[ad_1]

The Theme

AI uses computer algorithms to replicate the human ability to learn and make predictions. AI software needs computing power to find patterns and make inferences from large quantities of data. The two most common types of AI tools are called “machine learning” and “deep learning networks.”

There’s plenty of buzz around artificial intelligence and machine learning as more and more companies say they’re using it. There is a distinction between companies generating AI and machine learning services and products “pure plays” and companies that are integrating and implementing AI and machine learning applications as an innovation to the core model. However, beware, in some cases companies are using older data analytics tools and labeling it as AI for a public relations boost. But identifying companies that are actually creating superior and niche AI and machine learning products and services, as well as companies that are actually getting material revenue growth from AI and machine learning, can be tricky.

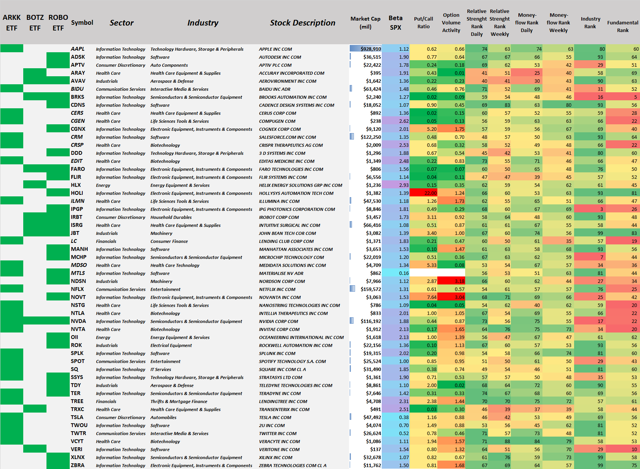

We are focusing on most liquid constituents from the “pure play” ETFs and “innovation leaders” ETFs (see Table 1 below).

- Global X Robotics & Artificial Intelligence Thematic ETF (NASDAQ:BOTZ)

- ROBO Global Robotics and Automation Index ETF (NYSE:ROBO)

- ARK Innovation ETF (NYSE:ARKK)

Our goal is very straightforward: to find and time entry into the best of the best candidates based on the growth and value – overlaid by technical, sentiment, money flow and cyclical factors. The horizon of the trades is mid-term to long term as outright absolute buys or spread relative buys against QQQ.

Technical Overview

BOTZ (Chart 1 – light blue line) and ROBO (Chart 2 – purple line) are very correlated to QQQ (Chart 1 – green line) and at the same time significantly underperforming the QQQ in the last 12 months, while ARKK (Chart 1 – yellow line), mostly due to the tech heavyweights, has been outperforming the QQQ. In the short- to medium-term horizon, we believe from a statistical standpoint that this spread will converge – where a full convergence would result in a 27-34% spread.

Chart 1 (Courtesy of TD Ameritrade ThinkorSwim)

Observing the spread between ROBO and QQQ (Chart 2 below on the right) in this case, there is a potential shift formation in relative strength, money flow, and cyclical factors in favor of ROBO. Factoring this assumption, we would also take into consideration a long/short strategy by buying selected stocks or portfolio of stocks from the ROBO and BOTZ universe and selling the QQQ – particularly if the market stalls or pulls back.

Chart 2 (Courtesy of TD Ameritrade ThinkorSwim)

We use ROBO and BOTZ as a benchmark and sentiment gauge, and we typically would not recommend trading the actual BOTZ or ROBO index except in opportunistic situations, due to liquidity constraints and lack of critical following – at least not yet.

Scorecard

Table 1 – BOTZ, ROBO and ARKK Stocks (Courtesy of Clarendon Global)

Picks

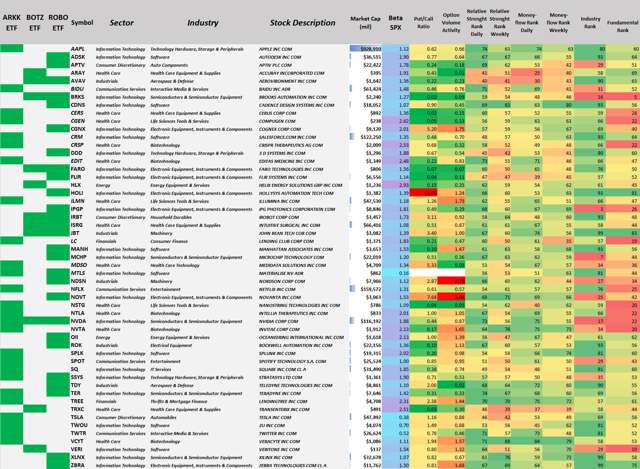

A short list of our buy picks is centered around stocks that have a solid show and balance of money flow and fundamental and sentiment factors with good technical signals and entry points. Our current buys are grouped by current price patterns formations as shown in Table 2 below:

- Reversal group are all momentum buys from the bottom and in mid-range from the bottom, until the bullish factors wane down, with plenty of room until first meaningful upside targets are met – Buy now.

- Resistance group are buys on the resistance crossroads, where small pullback, breakout or further consolidation is expected – Wait for the entry point from the pullback or from the consolidation breakout.

- Momentum group are momentum buys at new highs – If short-term pullback or consolidation happens, then it is a less risky entry.

Table 2 – Buy candidates by group (Courtesy of Clarendon Global)

We will be focusing on and creating more structured trade recommendation for Nvidia Corporation (NASDAQ:NVDA) from the Mid-range Reversal group and iRobot Corporation (NASDAQ:IRBT) from the Minor Resistance group as the widely followed and very liquid stocks for the complex strategies we are desiring.

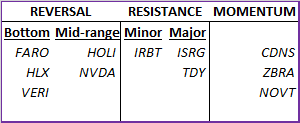

Nvidia Corporation

Nvidia is a very liquid stock and has heavy presence in all 3 followed ETFs, also marked as one of our Reversal buys in Table 1 above. We think that Nvidia has a small probability on a downside and a probable upside target of $230 in the next two months, so we constructed a long Condor (Buy $200/$210/$220/$230 June 21 Condor @1.86 debit) to best fit and take advantage of this possible outcome. The profit range is between $201 and $228 where the maximum profit is $814, the downside maximum loss (not implementing stop-losses) is $189, and the most important takeaway:

- The upside breakeven point is exactly at the confluence of the Fibonacci 61.8% retracement between the October 1st high and December 24th low, and

- One standard deviation price range probability between now and the June 21st expiration (blue cone line on the Chart 3 below).

Chart 3 – Nvidia Corporation (Courtesy of TD Ameritrade ThinkorSwim)

Chart 4 – Nvidia Corporation (Courtesy of TD Ameritrade ThinkorSwim)

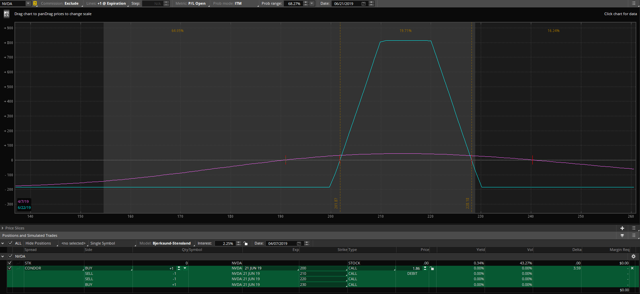

iRobot Corporation

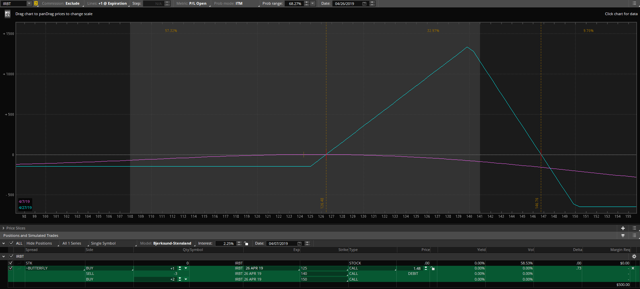

iRobot is a very liquid stock and has heavy presence in two of the followed ETFs, also marked as one of our minor resistance buys in the Table 1 above. We think that iRobot has a small probability on a downside, as it has made a short-term pullback recently, followed by a recent good entry point to a probable short-term upside target to at least to $133 in the next few weeks, so we constructed a long unbalanced Butterfly (Buy +1 125/-3 140/+2 150 April 26 unbalanced Butterfly @1.48 debit) to best fit and take advantage of this possible outcome. The profit range is between $126 and $146 where the maximum profit is $133 at 140, the downside maximum loss (not implementing stop-losses) is $148, and the most important takeaway:

- The upside breakeven point is slightly higher than the Fibonacci 50% expansion target between the December 24th low and March 1st high, and

- Significantly higher than the one standard deviation price range probability between now and the April 26th expiration (blue cone line on the Chart 5 below)

Chart 5 – iRobot Corporation (Courtesy of TD Ameritrade ThinkorSwim)

Chart 6 – iRobot Corporation (Courtesy of TD Ameritrade ThinkorSwim)

Conclusion

In addition to the critical effect AI and machine learning applications will have on the core economic growth, the number of AI and machine learning “pure play” and innovation leaders” stocks is going to grow exponentially. However, the segmentation of these stocks is going to get much more complex, and identifying “pure plays” from “innovative leaders” and “innovative leaders” from the rest of the stocks will get very tricky. Following and understanding these trends in their growth and complexity will be critical in preparation for trading and investing successfully.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News