberg, Orchid Research

In the first seven months of the year, passenger car sales contracted by 12.8% YoY, on track to post the second year of contraction in a row (2018: -4.3% YoY).

Source: Bloomberg, Orchid Research

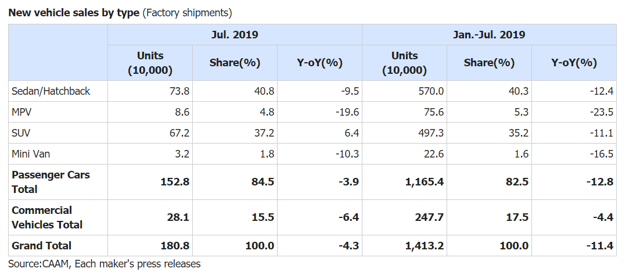

Here is a more detailed breakdown showing new vehicle sales per type:

Source: MarketLine

CAAM forecasts a decline of 5% for passenger car sales in the whole of 2019, which assumes a recovery in the second half of the year.

If we assume that CAAM is too optimistic, what would happen if auto sales in China remain weak in the second half of the year.

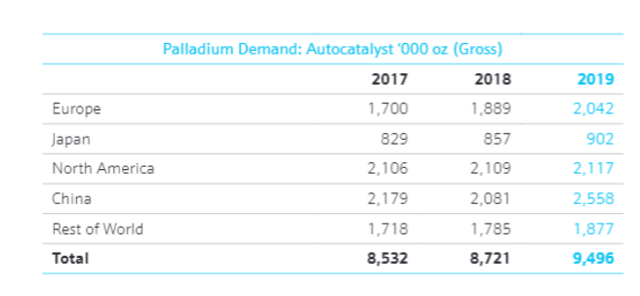

According to a stress test conducted by our friends at SFA Oxford, a decline of 10% in passenger car sales in China in 2019 would cut palladium annual domestic consumption by 80,000 oz, or 3.8%, to 2 million oz, in sharp contrast with Johnson Matthey’s projections of a 477,000 oz increase in Chinese autocatalyst demand.

Still, this would not be enough to balance the expected deficit for this year (around 800,000 oz, according to Johnson Matthey), unless there is a global contraction in global autocatalyst demand across the board. Johnson Matthey’s projected deficit assumes an increase of 775,000 oz of palladium (+9% YoY) from the automotive sector.

Source: Johnson Matthey

Although signals from the automotive market (in China and globally) have weakened increasingly this year, the palladium market is likely to remain in deficit, which should support an overall appreciation in prices. We will watch carefully the palladium yield curve to better assess our view.

For now, the curve continues to show a backwardation at the longer end of the curve (from January 2020 onward), implying market tightness, despite weak auto trends. This is bullish.

Source: Denver

Closing thoughts

Despite weak auto trends, including in China – the world’s largest automotive market – palladium prices have remained in backwardation, a clear sign of tightness. Our analysis shows that even though auto sales continue to weakness in the second half of the year, the palladium market should remain in deficit, thereby pointing to firmer prices.

Against this, we are induced to buy the dips in PALL, expecting a gain of roughly 12% in the near term.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our research has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. Therefore, this material cannot be considered as investment research, a research recommendation, nor a personal recommendation or advice, for regulatory purposes.

[ad_2]

Source link Google News