[ad_1]

Scott Olson/Getty Images News

The S&P 500 Covered Call & Growth ETF (NYSEARCA:XYLG) is an equity index ETF investing in S&P 500 components and selling covered calls on 50% of its holdings. XYLG trades away around half of its potential capital gains for an increased 6.4% distribution yield. Said trade is a positive when capital gains are low, a negative when capital gains are high, and likely a slight long-term net negative, as equity capital gains tend to be quite high.

XYLG’s strong 6.4% distribution yield, moderate potential capital gains, and solid dividend growth, make the fund a buy. The fund’s strong yield makes it a particularly appropriate investment for income investors and retirees. On the other hand, the fund’s comparatively lower potential capital gains and long-term expected returns make it a less appropriate investment for more bullish, long-term investors.

XYLG – Quick Overview

XYLG is an equity index ETF investing in S&P 500 components and selling covered calls on 50% of its holdings. Stock call options are relatively complicated derivatives, but selling covered calls is a well-known strategy with clearly defined effects. In practice, selling a covered calls means foregoing potential capital gains for increased dividends (option premiums). Downside potential remains the same.

XYLG sells covered calls on 50% of its holdings, which means the fund foregoes 50% of S&P 500 potential capital gains for a moderately increased 6.4% distribution yield. The S&P 500 currently yields 1.4%, so XYLG’s covered call strategy is responsible for 5.0% in increased dividends.

XYLG’s covered call strategy has several important benefits and drawbacks for the fund and its shareholders. Let’s have a look at these, starting with the benefits.

XYLG – Benefits

Strong 6.4% Distribution Yield

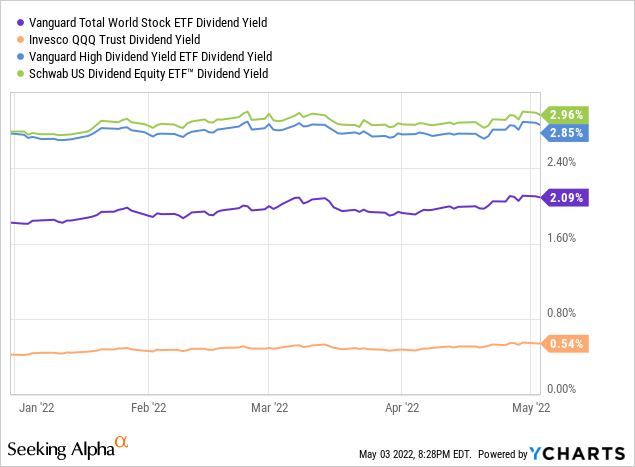

XYLG’s covered call strategy leads to an increased 6.4% distribution yield. It is a reasonably strong yield, and quite a bit higher than that of most broad-based equity indexes, or dividend-focused equity funds.

XYLG’s strong 6.4% distribution yield is a significant benefit for the fund and its shareholders, and particularly important for income investors and retirees.

As an aside, I estimated the fund’s 6.4% distribution yield by annualizing its most recent monthly distribution. XYLG technically sports an even-higher 8.4% TTM distribution yield, due to a special distribution in late 2021. Said special distribution was due to regulatory and accounting conventions surrounding covered call and other financial derivatives, and is not indicative of underlying generation of income, or of expected future distributions. In my opinion, and considering prevailing option prices, annualizing the fund’s latest monthly distribution is a much more accurate, informative measure of its yield.

Flat Market Outperformance

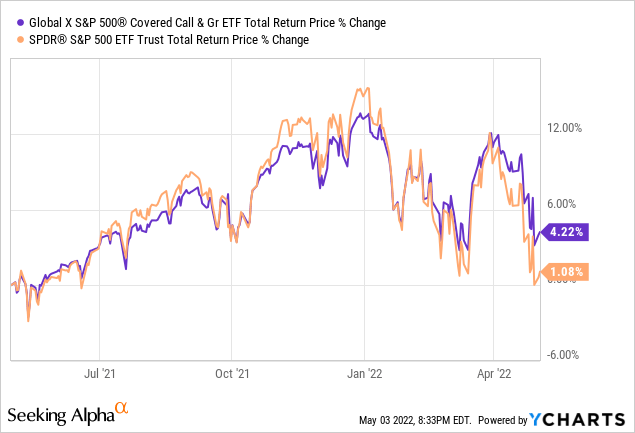

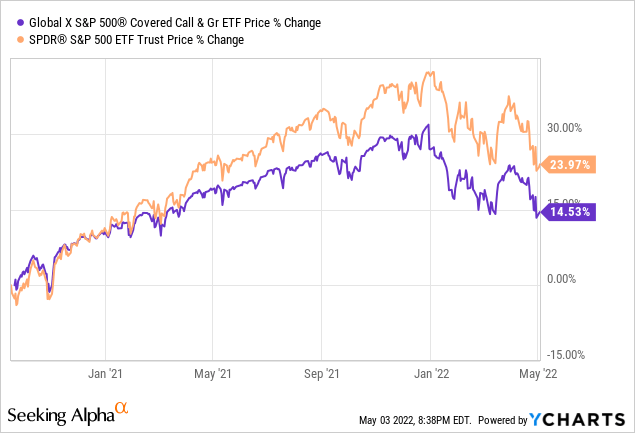

XYLG’s strong 6.4% distribution yield directly boosts total shareholder returns during most relevant market scenarios. Said yield is, however, particularly impactful when markets are flat, as there are relatively few confounding factors or movements during flat markets. The S&P 500 has been more or less flat for the past twelve months, during which XYLG has outperformed, as expected.

As can be seen above, XYLG has posted reasonably good total returns of 4.2% for the past twelve months, while the S&P 500 is only up 1.1%. XYLG outperformed by 3.1% during said time period. XYLG’s outperformance was almost entirely driven by the fund’s comparatively strong 6.4% yield.

XYLG’s distribution yield is also a benefit during bull markets and bear markets, but simply much less impactful during these. Capital gains matter much more than a 6.4% yield during bull markets, and the same is true for capital losses during bear markets. In practice, the fund’s strong distribution yield is most impactful when markets are flat.

XYLG’s outperformance during flat markets is a benefit for the fund and its shareholders, and particularly important for retirees. Long-term investors might be able to disregard flat markets by simply holding their investments until markets recover, but most retirees literally can’t afford to do so. Retirees need consistent capital gains or dividends to fund their retirement needs, and XYLG is stronger in this regard than most equity funds.

Moderate Potential Capital Gains

XYLG sells covered calls on 50% of its holdings, foregoing around half S&P 500 potential capital gains, but keeping the other half. Said index tends to see strong long-term capital gains, so XYLG should see moderate long-term capital gains. These are a benefit for the fund and its shareholders, and particularly important insofar as they allow investors to share in quite a bit of equity upside. XYLG should benefit from rising markets, and perform reasonably well during bull markets, and the same can’t be said for some other income or dividend funds.

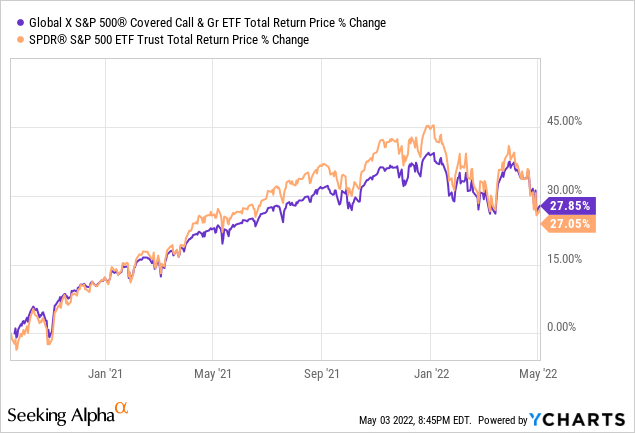

XYLG itself has seen strong capital gains since inception, buoyed by a massive bull market, and roughly equivalent to 2/3rds those of the S&P 500. The fund has outperformed expectations due to several small factors, including portfolio drift, increased option prices due to heightened volatility, and timing effects (capital gains are closer to expectations in shorter periods of time). XYLG should see somewhat lower capital gains moving forward.

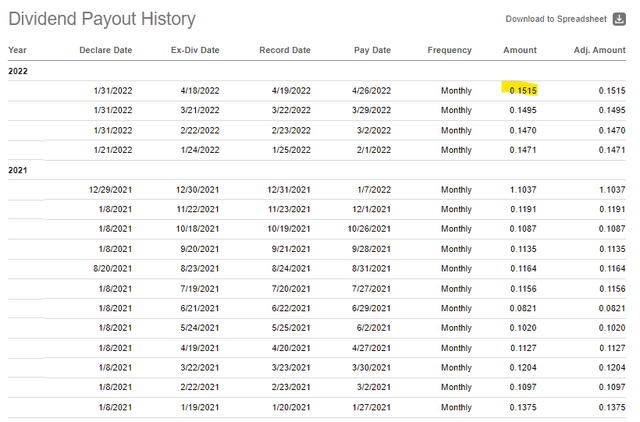

Capital gains means more assets, which means more covered calls sold, which should ultimately result in higher dividends for the fund and its shareholders. This has indeed been the case, with XYLG’s dividends growing at a roughly 10% CAGR since inception. Dividends should see further growth, although results are dependent on capital gains.

SeekingAlpha

XYLG provides investors with a 6.4% distribution yield, moderate potential capital gains, and solid dividend growth. Although the fund does not excel in any of these three metrics, all are reasonably strong, and make for a fantastic, well-rounded fund.

XYLG – Drawbacks

Comparatively Low Potential Capital Gains

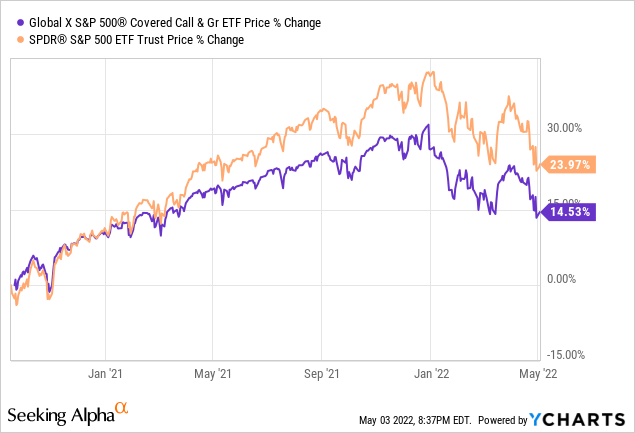

XYLG sells covered calls on 50% of its holdings, foregoing around half S&P 500 potential capital gains. As such, and by definition, the fund should see lower long-term capital gains relative to the S&P 500, a clear, significant negative for the fund and its shareholders. As previously mentioned, this has been the case since inception, although the fund did perform slightly better than expected.

Comparatively low potential capital gains are a negative and have two further important negative implications.

Bull Market Underperformance

Capital gains tend to be particularly strong during bull markets, and so XYLG will almost certainly underperform during these. This is a clear negative, and particularly important for very bullish investors, for which XYLG is an inappropriate investment. If you believe massive stock market gains are forthcoming and want to profit from these, XYLG is not the fund for you.

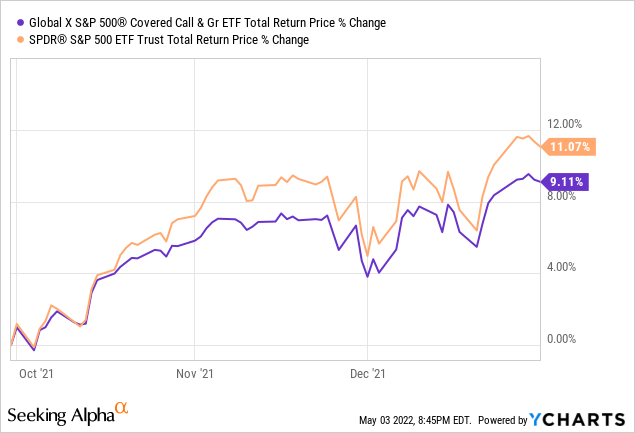

Equity markets have been on a massive, unprecedented bull market since the fund’s inception, during which the fund has underperformed, as expected. Equity performance during 4Q2021 was particularly strong, so I’m including a quick graph of the fund’s performance during said time period.

Long-term Underperformance

XYLG underperforms during bull markets, the most common market scenario by far. As such, the fund should underperform in the long term relative to most broad-based equity indexes. This has, surprisingly, not been the case since inception, with the fund very slightly outperforming the S&P 500 since inception.

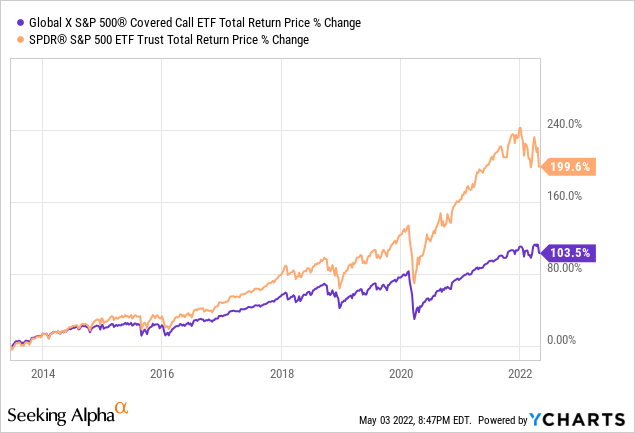

The above is almost entirely due to the fund’s relatively short track-record, having been created in late 2020. Global X has a similar fund, the Global X S&P 500 Covered Call ETF (XYLD) with a much longer performance track-record, and XYLD has underperformed, as expected.

XYLD follows a similar strategy to XYLG but sells covered calls on the entirety of its holdings. As selling a significant amount of covered calls led to significant underperformance, it stands to reason that selling a moderate amount of covered calls would have led to moderate underperformance. As such, and in my opinion, investors should expect XYLG to moderately underperform relative to the S&P 500 in the very long-term, even though this has not been the case since inception.

XYLG’s expected long-term underperformance is a significant negative for the fund and its shareholders, particularly relevant for long-term investors, but perhaps less relevant for some retirees. Buying and holding a simple S&P 500 index fund for a decade or two will almost certainly outperform buying and holding XYLG for the same period of time, but most retirees can’t simply buy and hold an equity fund for decades on end. Retirees have spending needs today, which means they need dividends or capital gains today. XYLG provides these, with a strong 6.4% distribution yield, but the S&P 500 does not.

Conclusion – Buy

XYLG invests in S&P 500 components and sells covered calls on 50% of its holdings. The fund’s strong 6.4% distribution yield, moderate potential capital gains, and strong dividend growth track-record, make the fund a buy.

[ad_2]

Source links Google News