[ad_1]

ETF Overview

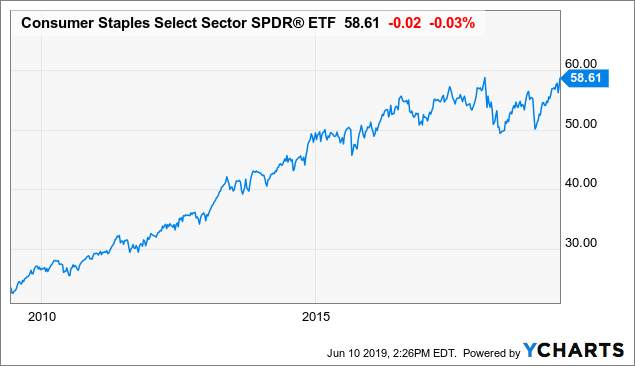

Consumer Staples Select Sector SPDR ETF (XLP) has a portfolio of large-cap consumer staples stocks in the United States. The fund basically selects consumer staples stocks in the S&P 500 Index. Its portfolio is concentrated as the top 10 holdings represent nearly 70% of the total portfolio. XLP is considered as a defensive ETF as it should perform better than other sectors in an economic recession. Since we are likely in the late cycle phase of the current economic cycle, investors should consider increasing exposure to consumer staples ETFs such as XLP.

Data by YCharts

Data by YCharts

Fund Analysis

A concentrated portfolio

XLP has a concentrated portfolio of only 40 stocks with its largest holding Procter & Gamble (PG) represents about 15.1% of the portfolio followed by Coca-Cola’s (KO) 11% and PepsiCo’s (PEP) 10.4%. As can be seen from the table below, its top 10 holdings represent about 69.1% of its total portfolio. This higher concentration in only a few stocks can introduce significant risk especially if a single stock performs poorly than other stocks. Nevertheless, most of these companies have competitive positions over its competitors. This should help mitigate XLP’s concentration risk.

Source: Morningstar

Strong international exposure

Investors should keep in mind that many of the companies in XLP’s portfolio have a sizable business internationally. This means that these companies’ earnings can be impacted by the strength and weakness of the U.S. dollar. In addition, economies in emerging markets can be quite volatile at times. This can result in a spike of demand in an economic boom but diminishing demand in an economic recession.

Growth may be limited

Most companies in XLP’s portfolio are companies that are already in the mature phase of the growth lifecycle. Future growth is still warranted thanks to global population growth. However, growth rate may be slower than the broader S&P 500 Index.

Low management expense ratio

XLP charges a low management expense ratio of 0.13%. Its MER is slightly higher than Vanguard Consumer Staples ETF’s (VDC) 0.10% and Fidelity MSCI Consumer Staples ETF’s (FSTA) 0.08%.

Valuation appears to be fair

The price to earnings ratio of XLP’s portfolio is about 16.8x. This is slightly higher than the ratio of 16.4x of the S&P 500 Index. However, the broader S&P 500 Index has a much higher earnings growth rate of 10.8% than XLP’s 7%. Therefore, we believe the stocks in XLP’s portfolio is likely slightly overvalued on a relative basis.

Macroeconomic analysis: When to invest in XLP

Consumer staples sector is a good defensive sector in an economic downturn

Consumer staples sector is considered as a defensive sector as companies in this sector derive a significant amount of revenue from people’s essential needs that are less impacted by an economic recession. While revenue decline is still likely in an economic recession, the consumer staples sector usually fared much better than other cyclical sectors such as energy and industrial sectors.

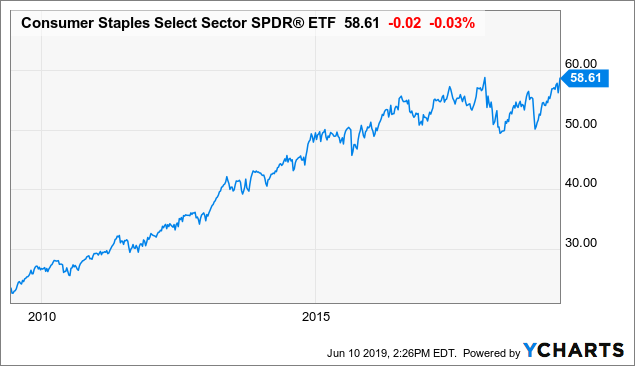

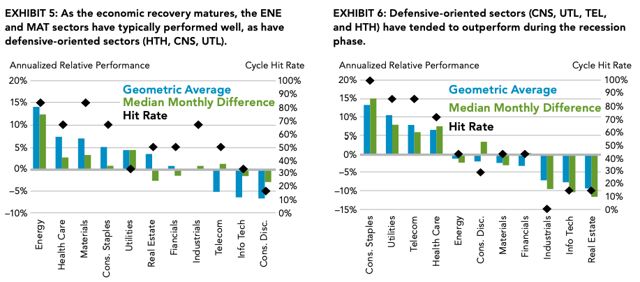

As can be seen from the two charts below, stocks in the consumer staples sector underperformed many other sectors in the early cycle and mid-cycle phases of the economic cycle.

Source: Fidelity: The Business Cycle Approach to Equity Sector Investing

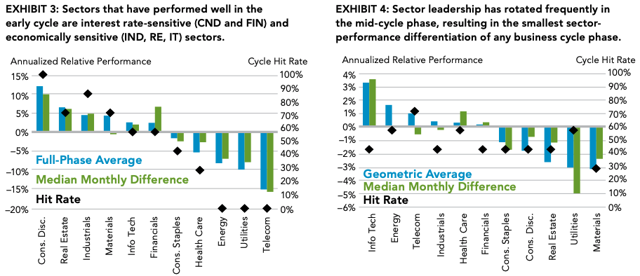

However, this does not mean that XLP’s fund price will not appreciate during the early cycle and mid-cycle phases. The chart below compares XLP and S&P 500 Index’s performances between 2009 and 2017. This time frame is considered as the early cycle and mid-cycle phases of the current economic cycle. While its fund performance trailed behind S&P 500 Index’s 196%, XLP still registered a price return of 138.3%.

Data by YCharts

Data by YCharts

As can be seen from the bottom left chart, as we move from the mid-cycle to the late-cycle phase, the consumer staples sector now outperforms many other sectors such as financials, industrials, and consumer discretionary. Finally, as can be seen from the bottom right chart, the consumer staples sector outperformed all other sectors in an economic recession.

Source: Fidelity: The Business Cycle Approach to Equity Sector Investing

Where are we in the current economic cycle?

The current economic cycle has been well into its 10th year. The economy in the United States continues to run at full capacity. In Q1 2019, the U.S. GDP growth rate re-accelerated to 3.2%. In the same time, its unemployment rate dropped to 3.6%. This is the lowest we have seen since 1969. However, the Federal Reserve has taken a wait and see approach and is not in any hurry to raise interest rates as inflation continues to be well below its 2% target. In addition, the uncertainties caused by the trade tensions between the United States and China may have the potential to derail the U.S. economy.

In this late stage of the economic cycle, XLP appears to be the best sector to invest as it should outperform other sectors. If an economic recession does not arrive anytime soon, this sector should still register good returns as we have shown earlier in the article.

Investor Takeaway

XLP is a low-cost ETF choice for investors seeking to invest in large-cap consumer staples stocks. We think this is a good ETF to anchor your money if a storm ever arrives such as an economic recession. Since we are already likely in the latter stage of the current economic cycle, we think investors may want to reduce exposure to other cyclical sectors and increase exposure to XLP.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

[ad_2]

Source link Google News