[ad_1]

When building your ETF portfolio, it is good to start with the basics. As an example, I recently offered Seeking Alpha readers my take on the perfect portfolio for the next 10 years. This article, as well as the follow-ups suggesting ETFs for the U.S. stock, international stock, and bond allocations, offered investors a sound foundation for the years to come.

From time to time, however, you may wish to enhance such a basic approach by supplementing it with ETFs targeted at certain sectors of the marketplace. In the past couple of weeks, I’ve watched as the market has experienced a fair amount of turmoil, in large part due to the re-escalation of trade tensions between the U.S. and China.

As a result, I started to think about the question of safety. What sectors might offer ‘safe harbor,’ if you will, in the midst of turbulent seas?

In doing a little prowling around on Seeking Alpha, I quickly came across a news item featuring the fact that U.S. healthcare spending is set to rise 5.5% per annum over the next decade. In turn, that news item linked to a Reuters article featuring data from the Centers for Medicare & Medicaid Services. Here are a couple of quick excerpts from the article.

“Rising income levels, better employment rate and more people enrolling for Medicare, the federal health insurance program for people aged 65 and above and the disabled, will cause healthcare spending to rise to 19.4 percent of the U.S. economy by 2027, the Centers for Medicare & Medicaid Services (CMS) said.

Annual spending growth for Medicare is expected to average 7.4 percent over the 10-year period, CMS said.

Prescription drug spending is also expected to rise and average 5.6 percent annually between 2018 and 2027 as employers and insurers push patients with chronic conditions to adhere to medications better, and as new and expensive drugs enter the market.”

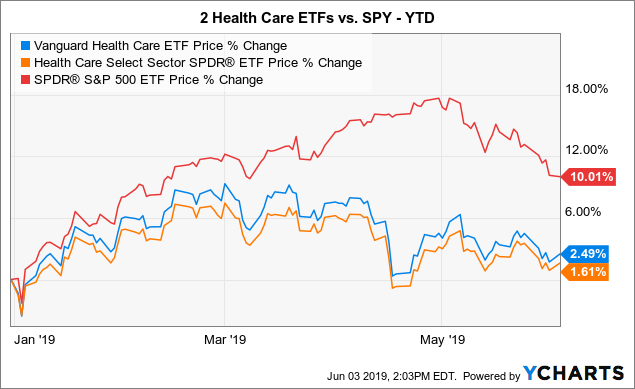

Given that, you might find the below graphic a little surprising. The red line represents the YTD performance of the S&P 500, as represented by the SPDR S&P 500 ETF (SPY), and the yellow and blue lines represent two ETFs that track the healthcare sector.

Data by YCharts

Data by YChartsAs a result, perhaps it is not surprising that a recent Kiplinger article suggested that it might be smart to buy healthcare stocks while they’re down. In short, the article argues that the recent rallying cry of “Medicare for all” has spooked investors, resulting in underperformance for stocks in the sector. However, whether, and when, that might happen is anyone’s guess. In the meantime, this sector likely offers about as good a safe haven as one might find.

For the rest of the article, I’ll review 2 ETFs that you may want to consider if a targeted investment in the healthcare sector sounds attractive to you. The two ETFs are the ones featured in the graphic above, namely:

- Health Care Select Sector SPDR ETF (XLV)

- Vanguard Health Care ETF (VHT)

Let’s start with a helpful high-level table containing some key data points. Then we’ll discuss each ETF in a little more detail.

| Ticker Symbol | XLV | VHT |

| ETF Name | Health Care Select Sector SPDR ETF | Vanguard Health Care ETF |

| Index Tracked | Health Care Select Sector Index | MSCI US Investable Market Health Care 25/50 Index |

| Inception Date | 11/18/2004 | 12/16/1998 |

| Expense Ratio | .13% | .10% |

| Assets Under Management | $17.08 Billion | $9.0 Billion |

| 30-Day SEC Yield | 1.67% | 1.48% |

| Number of Holdings | 62 | 363 |

| Daily Volume | $1.16 Billion | $45.8 Million |

| Average Spread | .01% | .04% |

Let’s now take a brief look at both ETFs.

Health Care Select Sector SPDR ETF

With an inception date of 12/16/1998, this ETF is the oldest in its segment, in fact, it goes back to the very early days of ETFs in general. With AUM of $17.08 billion, it is also by far the largest ETF in this segment. XLV is based on the Health Care Select Sector Index. This is one of the Select Sector indices provided by S&P Dow Jones. In each case, the starting point is the S&P 500. From there, companies are assigned to one of the eleven Select Sector Indices, according to major economic segment. Capping is applied to ensure diversification among companies within each index.

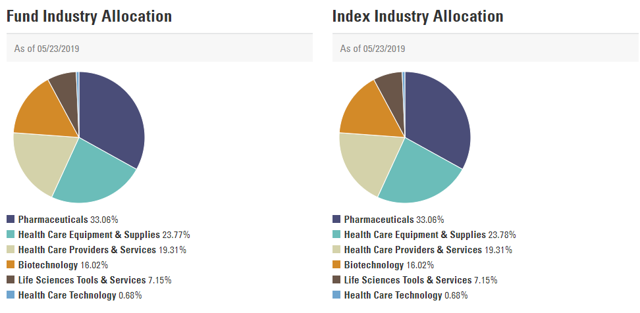

Let’s start with a look at the fund’s overall sub-allocation, within the healthcare sector.

Source: XLV Web Page

Source: XLV Web Page

Next, its top 10 holdings.

Source: XLV Web Page

Source: XLV Web Page

Here are a few things worthy of note:

- There are 62 constituents, or companies, in the index.

- The top 10 holdings comprise some 52.02% of the overall index, and are mostly large-cap pharmaceutical companies. This is also reflected in the overall 33.06% weighting of pharmaceuticals in the index (see pie chart).

- However, this risk is somewhat balanced by the inclusion of McKesson Corp. (NYSE:MCK) and similar companies involved in the distribution of healthcare products, and UnitedHealth Group (NYSE:UNH) and similar companies involved in healthcare services. This diversifies your risk, as the pie chart shows, across various sub-industries within the overall health sector.

XLV sports a very competitive expense ratio of .13%. The fund’s total net assets of $17.08 billion and whopping average daily trading volume of $1.16 billion mean that the fund is extremely liquid, leading to an almost invisible .01% trading spread (the average difference between “buy” and “sell” transactions). I would hope you hold this ETF for the long term, but the above figures will hold you in good stead should you need to trade.

Finally, XLV carries a 30-day SEC yield of 1.67%, distributed quarterly.

Vanguard Health Care ETF

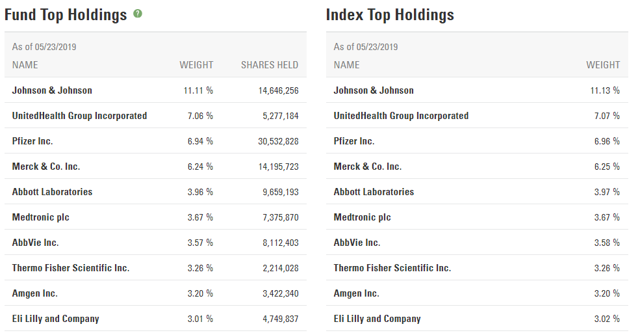

This ETF is based on the MCSI US Investable Market Health Care 25/50 Index, which includes healthcare stocks pulled from the top 98% of the total US stock market capitalization. Let’s start with a closer look at that index, in the below picture taken from the factsheet provided by MSCI.

Source: MSCI Factsheet

Source: MSCI Factsheet

Here are a few things worthy of note:

- There are 354 constituents, or companies, in the index. As can be seen, this ETF includes smaller companies in the portfolio than does XLV.

- The top 10 holdings comprise some 44.45% of the overall index, a little less than the 52.02% in XLV.

Vanguard supplements this with a rock-bottom expense ratio of .10%. The fund’s total net assets of $9.0 billion and average daily trading volume of $45.8 million mean that the fund is extremely liquid. While, at .04%, VHT’s trading spread is slightly higher than that of XLV, this will really only be of potential interest to active traders.

Finally, VHT carries a 30-day SEC yield of 1.48%, distributed quarterly.

Can We Pick A Winner From The Two ETFs?

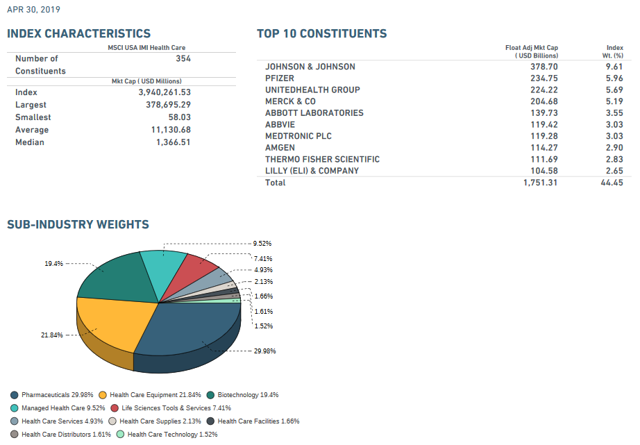

As can be seen, VHT and XLV take slightly different approaches. Using the S&P 500 as a starting point, XLV slants very heavily to large-cap healthcare companies. This can quickly be seen by its inclusion of a mere 62 constituents, with its Top 10 comprising 52.02% of the total.

In comparison, VHT pulls from a starting point of 98% of the total US stock market capitalization. As a result, it contains some 354 constituents. While the top 10 holdings of both ETFs are identical, the weighting of the top 10 holdings is lower in VHT, at 44.45% of the overall index.

As you might intuitively expect, this results in XLV offering a slightly higher dividend payout. However, over the long term, does this make it the superior ETF?

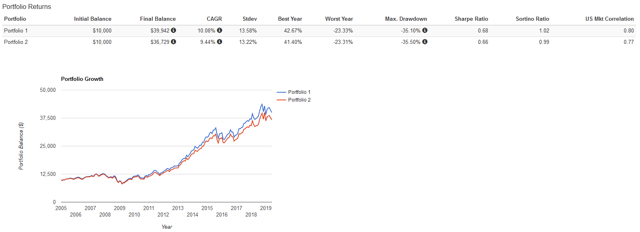

Have a look at the below results from Portfolio Visualizer. I ran a comparison of the two ETFs side by side. The period covered is from January 2005-May 2019 (limited by the inception date of VHT). All dividends were reinvested.

Source: Portfolio Visualizer Comparison

Source: Portfolio Visualizer Comparison

As can be seen, over this period, VHT has proved to be the winning choice, generating a CAGR that is some .64% higher than XLV without much penalty at all in standard deviation and a lower max drawdown. Unless XLV’s slightly higher dividend payout is important to you, or you plan to do a lot of trading and therefore may benefit from XLV’s tight trading spread, it appears that VHT is your best option.

Summary & Conclusion

There is much uncertainty in the market at the present time. Certainly, if you haven’t already done so, please take a look at the ‘perfect portfolio’ article linked in the opening paragraph of this article. It may cause you to think very seriously about the prudence of being a little conservative at this point in time.

Related to that, if you wish to overweight slightly in a defensive sector, healthcare may be a good choice.

As always, until next time, I wish you…

Happy investing!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes, and to consult with their personal tax or financial advisors as to its applicability to their circumstances. Investing involves risk, including the loss of principal.

[ad_2]

Source link Google News