[ad_1]

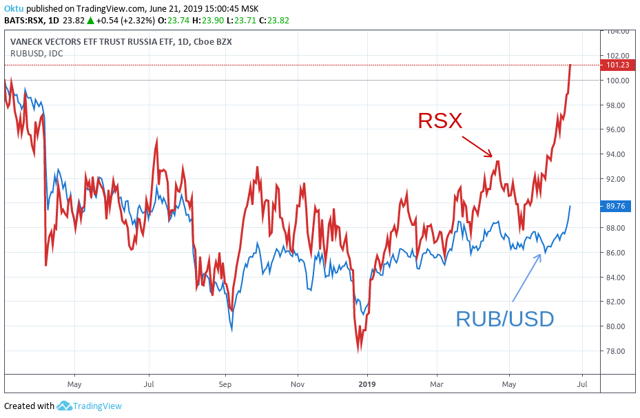

Almost a month ago, when the price of the VanEck Vectors Russia ETF (RSX) was at $21.5, I gave a positive forecast with the immediate goal of $22.6. Now the price of the fund is coming close to $24, and I would like to draw attention to the factors that have a strong influence on the price of the fund.

The RSX is tied to shares of Russian companies that are traded in rubles. Therefore, the value of the Russian currency considerably influences the price of the fund:

Since the beginning of the year, the ruble has risen almost 8.5% against the dollar. In consideration of the market dynamics and techniques, the value of the currency pair – USD/RUB – may well fall to the level of 61.5 rubles in the near future, which means short-term support for RSX. But I personally cannot say with great certainty that the ruble will go on growing stronger.

I single out three main factors that have made it possible for the ruble to show such a successful trend in the current year. And it seems that all these factors have already passed the peak of their inner strength.

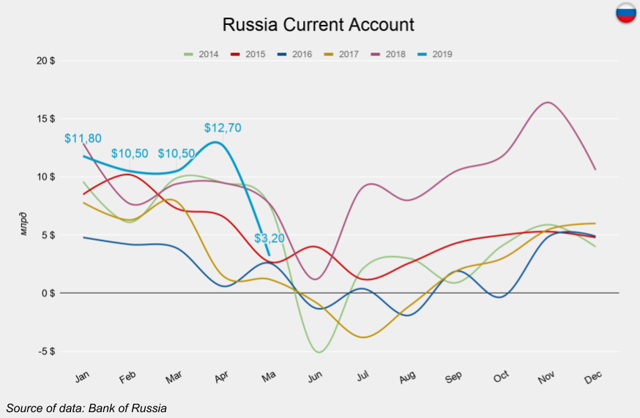

For one thing, there was an atypically high level of current account surplus in Russia in the first four months of this year. This situation created a foreign currency liquidity surplus which made it possible for the Ministry of Finance to purchase dollars daily to replenish its reserves without trouble (daily purchases for these purposes averaged $250 million):

But based on the current seasonality from May to September, the current account balance of the Russian Federation is decreasing and is even reaching negative values, which means the situation with foreign currency liquidity will become worse, and this will weaken the ruble.

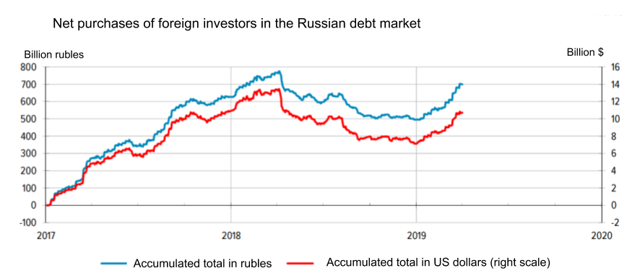

The second factor that supported the ruble was the increased interest of foreign investors in buying Russia’s debt:

Source: Russian Central Bank

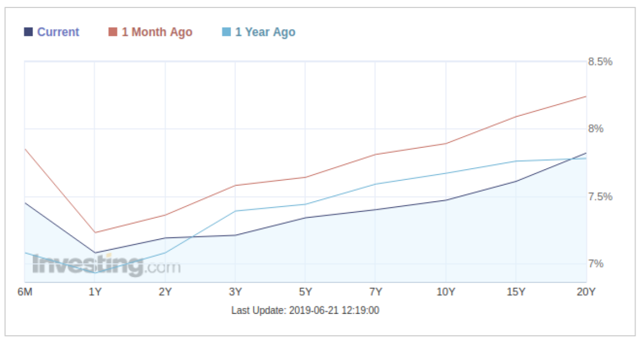

At the same time, over the last month, Russian government bond yields have decreased, not least because of the reduction in the interest rate in the Russian Federation. This will adversely affect the interest in Russia’s debt, and consequently the ruble:

The third factor which particularly strongly influenced the ruble last month was the forthcoming dividend payment period of Russian companies, which usually peaks at the end of June/the beginning of July. To pay dividends, export-oriented Russian companies have to change dollars for rubles. But after the payment of dividends, the opposite situation arises: dividend recipients will most likely want to convert them into hard currencies, which will result in a ruble inflow into the Russian financial market.

Bottom Line

Now RSX’s dynamics is clearly positive, and taking into account the techniques, it can be expected that the price of the fund will rise to $24 in the near future. But remember that whereas, until now, the dynamics of the ruble value has helped RSX grow, in the near future, it will slow down the growth of the fund.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News