[ad_1]

The recent escalation in trade tensions between the US and China has been weighing heavily on financial markets. Since this trade war began in January 2018, there has been debate over whether small-cap stocks are more attractive than large-cap stocks, as certain investors believe that the former are more insulated from the tariffs. The Russell 2000 is a popular index that is representative of small-cap growth stocks. The iShares Russell 2000 ETF (IWM) is the largest ETF tracking this index. This article compares the performance of the IWM ETF to the S&P 500 benchmark using specific risk statistics, to assess the validity of increasing exposure to small-cap stocks over large-cap stocks as an investment strategy, as Russell 2000 stocks may not necessarily offer the protection investors are seeking amid heightened global trade uncertainty.

Prospectus Review

Before we assess the performance of the iShares Russell 2000 ETF amid rising trade tensions, let us first review the fund. The IWM ETF aims to track the Russell 2000 as its underlying benchmark, which consists of small-cap stocks. According to ETFdb.com, out of the three ETFs that track this index, the IWM ETF holds the largest amount of Assets Under Management ($40.37 million) and has the highest average daily trading volume (20.40 million). A higher average trading volume implies investors can buy and sell shares in the fund more easily amid lower liquidity risks. These attributes make it the most attractive ETF to gain exposure to small-cap stocks (Russell 2000).

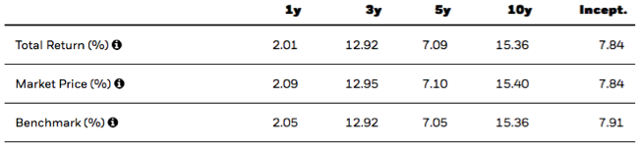

Note that the fund does not necessarily invest in all of the stocks within the Russell 2000, but instead employs a “Representative Sampling” strategy, whereby it invests in a large sample of stocks that are collectively expected to accurately represent the index in terms of certain investment characteristics (e.g. sector weightings). The discrepancies as a result of this strategy, and other factors such as buying/ selling activity, results in tracking error risk, in which case, the price movements in the publicly-traded fund may not always accurately represent changes in the underlying index. In fact, the degree of tracking errors of the ETF relative to its benchmark can be found below.

Source: iShares

Therefore, investors seeking to gain exposure to the Russell 2000 through the IWM ETF should take this tracking error risk into consideration. Nevertheless, it is still one of the most popular investment vehicles to play the small-cap space and is an ETF worth keeping under the radar for portfolio diversification purposes across different market-capitalization sizes.

Performance of IWM vs. S&P 500

IWM ETF has just slightly outperformed the S&P 500 since the beginning of this year, delivering 12.91% vs. 12.73% respectively (at time of writing). However, since January 2018 (beginning of trade tensions), IWM has vastly underperformed the S&P 500, with a return of 0.36% vs. 5.70% respectively (at time of writing). Moreover, the average monthly return of the IWM ETF over this same period of time has been 0.19%, while the S&P 500 has offered a 0.42% average monthly return.

The notion that small-cap stocks are less affected by trade tensions and escalation in tariffs is not proving to be the case.

Jill Hall, U.S. Equity Strategist at BofA, recently discussed the impact of tariffs on small-cap stocks:

A lot of these companies are suppliers to the big multinationals. Many of them have been highlighting the impact of trade on calls this earnings season… A lot of these companies might not be able to be as nimble about shifting their supply chains or pricing that through.

Therefore, while increasing exposure to small-caps over large-caps may have appeared as an attractive strategy in reaction to trade tensions during the first half of 2018, it has not proven successful since then; since the second half of last year, the performance of the Russell 2000, and consequently the IWM ETF, has disappointed.

Nevertheless, let us evaluate some risk-reward metrics to determine whether it is worth increasing exposure to the IWM ETF (over the S&P 500) amid rising trade tensions going forward.

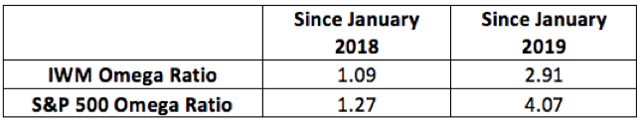

The Omega ratio is a risk-reward metric that reflects the probability of achieving a return above a certain threshold, relative to the probability of achieving a return below the threshold. The probabilities are determined by historical performances; however, the reason the Omega ratio is an attractive risk-reward metric is because unlike most other such metrics, it does not assume that the historical returns are normally distributed. Instead, the probability densities are determined by the actual distribution of returns, which allows for more accurate assessments of future upside/downside potential (relative to the specified threshold). The higher the Omega ratio, the greater the likelihood of achieving upside reward relative to downside risk.

In our case, a threshold of 0% has been set in order to evaluate the likelihood of IWM/S&P 500 delivering a positive monthly return relative to the likelihood of delivering a negative monthly return. The Omega ratios have been calculated for two periods: since the beginning of 2018 (beginning of trade war) and since the beginning of 2019. The results can be found below:

For the time period since January 2018, the Omega ratio for the S&P 500 is higher than that of IWM. Hence, this implies that going forward, IWM is less likely to deliver a positive return in comparison to the S&P 500 as trade tensions continue to rise. While the ratio for IWM has improved in 2019, the divergence in the Omega ratios (in favor of S&P 500) is even wider this year. Thus, even though IWM has slightly outperformed the S&P 500 since the beginning of this year, the large-cap benchmark index is still much more likely to deliver positive monthly returns in comparison to the IWM ETF going forward.

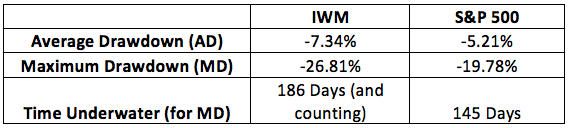

Calculating the drawdowns for IWM and S&P 500 (since the beginning of the trade war) allows us to further assess the downside risks they pose amid the trade tensions. The results summary table below exhibits the Average Drawdown, Maximum Drawdown, and Time Underwater (for Maximum Drawdown) since January 2018.

Since January 2018, IWM has both a higher Average Drawdown and Maximum Drawdown. In fact, the MD witnessed by the S&P 500 was exited on Apr. 23, 2019, when the index reached a new high, whereas IWM is still underwater since its MD. Though, note that amid the reigniting in trade tensions over the past month, the S&P 500 has turned underwater again as well. Nevertheless, the IWM ETF clearly poses more downside risk than the S&P 500 amid rising trade tensions.

Therefore, these results undermine the strategy of allocating more capital towards small-cap stocks over large-cap stocks as the trade dispute continues. However, past performance is not necessarily a good indicator of future performance, and there are several other factors we must take into consideration when determining the effectiveness of the aforementioned strategy going forward.

It is worth noting that apart from trade tensions, there have also been other factors at play that have induced poor performance for the Russell 2000 index and IWM ETF. The 10yr yield has been plummeting even amid the U-turn by the Fed from a hawkish to dovish stance at the beginning of this year. In fact, the 3-month yield and 10yr yield are already well into inversion territory. These bond market developments do not bode well for financial sector stocks. About one-fourth of the Russell 2000 index is composed of financial sector stocks, and the sector holds the largest weighting in the IWM ETF at 18.02%. On the other hand, the financial sector only makes up about 13.14% of the S&P 500 index. Thus, the IWM ETF faces more downward pressure from the financial sector (than the S&P 500) amid an inverting yield curve. Nevertheless, these adverse conditions in the bond market are not likely to go away any time soon given that even a dovish Fed over the past several months has been unable to inhibit the inversions in the yield curve. Therefore, from this perspective, the Russell 2000 could continue to face more pressure from the inverting yield curve (than the S&P 500) for the foreseeable future, which actually reinforces the case against allocating more capital towards small-cap stocks over large-cap stocks.

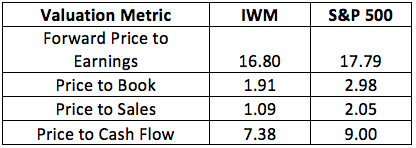

Furthermore, an essential fundamental factor we must take into consideration is valuations. The table below exhibits the valuation metrics for both the IWM ETF and the S&P 500.

Source: Collated using latest data from Morningstar

While the IWM ETF has vastly underperformed the S&P 500 since the beginning of the trade war, it has also become more attractively valued relative to the large-cap benchmark index. IWM is cheaper by every valuation metric listed above, which could potentially induce the ETF to outperform the S&P 500 going forward. However, investors must keep in mind that since the start of this year, the earnings estimates for small-cap stocks have been slashed much more vigorously than for large-cap stocks, as Russell 2000 earnings are expected to suffer more than the S&P 500 earnings amid challenging economic conditions going forward. This would explain why investors are less willing to pay for the future earnings of Russell 2000 stocks as opposed to the future earnings of S&P 500 stocks, consequently resulting in a lower forward PE for IWM. Therefore, even amid more attractive valuations, investors should remain cautious about investing in IWM, as deeper cuts in earnings forecasts/gloomier earnings outlook for small-cap stocks once again undermines the strategy of allocating more capital towards small-cap stocks over large-cap stocks going forward.

Bottom Line

Our risk statistics analysis reveals that the strategy of seeking shelter in the small-cap space amid rising trade tensions is not advisable. The Omega ratios (with a threshold of 0%) for the IWM ETF are notably lower than those for the S&P 500, implying that our small-cap ETF is less likely to deliver positive monthly returns than the S&P 500 as trade tensions worsen going forward.

While small-cap stocks have performed strongly since the start of this year, the IWM has failed to recover from its Maximum Drawdown of -26.81% (much larger than the S&P 500’s -19.78% MD). Not only has it witnessed a greater drawdown than the S&P 500, but it has also been underwater in drawdown territory for a more extended period of time (186 days and counting).

Hence, the IWM ETF offers lower upside reward and greater downside risk based on these risk statistics. Therefore, despite certain investors preferring the strategy of holding more exposure to small-cap stocks over large-cap stocks amid rising trade tensions, research suggests that the iShares Russell 2000 ETF is not likely to perform better than the S&P 500 going forward. This does not necessarily mean that the ETF will move downwards from here (as direction will strongly be determined by trade negotiation developments), but it is not recommendable to allocate more capital to the IWM ETF over the S&P 500 amid rising trade tensions going forward.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News