Last December, President Donald Trump introduced tariffs on approximately $200 billion in Chinese goods, triggering fears of a global economic downturn. Those fears were renewed over the weekend when Trump hiked tariffs once more on Friday, May 10, sparking retaliatory plans to increase tariffs on US goods beginning in June. So what action (if any) are investors to take in response? The S&P 500 Power Buffer ETF – July (PJUL), may be the China Trade “trade” of the week, regardless of the impact of the US-China trade war on the market.

PJUL is part of the Innovator S&P 500 Defined Outcome series of ETFs, which seek to provide investors with the upside of the S&P 500 (to a cap) and defined downside buffers, over an outcome period of approximately one year, at which point the ETF will reset. Perhaps the greatest innovation behind these ETFs is the price discovery that has been applied to the “structured outcome,” allowing investors to buy and sell at any time throughout the day (like a stock).

The Trade War “ETF Trade”

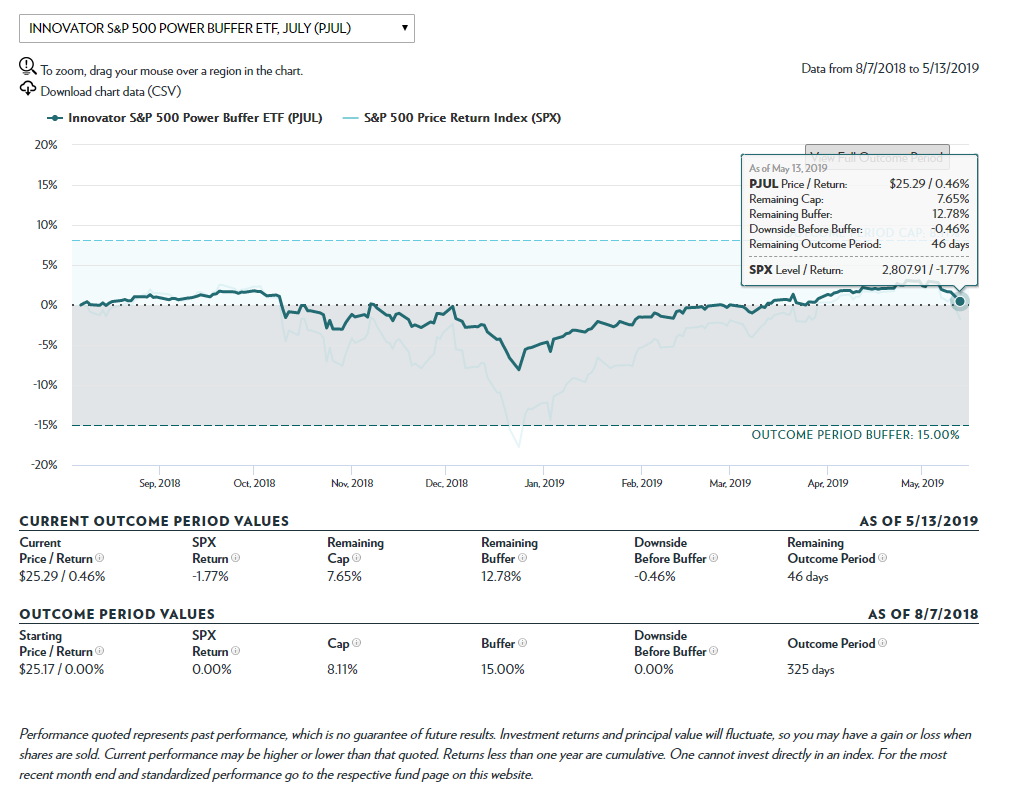

As of May 13th, 2019 the Innovator S&P 500 Power Buffer ETF – July (PJUL) is flat (+0.46%), with 46 calendar days remaining in its outcome period. The ETF has a remaining buffer of 12.78%, and a remaining upside cap of 7.65%. This means that at the end of June 30th (46 days from now), if the China Trade plays out negatively in the markets, and the S&P finishes down 10% (for example), PJUL’s buffer will be in effect and the ETF will be down 0% (before fees and expenses). If the S&P rebounds over the next 46 days, and ends in the black, you will participate in the growth (capped at 7.65% before fees and expenses). (See chart below.) We view this as an actionable way to potentially add a degree of protection against a short-term decline in the market, and participate should the threat subside and markets finish positively over the next 46 days.

The benefits of placing structured outcomes inside the liquid ETF wrapper are just beginning to be realized.

For more ETF strategies in the equity space, visit the Equity ETF Channel.