[ad_1]

This article was coproduced with Hoya Capital Real Estate.

Real estate ETFs are an excellent option for investors seeking low-cost, liquid, and diversified exposure to real estate. While iREIT is geared primarily toward individual and institutional investors with the time and manpower to evaluate and actively manage portfolios of individual securities, admittedly not every individual or firm can dedicate those resources specifically to their real estate allocation, which is where ETFs can be extremely valuable investment tools.

Unlike investment alternatives like direct real estate investments that require a substantial upfront investment and lack liquidity, or real estate crowdfunding platforms that are effectively “black boxes” of illiquid and high-fee portfolios, real estate ETFs offer investors relatively easy, liquid, and diversified access to the critical real estate asset class.

With our just-announced partnership with Hoya Capital Real Estate, iREIT has significantly expanded our capabilities specifically related to real estate ETF research. Through our joint ETF Spotlight series, we take a look under the hood of some of the most popular real estate ETFs and highlight the strengths and idiosyncrasies of these funds.

You Can Do Better Than VNQ

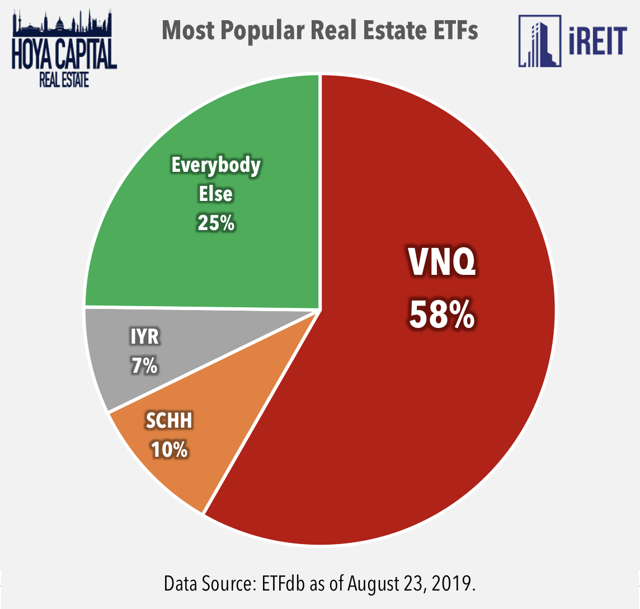

One ETF stands alone in the real estate category, and it’s a true Goliath by any measure. Perhaps due to “career risk,” a herding mentality, or simple unfamiliarity with the investment alternatives, many investors and financial advisors invest exclusively in a single ETF for their real estate exposure – the Vanguard Real Estate ETF (VNQ) – which itself commands nearly 60% of the total real estate ETF assets under management at roughly $35B.

I don’t think anyone can complain about VNQ’s performance year to date, keeping in that the fund’s coverage goes beyond just REITs to include other types of real estate companies, such as those involved in services and development, as well as other REITs.

Examples of companies inside the index Vanguard seeks to track (and in peer REIT funds) include real estate services companies CBRE Group (CBRE) and Jones Lang LaSalle (JLL), real estate developer The Howard Hughes Corp. (HHC), and specialty REITs Lamar Advertising (LAMR) and Rayonier (RYN). Source: Yahoo Finance

Source: Yahoo Finance

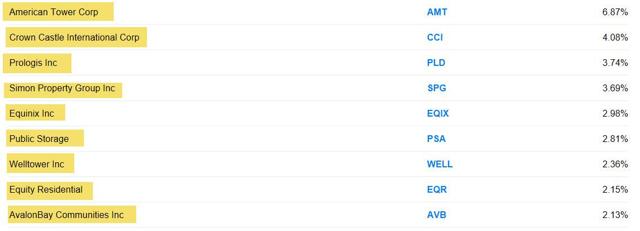

Vanguard Global ex-U.S. Real Estate ETF (NASDAQ:VNQI),which tracks the performance of the S&P Global ex-U.S. Property Index, is the top REIT ETF performer year to date (-2.0%). To make room for additions in VNQ, its holdings of other stocks include: American Tower (AMT), Crown Castle (CCI), Prologis (PLD), Simon Property (SPG), Equinix (EQIX), Public Storage (PSA), Welltower (WELL), Equity Residential (EQR), and AvalonBay (AVB).

Source: Yahoo Finance

Investing in a single fund, however, discounts the vast differences of investment characteristics within the real estate sector. Investors needs and objectives are anything-but monolithic, and the same can be said about the REIT and broader real estate investment sectors.

To illustrate that point, it’s remarkable to note that the average spread between the best and worst-performing REIT sector over the last 15 years is roughly 40% and been above 65% in three of the last 10 years!

During this same time, the average spread between the best and worst-performed equity industry group, tracked by the SPDR ETFs, was a more modest 31% with a peak of 36% in 2011. This has significant implications when it comes to asset allocation within the real estate sector.

(Source: SPDR)

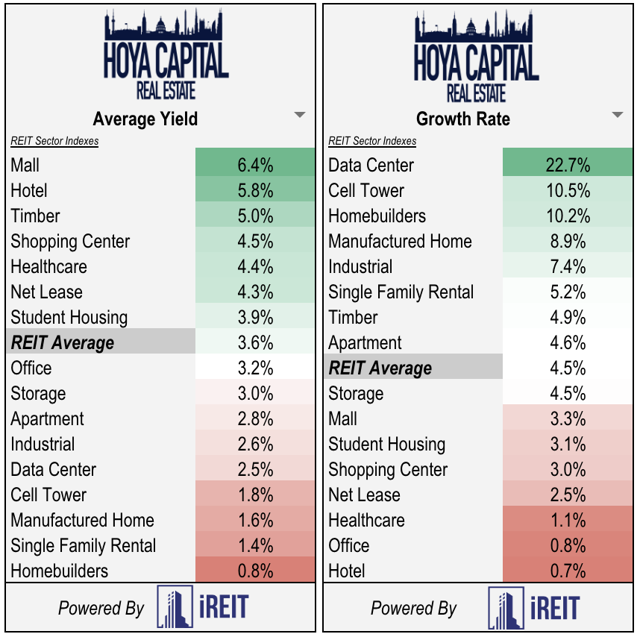

To further illustrate that point, we look at Hoya Capital Real Estate’s sector graphics below, powered by iREIT Terminal data. While the general rule-of-thumb is that REITs generally yield around 4%, we see that’s wide variation around the 4% figure among real estate sectors.

The same theme applies to average FFO growth rates. While the average REIT has grown FFO per share about 4.5% per year over the past five years, we see a huge disparity between the faster growers and the slower growers. Unsurprisingly – as there’s no free lunch on Wall Street – the fastest growers are typically the lowest-yielders and vice versa.

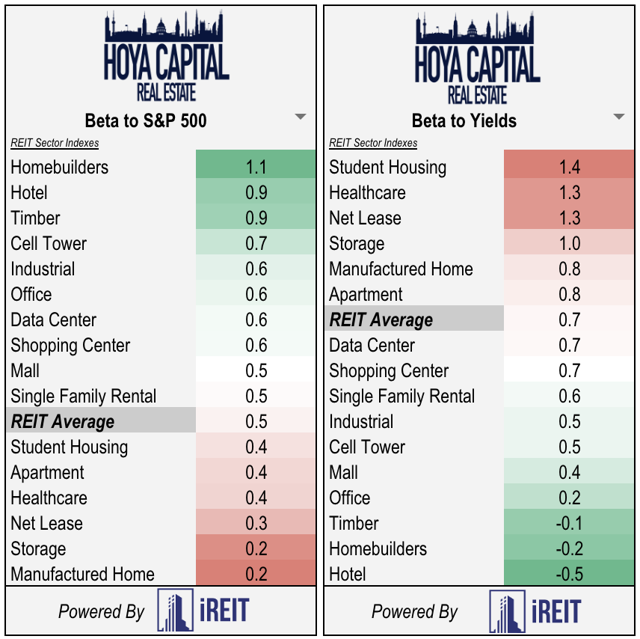

This phenomenon can be extended to an analysis of the economic and interest-rate sensitivity of the different REIT sectors. While REITs as a whole are generally viewed as a defensive, yield-sensitive equity sector, this monolith view really only applies when speaking in terms of broad averages.

While rate-sensitive sectors like healthcare and net lease are indeed quite negatively impacted by rising interest rates, hotel and timber REITs, for example, are actually positively correlated to interest rates while other REIT sectors have little or no correlation at all to interest rates.

The same theme applies to sector sensitivities to changes in equity market valuations. Once again we note that there’s substantial variation in investment characteristics with the real estate sector, even more so than the variation seen between equity industry groups.

The Implications for Investors

So what are the implications of this substantial intra-sector variation in investment characteristics for individual investors and financial advisors? Put simply, using a single fund to represent the entire real estate asset class, as many investors currently to do, would be akin to investing one’s entire asset allocation into a single equity fund. Perhaps one could argue that it’s even worse, considering there’s 30%-40% more variation in real estate sectors compared to typical industry groups within the S&P 500.

While an individual investor may be fine with that, it would be financial malpractice for an advisor to utilize a monolithic asset allocation for all of their clients – many of whom presumably have different investment objectives, risk tolerance, and different existing exposures.

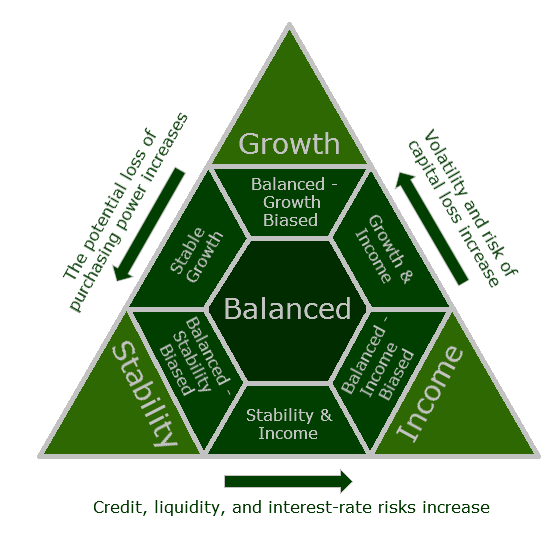

(Source: Emerald Spark)

Growth-oriented investors in taxable accounts probably shouldn’t have significant exposure to high-yielding, slow-growing net lease or healthcare REITs, just as income-oriented retirees seeking a steady and reliable source of income shouldn’t be invested heavily in speculative or growth-oriented real estate sectors.

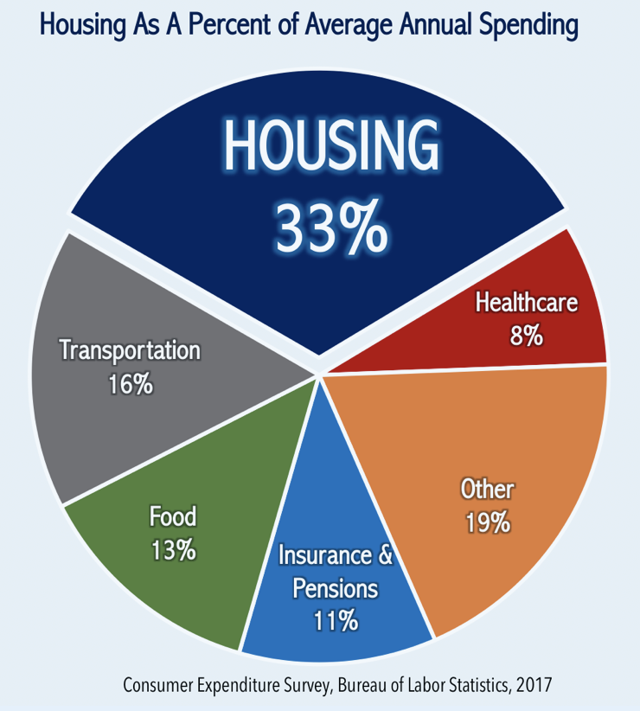

Additionally, while homeowners may not need any extra exposure to residential real estate, renters who spend an average of 30%-40% of their incomes toward housing every year should have offsetting exposure to residential real estate to address that mismatch between the asset and liability side of their personal balance sheet.

Source: Consumer Expenditure Survey

While there’s nothing inherently wrong with broad-based real estate ETFs like VNQ, which offer instant diversification, are generally dirt cheap, and have ample secondary market liquidity for the trading crowd, these ETFs are the hammer in an investment tool kit. While you can get a lot done with a hammer, no sane builder – except one set on destruction – would arrive to a job site with a hammer alone.

Thankfully for investors, there has been significant innovation in the real estate ETF category over the last several years which has added a number of useful tools to an investors’ toolkit. The creation of sector-based real estate ETFs has enabled investors to apply the level of customization to one’s real estate portfolio that’s both necessary and long overdue, recognizing the diversity of investor’s needs (growth vs. income) and their current real estate exposure (renter vs. owner).

We think that real estate ETF investors and financial advisors can significantly enhance investment outcomes through the level of portfolio customization that we call Real Estate Robo-Investing. To help with that, we’re excited to unveil a new groundbreaking offering at iREIT: the Real Estate Robo-Investor.

Photo Source

What Is Robo-Investing?

While the clever marketing teams at leading robo-advisory firms like throw around buzzwords like “algorithm-driven asset allocations” or “artificial intelligence-optimized portfolios,” at the end of the day, a robo-advisory service is essentially a model portfolio platform driven by a demographic questionnaire.

Of course, there are additional services (automation, rebalancing, tax loss-harvesting etc.) that can justify the typically-reasonable investment advisory fee, but the true “value-add” from an investment perspective is this demographic-driven asset allocation model that allows for a portfolio to be customized to fit the needs and objectives of an investor.

The models are the true secret sauce behind these services, utilizing quantitative models – grounded in Modern Portfolio theory – to construct asset allocations that better fit the investor’s risk and return objectives. By teaming-up with Hoya Capital, who has been a leader in the real estate robo-advisory space, we have been able to bring that innovation to our iREIT subscribers by offering members exclusive access to Hoya Capital’s four most popular model portfolios.

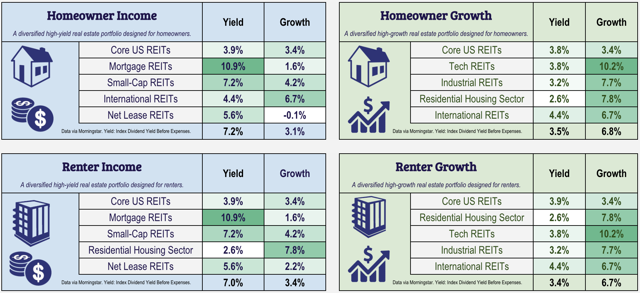

The four models are constructed based on the two most critical questions in any “robo” questionnaire: Growth vs. Income and Renter vs. Owner. Just as individual investors and well-intentioned financial advisors would be expected to optimize a broader asset allocation around those critical axes, we believe that there’s no reason or excuse for investors and advisors not to construct a real estate ETF allocation with this same level of diligence considering the vast intra-sector differences in investment characteristics.

Driven by iREIT Terminal data, the iREIT research team periodically rebalances the models. For instance, yield-oriented models are overweight the yield-oriented real estate sectors and underweight the more speculative, higher-growth sectors and vice versa.

Similarly, renters are allocated higher exposure to residential real estate to offset their significant liability to rising housing costs. The end result is a degree of customization and optimization that’s critically needed by real estate ETF investors and that, frankly, advisory clients should expect from their financial advisor.

Source: Hoya Real Estate

Each model is constructed using five primary real estate ETFs along with their tax-loss harvesting compliment. Tax-loss harvesting is a technique by which investors in taxable accounts can “harvest” tax losses within an ETF portfolio by selling lots that are trading at a loss and temporarily replacing the assets with its ETF compliment, which offers similar – but not identical – exposure.

Because the IRS does not view similar ETFs as a “substantially identical security,” the transaction would not be considered a “wash sale.” After 31 days, the investor could switch back into the primary ETF while roughly maintaining the target allocation during that period. Sound complicated? Take a look at a primer from TD Ameritrade and Personal Capital.

(Source: Personal Capital)

Remember when we said there’s no “free lunch on Wall Street.” Well, tax-loss harvesting using ETFs is the closest thing there is to a free lunch, being described as the “easiest form of alpha.” While the full magnitude of the risk-free gains are up for debate with robo-advisory firms claiming upwards of 1% per year, the independent peer-reviewed consensus puts the gains at between 0.25%-0.75% per year depending on an investor’s tax rate and is amplified by holding a more diverse allocation of individual ETFs.

Of course, holding a single real estate fund for one’s real estate asset allocation would all but negate any potential benefits of this strategy. Holding a more diverse set of sector-based or exposure-driven real estate ETFs rather than a single monolithic fund would predictably push those gains toward the upper-end of the ranges and it’s easy to see how this “alpha” would more than offset any potential “savings” from a few basis points on the expense ratio from the broad-based funds.

Bottom Line: You Can Do Better Than VNQ

ETFs are an excellent option for investors seeking simple, low-cost, and diversified exposure to real estate, particularly for investors who have limited time to dedicate to active real estate research. Utilizing a single fund, however, discounts the vast differences of investment characteristics within the real estate sector. There’s significantly more variation between REIT sectors than between entire industry groups.

Perhaps due to “career risk,” many financial advisors invest exclusively in one ETF for real estate exposure – VNQ – even as its holdings may be unsuitable for many of their clients. Innovation in the real estate ETF space – notably sector-based ETFs – has enabled investors to customize their portfolios toward their more specific needs, objectives, and existing exposures.

This level of basic customization is critically needed within the immensely diverse real estate sector and is the minimum that advisory clients should expect from their financial advisor.

We’re excited to unveil a new groundbreaking offering at iREIT: the Real Estate Robo-Investor, complete with four customized model portfolios. Whether you have a few hours a day, a few hours a month, or a few hours a year to spend on real estate investment research, we’ve got you fully covered at iREIT.

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

Hoya Capital Teams Up With iREIT

Hoya Capital is excited to announce that we’re teaming up with iREIT to cultivate the premier institutional-quality real estate research service on Seeking Alpha!

While we’ll continue providing our free sector reports, iREIT subscribers will now get exclusive access to our expanded real estate coverage including:

- Expanded REIT Rankings Reports With Exclusive Content

- Real-Time Economic Analysis & Commentary

- Hoya Capital Real Estate ETF Model Portfolios

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Hoya Capital Real Estate is an SEC-Registered Investment Advisor committed to making real estate more accessible to all investors. Hoya Capital Real Estate advises an ETF and individual accounts by investing in portfolios of publicly-traded commercial and residential real estate companies.

[ad_2]

Source link Google News