[ad_1]

SPDR Biotech ETF (NYSE:XBI) provides investors diversified exposure to one of the most exciting industries in the market. Diversified is a relative term here because biotechnology companies, particularly those that are still in early stages of drug development, are often times the riskiest of stocks to invest while also offering the potential for outsized returns. Biotech has been exceptionally volatile over the past year weighed down by poor sentiment from decelerating growth among the mega-cap firms in the group among broader macro themes. This article highlights the performance of XBI underlying stocks including themes and trends in the group.

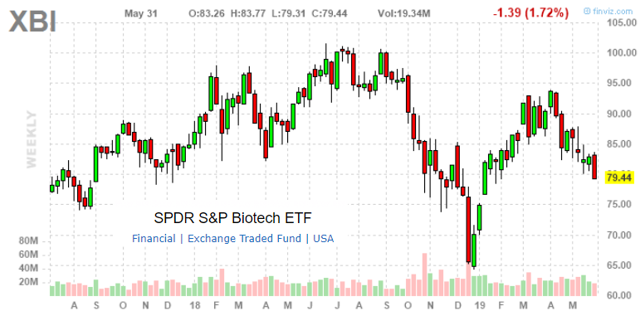

XBI weekly price chart. Source: Finviz.com

ETF Analysis

XBI Key Stats. Source: ycharts.com

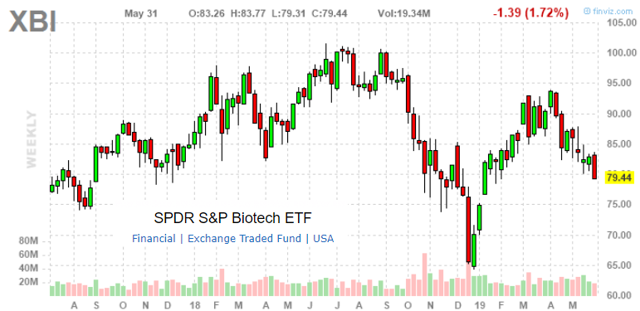

XBI is actually the second largest biotechnology industry-specific exchange traded fund by total assets at approximately $4 billion, behind the iShares Nasdaq Biotechnology ETF (NASDAQ:IBB) which has current total assets of $7 billion. Investors should be aware that the two funds have a very different weighting methodology that has wide-ranging implications from varying levels of risks and return given different methods of diversification. IBB is based on a market cap weighted index so the largest biotechs have the corresponding higher weighting in the fund. For example, Celgene Corp. (CELG) in IBB has the highest weighting at 8.6% while just the top five holdings together represent about 40%.

On the other hand and what makes XBI more interesting, in my opinion, is that XBI is based on a ‘modified’ equal weight index where each of the 120 holdings have a weight between 0.1% and 2%. The index takes into consideration factors like the trading float and liquidity. In XBI, the top five holdings together represent only 9.9%. This type of methodology gives the smaller companies a greater importance in the fund thereby amplifying the gains and losses from small caps. Overall, XBI should be more volatile but with the potential to significantly outperform IBB should one of the smaller biotechs to hit a proverbial home-run. Indeed, XBI returned 36.6% over the past three years, significantly better than IBB that only gained 6.7%.

Data by YCharts

Data by YChartsWhile biotech stocks have had an incredible decade, the industry performance has been otherwise weak over the past year. This timing coincides with the global pullback of the ‘growth’ equity style factor associated with biotechnology among broader themes of global cyclical concerns and a stronger U.S. Dollar. Decelerating growth among the mega-cap companies in the group have also weighed on the sector, hitting IBB more. Biotech’s valuations peaked during Q3 of 2018. XBI is down 17.8% over the past year compared to IBB which is down 9%

Data by YCharts

Data by YChartsXBI Holdings’ Performance 2019

It’s important to recognize that the ongoing period of volatility in equity markets that started in the second half of last year has left a wide dispersion of returns across different comparison periods. Simply put, the performance data is all over the place from MTD, YTD, and over the past year.

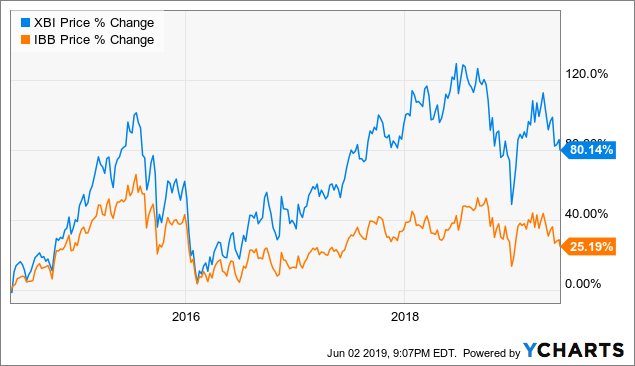

XBI performance data. source: ycharts.com/table by author

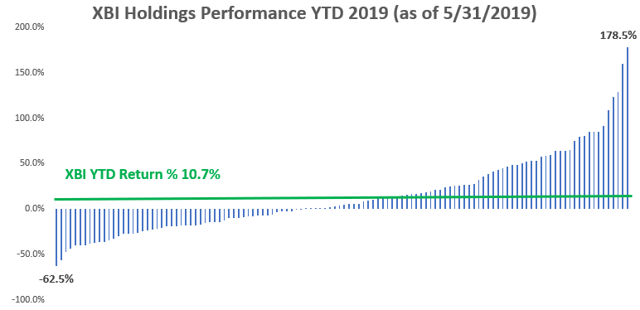

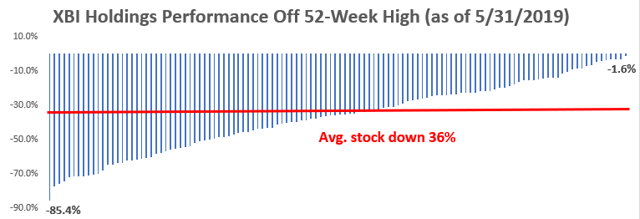

While XBI is up 10.7% year to date 2019, the ETF is technically in a ‘bear market’ down 21.8% from its 52-week high. My data shows that the average stock in the group is down approximately 36% from its 52-week high. Micro and small caps have had the biggest losses over the past year. The apparent strength this year could be described as a bounce from the extreme pessimism that gripped global markets in late Q4 2018. The rebound from January through April was helped by a more dovish Fed policy stance and overall better than expected earnings that supported overall risk sentiment. Reemerging global growth concerns and a rising U.S. recession risk now, are again weighing on financial markets and biotechs have not been spared.

Out of 120 current holdings in XBI, 68 or 55% of the stocks have posted a gain this year with the average winner up 40% compared to a 20% loss among the losing stocks.

XBI holdings YTD performance. source: ycharts.com/chart by author

XBI YTD commentary

With the exception of Celgene Corp. (CELG) up 46% in 2019, a number of the large cap biotechs in the group have underperformed the ETF. AbbVie Inc. (ABBV), Amgen Inc. (AMGN), Biogen Inc. (BIIB), and Regeneron Pharmaceuticals Inc. (REGN) are each down double digits YTD. Biogen fell significantly on news its Alzheimer’s treatment failed in a late-stage trial back in March. That led to a stock plunging by nearly 30% on the news back in March.

Five stocks in XIB have doubled in 2019. Investors in Spark Therapeutics Inc. (ONCE) got the ultimate payout when news emerged that pharmaceutical giant Roche (OTCQX:RHHBY) agreed to acquire Spark for $4.8 billion ($114.50 per share) in February. The stock is up 179% this year.

Gene therapy and oncology specialty firms have been a hot segment this year. Small cap ArQule Inc. (ARQL) is up 160% in 2019 which actually just brought it back to its level from October of last year. The stock jumped 50% on an in-line Q4 earnings release back in January and has been trending higher all year. Eli Lilly (LLY) acquired Loxo Oncology (LOXO) which has bumped up valuations for a number of other companies in the space. Ziopharm Oncology Inc. (ZIOP) is another one that has benefited from the M&A speculation up 129% this year. Epizyme Inc. (EPZM) and Coherus BioSciences Inc. (CHRS) round out the top five winners each up 123% and 109% respectively.

XBI 1-year performance commentary

Over the past year however, 82 of the 122 holdings are underwater with a negative return. The median return over the past year is negative 16.3%. Worst still are the numbers off from the 52-week high of each respective stock, down on average 35% from their highs.

XBI holdings % 52-week performance. source: ycharts.com/chart by author

Immunogen Inc. (IMGN), Puma Biotechnology Inc. (NASDAQ:PBYI), and Intrexon (XON) are among the biggest losers over the past year each down more than 70%. One of the biggest risks in emerging biotech is that a pipeline drug fails at trials undermining the entire investment thesis. This risk is considerably greater for the companies that may only have a few currently marketed and whose operational future may depend on the R&D pipeline moving along as planned.

Immunogen fell as much as 40% on news the FDA recommended run a second Phase 3 trial of an ovarian cancer drug after the first phase failed to show patients responded to the treatment. Intrexon included the ominous disclosure in its annual report saying “there is substantial doubt about its ability to continue as a going concern” without any of its pipeline products showing the potential for commercial success. Curiously my research here did uncover that the CEO Kirk Randal has been a heavy buyer of the stock over the past month suggesting at least someone believes there is value here.

XBI Valuation Metrics

My data also shows that there are about 40 companies without material revenues, essentially still in a research phase without a marketable product. It’s very difficult for investors to assess value when a company may go years just burning cash in the process of bringing a promising drug to market. I like to think of biotech as the wild wild west of investing where a degree in biochemistry may come in handy. Below are presented the 46 stocks out of the 120 stocks with positive earnings over the trailing twelve months represented by a positive price to earnings ratio. Only three stocks pay a dividend.

XBI select valuation metrics. source: ycharts.com/chart by author

I wouldn’t advise anyone to invest in biotech simply based off of trading based multiples but nevertheless here they provide a reference point. The market likes to reward growth and what we are seeing is a discount for decelerating revenue or lower earnings. Arena Pharmaceuticals Inc. (ARNA) screens well, trading at a 4.4 PE, and 2.4x EV to EBITDA over the past year deserving of a closer look.

Conclusion

The data above should serve as a good starting point for further research and analysis into the group. The way I view biotech is that investors need to have a clear understanding of the drug pipeline of the individual companies with confidence in the management team to execute the process from R&D to market effectively. I like the ETF because it allows investors to gain exposure to trends in biotech without the need to completely understand the various drugs that may otherwise require a deep technical background for necessary due diligence. I’m bearish on XBI over the near term based on my view of continuing macro weakness and poor sentiment towards high risk growth factor type stocks, particularly the small caps in XBI with an uncertain product pipeline.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News