[ad_1]

(Pic Sourced Here)

We may still have weeks to wait for the next FOMC meeting, but in his congressional testimony Chairman Powell sealed the deal to lower the Fed Funds rate for the first time since the end of the Great Recession and the fallout has been almost predictable. Ignoring the reason why Powell feels compelled to lower rates in the first place, the S&P 500 has pushed to new heights while financial stocks once again find themselves at risk of missing out on the party with bank stocks in particular being among the biggest losers. That underperformance combined with relatively stable earnings and sporting “cheap” multiples normally attracts value investors but are bank stocks a value or a value trap?

The chairman isn’t the only one to have their hand forced, lowering rates means it’s time for us to revisit our most recent article on bank stocks, Financial ETFs Are No Sure Thing where we argued that investors should reconsider putting capital to work in what appeared to be undervalued bank stocks. We made two arguments against buying bank stocks then and nothing has changed in our outlook in the last three months. With rates now guaranteed to fall, and bank stock funds trading close to historically high valuations, now is not the time to go bargain hunting in the financial bin.

Historical Lessons

We made two arguments in our last post with the first being that investors shouldn’t consider the price multiples of bank stocks relative to the broader market because bank stocks, and the funds that hold them, seemingly always trade at a discount to the rest of the market. What’s truly important is to view those price multiples compared to their own historical levels where you would see that any number of pure bank funds were then trading near the high end of their historic ranges. That hasn’t changed since that post which we’ll discuss again later on.

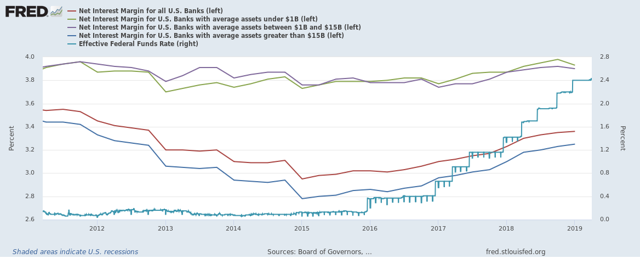

The second and perhaps more important argument was that the possibility of the Fed cutting rates was going to have a far bigger impact on bank stock returns going forward. No two banks may be exactly alike, but they all have a few similarities including a heavy dependence on Net Interest Income (NII) which is why analysts focus on the Net Interest Margin (NIM) or the difference between what banks pay for deposits and what they receive on the loans they make. NIM growth closely tracks changes in the Fed Fund rate making their bottom lines uniquely vulnerable to the FOMC’s policies.

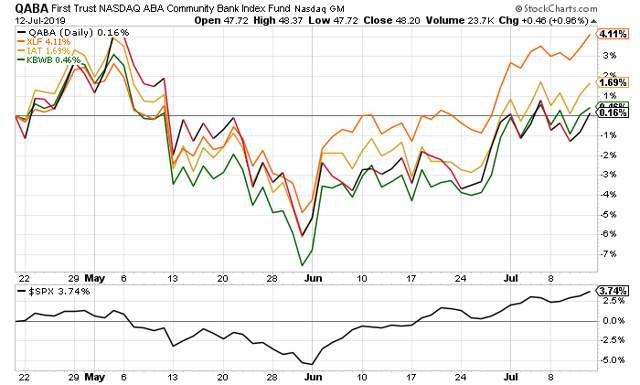

Most vulnerable, a veritable “canary in the coal mine” are those small, local banks that depend most on NII and which make up the First Trust NASDAQ ABA Community Bank Index Fund (QABA). Typically smaller (the fund has an average market cap of just over $2 billion), they lack the revenue diversification of a megabank and depend heavily on NII along with wealth management or other services to keep their bottom lines in the black. So how has QABA performed since our last article as expectations for a Fed rate hike reached a crescendo?

Well, as you can see in the chart above, QABA has certainly underperformed a host of other funds although there’s more here than meets the eye. The top-performing fund of the four is the Financial Select Sector SPDR (XLF) which is a broad sector fund holding far more than just bank stocks. XLF’s holdings all come from the S&P 500 which in fact it actually outperformed during this period! Then there’s the iShares U.S. Regional Banks ETF (IAT) up over 1.6% followed by the Invesco KBW Bank ETF (KBWB), a broader fund with a much higher overall market cap, which was surprisingly flat despite having strong earners like Citigroup (NYSE:C) but more on that later.

There’s no doubt that QABA lagged behind its peers although not by as much as you might expect and even during the two days of Chairman Powell’s testimony it was only down .46%, underperforming IAT and KBWB by 20-30 bps. We’re still several weeks out from the next FOMC gathering but why hasn’t QABA felt more of a sting from Powell’s testimony or the near guarantee of a 25-bps rate cut? Partly because investors have yet to cut their expectations!

Lowered Expectations:

When we wrote that last post, QABA was trading at the peak of its historical P/B ratio and close to it for the P/E ratio as were several other funds including XLF. Fast forward almost three months and the situation has hardly changed with both its current P/B and P/CF ratio again in the top percentile while the P/E ratio remains in the upper third of its range. Even then the fund’s P/E is at 13.5x which is substantially higher than that of KBWB (10.87x) and the broad financial sector fund XLF (12.69) and even the regional bank stocks of IAT (12.12x). Clearly, the idea that smaller banks might be the most at risk from a rate cut has yet to sink in, unless investors expect that this will be a true “one and done” cut.

In fact, investors have done a fairly good job of staying in until the tide turns as the average stock in QABA has seen its quarterly EPS increase compared to the prior period, according to data we found at Finviz.com. Looking at the most recent data from the Federal Reserve in the graph several paragraphs back, you can see that NIMs for smaller banks (assets under $1 billion) fell slightly from 4Q 18 to 1Q 19 but the median EPS growth was approximately 7% for the components of QABA.

But don’t let that growth fool you into thinking that it’s nothing but smooth sailing ahead for QABA which has an abysmally low ETFG Green Diamond score thanks to the combination of iffy momentum, poor sentiment (including almost no short interest) and poor fundamental scores. In fact, one reason why the fundamental score was so low is that we couldn’t see any clear pattern between quarterly EPS growth and performance with little to no correlation between the two.

Maybe an easier way to understand QABA is by pointing out that no matter what multiple you look at, the fund’s current price multiples are higher than that of an ETF with large bank exposure like KBWB while offering a lower dividend yield that’s closing in on the lowest levels it ever has been.

Not exactly screaming “buy me” as we approach the first rate cut in over a decade.

Watch Out, It’s a Trap!

But a bigger mystery for some might be why KBWB, with larger banks that should be more immune from pressure on NIMs is doing so poorly and for that, we have to look at two of America’s oldest “banks,” at least thanks to a series of prior mergers, the Bank of New York Mellon (BK) and State Street (STT). We put banks in parentheses because both institutions while once upon a time had retail banking operations have long since evolved into custodial banks whose role is to safeguard assets, process transactions and provide those boring services that make our financial markets possible. And BK and STT are two of the largest custodian banks in the world with tens of trillions in assets under custodianship and trillions more in AUM. They’re also two of the most looked-down-upon stocks in the market these days with both down substantially in 2019.

Perhaps the best sign of how far they have fallen is the fact that neither has merited an article on Seeking Alpha since the end of April when both showed a drop in their quarterly earnings! The situation has steadily gotten worse since then and both are down double digits against not just the S&P 500, but even the Financial Select Sector SPDR, a fund managed by State Street! And that’s one reason why KBWB, with almost 7.5% invested in BK and STT is flat compared to the rest of its peers.

Does that mean investors have been too hasty in embracing small bank stocks but not large custodian banks where interest income is typically less than a third of total revenue? Is it time to go long the downtrodden custodians and short main street? Not so fast because for once, investors have been judging the situation correctly, if only in the short term.

Value investors and contrarians might be immediately drawn to the idea of an overlooked bargain in BK and STT, which are not only the worst two performing financial stocks in 2019 but also two of only the six S&P 500 financials that are even in the red for the year! Throw in the fact that both are reporting second-quarter earnings next week after a strong quarter for both bonds and stocks, which means likely inflows into both ETFs and mutual funds and it seems like a case could be made for a speculative bet on the banks although we’d suggest pumping the brakes for now.

Being singled out like that by investors isn’t the byproduct of being overlooked by investors so much as actively hated and for the original sin of investing, weak earnings. Both banks had disappointing first-quarter results on both a q-o-q and y-o-y basis and across both fee and interest revenue lines. While BK and STT both claimed a significant impact for the rising dollar, they both also saw significant drops in service and management fees with STT particularly hit hard with double-digit drops from 1Q 18 to 1Q 19. No wonder its stock is down over 11% YTD and more than 40% in the last year.

And even that showing isn’t enough to have tipped STT or BK into value stock territory with their relative valuation scores still within spitting distance of some of their financial peers. Citigroup, which offers custodial services, has a trailing P/E ratio of 10.41x and a P/B of .94x compared to 9.34x and .97x for State Street or 11.59x and 1.11x for BK, respectively. And Citigroup is up over 48% this year! In fact, the multiples for STT and BK are only attractive when compared to much better performing regional banks like PNC or M&T (MTB) while they’re in-line with mega-bank institutions like Goldman Sachs (NYSE:GS) or Morgan Stanley (NYSE:MS). In other words, even with their lackluster performance it’s hard to make a serious argument for BK and STT being undervalued. If anything, their long-term prospects are stuck under the sword of Powell with no let-up in sight in the near future and are still trading in line with stocks of a similar size in the sector. Not exactly a strong value case.

Conclusion:

So what’s a bank stock investor to do? With the FOMC likely to cut rates and “true” bank stocks already up strongly this year or trading the same valuations as the ones who actually are up strongly this year, it’s hard to make a compelling case for being long. The best thing for investors would be to deploy that capital towards another use in a sector that could benefit from a negative real yield environment like gold or wait for a signal that the FOMC’s policies might be giving new life to this already long-lived economic rally.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Assumptions, opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. ETF Global LLC (“ETFG”) and its affiliates and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively ETFG Parties) do not guarantee the accuracy, completeness, adequacy or timeliness of any information, including ratings and rankings and are not responsible for errors and omissions or for the results obtained from the use of such information and ETFG Parties shall have no liability for any errors, omissions, or interruptions therein, regardless of the cause, or for the results obtained from the use of such information. ETFG PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. In no event shall ETFG Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information contained in this document even if advised of the possibility of such damages.

ETFG ratings and rankings are statements of opinion as of the date they are expressed and not statements of fact or recommendations to purchase, hold, or sell any securities or to make any investment decisions. ETFG ratings and rankings should not be relied on when making any investment or other business decision. ETFG’s opinions and analyses do not address the suitability of any security. ETFG does not act as a fiduciary or an investment advisor. While ETFG has obtained information from sources they believe to be reliable, ETFG does not perform an audit or undertake any duty of due diligence or independent verification of any information it receives.

This material is not intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only correct as of the stated date of their issue. Prices, values, or income from any securities or investments mentioned in this report may fall against the interests of the investor and the investor may get back less than the amount invested. Where an investment is described as being likely to yield income, please note that the amount of income that the investor will receive from such an investment may fluctuate. Where an investment or security is denominated in a different currency to the investor’s currency of reference, changes in rates of exchange may have an adverse effect on the value, price or income of or from that investment to the investor.

[ad_2]

Source link Google News