[ad_1]

About two years ago, a friend introduced me to Scott Acheychek, president of REX Shares. REX creates unique ETPs that traders may find compelling, such as its MicroSectors line of ETPs.

I was invited by Scott to attend the opening bell ceremony on the floor of the NYSE on Monday, June 10. It was a great event, with brief footage here from the NYSE website.

I recently followed up with an interview with Scott about MicroSectors and the Big Oil suite of products offered by REX.

Tell me about REX Shares, Scott.

Sure thing. REX is an ETP architect. We specialize in creating and distributing new and unique products to the marketplace. We are traders and structurers at heart so we look to create products that we would want to trade ourselves.

Very good. So what was lacking in the standard ETPs that many investors are familiar with when it came to “Big Oil” (such as XLE or the Leverage/Inverse ETFs: ERX and ERY)? Why did REX Shares see an opportunity to innovate here?

In broad terms, we look for big picture themes that are inadequately captured by existing indices. We ask ourselves if we would trade certain indices if we had bullish or bearish views related to that market.

People get stuck on tickers, and the tickers become default mechanisms to express views. It’s a shame because often times traders don’t really know much about how the underlying index is constructed; even if they do know, they may perceive that they don’t have strong alternatives. We shock people all the time just by sharing index information, which we do often on @msectors.

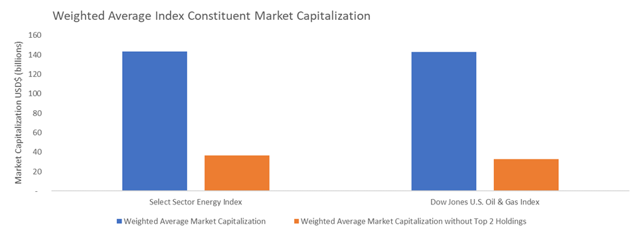

Getting back to my earlier point, we look at the indices underlying all of these energy products and find room for improvement. Investors looking for large cap U.S. oil exposure are surprised to learn about the massive weighting – I’ll argue overweighting – of the top two holdings in the S&P Energy Select Sector Index; and for that matter in the Dow Jones U.S. Oil & Gas Index as well. For instance, take a look at this picture on the Energy Select Index components from State Street’s website:

The ~43% allocation to the top two holdings should stand out, whether you hold these products for the long term, or you trade short-term! This weighting to XOM and CVX is similar in the Dow Jones U.S. Oil & Gas Index as well.

Adam, if someone actively chooses to buy and hold or trade Exxon and Chevron, that’s one thing, but in the post-Deepwater Horizon world, I’d argue you’d want a little more balance out of an index that provides your short or long term energy allocation. Don’t get me started on market cap weightings when you include massive firms like Exxon and Chevron.

The below chart further illustrates my point on these so called energy “benchmark” indices that are market cap weighted:

There is arguably far too much influence exerted by the heavyweights, and as such market cap index construction can distort the overall behavior of some of the prominent names in the sector.

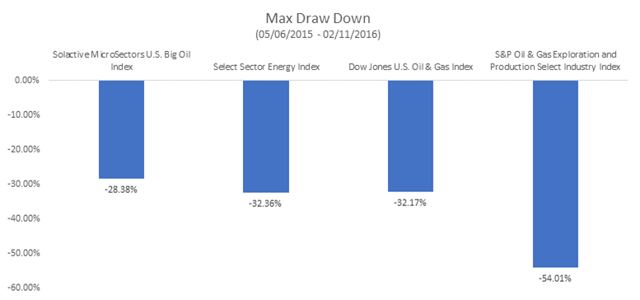

Can you tell me a little about the Solactive MicroSectors™ U.S. Big Oil Index? How is it constructed, and how did the Big Oil index perform during the oil sell-off (late 2015/early 2016)? I imagine the E&P indices have outperformed since that bottom.

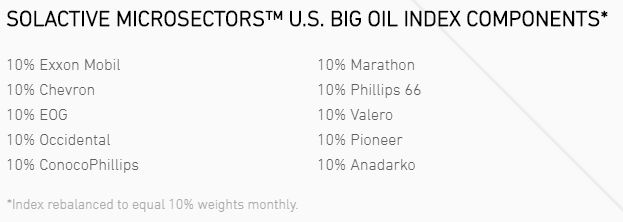

The Solactive MicroSectors U.S. Big Oil Index is composed of the ten biggest U.S. stocks in the energy sector as determined by free-float market capitalization. The index is equally weighted across these ten stocks, providing a unique performance benchmark that allows for a more diversified approach, rather than being dominated by a couple names. The MicroSectors U.S. Big Oil Index is for investors looking to overweight or underweight energy, or for more frequent traders looking to get specified exposure to the biggest names in U.S. Oil or Energy.

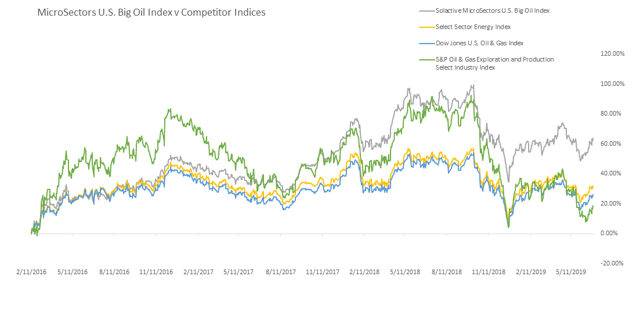

In regards to performance during the oil sell-off, please see the charts below illustrating how MicroSectors U.S. Big Oil Index compared to the so called traditional energy benchmarks. Since that sell-off, E&P indices had a good run, but they’ve been struggling since the more recent oil and macro sell-off in late 2018.

Source: Bloomberg 05/06/2015-02/11/2016

MicroSectors U.S. Big Oil Index vs Benchmark Indices since Oil Bottom

Source: Bloomberg 02/11/2016-07/17/2019

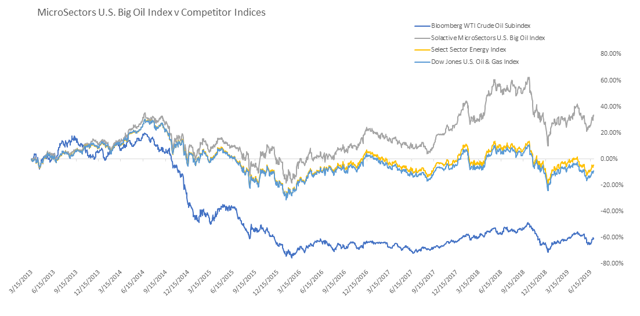

Interesting, Scott. Can you also share your Big Oil Index performance for as far back as it goes compared to these other indices?

Sure thing, Adam. Our data goes back to March 2013. Since this time we are the only index of this bunch to be in positive territory.

Source: Bloomberg 03/15/2013-07/16/2019

Impressive. What are some of the prominent names that traders would recognize in your Big Oil Index?

The beauty of MicroSectors lies in its simplicity. Our Big Oil Index contains just the ten biggest companies in big oil, and we weight them equally, rebalancing once a month. The Big Oil Index does not overlook the large players in oil, and this becomes apparent as soon as one examines the index constituents.

Let’s turn from the index and onto the ETNs that REX has created. Can you let readers know about the Big Oil Product Suite that REX Shares offers?

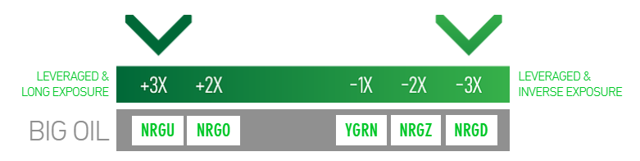

Sure, our goal is to prove that our Big Oil Index should be the benchmark for energy trading. We realize that investors and traders look at different levels of exposure to make their trades, and so we provide a full suite of products linked to our index: 3x (NRGU), -3x (NRGD), 2x (NRGO), -2x (NRGZ), and also unlevered inverse (-1x) via YGRN.

We believe in providing a full suite of products to allow traders to pick which exposures they want to access when they anticipate energy trade setups, whether long or short. This product suite helps traders achieve that goal.

Speaking of ETN’s, why did REX opt for the exchange-traded note structure rather than creating exchange-traded funds?

The ETN structure allows REX to tap specific segments of the market that aren’t possible with an ETF wrapper. As mentioned, the beauty of our products lies their simplicity; just the ten biggest stocks in the sector, equally-weighted. That is only possible with an ETN.

Our goal with all of our MicroSectors is to create products that contain the stocks people know in the sectors they follow. This allows us to access compelling investment strategies in areas like just FANG+ in tech, the biggest U.S. banks in financials, or the biggest names in energy.

If you had one last line to share on MicroSectors, what would it be?

Our leverage and inverse trading products are just that: trading products. They aren’t for everyone; they are for sophisticated investors and traders who understand the daily resetting leverage and inverse structure and have a grasp of our concentrated indices. If you want to express a specific view on energy or tech, and don’t wish for the index to be overweight two names or diluted with non-leaders in a sector, then I think MicroSectors is worth your consideration.

Thanks, Scott. I wish you and REX Shares the best as you continue to innovate in the industry.

Thanks Adam.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News