[ad_1]

Main Thesis

The purpose of this article is to evaluate the Schwab U.S. Dividend REIT ETF (SCHH) as an investment option at its current market price. While I have been bullish on Real Estate for some time, I am now striking a more cautious tone. While I do not expect vast under-performance from the sector, I think Real Estate will struggle to beat the market going forward, and, with SCHH’s current yield now below the 3% mark, the income cushion in the interim is not as attractive as it has been prior. In fairness, I see tailwinds for the sector, including continued economic growth, a tight housing market, and resilient consumer spending. However, headwinds exist as well. My primary concern is interest rate expectations, which seem to illustrate a disconnect between investors and the Fed. While the Fed has reiterated caution with respect to lower rates, investors are projecting three rate cuts by year-end, which in my mind is not likely to happen. With Real Estate rallying on the prospect of lower rates, there could be a painful reversal if rate cuts do not materialize. Finally, while the Real Estate sector has benefited broadly from rising apartment rents and retail spending, I believe both will pull back from here. Apartment rents are rising faster than wages, and there is bound to be a limit to what people can afford. Similarly, consumers continue to increase their e-commerce purchases, and that is bound to pressure brick and mortar property owners to some degree.

Background

First, a little about SCHH. The fund’s stated goal is “to track as closely as possible, before fees and expenses, the total return of the Dow Jones U.S. Select REIT Index.” The fund attempts to hold the same proportions of its stocks as the weightings in the index and is managed by Schwab. SCHH is currently trading at $44.08/share and yields 2.91% annually, based on the distributions from the last four quarters. I have been bullish on Real Estate for some time, and recommended SCHH when I reviewed the fund in February. Since then, the market has seen some volatility, but SCHH has managed a positive return around 2%. Furthermore, the fund has been beating the broader market since 2019 began, which is clearly a positive.

Despite this backdrop, I am now becoming much more cautious on the Real Estate sector as a whole. With the strong share price gains, yields have been depressed, meaning new investors will not be getting the “high” dividend yield they would have locked in months ago. In addition to this income concern, there are a few other macro-economic trends that could pressure the sector in the second half of the year, which I will discuss in detail below.

Sector Performance Is Feeling Pressure

I want to begin the review to illustrate the underlying reason for my initial concern with the Real Estate sector – performance. While SCHH still beats out the S&P 500 since the year began, the spread is narrowing quickly. While the fund out-performs the S&P by about 3% since January 1 (once dividends are accounted for), the most recent month tells a different story, as the two graphs below indicate:

Source: CNBC

As you can see, SCHH has been feeling some pain in the short-term, while the broader market is managing gains. This has prompted me to re-evaluate my out-perform rating on SCHH, and there are three key reasons for this (in addition to the short-term weakness).

Dividend Growth, Or Lack There-Of

One of my first points of concern is the fund’s dividend. As a “Dividend Seeker,” this should not be a surprise, as I pride myself on finding and investing in growing income streams. During my last review, SCHH scored big on this point, delivering significant dividend growth over the course of 2018, helping to keep the fund’s yield competitive.

Unfortunately, this time around is a different story. While the Q2 distribution did see about 10% growth on a year-over-year comparison, the Q1 distribution was very meager, and has counteracted the most recent growth. In fact, the negative growth for the first half of 2019 is quite significant, when the first two distributions are taken together, as illustrated in the chart below:

| Fund | 2018 Jan – June Distributions | 2019 Jan-June Distributions | YOY Increase |

| SCHH | $.57/share | $.45/share | (21)% |

Source: Charles Schwab

As you can see, the current income offered by SCHH has taken a bit of a hit. This, combined with a rising share price, are the culprits behind the yield slipping below 3%. While a 2.9% yield is not terrible given our current environment, there are other funds heavy with real estate exposure that offer more attractive dividends.

My takeaway here is mixed. SCHH still sports a reasonable yield, and it can certainly make up for this lack of growth in the second half of the year. However, even if the dividend growth picks up somewhat, SCHH will have a difficult time pushing the yield above 3% without seeing its share price decline, which would negate the immediate impact of higher distributions. Therefore, I see this reality as a key reason why I believe further upside is likely limited from here, and would wait to see some progress before building to current positions.

Rents A Source of Profit, But Looking Stretched

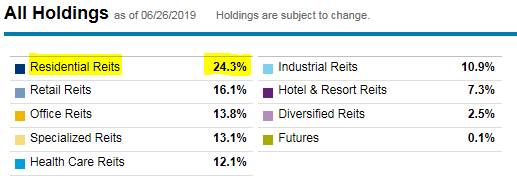

A second concern I have for SCHH relates to the apartment rental market, which is an area I have been bullish on for some time. On a macro level, I have seen rising rents, increasing demand, and population growth as being huge drivers to apartment rental REITs’ strong performance, and that has been a sub-sector that has indeed done well within the Real Estate space. This reality has been a positive for SCHH, as residential REITs make up about a quarter of total fund assets, as shown below:

Source: Charles Schwab

Clearly, the performance of this sector is of critical importance for SCHH, and the individual holdings include names such as Avalonbay Communities (AVB), Essex Property Trust Inc. (ESS), and Mid-America Apartment Communities (MAA). As I mentioned, this is an area that I have routinely recommended, specifically MAA, which I have covered on multiple occasions.

While I generally feel that apartment communities will continue to perform reasonably well in the years ahead, I believe their short-term valuations are looking a little stretched, similar to the Real Estate sector as a whole. Simply, the sub-sector is not cheap, with the stocks I mentioned above trading at Price to Funds From Operations ratios of 21.5, 21.9, and 18.5, respectively.

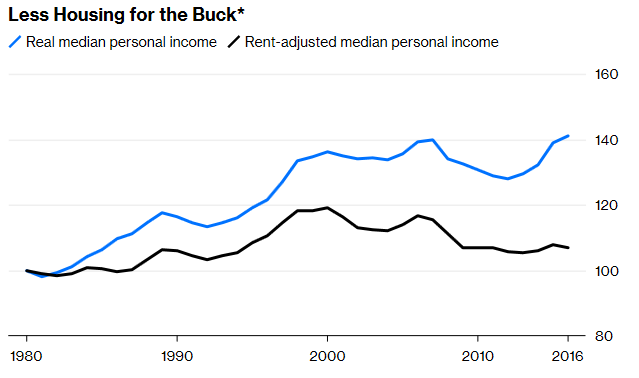

With this in mind, it is important to consider if these lofty valuations are justified, in the spirit or whether the apartment communities will continue to see high occupancy and aggressive rent increases. Again, while I believe the overall story is positive, I see some underlying fundamentals that could pressure pricing power in the near-term. One, rents are rising faster than wages. While this has been good for profits, it has pinched renters to the point where I am wondering how much higher rents can climb before reaching some leveling-off point. Specifically, Americans are seeing their incomes increase, but renters are spending a larger share of their income on rising rents, which is actually limiting their spending power, as the graph below illustrates:

Source: Bloomberg

The key takeaway here is that over the past few years after-rent incomes are on the decline, which is pressuring broader consumer spending, but will also start to limit further rent hikes. Given the sharp increase in medium personal income, the fact that after-rent incomes have been declining is truly telling on how high rents have gotten in major metropolitan areas. While I would not expect a dramatic decline in rents any time soon, it is clear that renters are feeling stretched to the point where they may consider alternative housing options.

On that point, home buying has picked up in the U.S. over the past couple of months. While lower interest rates are likely the primary driver to this development, rising rents are probably also convincing renters to consider making the leap to homeownership. In fact, according to data compiled by Bloomberg, pending home sales rose 1.1% in May compared to April, which was slightly above economist estimates that expected a 1% increase. My takeaway here is simply that as rents increase and home buying interest increases, rental demand could level off. This could cap further gains and make the recent out-performance in apartment REITS difficult to duplicate.

Interest Rates: Bullish For Real Estate, But Are Investors Expecting Too Much?

A third point I want to touch on is the market’s expectations for interest rate movements, which have a disproportionate impact on the Real Estate sector. Broadly speaking, lower rates are a positive for Real Estate stocks and funds, such as SCHH. This is because it allows for REITs to borrow money cheaply, investing that money in properties and compounding rates of return. All things being equal, SCHH should benefit from lower rates. Thinking back over the past 6-12 months, this story has proved to be true. The Real Estate sector was under-performing for most of 2018 while rates were going up, only to become one of the top performing sectors for the year when the interest rate outlook for 2019 changed dramatically. Specifically, the Fed had indicated rate hikes in 2019, only to change course and express a neutral policy heading in to the new year.

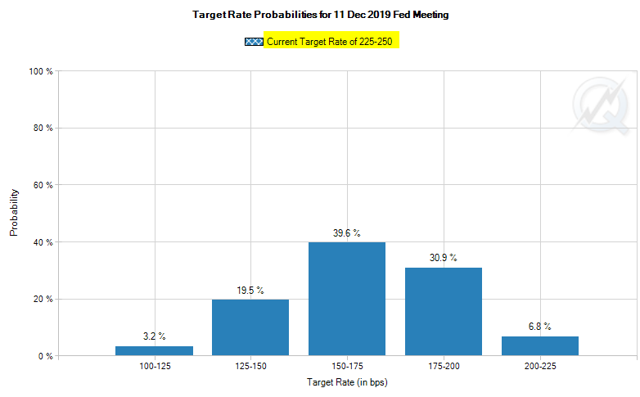

As 2019 has gone on, this story has continued. As I showed earlier, SCHH has been beating the market this year, as interest rates have slightly declined and, more importantly, investors have begun to expect lower rates in the near future. To illustrate, consider the current outlook compiled by CME Group, which indicates the market now expects three rate cuts by the end of the year, as shown below:

Source: CME Group

Clearly, investors expect interest rates to be going lower, and that has been bullish for SCHH, as investors are banking on markedly lower borrowing costs.

Of course, this sounds like good news for SCHH, so why am I striking a cautious tone here? The answer is simply because I view this outlook as overly optimistic, and I do not see the Fed being able to justify three rate cuts this year. More worryingly, the market seems very convinced that this is going to happen, as opposed to pricing in a mixed probability. The market appears 100% certain there will be one rate cut, and is offering near certainty on two cuts. My own personal view is I believe there will be one cut by year-end, but I find it very unlikely we will see three. The market obviously disagrees, but my point here is that the Real Estate sector will be disproportionately hit if these expectations are not met. The sector has been rallying on the dovish outlook, so if that outlook does not materialize I would expect some pain. In normal circumstances, I would not be overly concerned, but Real Estate valuations have gotten stretched aggressively over the last year, as investors piled in to stocks offering high yields and low amounts of foreign sensitivity. Given the run-up we have seen, it may not take much to spur a move to the downside.

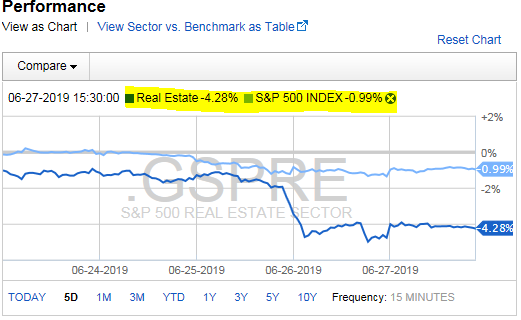

While the above is simply my opinion, consider the price action of the sector this week. Over the past five trading days, the S&P 500 is down slightly, but Real Estate has taken a relatively big hit:

Source: Fidelity

This leads me to question what the cause behind this divergence is. While not responsible for the entire move, one development was remarks made by Federal Reserve Bank of St. Louis President James Bullard. Specifically, in an interview reported by Bloomberg, he stated:

I think 50 basis points would be overdone. I don’t think the situation really calls for that. But I would be willing to go 25.

This put some cold water on the possibility of a .50% cut next month, which the market had been pricing in to some degree. Considering Bullard was the sole voting member to advocate for an interest rate cut in the June meeting, this was a significant statement coming from the dovish side of the Fed.

My point here is mainly to illustrate how volatile the Real Estate sector may be in the months ahead if the market does not get the interest rate cuts it is expecting. The action this week was certainly impacted by Bullard’s statement, which led to sharp drops across the sector. Unless an investor is very confident the market will ultimately be appeased by Fed action this year, I would reiterate caution at current levels.

E-Commerce Growing, Will Pressure Mall Operators

A final point on SCHH is the growing trend of e-commerce, which is accelerating. I do want to point out this is not an area that overly concerns me for Real Estate as a whole. This is because commercial real estate investors can shift capital to the industrial warehouses that store goods (such as for Amazon (AMZN)), rather than invest in retail outlets. Simply, there will continue to be opportunities in the space, regardless of the rise in e-commerce sales.

However, that does not mean that all Real Estate stocks and funds will be able to shift quickly. For example, SCHH has over 16% of its holdings in the retail REIT space, which is the second largest sector by weighting for the fund. Simon Property Group (SPG) makes up a large portion of this exposure, as it is the second largest stock in the portfolio, at over 7% total holdings. SPG is an operator of major shopping centers across the U.S., and the stock has struggled over the past five years, as shown below:

Source: Seeking Alpha

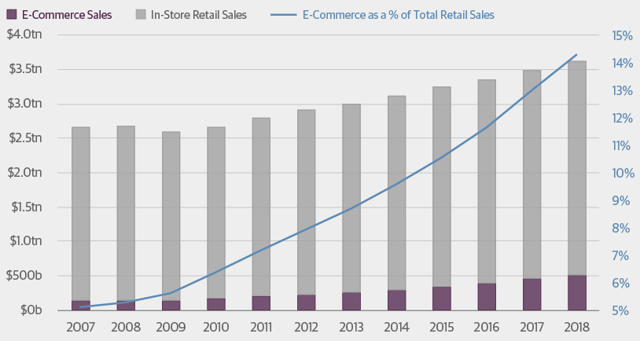

A reason for this under-performance has been the announcement of mass store closings from major mall tenants, such as Sears Holdings Corp (OTCPK:SHLDQ). This trend is partially explained by the rise in e-commerce sales, which now make up over 14% of total retail sales, as shown below:

Source: Guggenheim

As you can see, while e-commerce still makes up the minority of actual sales, the trend is accelerating rapidly. Going forward, this is going to pose a major challenge to mall operators, and that is a sub-sector within Real Estate I really want to minimize exposure in. Considering SCHH’s large weighting in this area, that poses another concern for me going forward.

Bottom-line

SCHH is a broad Real Estate ETF, owning almost 100 different companies and covering a wide range of sub-sectors. When Real Estate is in favor, this is one of my preferred vehicles, as I am biased towards Schwab funds as a whole. They sport very low expense ratios (the current expense ratio for SCHH is .07%) and are extremely popular among retail investors.

However, while I have recommended SCHH earlier this year, and continued to reiterate bullishness on the Real Estate sector until recently, I have now begun to shift out of the sector. Simply put, the returns have been stellar, as Real Estate has been beating the market and delivering above-average income. However, the valuations within the sector are getting quite pricey, and the yields have come down to the point where other fixed-income options better suit my needs. Furthermore, the sector is very sensitive to interest rate movements, and if the market’s expectations for lower rates do not become a reality, I would expect a decent sell-off in the sector. In fact, this past week was a fairly good preview of what could happen in this regard. Therefore, I am starting to divest my Real Estate exposure, and will look to add capital back in to the sector once some of the headwinds have passed. As such, I am unwilling to recommend new positions in SCHH at this time.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News