[ad_1]

It makes sense for investors to put their money in high-quality companies that can withstand business cycles and have shareholder-friendly management that rewards investors by consistently growing dividends for years. In my previous article, I wrote about the SPDR S&P Dividend ETF (SDY) as a great way to gain exposure to more than a hundred such stocks which have been consistently growing dividends for 20 years. The Invesco High Yield Equity Dividend ETF (PEY) also holds 50 companies with a great history of dividend growth and offers a higher dividend yield than SDY but I believe this is not a great ETF. Unlike SDY, PEY’s portfolio consists of some small-cap and low-quality dividend stocks which could drag its performance in the future. The ETF is also more expensive than some of its rivals. I think income-seeking investors should steer clear of Invesco High Yield Equity Dividend ETF and consider other higher-quality funds.

Image courtesy of Pixabay

The US stock markets continue to shoot higher. Last week, the S&P-500 and the Nasdaq Composite closed on record levels after the Commerce Department’s report showed that the US economy expanded by 3.2% in the first quarter, beating economists’ estimate of 2.5%. I believe this solid performance was particularly impressive considering that this also includes the impact of the US government shutdown as well as the signs of a slowdown in the manufacturing activity. The country also witnessed strong gains in retail sales which roared back to life by climbing by 1.6% in March after dropping by 0.2% in February. These factors have eased concerns regarding consumer spending and the health of the overall economy. This, combined with the Federal Reserve’s decision to dial back of rate increases, has pushed the US stocks higher in 2019. The S&P-500, Dow Jones, and the Nasdaq Composite have gained by 17%, 14%, and 23% this year respectively.

That being said, there’s also no denying the fact that the global economic growth is slowing down. A number of US’s key trading partners are struggling which can have a negative pull on the US growth. The International Monetary Fund recently slashed its global economic growth forecast for 2019 to 3.3% from 3.5% previously. Additionally, manufacturing output remains low and its outlook is uncertain. After climbing by 1.7% in 4Q18, production at factories fell to an annualized rate of 1.1% in 1Q18 which was the first quarterly decline since 3Q17. If consumer spending also comes under pressure in the coming quarters, then that could raise concerns about the economy moving forward. This may have a negative impact on stock markets.

In this backdrop, investors should focus on buying high-quality stocks which have a solid track record of consistently growing dividends for several years. For passive investors, ETFs offers a great way to gain exposure to dozens or even hundreds of dividend stocks. Invesco High Yield Equity Dividend ETF appears as one such fund which not only offers a high dividend yield but also holds companies that have been growing dividends for at least 10 years.

I believe the real appeal of investing in dividend stocks with a prolonged stretch of growing shareholder payouts becomes apparent when the going gets tough, not when the markets are soaring. That’s because such companies are often well-established with a solid business model that can withstand business cycles and their stocks hold up better than the broader market during times of economic weakness when other stocks crash. Consequently, the ETFs which focus only on these stocks should outperform the market during difficult periods. But Invesco High Yield Equity Dividend ETF, or PEY, hasn’t always lived up to that promise.

In the fourth quarter of last year the S&P-500 and Dow Jones fell by 14.3% and 12.5% respectively but those ETFs which hold companies that have been growing dividends for a decade or more, such as SPDR S&P Dividend ETF and ProShares S&P-500 Dividend Aristocrats ETF (NOBL) held up better. SDY and NOBL clocked losses of 8.5% and 9.7% respectively. PEY, on the other hand, performed poorly than its rivals as shares dipped by 11.6% in this period, nearly matching the Dow Jones’s losses.

During the global financial crisis of 2007-09, PEY’s actually underperformed the broader market. From October 2007 through the end of March 2009, the S&P-500 and Dow Jones dropped by 48% and 46% respectively but PEY plunged by 65% in this period.

I believe the underperformance is driven by PEY’s stock selection methodology. PEY follows the NASDAQ US Dividend Achievers 50 Index which consists of companies who have increased regular annual dividends for at least the last ten straight years and have a minimum market cap of $1 billion. The Index makes its picks from the broader NASDAQ US Broad Dividend Achievers Index who meet its market cap criteria. PEY does not include REITs or units of the limited partnership. The selected stocks are then ranked on the basis of trailing-twelve-months dividend yield and the top-50 are included in the ETF.

PEY successfully avoids being heavily tilted towards one security or an individual sector by capping the weight of a single stock at 4% and a single sector at 25%. Additionally, the number of securities for a single sector is capped at 12 stocks. This has made PEY a fairly diversified ETF.

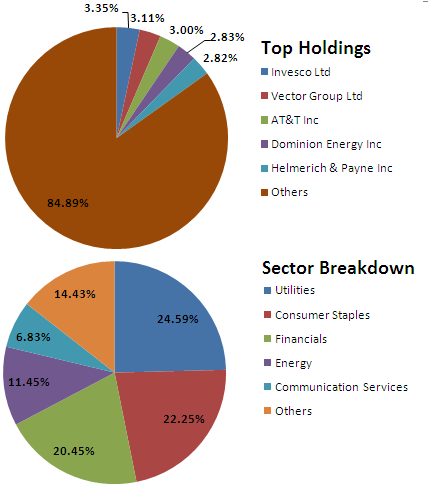

PEY’s Top Holdings and Sector-Wise Breakdown. Image: Author

Due to a low threshold on market cap, PEY ends up holding a number of small-cap stocks including companies such as Vector Group Ltd. (VGR), Southside Bancshares (SBSI) and Universal Corp (UVV). The small caps often underperform against the broader market during the general weakness. In the fourth quarter of 2018, the Russell 2000 Small-Cap index plunged by 20%. I think the small-cap exposure could be one of the reasons behind the ETF’s underperformance. The fund could perform poorly again in the future if the market turns.

PEY comes with an expense ratio of 0.54% which means that it charges $54 each year on every $10,000 of investment. This makes PEY more expensive than SDY and NOBL which have a lower expense ratio of 0.35% each.

However, PEY offers an above-average dividend yield, which is an advantage of ranking stocks by dividend yield. PEY’s trailing twelve months distribution yield stands at 3.70%. That’s higher than what investors get with other ETFs which consists of stocks with a long history of dividend growth. SDY, NOBL, ProShares S&P MidCap 400 Dividend Aristocrats ETF (REGL), Cboe Vest S&P 500 Dividend Aristocrats Target Income ETF (KNG), and Invesco Dividend Achievers (PFM) offer dividend yields of between 1.8% and 3.5%.

On the other hand, a drawback of being overweight on yields is that it can give investors exposure to companies whose high yield is an indication of a higher risk of a dividend cut. Additionally, funds such as SDY and NOBL select their stocks from the S&P-500 which consists of mostly mid-to-large-cap well-established companies. PEY, on the other hand, can select any stock that has grown dividends for ten years and has a market cap of more than $1 billion. That means that PEY can also pick small-cap companies who are low-quality stocks which have been growing dividends but only at a nominal pace and their payouts seem unsustainable. Since stocks are ranked on a yield basis, such low-quality dividend stock may sport an above-average yield and could end up becoming one of ETF’s top holdings.

Looking at PEY’s top-5 holdings, we can identify at least one company – Vector Group Ltd. – which I consider as a low-quality dividend stock which will struggle to even maintain its existing dividends.

Vector Group, which is a tobacco and real estate company valued at $1.6 billion, hasn’t announced a meaningful dividend hike since late-2016 (besides the 5% stock dividend). Vector Group is PEY’s second-largest holding, as indicated in the image above. Unlike a vast majority of great dividend stocks, such as Exxon Mobil (XOM), which generate strong levels of cash flows and uses them to fund capital expenditure and dividends, Vector Group typically uses debt to pay for dividends. Its tobacco business, where it operates at the low-end of the market, is highly profitable and has been fairly stable, but its real estate business is struggling with declining profits. Unless the real estate market turns, the company will find it difficult to sustain shareholder payouts amid growing debt and rising interest expenses.

I believe exposure to small-caps and low-quality dividend stocks might drag PEY’s performance in the future. In the last twelve months, PEY has risen by just 5.2% while SDY and NOBL have posted gains of more than 10% each. Although PEY boasts about holding stocks that have grown dividends for at least ten years in a row, it doesn’t have a portfolio of outstanding dividend stocks. I believe investors who wish to build a defensive portfolio should avoid this ETF and instead focus on better funds such as SDY and NOBL.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News