[ad_1]

The past two or three weeks have certainly been challenging for the equity markets, particularly in the United States. The main reason that has been blamed for this is the escalating trade tensions with China and others, although there are also a few indicators displaying early warning signs of economic weakness. Regardless, this has caused market participants to flee into perceived safe havens such as bonds. Another asset class that you may want to consider if you are trying to protect your money is preferred stock. Indeed, one of the more popular preferred stock ETFs, the iShares U.S. Preferred Stock ETF (PFF), has held up pretty well and boasts a higher yield than investment-grade bonds or U.S. Treasuries.

About The Fund

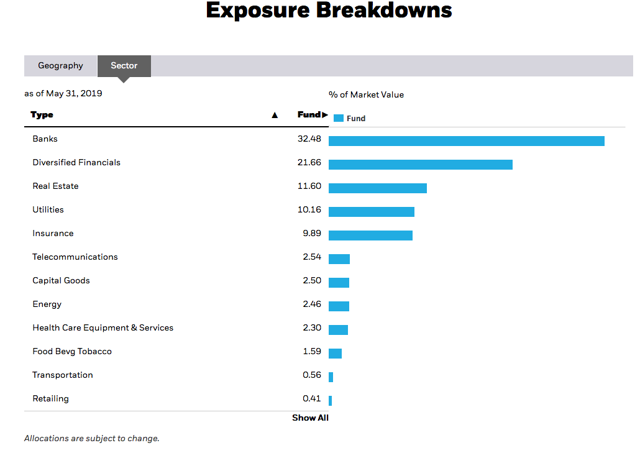

As is the case with many ETFs, the iShares U.S. Preferred Stock ETF is designed to track an index. In this case, that index is the ICE Exchange-Listed Preferred & Hybrid Securities Transition Index. This is a reasonably well-diversified preferred stock index, although it does have a fairly high exposure to banks and other financial firms:

Source: iShares

Source: iShares

This does make some sense though because banks are among the largest issuers of preferred stock. This is due to the fact that current regulations allow banks to treat preferred stock as tier-1 capital, similar to common equity. Thus, money brought in through the issuance of preferred stock helps a bank look healthier in the eyes of regulators without the need to dilute common shareholders to achieve the same goals.

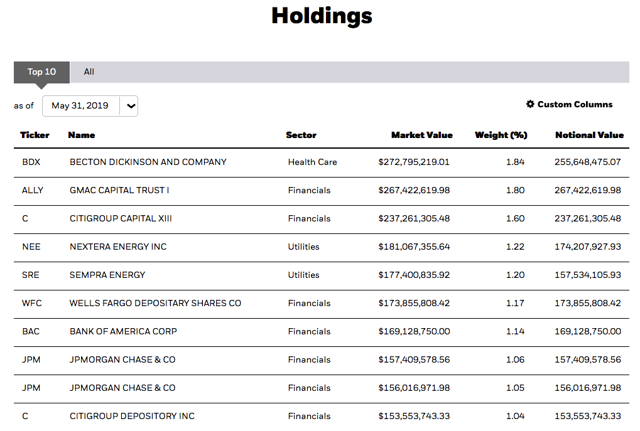

While this high level of financial exposure may concern some potential investors in the fund, it still only represents 54% of its total assets so there is still a lot of room for other sectors to be included in the fund and we can clearly see that above. This should help provide a certain amount of protection against sector-specific industry downturns. In addition, we can see that no individual company accounts for an outsized portion of the fund:

Source: iShares

Source: iShares

Thus, we can be assured that PFF certainly looks like it should be a reasonably safe place to put your money, at least from the perspective of being quite well diversified.

About Preferred Stock

Preferred stock itself has a number of characteristics that increases its margin of safety over that of common equity. Most prevalent among this is that preferred stock occupies a higher position in a company’s capital stack than common equity (but lower than debt). In practical terms, this means that in the event of a firm’s bankruptcy, the holders of the preferred shares need to receive their money back before the common holders receive anything. Of course, in most cases a bankruptcy results in both the common and the preferred equity holders being wiped out, but this is still a margin of protection that the preferred equity holders have over the common.

In addition to this, the holders of preferred stock have a superior claim against the cash flows of the underlying business than the common equity holders do. This is most evident in the fact that preferred stockholders must receive their promised dividends in full before the common shareholders can receive any dividend at all. This usually results in companies doing whatever they can to ensure that their preferred shareholders receive their dividends. This is therefore similar to bonds despite the fact that missing a payment on the preferreds does not actually push a company into default like missing a bond payment does.

Preferred stocks are also similar to bonds in that they are fixed-income instruments. This is due to the fact that in most cases the dividend payment of a preferred stock is fixed at issuance. Unlike the case of common stock, preferred investors usually do not benefit from the growth of and success of a business. As such, preferred stock is usually valued based on its dividend, similar to the way in which a bond is.

Valuation

This last point is somewhat critical to our thesis since it means that preferred stocks have generally not been affected by the reduced expectations for growth that have come along with the escalating trade tensions. In fact, as we can see here, PFF has been almost totally flat this year:

The sole exception to this relative stability came at the end of last year and the start of this one, which was a time in which everybody was fleeing risk assets out of concerns over the policies of the Federal Reserve. In contrast, there has been virtually no price change this month in reaction to the increasing trade tensions. This acts as a strong support for our thesis of using this fund as a way to protect your wealth against volatility.

The sole exception to this relative stability came at the end of last year and the start of this one, which was a time in which everybody was fleeing risk assets out of concerns over the policies of the Federal Reserve. In contrast, there has been virtually no price change this month in reaction to the increasing trade tensions. This acts as a strong support for our thesis of using this fund as a way to protect your wealth against volatility.

As of the time of writing, PFF has a trailing 12-month distribution yield of 5.39%. Perhaps curiously, this is better than the 4.96% yield available on the iShares iBoxx $ High Yield Corporate Bond ETF (HYG). This does not make a whole lot of sense since the preferred shares contained in PFF are issued by more financially solid firms than the high-yield bonds contained in HYG. In other words, PFF is actually safer than HYG and has a better yield! While it is true that investment-grade corporate or government bonds are safer than PFF’s preferred stock, they also have much lower yields. This would also appear to argue in favor of PFF as a good place to put your money in order to generate nice safe returns.

Interest Rates

As preferred stocks are generally considered to be fixed-income investments, there is a link between them and interest rates. In short, as preferred stock has a fixed dividend and no maturity date, it should generally be valued like a bond with an infinite duration. As some readers may recall, I have in the past suggested that investors avoid preferred stock during interest rate tightening cycles like we had last year for this reason.

While predicting Federal Reserve policy can be somewhat of a fool’s errand, I find it unlikely that the central bank will hike rates much, if at all, going forward. Earlier this year, the central bank did say that it will not hike rates in 2019 because the economy cannot support them. In fact, it may be the Federal Government that cannot handle them as it spent around $500 billion last year in interest on the national debt. When we consider that the Congressional Budget Office is projecting permanent $1 trillion annual deficits starting next year, higher interest rates would only exacerbate its financial situation. In addition to this, the corporate sector is highly leveraged so higher interest rates would have a negative effect here as well. These factors could ultimately result in a forced reduction in interest rates going forward, which could actually prove positive for preferred stocks.

Conclusion

In conclusion, the terrible market performance that we saw in May has undoubtedly weighed on the psyche of many investors. In contrast though, preferred stocks have actually held up quite well and appear to be presenting a nice safe place for you to put your money while these issues are resolved. The fact that these stocks are both safer and offer higher yields than high yield bonds only adds to their appeal. Overall, PFF may be worth adding to your portfolio.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. We are currently offering a two-week free trial for the service, so check us out!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News