[ad_1]

Tanaonte

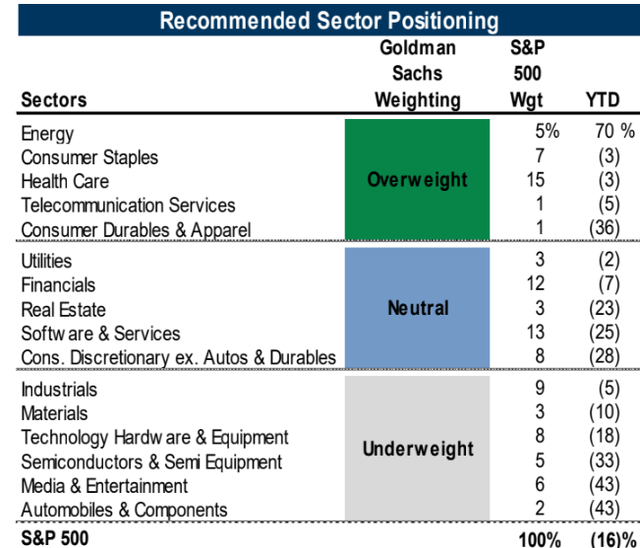

Semiconductor stocks have suffered substantially in 2022. As of last week, the chip industry was one of Goldman Sachs Investment Research’s recommended underweights even after a 33% year-to-date price drop. While the major investment bank is soft on semis, I reviewed the evidence independently, and found that the group could be worth a shot – but at the right price and time. Let’s dig into a major domestic semiconductor ETF.

Goldman’s Sector Recommendations

Goldman Sachs Investment Research

According to SSGA Funds, the SPDR S&P Semiconductor ETF (NYSEARCA:XSD) provides investors exposure to the semiconductors segment of the S&P TMI, which comprises the Semiconductors sub-industry. It tracks a modified equal-weighted index which provides the potential for unconcentrated industry exposure across large, mid, and small-cap stocks. Just recently, it was reported that global chip sales dipped 3.4% in the third quarter, so sentiment is quite soft right now.

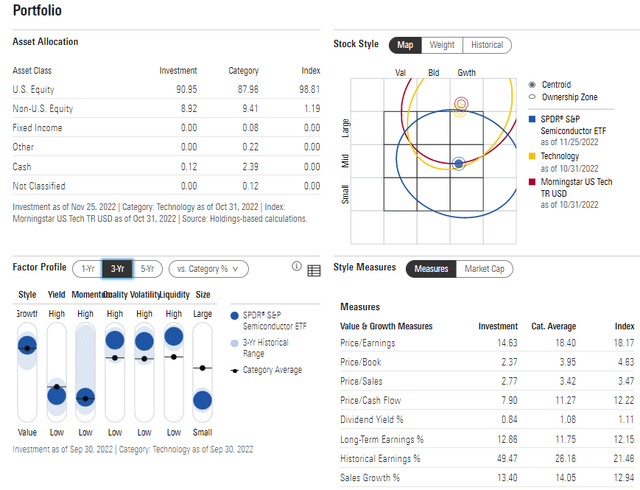

The weighted-average market cap is about $46 billion, so holders might think they are mainly tapping large-caps by owning XSD, but the median average size of the holdings is $5.7 billion, so there’s also mid-cap exposure. In fact, the fund acts more like a mid-cap growth ETF when plotting the market cap and value/growth features on the style box. Finally, the ETF’s dividend yield is small at just 0.83%.

XSD: Factor Profile & Portfolio Analytics

Morningstar

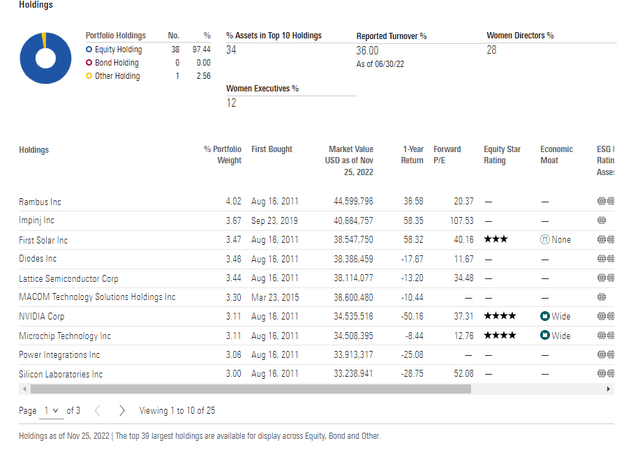

Since XSD takes an equal-weight approach, each holding will have about the same impact as any other but notice in the table below that there have been some major 2022 winners that now account for a larger chunk of the fund. The fund rebalances each quarter.

XSD Portfolio & Top Holdings

Morningstar

XSD is an effective way to get exposure to semiconductors stocks as it costs just 0.35% per year and features a 30-day median bid/ask spread of just nine basis points. The index ETF holds shares of just 38 companies and has a forward price-to-earnings ratio of 17.4, according to SSGA Funds – about on par with the broad market average. What is appealing from a valuation perspective is that its three-to-five-year EPS growth is seen at 14.4%, making for an exceptionally low forward PEG ratio of just 1.2.

Overall, I like the valuation here given the earnings growth outlook and after a major beat down in the past year, driving the “P” down while the “E” sees just a temporary dip.

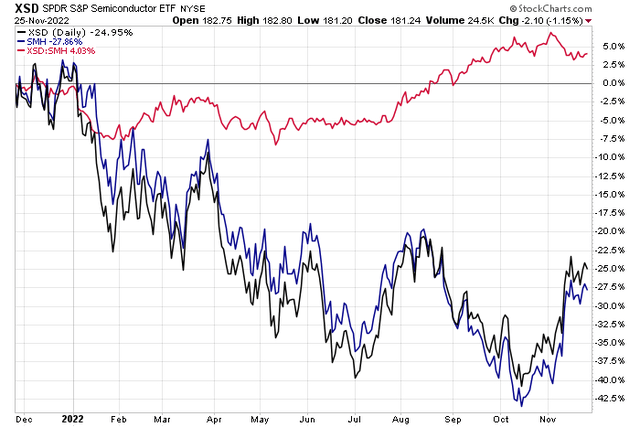

Interestingly, though, the equal-weight Semis ETF is trending up against the more well-known VanEck Semiconductor ETF (SMH).

XSD Beating SMH Sharply In H2

Stockcharts.com

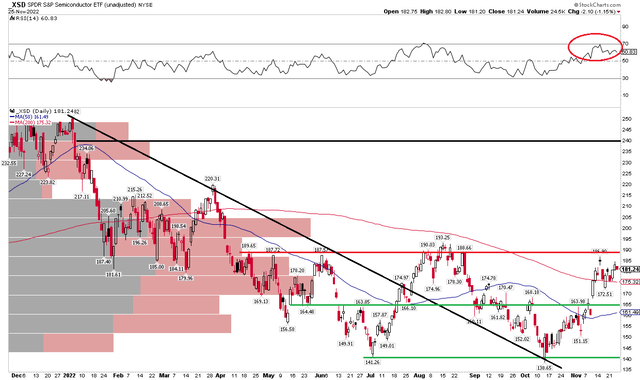

The Technical Take

With a good valuation and being unloved by Goldman, what does the chart have to say? I see XSD near important resistance, so timing your buy on this low-PEG ratio ETF is important. Notice, though, that the fund has rallied above its falling 200-day moving average for the first time since the end of Q1. Still, I assert XSD needs to climb above its August high of $193.25 to help support the thesis that the near-double-bottom notched in October near $140 was the low.

Also concerning me is a high RSI. Normally, I like a strong RSI, but in this case, we saw similar momentum action at the August rebound high in price. The fund might be due for a pullback, but I see support near $160 to $165 care of a price gap and where the flat 50-day moving average comes into play.

XSD: Shares Eyeing A Breakout, But Patience Needed

Stockcharts.com

The Bottom Line

While some stocks show strong breakouts right now, XSD is not quite there yet. I see some pullback risk to this equal-weighted semiconductor ETF. Buying on a dip into the $160s should be a prudent move as the fund looks appealing on valuation.

[ad_2]

Source links Google News