[ad_1]

Main Thesis

The purpose of this article is to evaluate the SPDR Bloomberg Barclays Investment Grade Floating Rate ETF (FLRN) as an investment option at its current market price. The fund gives investors exposure to floating rate debt, which are bonds whose interest rates reset at prevailing interest rates automatically. This was an investment type I was pushing last year, due to the consistent Fed action of raising interest rates. This allowed FLRN, and similar funds, to raise their distributions accordingly, all while seeing their underlying assets increase slightly in value. This was a profitable play for a while, but the current market outlook suggests the attractiveness of these assets may have peaked for a few reasons. One, the Fed has put further interest rate increases on hold, which will make the likelihood of seeing FLRN increase its yield decline. Two, other short-term assets, such as fixed income corporate debt, certificates of deposit, and savings accounts have all seen their yields increase as well. The differential between FLRN and yields on those liquid assets is practically non-existent. In the case of products that are FDIC insured, investors would be taking on zero default risk to essentially earn the same amount of income. Furthermore, some investors are expecting interest rates to actually decrease by year-end, which makes floating rate debt even less attractive. While FLRN offers exposure solely to investment grade corporate credit, which has minimal default risk, its current yield and outlook still makes me question the validity of taking on any type of risk, when one could earn a similar amount with none.

Background

First, a little about FLRN. The fund is managed by State Street and “seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Bloomberg Barclays U.S. Dollar Floating Rate Note < 5 Years Index”. Currently, the fund is trading at $30.63/share and pays monthly distributions, with an annualized yield of 2.84% based on its latest payout. I reviewed FLRN for the first time back in late October, when I recommended the fund as we were still in a rising rate environment. As rates did indeed rise in December, FLRN has actually generated just under a 1% return since that time. However, since the new year began, the market outlook for floating rate funds has shifted dramatically. In turn, I am no longer bullish on this investment type, and will explain why in detail below.

Floating Potential Is Dwindling

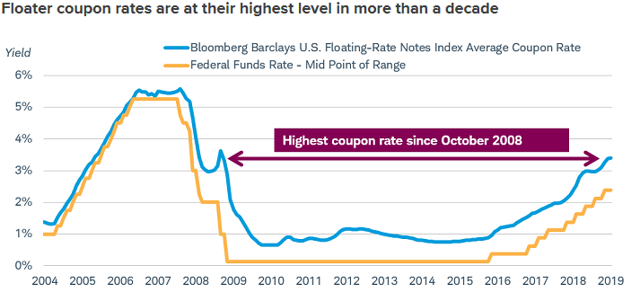

To begin, I want to touch on the main reason why I believe the potential for floating rate funds has peaked. The primary factor here is interest rates. A key benefit of floaters is that their coupon rates reset throughout the year, at regular intervals, based on the movement of short-term interest rates. This type of debt is preferable during times of rising rates, and 2018 was such an instance. As short-term interest rates rose last year, the distributions offered by funds like FLRN rose in turn, and this was a theme that out-performed standard investment grade bond funds, as I discussed back in my October review. As the graph below illustrates, the coupon rates for an index of floating rate debt increased in lock-step with the federal funds rate:

Source: Charles Schwab

Source: Charles Schwab

While this graph shows that floaters were indeed meeting their stated objectives, the major takeaway here that I see is that coupon rates for those assets are now at their highest levels in over 10 years. While this does not mean they can not rise further, the macroeconomic outlook makes that scenario appear unlikely.

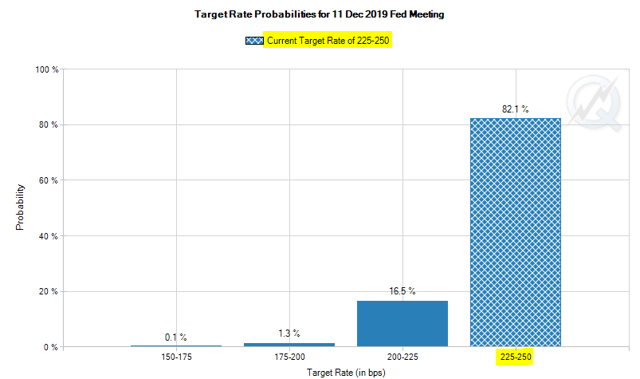

The problem is the Fed appears to be nearing the end of its rate hike cycle, with Fed officials swiftly reversing their “long way from neutral” speak last year in favor of “patience”. While it is true that the Fed could indeed resume hiking rates after this period of “patience” ends, the futures market does not think this is likely. In fact, according to CME Group, which tracks the futures market for investor sentiment on interest rate movements, there is currently a 0% chance of a Fed rate increase this calendar year, as illustrated below:

Source: CME Group

Source: CME Group

Strikingly, there is actually a reasonable chance of an interest rate decrease by year-end, which would be bad news for floating rate funds especially.

The implication of this outlook is that the income upside offered by floating rate investments is starting to dwindle. Without the possibility of higher distributions in the near future, investors have to take the current yield at face value, rather than an income level that is set to increase. With a yield below 3%, the attractiveness of FLRN is largely dependent on what other short-term products are offering. And, as I will discuss in the following paragraph, the yields offered by many low-risk products are indeed very similar to FLRN.

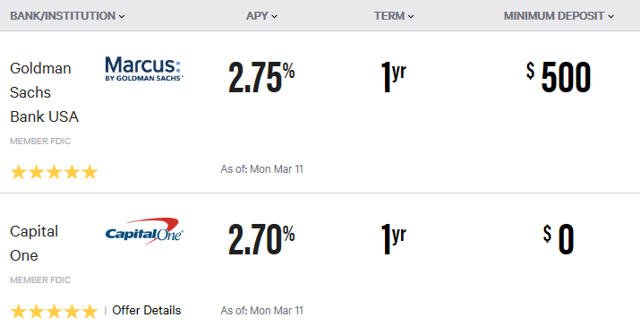

Yield Comparable To Short-Term CD

As I alluded to above, one of the principal reasons for buying FLRN would be to earn income that increases over time. With the absence of short-term interest rate increases, the likelihood of this occurring is minimal. Therefore, it is important to judge its current yield, of 2.84%, against other short-term options. A simple exercise is to look at a basic, 1-year certificate of deposit. A quick internet search reveals a couple of options from reputable financial institutions, offering yields strikingly similar to FLRN, illustrated below:

Source: Bankrate.com

Source: Bankrate.com

As you can see, the rates are comparable but, of course, one could point out that FLRN is higher, so why not just buy FLRN in this scenario?

Well, there are two reasons. One, while the yield differential offered by FLRN is indeed advantageous, it also carries default risk, in the unlikely event an investment grade corporate fails to pay its debts. While default risk among investment grade is low, it is not zero, and certificates of deposit are federally insured and carry zero default risk. Therefore, it seems a small sacrifice to take a 2.75% yield over a 2.84% yield, when the lower figure is risk-free.

A second reason is that FLRN’s current yield is not static. While interest rates could rise, boosting the future yield, the opposite is also true. In fact, FLRN has seen its distribution drop slightly in 2019, by about 1%, from February to March, illustrated in the chart below:

Source: State Street

Source: State Street

While this decline is fairly minor, it does illustrate that the income stream is not constant and can decline, where as a certificate of deposit offers a fixed rate. Considering that the current interest rate outlook is that we may see short-term rates decline, rather than rise, over the next 12 months, there is a greater possibility of a further decline in income, as opposed to an increase.

My takeaway here is that once these risks are factored in – default risk and interest rate risk – the slight yield differential offered by FLRN is simply not worth it.

Fixed Income: Lock In A Slightly Higher Yield

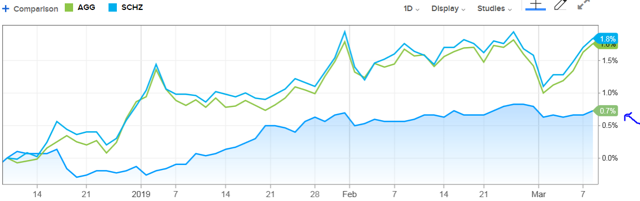

In the preceding paragraph, I mentioned the option of taking cash out of floating rate funds and putting it in a savings account to earn a similar yield. While a reasonable option, investors could possibly be better served by using those funds to invest in a fixed rate bond fund, such as the iShares Core U.S. Aggregate Bond ETF (AGG) and the Schwab U.S. Aggregate Bond ETF (SCHZ). These are broad funds that are well-served as benchmarks, and were actually what I suggested rotating out of last year and in to FLRN. With the interest rate outlook shifting, I am now suggesting the opposite.

The reason is, last year FLRN, and similar floating funds, were out-performing fixed bond funds, like SCHZ and AGG, as well as delivering rising distributions. The benefit to me seemed clear, and it was a profitable move in the last calendar year. The new year has changed this dynamic, with FLRN under-performing both these options over the past 3 months, illustrated below:

Source: CNBC

Source: CNBC

As you can see, these fixed income funds, filled with treasuries, mortgage backed securities, and investment grade corporate debt, are seeing greater returns in the current market climate. Furthermore, their yields are slightly higher, illustrated in the chart below:

| Fund | Current Yield |

| FLRN | 2.84% |

| AGG | 2.98% |

| SCHZ | 2.88% |

Source: Author calculated yields based on most recent distributions

My takeaway here is that AGG and SCHZ seem to hold the advantage to FLRN at the moment. While the difference in yield is not substantial, the income streams should not decline if rates go down, where as for FLRN it would likely drop. Therefore, investors can not only obtain a higher yield now, they can lock it in in case of future interest rate declines. While it is true that investors would not profit from rising interest rates, as they would with FLRN, the current outlook does not suggest rates are going to rise in the short-term. Once that outlook changes, I would look to rotate back in to FLRN, but that is not the case now.

Bottom line

Last year we saw rising rates, market volatility, and low corporate defaults, which was a recipe for strong performance from floating rate funds. FLRN was no exception, and saw price gains as well as rising income. The fund was attractive for most of the year, and looked set to continue similar performance in 2019 based on Fed projections. However, the Fed has since become increasingly dovish, to the point where the market has zero faith in their initial forecast of two interest rate hikes for 2019. In fact, investors actually think a decrease in rates is the larger possibility, and that does not bode well for floating rate debt.

And the results have already been clear: FLRN is under-performing standard bond funds, and its income level has seen a slight decrease. Furthermore, since short-term rates did rise last year, the income offered by risk-free products almost mirrors FLRN, which makes me question the logic of taking on default risk for a nearly identical yield. For investors who want to stay in bonds, they may be interested in heading back in to benchmark funds like AGG or SCHZ, which offer slightly higher yields without the potential for automatic income drops if rates do decline. For these reasons, I am not optimistic on FLRN, or similar floating rate products, and would encourage investors to look elsewhere for yield at this time.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News