[ad_1]

ETF Overview

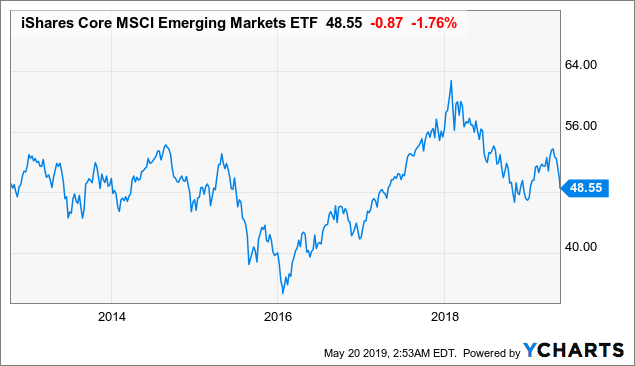

iShares Core MSCI Emerging Markets ETF (IEMG) focuses on quality stocks in the emerging markets. The ETF tracks the MSCI Emerging Markets Investable Market Index with a focus towards large-cap stocks. The fund has a high exposure to China due to its selection towards large-cap stocks. The fund’s performance often has an inverse correlation to the strength of the USD. Given the volatility of emerging markets, this fund may not be suitable for investors with a long-term investment horizon.

Data by YCharts

Data by YCharts

Fund Holdings

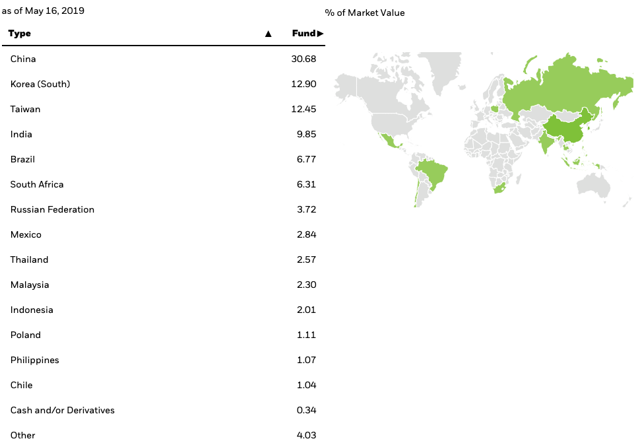

Geographic breakdown

IEMG’s portfolio of stocks are mostly located in Asia Pacific with a high exposure to China. As can be seen from the table below, 30.68% of its funds are invested in China followed by South Korea’s 12.90% and Taiwan’s 12.45%.

Source: iShares Website

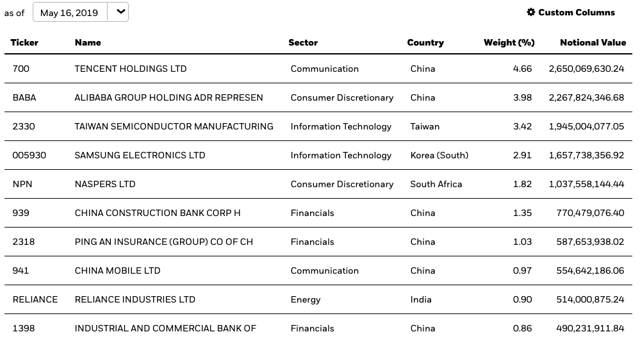

Top Holdings

IEMG’s exposure to China is also evident when we examine its top 10 holdings. As can be seen from the table below, 6 out of the top 10 holdings are Chinese companies. Although many of these companies are companies with a wide moat rating by Morningstar, the high exposure to China can be risky especially because of the current tension between the U.S. and China.

Source: iShares Website

Fund Analysis

Performance lagged behind S&P 500 Index

Although emerging markets tend to deliver strong economic growth rates than developed countries, this does not necessary translate into strong returns. As can be seen from the chart below, IEMG’s fund performance lagged behind S&P 500 Index in the past 7 years. In fact, its fund performance over the span of 7 years was negative 1.14%. On the other hand, S&P 500 delivered a return of nearly 100% in the same time. Therefore, IEMG may not be a suitable ETF to hold in the long-term.

Data by YCharts

Data by YCharts

Currency risk

Since IEMG invests in emerging markets, its fund value can be impacted by the swing of foreign currency exchanges. Certain currencies such as South African rand can be much more volatile than currencies in the developed countries. China’s Renminbi can also be impacted by government regulation and trade tensions between China and the U.S.

High exposure to China

IEMG basically selects large-cap stocks include in MSCI Emerging Markets Investable Market Index. This approach acts as a double-edged sword. The approach reduces its exposure to small-cap stocks which are less liquid and more expensive to trade. In addition, small-cap stocks can be much more volatile in already volatile emerging markets. On the other hand, large-cap stocks are less volatile and have stronger business fundamentals than small-cap stocks. Nevertheless, the fund’s approach of select stocks based on market capitalization can result in higher concentration in larger emerging markets such as China. This explains why IEMG has a high exposure to China. This high exposure also exposes investors with higher risk to one single country.

Low management expense ratio

IEMG charges a low management expense ratio of 0.14%. For example, its MER is lower than other ETFs such as JP Morgan Diversified Return Emerging Markets ETF’s (JPEM) 0.45% or iShares MSCI Emerging Markets ETF’s (EEM) 0.67%.

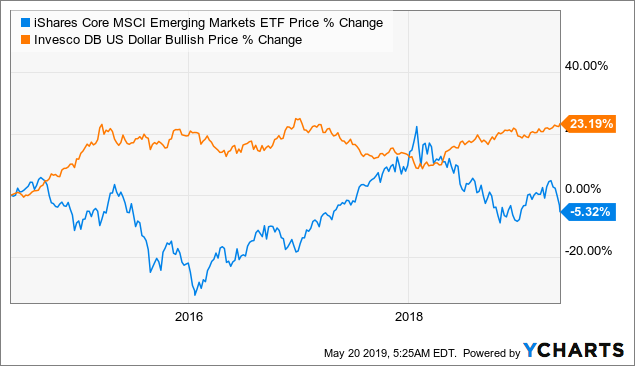

Investing Strategy: Pay attention to the Fed’s policy and the strength of USD

The best strategy to invest in the emerging market is to follow the strength of the U.S. dollar. When the USD strengthens against other currencies, a significant amount of money will flow from the U.S. to other countries such as emerging markets. To be more precise, it is the Federal Reserve’s policy that often depicts the strength of the USD. When the Fed raises the Fed Funds Rate, it will often result in a stronger USD as some money flows from other countries to the U.S. to take advantage of higher interest rates. On the other hand, when the Fed lowers this rate, some money will flow out of the U.S. to other countries. These funds will often invest in emerging markets and drive the stocks overseas higher. In fact, IEMG’s share price inversely correlates with the strength of the USD (see chart below).

Data by YCharts

Data by YCharts

Investor Takeaway

We think IEMG is a good ETF to gain exposure to the universe of emerging-markets stocks. However, we do not think the fund is suitable for investors with a long-term investment horizon. In addition, the fund has a high exposure to China. Since the current tension between U.S. and China may continue to weigh on China’s stock market, we think investors may want to take a wait and see approach.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News