[ad_1]

Don’t be confused by the title. Homebuilding stocks have been showing strength since the start of this year. What I am going to discuss in this article are leading homebuilding indicators that finally point to the return of growth. The the numbers are still weak, but it’s looking better and better. It is even likely that the bull market continues on the mid-term.

Extra: This article discusses the iShares U.S. Home Construction ETF (ITB). This ETF covers all major homebuilders and is, therefore, the best tool to track building sentiment/activity.

Source: HousingWire

Homebuilders Have Been Confusing

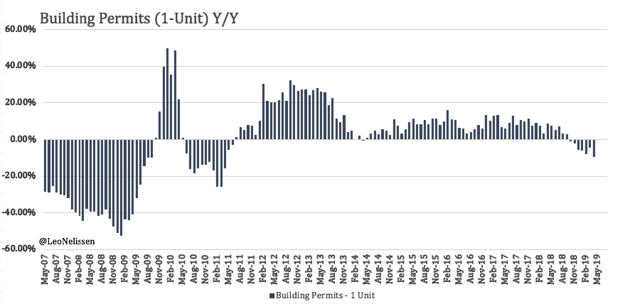

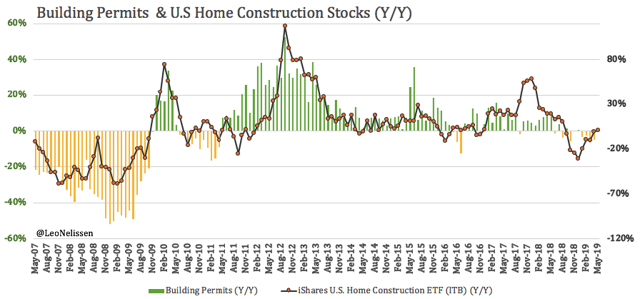

Let’s start with the bad news. The just released housing numbers do not look very promising. Housing starts declined by 2.5% in April which is a huge improvement compared to the 12.3% decline in March, but it means the contraction continues with 7 consecutive months of slower housing starts. Building permits came in at -5.0% which is a slight improvement compared to -6.5% in March, but it is the 5th consecutive month of slower permits. Building permits for 1 units continue to be even worse with a negative growth rate of 9.4%. Since the start of contraction in October of 2018, the average monthly growth rate has been -5.0%. Homebuilding stocks have been slow as well, with negative year-on-year returns of -30% at the end of last year which has currently improved to an increase of 1.0% compared to the previous year month.

What we see below is that homebuilding stocks are fairly valued at current levels with low year-on-year stock price performances and very weak building permits.

These year-on-year returns continue to be around 0% over the next few months in case the ITB ETF remains at current prices. This won’t happen, but it shows us how the future year-on-year performance would behave in case the stock prices were unchanged (how much is already priced in).

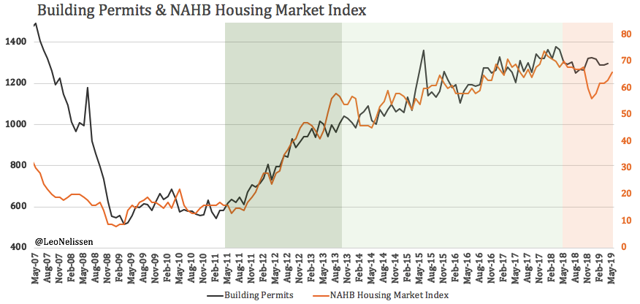

That’s why it is important to look at the leading NAHB housing market sentiment index. This index tracks sentiment in the single family housing market and is reported one month ahead of building permits and housing starts.

The NAHB index increased from 63 in April to 66 in May. This is still down 5.7% compared to the prior-year quarter but up significantly compared to the prior months. It is even starting to look as if housing sentiment is continuing its uptrend.

Such an uptrend could eventually lead to building permits growth over the next 1-3 months. Hence, it would also justify higher returns for homebuilding stocks.

The downside is the failure to restart the uptrend which would very likely lead to lower homebuilding stocks as the graph below suggests.

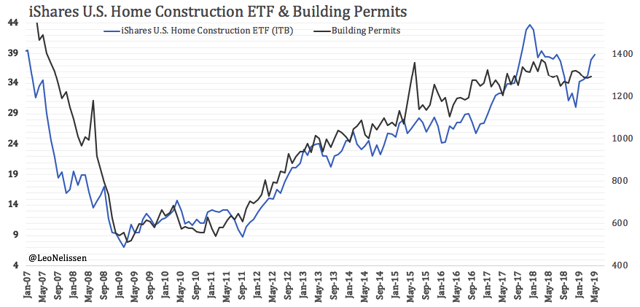

Before it starts to sound like ‘homebuilders go up when they go up and down when they go down’, I think we need to look at the bigger picture. The ITB ETF is close to breaking out to the upside after going sideways for a few weeks. This time, this would be justified given that NAHB sentiment is working on a bottom. I think homebuilders can go as high as $42 over the next 1-3 months as long as this bottom turns into a sentiment uptrend. Homebuilders are still well below their 2018 highs and could easily run higher as the year-on-year returns are still fairly valued given the slow performance of building permits.

Source: FINVIZ

Source: FINVIZ

All things considered, I am looking to buy some shares of homebuilders like NVR (NVR) and D.R. Horton (DHI). I am keeping my positions small, but I think it is worth a long position given that NAHB data looks very promising indeed. However, keep positions small as we are not yet out of the woods and things can quickly turn again. But that’s the risk when buying close to (potential) bottoms.

Thank you very much for reading my article. Feel free to click on the “Like” button, and don’t forget to share your opinion in the comment section down below!

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in DHI, NVR, ITB over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article serves the sole purpose of adding value to the research process. Always take care of your own risk management and asset allocation.

[ad_2]

Source link Google News