[ad_1]

We are generally not big fans of “thematic” funds and ETFs. While the themes for the funds generally sound exciting, all too often the implementation is troublesome and investors would be better off with just an index fund or two. Unfortunately, the Invesco Global Water ETF (PIO) looks like it’s one of those cases.

About PIO

The fund tracks the NASDAQ Global Water Index. According to the index methodology document to be included in the index a security must “be involved in the creation of products that conserve and purify water for homes, businesses, and industries.” It also must be classified as participating in the “Green Economy” by SustainableBusiness.com LLC.

As with most indices there are some rules to make sure very small, low volume stocks are excluded. Additionally, there are some restrictions in place to prevent over-concentration. For example, no country can have more than 10 securities in the index, a country’s total weighting is limited to 40%, no single stock can be weighted more than 8%, no country can have two securities in excess of 4%, and the maximum number of securities in excess of 4% is five. It’s nice to see an index constructed so that investors are getting a sufficient degree of diversification as opposed to some other indices that are basically determined by the trajectory of a handful of stocks.

Considering how much discretion goes into selecting securities for the index, the fund has more in common with an actively managed fund than a simple passive index. While that might partially justify the high expense ratio the active management component still needs to add value beyond a simple index to make the fees worthwhile.

What Portfolio You Get with PIO

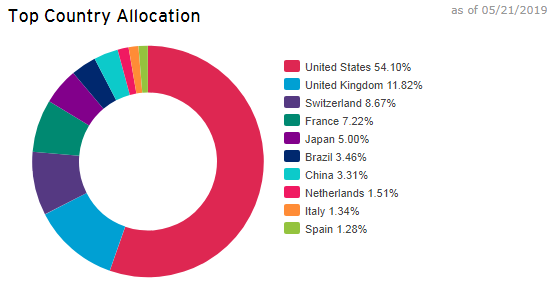

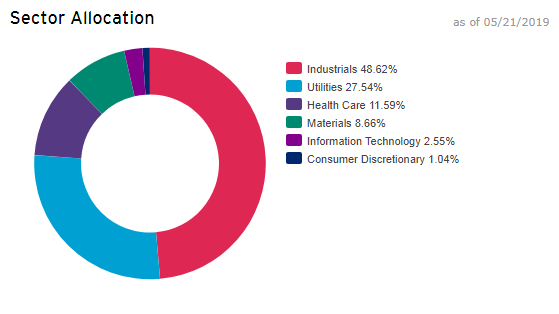

Looking at the relative country weightings for PIO shows that it is quite similar to a total market index fund. Additionally, examining the sector weightings shows the fund is concentrated in the industrial, utility, and healthcare sectors. This makes sense given the focus of the index the fund tracks.

The chart below shows the relative country weightings for PIO. Note that although the index limits an individual country’s weight to 40%, the index is technically allowed to ignore the rules if it has deemed to be in the best interest of the index. Also, the fund is only rebalanced several times a year so weighting can change in the interim.

(Graphic source: Fund website)

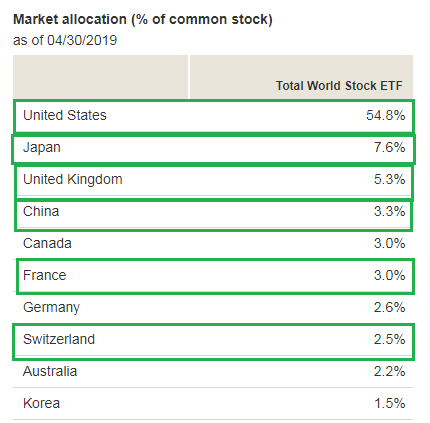

What is interesting is that the country weightings are quite close to a total market fund. Below is a chart of the top 10 country weights for the Vanguard Total World Stock ETF (VT).

(Graphic source: Vanguard website, green highlights author)

The US weighting is almost the exact same (As is China for that matter). Japan and the UK are both in the top five as well.

When we look at the sector weightings we see the fund has almost 90% of its assets in just three sectors – industrial, utilities, and healthcare.

(Graphic source: Fund website)

Performance and Summary

Here we come to the main problem we have with a lot of these “thematic” funds. Many companies, particularly industrials, are heavily diversified conglomerates. Top holdings like Danaher (DHR) and Toro (TTC) have many different businesses. Other companies like Gerberit and Toto (OTCPK:TOTDY) are just simple run-of-the-mill building products companies (in this case bathroom and plumbing products).

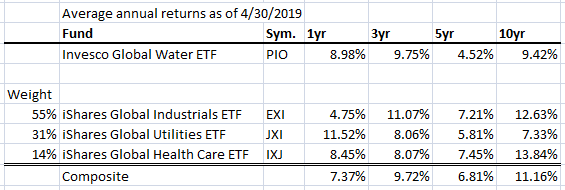

What if you simply bought a global industrial ETF, global utility ETF, and a global healthcare ETF in roughly the same relative weights?

(Source: Performance data from fund websites, author’s calculations)

Well, the answer is you would have outperformed PIO over the long term. We don’t think this is necessarily a process fault with the index or the management of the fund. For many themes, it’s very hard to distill them down into a group of individual stocks and sometimes the theme itself isn’t very differentiated from the overall economy. In summary, we just don’t see a compelling reason for breaking out this theme as a separate type of investment. We don’t see the case for investors to pay .75% to just mirror the broader global industrial, utility, and healthcare trends.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News