[ad_1]

The iShares Core MSCI Emerging Markets ETF (IEMG) looks to provide investors with exposure to emerging markets through a portfolio with mixed market-capitalizations. Shares of IEMG have traded bullishly since the beginning of 2019, rallying off of a low around $46. However, trades found a top just under $54 in mid-April, and trading since then has dropped the value of the ETF towards $50. With IEMG crossing its 200-day moving average bearishly, investors might choose to avoid the riskier fund. This is especially the case after several emerging markets have seen growth expectations dropped after first quarter data disappointed.

From Finviz

The International Monetary Fund (IMF) provided its April 2019 World Economic Outlook (WEO) with the worrying title “Growth Slowdown, Precarious Recovery.” It’s no secret that major financial institutions like the IMF consider slowing global economic growth a significant risk through the end of 2019. The IMF projected in that WEO that “growth across emerging market and developing economies is projected to stabilize slightly below 5 percent,” however there will be “variations by region.” With this in mind, investors should be cognizant of the regions that they move into realizing that risks can be secular.

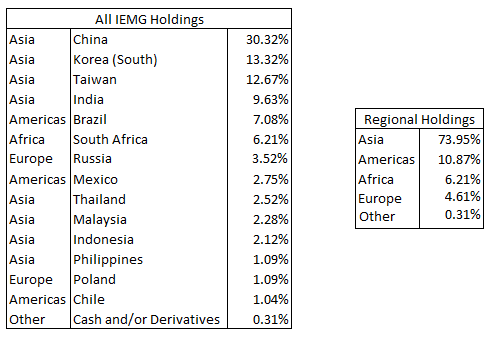

Like many emerging markets ETFs, IEMG focuses on the BRICK cohort (Brazil, Russia, India, China, and Korea) with over 60 percent of that portfolio dedicated to it. The only country not represented is Russia, and the majority of that BRICK percentage is represented by Asia. For that reason, the success of this ETF relies heavily on the performance of the major Asian economies.

China

As of May 10, the US increased tariffs from 10 percent to 25 percent on $200 billion worth of Chinese imports, according to AP news. President Trump introduced the new tariffs in a sudden protectionist move despite the Chinese delegation’s visit to the US in the same week. The increase in tariffs is expected to accentuate GDP losses for both the US and China. Even before the new tariff increases were announced, China reported a surprise 2.7 percent decrease in exports for April 2019 with 3 percent growth expected. The negative export surprise is accompanied by a 17-year low in Chinese industrial output. While GDP is slowly shifting towards consumption, a slowdown in manufacturing could have a significant effect. The Shanghai Composite Index, though up 17.7 percent YTD, has fallen 10.0 percent from its peak at 3,267 as of May 10, 2019.

South Korea

The economic outlook for the second largest represented country, South Korea, was pessimistic as the Bank of Korea expected to continue a disappointing 2018 with more deceleration in 2019. According to the Nikkei Asian Review, 2018 growth of 2.7 percent (the slowest in six years) was expected to slow to 2.6 percent. That pessimism was confirmed as first-quarter GDP came in harshly lower at 1.8 percent year over year. The South Korean economy continues to be swayed by the volatile semiconductor market which benefited from robust demand as cryptocurrency took over. However, as illustrated by recent earnings from SK Hynix (profit down by 69 percent), the industry is cooling and could weigh on the South Korean economy where 21.1 percent of exports were semiconductors in 2018.

Taiwan

Just behind South Korea, Taiwan is the third-highest country represented in IEMG holdings, and similar to South Korea’s economy, the Taiwanese economy is expected to see a slowdown in the last three quarters of 2019. According to Taiwan Business Topics, Minister Tzer-ming of the Directorate General of Budget is forecasting growth to be 2.27 percent in 2019, down from 2.41 percent forecasted in November 2018, and UBS Group’s (NYSE:UBS) forecasts have fallen even more from 2.6 percent to 2.3 percent. The forecast downgrades have come in conjunction with poor economic data such as a 6 percent drop in new export orders in January and a sharp 7.69 percent drop in industrial output growth. A softer semiconductor industry, as discussed in South Korea’s review, would impact the largest Taiwanese holding in IEMG, Taiwan Semiconductor Manufacturing (TSM).

India

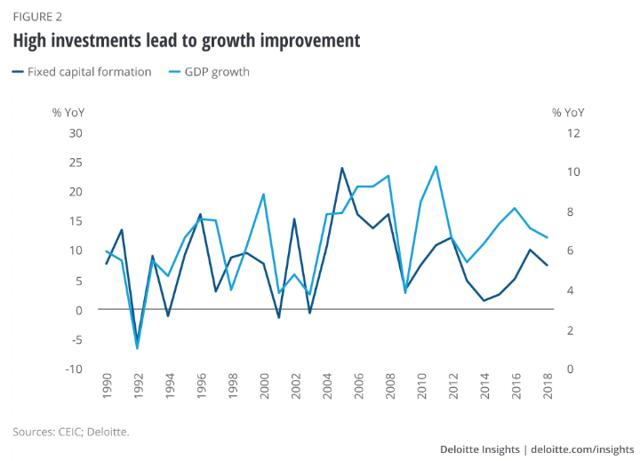

India’s economic outlook is the first of IEMG’s top holdings that has not been significantly stunted by global trade tensions. Though volatile, Deloitte’s Indian economic outlook suggests that the country can keep growing at a fast pace in the range of 7.2-7.4 percent commenting that its economy is “possibly the least affected by global turmoil.” The Indian economy is also likely to see some support if the Federal Reserve continues its relatively dovish stance on monetary policy in 2019. The halt in US tightening allowed the Reserve Bank of India to cut its policy rate by 25 basis points in February and April this year. Increased liquidity should help spark higher capital formation from inflows which Deloitte’s chart shows is correlated with higher growth.

While the non-Asian emerging markets compose a minority, there are two that deserve just over 10 percent of the portfolio. Brazil is the largest representative of the Americas region at 7.08 percent and South Africa is the only representative of the Africa region at 6.21 percent.

Brazil

Brazil, the largest non-Asian emerging market represented in the portfolio, continues to try and shake off a 2015-2016 economic recession with largely disappointing results. A May 6thbriefing from BBVA Research reports that Q1 2019 GDP growth likely came in around Q4 2018 GDP growth of 1.1 percent. A stronger recovery was expected with a new government introduced at the beginning of 2019, but those expectations have been replaced by disappointment. Bloomberg reported that March industrial production numbers “fell by more than double analysts’ expectations” despite low-interest rates. It seems unlikely that the economy will find a strong recovery in the latter three quarters of 2019, especially with Argentinian growth struggles weighing on Brazilian exports.

South Africa

South Africa is the only African nation represented in the IEMG portfolio, and like its emerging market cohorts, forecasts for its growth in 2019 have been reduced. The IMF dropped its expectations for GDP growth from 1.4 percent to 1.2 percent and the South Africa Reserve Bank slashed its expectations from 1.7 percent to 1.3 percent. With President Cyril Ramaphosa’s election, he will be looked upon to stabilize a struggling economy overwhelmed with sovereign debt. The Daily Maverick suggests that policy action will need to be quick as a review of South Africa’s credit rating later this year could cause significant damage to the South African economy if the rating is downgraded and South African bonds are removed from the Citi World Government Bond Index.

For most of IEMG’s top holdings, there seems to be a consistency in lowered growth projections as the first quarter of 2019 comes to a close. It seems that optimism in emerging economies at the beginning of the year was misguided or at least surprised by unexpected economic events like the intensification of the US-China trade dispute. The one stand-out positive appears to be India which seems to have the highest probability of sustaining high growth rates in a global slowdown. For this reason, IEMG probably won’t see a confident rally from its recent drop. In fact, since India looks likely to outperform its emerging markets peers, investors might prefer choosing a fund based on Indian assets.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News