[ad_1]

Tallbacken Capital Advisors CEO Michael Purves shared a contrarian outlook on the bond market with viewers of Real Vision’s Trade Ideas, warning that there is a “good case” to be made for rates going higher.

He pointed out that the correlation between German bunds and 10-Year Treasury yields “has been spiking hugely.”

Given the increasing correlation, Purves believes that if Eurozone data improves, yields will be lifted higher and that could be “exported into our market over here and then you [could] see a quick rise higher here.”

How to Play The Thesis

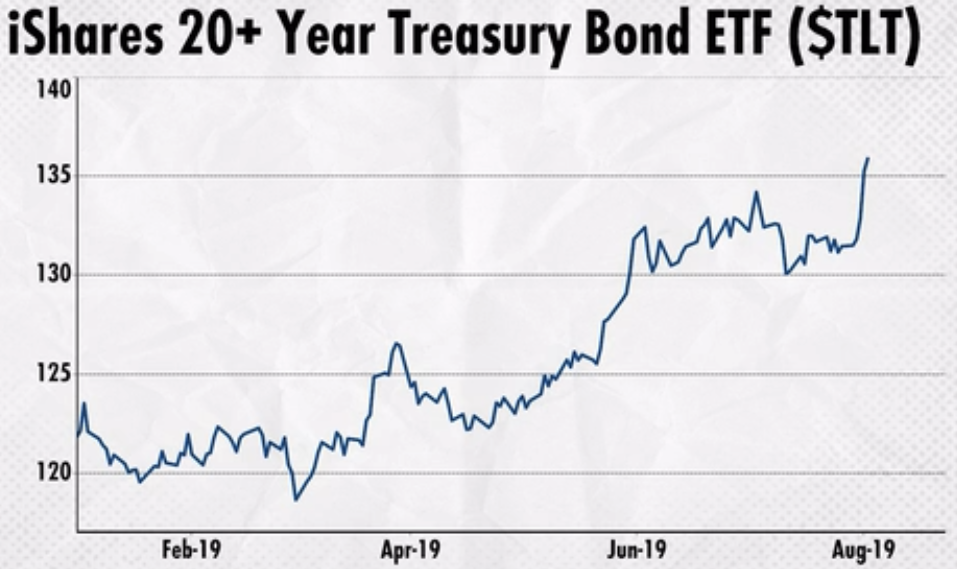

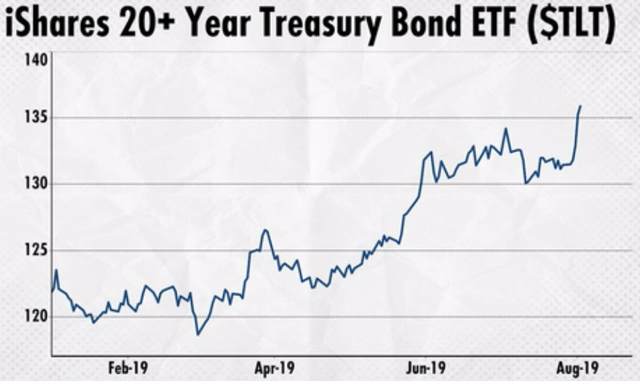

An obvious way to play the contrarian thesis that rates could actually go higher is to short or buy puts on the iShares Barclays 20+ Year Treasury Bond (TLT), Purves said.

He also shared a couple of more ideas on the same thesis from different angles.

He also shared a couple of more ideas on the same thesis from different angles.

First, shorting utilities. “Within equities, I think if rates do go higher, utilities have been extraordinarily aggressively bid. It’s effectively the same trade, those have a lot of torque to the downside if rates do in fact break there,” he explained.

And second, he said: “Getting long banks would probably play as well, if particularly the back end increases higher and that you see those yield curves ranging a little bit more dynamically to the upside.”

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is pretty obvious, but we should probably say it anyway so that there is absolutely no confusion… The material in REAL VISION GROUP video programs and publications (collectively referred to as “RV RELEASES”) is provided for informational purposes only and is NOT investment advice. The information in RV RELEASES has been obtained from sources believed to be reliable, but Real Vision and its contributors, distributors and/or publishers, licensors, and their respective employees, contractors, agents, suppliers and vendors (collectively, “Affiliated Parties”) make no representation or warranty as to the accuracy, timeliness or completeness of the content in RV RELEASES. Any data included in RV RELEASES are illustrative only and not for investment purposes. Any opinion or recommendation expressed in RV RELEASES is subject to change without notice. RV Releases do not recommend, explicitly nor implicitly, nor suggest or recommend any investment strategy. Real Vision Group and its Affiliated Parties disclaim all liability for any loss that may arise (whether direct, indirect, consequential, incidental, punitive or otherwise) from any use of the information in RV RELEASES. Real Vision Group and its Affiliated Parties do not have regard to any individual’s, group of individuals’ or entity’s specific investment objectives, financial situation or circumstances. RV Releases do not express any opinion on the future value of any security, currency or other investment instrument. You should seek expert financial and other advice regarding the appropriateness of the material discussed or recommended in RV RELEASES and should note that investment values may fall, you may receive back less than originally invested and past performance is not necessarily reflective of future performance. Well that was pretty intense! We hope you got all of that – now stop reading the small print and go and enjoy Real Vision.

[ad_2]

Source link Google News