[ad_1]

(Pic Sourced Here)

The financial media may be obsessed with the “tweet that was heard around the world” that shaved more than $1 trillion off global equity markets but we’re more interested in what it and the burgeoning trade war means for emerging market (EM) investors going forward. Specifically, those long-term investors who may be debating whether it’s time to sell and rotate back to a pure domestic focus. Middling performance and high volatility were bad enough, but an all-out trade war could be the final straw for those who still believed in diversification. Instead, we’d suggest long-term investors and asset allocations shift their gaze from traditional index replicators and take a look at three dividend funds that could offer a better way to get your EM exposure.

This isn’t the first time we’ve talked about smarter ways to add EM exposure to your portfolio. Last fall we wrote in EM And High Vol: Beware Of A Falling Knife that the key to managing your EM allocation was reducing your overall volatility so you would be less tempted to cash in or out of the space depending on what the President was tweeting on a day to day basis.

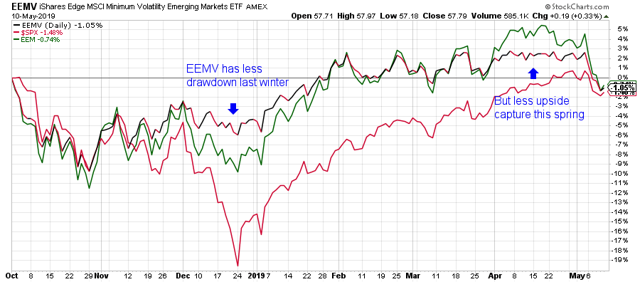

The one fund we recommended in that earlier piece, the iShares Edge MSCI Min Vol Emerging Markets ETF (EEMV) has certainly delivered on the promise of performing in line with the broader EM universe with lower volatility as you can see in the chart below.

In fact, we wrote at the time…

“Using EEMV as an EM core position means giving up some upside potential in the event of a strong and sustained upward move like in 2017 but gaining significantly lower volatility in the tradeoff.”

Instead, EEMV has ended a very volatile period delivering almost the same return as vastly larger iShares MSCI Emerging Markets ETF (EEM) with substantially less volatility in the short time since our last article.

From the standpoint of an asset allocator, that sort of risk/reward scenario is probably a solid single, maybe even a double depending on the overall equity allocation, not to mention how anxiety prone the client might be, but that might not be enough for some investors. At our semiannual conference, Spring 2019 ETP Forum one guest on a panel discussion over smart beta funds made the comment that with lower returns, higher volatility and high correlations, why should investors really bother with international diversification? While the questions may have been rhetorical, it did get us wondering if there was a smarter way to get EM exposure.

After all, EEMV is an excellent fund which has an annualized return of almost 7.9% over the last three years ending 5/9/19 and with substantially less volatility than EEM but at a cost in performance. EEM had an annualized return of 11% during that period which meant that EEM and EEMV had almost identical Sharpe Ratios. That sets up an almost perfect trade-off; investors who were willing to give up return for less risk (or volatility) could switch to EEMV without taking a lower risk/reward tradeoff and helping them stay in the fund for longer periods. But for performance obsessed investors, trading off returns for volatility only reinforces the idea of “why bother diversifying.”

So, is it possible to get a higher return without trading up on risk which we’ll continue to look at from the standpoint of volatility? After all, you could always swap out a broad EM fund for a more specialized product focusing on specific sectors or countries but replacing EEM with a China-A shares fund means taking on up and down moves so vicious that a professional bull rider would probably start to sweat. Instead, we wanted to find a handful of funds that could offer broad, non-country specific EM exposure, with comparable returns to funds like EEM, and with low correlation to U.S. equities but with less overall volatility. And more importantly, funds you can stay with for the long-haul.

That might sound like a seriously tall order but in fact, we found two solid funds and a third with strong potential that fit the bill in a unique category, EM dividend funds. They could be a solid add to any long-term investors portfolio but only if they can check their attitudes about dividends at the door.

Dividends Can Do More than Provide Income

What do you mean by checking your attitudes at the door? First there’s the common perception of dividend-paying stocks as belonging to that category of mature companies which is completely at odds with EM investing. After all, isn’t the purpose of investing abroad to find stocks in growing markets that can offer the potential for fast growth that our more developed, and richly priced, nation seems to lack? Why would you want to surrender any of that growth (see price appreciation) potential for a chance to invest in something like Thailand’s version of General Electric (GE)?

The answer has less to do with growth and more about information, specifically the lack thereof and where your EM returns are coming from. Remember that most developing nations lack the sort of rigorous securities laws and regulations that define our own market, specifically on sharing information with investors, making it difficult to accurately model or otherwise value many of the common names in the EM universe. After all, General Electric has to provide quarterly updates and disclose major events that could impact its businesses, but what sort of rules apply to a small steel operation in Sri Lanka? Does the government even have the resources to enforce the rules that are in place?

Regular dividends can help overcome some of that information asymmetry that makes investors have such high expected returns for EM funds for the same reasons as it does in the domestic market. Dividends have a signaling effect as a publicly traded company feels confident enough in its future cash flows, or ability to tap capital markets, to return cash to its shareholders. Investors at an information disadvantage can look at a steady stream of dividends and interpret that as at least a sign of financial stability. And companies with a history of regular, stable dividends can even justify a higher valuation over a long period of time, meaning that taking cash from the business and returning it to shareholders does not necessarily subtract from future growth, which influences the fundamental P/E ratio.

Dividends also play an important role in reducing volatility and improving returns, at least according to research into domestic funds here in the U.S. according to the work of a trio of researchers, C. Mitchell Conover, CFA, Gerald Jensen, CFA, and Marc Simpson, CFA in What Differences Do Dividends Make where they explore the impact of dividends on different investment styles and investor returns. While their focus was exclusively on U.S. equities, they found a strong relationship between dividend payers and higher overall returns, but especially among growth and small and mid-cap stocks confirming the work of other researchers that low dividend payouts do not imply strong future growth or returns.

Three Dividend Funds to Watch

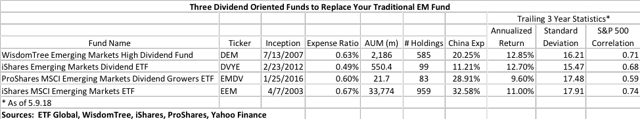

As to our three funds, what we like about them is not just performance or volatility, in fact one hasn’t quite lived up to its potential, but how they each follow a unique strategy in the space. Two in fact have outperformed the ‘OG’ emerging market fund EEM over the last three years and with lower volatility and a slightly smaller correlation to the most common S&P 500 replicator, the SPDR S&P 500 Trust ETF (SPY).

First we’ll look at our two strongest candidates, the WisdomTree Emerging Markets High Dividend Fund (DEM), a fund that’s been around for so long in the space that it’s undergone two name changes and the iShares Emerging Markets Dividend ETF (DVYE). Both have a large number of holdings which you might think would mean you’d get much more benchmark-like performance which is hardly the case here with both funds outperforming EEM both on risk and reward and with comparable fees to boot. Like most investors, you’d be forgiven for thinking that the reduced China exposure is the main culprit although that was a serious contributor.

Like most dividend bunds, DEM and DVYE have unique sets of rules they follow to screen for investments with some overlap between them. Both have a minimum market cap ($200m for DEM, $250m for DVYE), minimum dollar amount of shares traded but DEM requires a minimum annual dividend payout of $5 million while DVYE requires three years of continuous dividends, not increasing dividends, just continuous. Both then rank their universes by dividend yield with DEM picking the top 30% for inclusion with the caveat that a least 100 Chinese stocks must be included while DVYE simply takes the top 100 although with certain restrictions on the number from one country. Finally, both funds incorporate the dividend yield when weighting their portfolios.

So are DEM and DVYE really the same fund in different wrappers? The differences in the investment universes and screening criteria do lead to some substantial differences in their portfolios. If you compare annual returns back to 2013 you’ll see that they do tend to follow each other in direction but not necessarily in magnitude with a difference of several hundred basis points in their returns. In fact, while they don’t have as much portfolio overlap as you might think, they do another major similarity in their portfolios is where they get their China exposure from.

Beyond having outsized allocations to certain countries like Russia and Taiwan compared to the rest of the EM space, but their China weightings are substantially lower and of a very different character than the rest of the EM universe. Remember DEM and DVYE came to market before the A-share space became more open to foreign investors which is why both screening criteria that say all China exposure must come from Chinese companies that are either actively traded in the U.S. or Hong Kong.

So unlike EEM, you won’t find any A-share exposure in these portfolio’s and instead get the more mature, stable names that make up the allocation in older China funds like the iShares MSCI China ETF (MCHI). That mature and stability can come at a price, namely somewhat lower returns like in 2019 where MCHI us up over 14% YTD through 5.10 versus a 23.3% return for the most common China A-share fund, ASHR.

If the idea of not having the broadest possible EM universe to choose from, or overly restrictive dividend screening criteria is something you can’t live with in a more volatile space, then you might want to consider the third fund on our list, the ProShares MSCI Emerging Markets Dividend Growers ETF (EMDV), a relatively new fund but with a straightforward strategy. First, instead of a custom universe of countries to choose from, EMDV relies on the already famous MSCI Emerging Market index and where it builds out a portfolio of equally weighted stocks that have increased their dividends for seven straight years. That quickly whittles down a universe of over 1100 names to just 83 and when equally weighted means that the smallest position at the end of April was just under 1% compared to a fraction of .01% for its benchmark.

So what kind of China exposure does that get you? While nearly 30% of the portfolio in Chinese stocks, that total includes stocks that trade in Hong Kong and the USA. Going by renminbi exposure, only about 12.6% of the portfolio could be considered “mainland” China with a distinct bent towards more value-oriented names, which is hardly surprising given that it’s a dividend fund. What was surprising was despite pulling its investments from the MSCI EM index, it had the lowest correlation of the three funds we examined to EEM, although being lightly traded in its early history might be a contributing factor. But if that lowered correlation continues, it could mean that EMDV offers a more unique (less correlated) return for EM investors going forward.

Conclusion

We hope that this “short” article can serve as a starting point for investors looking for better EM options, but as they say, the proof is in the pudding which is why we decided to end with a chart showing how our three funds compared to the broader EM universe using EEM, EEMV and why not the S&P 500? This chart only measures from May 3rd to May 10th so hardly exhaustive, but we think it’s still illuminating.

While our low vol and all three dividend funds have lost less ground than EEM, it was the newest fund EMDV that has done the best thanks to sharp bounce on Friday in China A-share stocks. Whether EMDV can build on that for a sustainable lead remains to be seen, but we hope that these funds can serve as a starting point for building a more diverse, less volatile, portfolio.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Assumptions, opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. ETF Global LLC (“ETFG”) and its affiliates and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively ETFG Parties) do not guarantee the accuracy, completeness, adequacy or timeliness of any information, including ratings and rankings and are not responsible for errors and omissions or for the results obtained from the use of such information and ETFG Parties shall have no liability for any errors, omissions, or interruptions therein, regardless of the cause, or for the results obtained from the use of such information. ETFG PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. In no event shall ETFG Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information contained in this document even if advised of the possibility of such damages.

ETFG ratings and rankings are statements of opinion as of the date they are expressed and not statements of fact or recommendations to purchase, hold, or sell any securities or to make any investment decisions. ETFG ratings and rankings should not be relied on when making any investment or other business decision. ETFG’s opinions and analyses do not address the suitability of any security. ETFG does not act as a fiduciary or an investment advisor. While ETFG has obtained information from sources they believe to be reliable, ETFG does not perform an audit or undertake any duty of due diligence or independent verification of any information it receives.

This material is not intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only correct as of the stated date of their issue. Prices, values, or income from any securities or investments mentioned in this report may fall against the interests of the investor and the investor may get back less than the amount invested. Where an investment is described as being likely to yield income, please note that the amount of income that the investor will receive from such an investment may fluctuate. Where an investment or security is denominated in a different currency to the investor’s currency of reference, changes in rates of exchange may have an adverse effect on the value, price or income of or from that investment to the investor.

[ad_2]

Source link Google News