[ad_1]

Investment Thesis

Vanguard Dividend Appreciation ETF (VIG), as one of Vanguard’s low-cost, passively-managed funds, provides a strong, steady dividend yield and outpaces the yield of similar funds.

In this ETF review, we will take a look at VIG’s fundamentals, determine if it is an appropriate investment for dividend investors seeking yield, and compare it with similar ETFs to find the best funds in this category.

Basic Fund Information

From the fund’s website: VIG “provides a convenient way to track the performance of stocks of companies with a record of growing their dividends year over year, it seeks to track the performance of the NASDAQ US Dividend Achievers Select Index, and follows a passively managed, full-replication approach.” Vanguard lists the fund’s expense ratio as 0.08% and reports total net assets of $40.9 billion as of 03/31/2019. VIG was established on 04/21/2006 and recently completed its 13th year of operations.

Dividends

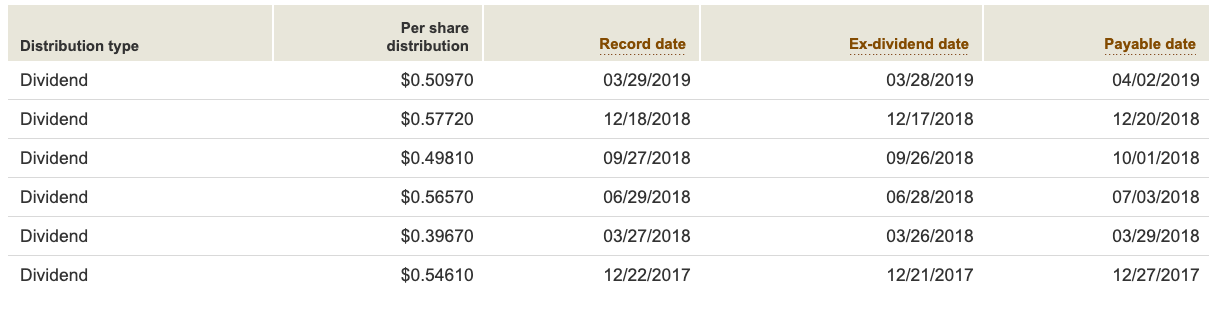

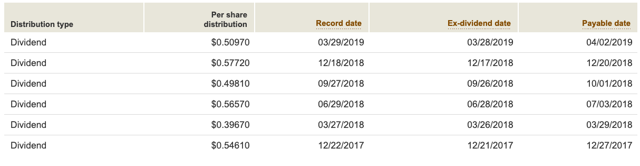

VIG pays dividends quarterly and has done so consistently over the six most recent quarters, as shown below:

Based on the last four dividends totaling $2.1507/share and VIG’s current trading price of $111.57/share (as of 10:55 am CST on 05/08/2019, courtesy of Yahoo! Finance), VIG’s dividend yield is 1.93%.

Portfolio

VIG holds a total of 185 stocks, among them Procter & Gamble Co. (PG), Visa Inc. (V), Microsoft Corp. (MSFT), Johnson & Johnson (JNJ), and Walmart Inc. (WMT). Its major sector weightings are to consumer services (20.1%) and industrials (27.5%).

Performance

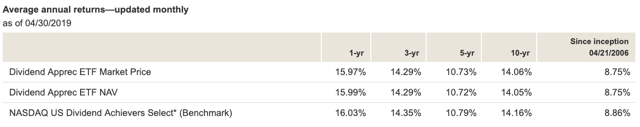

There is not much to see here that was unexpected. VIG closely follows its index and has returned about 9% since its inception in 2006:

Financial Statement Analysis

Financial Statement Analysis

The next step in the review process is to read VIG’s most recent financial statement, which is the annual report, dated 01/31/2019. Major sections of this report are summarized below:

Statement of Net Assets (Including Portfolio Holdings, p. 10)

I scanned the listing of portfolio holdings and found only equities in the fund’s core holdings. VIG also has a few small positions in U.S. Treasury bonds, a money market fund used for cash management, and a futures position in the S&P 500 index (which was disclosed on its website and in the notes to the financial statement). The last page of this statement reports net assets of $38.8 billion.

Statement of Operations (p. 14)

VIG earns a respectable $746 million of investment income. Net of expenses totaling $24 million (mostly management fees), VIG’s net investment income is $722 million. On the downside, the bottom of this schedule reports a depreciation in investment value of $2.495 billion. Coupled with a positive net gain from the sale of its holdings, net income from operations served to reduce net assets by almost $336 million; VIG’s holdings apparently had a tough year.

Statement of Changes in Net Assets (p. 15)

The only item of note on this statement is that all shareholder distributions were made from net investment income, indicating that VIG earned all of the dividends that it distributed. Despite the reduction in net assets from operations noted in the previous paragraph, overall VIG was able to increase its net assets by about $3.9 billion due to investor purchases of the fund.

Financial Highlights (p. 16)

This section highlights the various items affecting NAV and tracks NAV over a period of years. It is very encouraging to see that VIG’s NAV began 2015 at $71.47 and has grown to $104.09 in the current period! Additionally, as noted in the previous paragraph, VIG has consistently distributed dividends from its net investment income (meaning that those distributions are earned) during all five periods shown; an even better sign of financial stability and growth!

The results of the financial analysis show that VIG is in very stable financial shape. Next, we’ll finish up this ETF review by comparing VIG to some of its peers to determine if it is the best fund in the space.

Fund Comparison

To compile a listing of ETFs comparable to VIG, I used the excellent screener at ETFdb.com. Constraining the search to U.S. equities focused on dividends with yields over 1.89%, the screener returned a list of 70 funds. Of these, VIG was the second largest, sandwiched directly between two fellow Vanguard funds. To narrow this list even further, I reduced it to ETFs with over $1 billion in assets, resulting in a more manageable list of 23 funds.

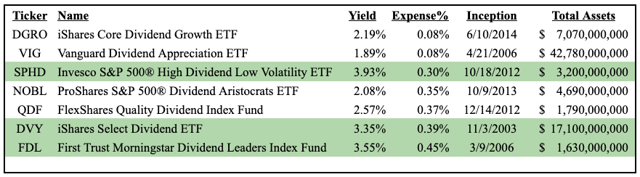

Of these 23, I briefly reviewed each fund’s website to determine which funds were focused on companies who were consistent dividend payers and dividend growers, instead of just picking the highest-yielding equities. This resulted in the following list (sorted by expense ratio):

VIG and another iShares selection, while winning in the expense ratio column, are definitely not the highest-yielding ETFs in this category. If you’re willing to add another 20 basis points (0.2%) to your fund’s expense ratio for a higher yield, than I would recommend the following three ETFs instead of VIG:

- Invesco S&P 500® High Dividend Low Volatility ETF (SPHD)

- iShares Select Dividend ETF (DVY)

- First Trust Morningstar Dividend Leaders Index Fund (FDL)

Summary

In this analysis, we have proven that VIG is a financially-stable, low-cost ETF paying steady dividends. However, several similar ETFs focused on companies with growing dividends pay a much higher yield if the investor is willing to accept a higher expense ratio.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News