[ad_1]

ETF Overview

Invesco S&P 500 High Quality ETF (SPHQ) owns a portfolio of high-quality S&P 500 stocks. Its portfolio of stocks are stocks with solid balance sheet, and generates high return on equity. The fund’s high exposure to information technology sector means that the fund should perform well during an economic boom but could underperform in an economic recession. Although SPHQ should be considered as a long-term core ETF to hold, we are already in the latter stage of the current economic cycle. Therefore, investors may want to wait till the beginning of the next cycle.

Data by YCharts

Fund Holdings

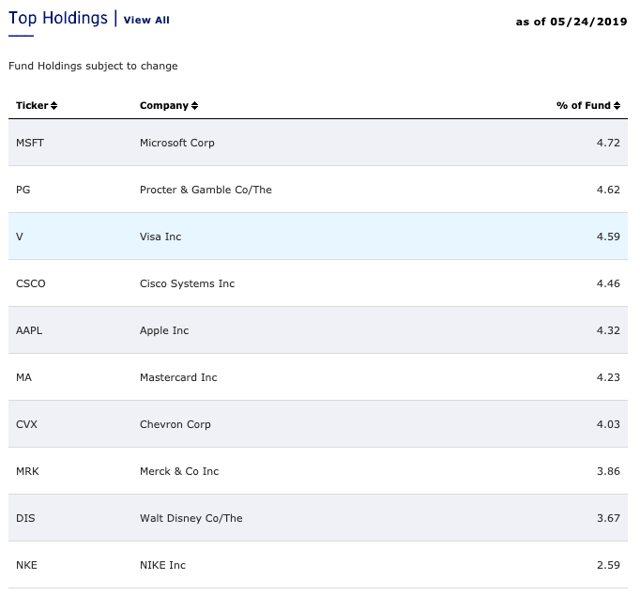

SPHQ tracks the S&P 500 Quality Index. The index selects stocks with high return on equity, low growth in capital expenditure, and low financial leverage. The low financial leverage screening criteria is advantageous as it screens out companies that have high leveraged balance sheets. The criteria of high ROE and low growth in capex ensures that most of the stocks in the index will generate a growing free cash flow. This means that stocks in the index tend to be stocks that will be able to grow their dividend consistently for a lengthy period of time. As can be seen from the chart below, many of SPHQ’s top 10 holdings are companies that have consistently grown their dividends for a lengthy period of time. For example, Procter & Gamble (PG) has increased its dividend for 63 consecutive years. Other companies such as Visa (V), Mastercard (MA), Apple (AAPL), and Cisco (CSCO) have double-digit compounded annual growth rates in the past 5 years.

Source: Invesco

Fund Analysis

Most of these firms have economic moat

The fund consists of companies that have competitive advantages over their peers. These are firms that have economic moats against its competitors. These companies may have superior technologies (e.g. Cisco) than its peers, may have strong network effects that makes it difficult for its customers to switch to another network (e.g. Mastercard, Visa, etc.), or have strong recognizable brands (e.g. Nike (NKE) or P&G). As a result, these companies tend to be more profitable and consistently deliver strong earnings growth.

Higher concentration in fewer sectors

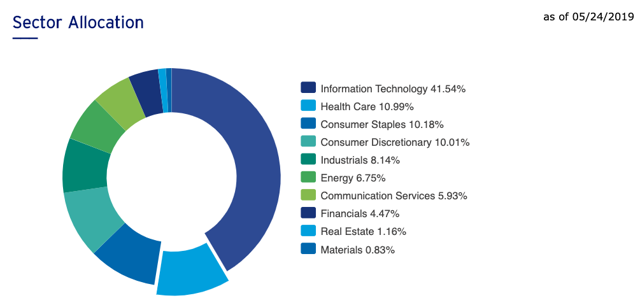

While SPHQ has a cap of 5% on individual stock weightings, it does not constrain its sector weightings or rebalance its portfolio of stocks based on sector weightings. This means that the fund can be over-exposed to a few sectors. As can be seen from the pie chart below, about 41.5% of SPHQ’s portfolio is related to the information technology sector.

Source: Invesco

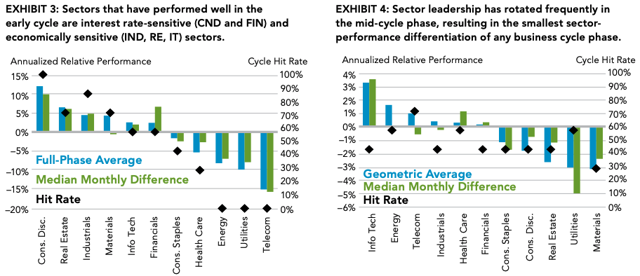

This high exposure to IT sector can be beneficial when the economic cycle is in the early or mid-phase. As can be seen from the chart below, the IT sector tends to outperform other sectors in early cycle environment and can do very well in a mid-cycle environment.

Source: Fidelity: The Business Cycle Approach to Equity Sector Investing

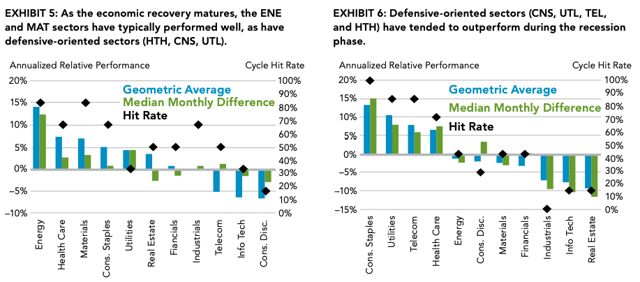

On the other hand, the IT sector tends to underperform in late-cycle and recession phase (see two charts below). Therefore, SPHQ’s high exposure to IT sector can result in poor fund performance in late-cycle and recession phase.

Source: Fidelity: The Business Cycle Approach to Equity Sector Investing

Low management expense ratio

SPHQ charges a low management expense ratio of 0.15%. For reader’s information, SPHQ used to charge MER of 0.29% but decided to lower its MER to 0.15% in August 2018 in order to compete against other peers. As a result, its MER is now comparable to iShares Edge MSCI USA Quality Factor ETF’s (QUAL) 0.15% but lower than other ETFs such as Fidelity Quality Factor ETF’s (FQAL) 0.29%.

Macroeconomic analysis

The current economic cycle has been well into its 10th year. The economy in the United States continues to run at a full capacity. In Q1 2019, U.S. GDP growth rate re-accelerated to 3.2%. In the same time, its unemployment dropped to 3.6%. This is the lowest we have seen since 1969. However, many stocks in SPHQ’s portfolio have sizable businesses internationally. Therefore, investors should also pay attention to global macroeconomic trends. The uncertainty surrounding the trade tensions between China and the United States may have the potential to derail the global economy. President Trump’s recent decision to impose 25% tariffs to $200 billion Chinese imported goods (and another $300 billion is underway) will likely result in slower economic growth and lower business activities. The uncertain environment will likely keep businesses from investing. This will definitely affect SPHQ’s fund performance.

Investor Takeaway

We think SPHQ is a good ETF for investors with a long-term investment horizon. Its selection of quality S&P 500 companies ensures that the fund should perform well over the long-term. However, since we are already in the latter stage of the current economic cycle, its high IT sector exposure may mean that the fund will underperform in an economic recession. Therefore, conservative investors may want to stay on the sideline and wait for a better entry point.

Disclosure: I am/we are long CSCO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

[ad_2]

Source link Google News