[ad_1]

David McNew/Getty Images News

Introduction

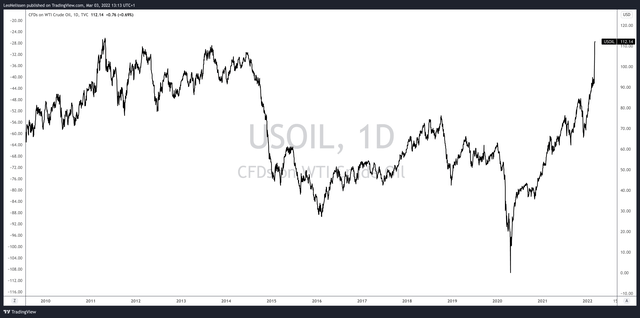

It’s time to discuss a very delicate topic: energy. I’ve been one of the biggest energy bulls since 2020, and energy is close to 16% of my total dividend growth portfolio. In addition to that, I have positions in Marathon Oil (MRO), Devon Energy (DVN), and Pioneer Natural Resources (PXD). I bought most of them very low in 2020. Since then, a lot of drillers have advanced close to 200% as oil made its way to more than $100 per barrel ($110 while I’m writing this). In this article, I will explain why I am selling some trades. As an example, I will use the SPDR S&P Oil & Gas Exploration & Production ETF (XOP), which is the perfect benchmark for this industry. However, please be aware that I am not selling a single share of my long-term oil holdings in Exxon Mobil (XOM), Chevron (CVX), or Valero Energy (VLO), which isn’t technically a driller. This is just about the trades and my assessment of the risk/reward.

Allow me to explain.

Taking Profits In Oil

One of the things I tweeted on 3/3/21 is that I’m selling some of my oil and gas trades, especially the ones that ran hot. I noticed after conversations that a lot of my friends in asset management were doing the same. Some started too early, but the consensus is to take profits.

Twitter (@Growth_Value_)

What caused me to make that decision is based on a number of things. First and foremost, the price of oil. I have been bullish on oil since 2020 based on a number of things. The most obvious one is rebounding demand after massive lockdowns in 2020 and a gradual but bumpy recovery since then. Meanwhile – and this is very important – oil and gas drillers did not increase their production. It had many reasons. The supermajors like Exxon started to implement climate goals to become carbon neutral in the future, activist investors started to call for less drilling and more alternative projects, and governments around the globe simply stopped pushing for higher production. Again, because of the climate.

As the graph below shows, investments (capital expenditures “CapEx”) are expected to be close to 40 billion in 2021. That’s way below 2014 levels and just barely above the 2020 lows – relatively speaking.

Bloomberg, Crescat Capital

This is likely creating a supply/demand imbalance that could cause a deficit in 2022.

Just recently, I saw an interesting news article on Seeking Alpha (screenshot below), which shows that the major producers are either seeing lower production or very weak volume increases.

Seeking Alpha

It makes way more sense for these companies to focus on free cash flow growth rather than production. They are the “bad guys” polluting the environment anyway. Now they reduce the need to increase production while rewarding shareholders with high dividend growth and massive buybacks.

Note that all of these companies are part of the XOP ETF, which is a well-diversified ETF with a 0.35% total expense ratio that allows investors to ignore single-company risk. The ETF has $4.9 billion in assets under management and 59 holdings. Established in 2006, The ETF seeks to provide exposure to the oil and gas exploration and production segment of the S&P TMI, which comprises the following sub-industries: Integrated Oil & Gas, Oil & Gas Exploration & Production, and Oil & Gas Refining & Marketing

But more importantly, it allows me to cover the entire industry without having to focus on a single stock.

State Street (SPDR)

As a result of the aforementioned supply strategy, oil has quickly accelerated from negative prices in 2020 (due to storage issues) to $80-$90. After that, Ukraine’s war fears followed by an actual invasion took over, pushing oil to more than $100. It’s a truly remarkable move that, believe it or not, doesn’t give me pleasure – even though I’m long. The impact on the global economy is massive as energy inflation will work its way through the system. It’s fun for oil stocks but not for the market as a whole. Let alone consumers who are on a tight budget.

TradingView

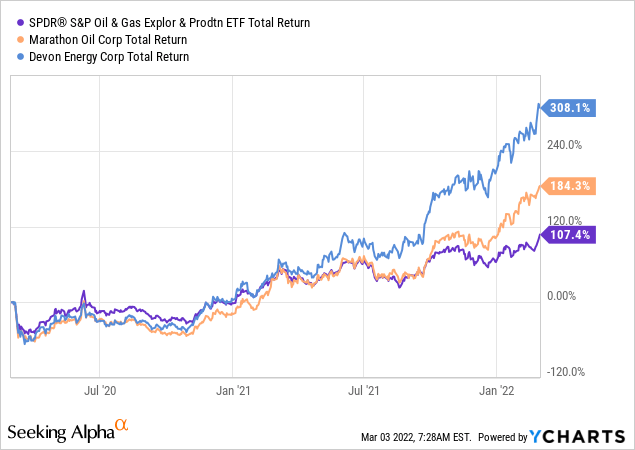

As a result, since March of 2020, XOP has returned more than 100%. Some of its stronger components are up 180% and 308% as the graph below shows.

So, why did I decide to sell some?

Right now, I’m afraid we could see accelerating supply as oil prices have risen too far. So far, the production increase in the US has been subdued compared to prior cycles. After 2016, companies quickly ramped up production to repair their balance sheets. It caused oil to peak well below current levels. Prior to 2014, the US benefited from the shale revolution, which make the country energy independent under former President Trump. Now, the recovery in production is pressured by unwillingness and/or the inability to increase production.

eia

The biggest part of production growth came from smaller, private companies. As the graph below shows from the 4Q21 Dallas Fed Energy Survey, we see that most of these companies were actually looking to ramp up production. Reuters reported the same, although it mentioned supply chain issues that made it harder to increase production.

Dallas Federal Reserve

Now, we’re seeing headlines like the one below. Politicians from both sides of the aisle are now pushing President Biden to increase domestic oil production.

Fox News

In this case, producers seem to have an open ear. Pioneer Natural Resources CEO Sheffield came out in favor of higher production. That means something as he has been on the forefront of free cash flow over CapEx since the start.

In an interview with S&P Global, Pioneer’s (NYSE:PXD) CEO said the past week brought about a “mindset change.” In speaking about the war in Ukraine, and ability for the shale patch to add barrels, he indicated, “if there’s a coordinated effort, we would definitely participate in that.” His comments come after his company guided to falling production in 2022. – Seeking Alpha

As a shareholder, I know it will hurt the bull case, but it’s the right thing to do. After all, consumer prices are at 7.5% year-on-year inflation. That’s pre-Ukraine.

St. Louis Federal Reserve

From an economic point of view, we need higher oil production. But also from a political point of view. The Democrats will have a hard time in the midterms with inflation this high. It, therefore, makes sense to support the call for higher production. After all, it’s shaping up to get support from Dems and the GOP.

Gameplan

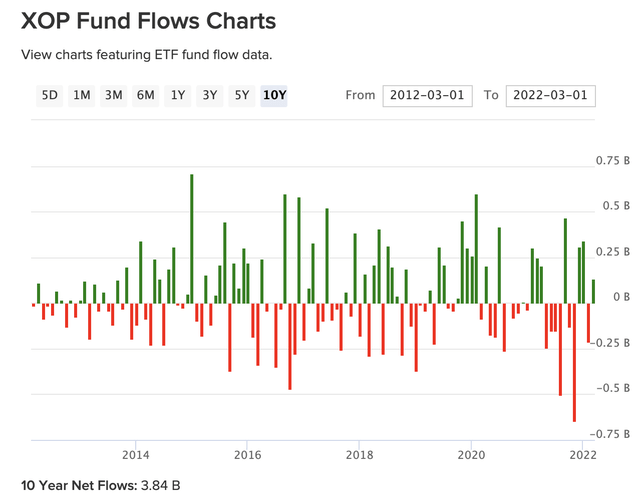

XOP is doing really well. The ETF is up 27% year-to-date, 45% over the past 6 months, and up more than 13% over the past four weeks. Fund inflows are strong since the end of 2021 as investors want in. So far, most of these investors are making money.

ETFDB.com

XOP, which is the only large ETF that offers exposure to the most successful US drillers, has steadily outperformed the S&P 500 since 2020.

Yet, now, I advise taking money off the table. If you own XOP or any of its holdings for capital gains, consider taking a profit.

I will not sell all of my trades, but I will lighten up considerably. The long-term investments will remain untouched. I will keep those throughout many cycles as I buy for income. Right now, they will repair their balance sheets and hike dividends. Even if oil refrains from rising further.

I still believe that oil prices will remain elevated on a long-term basis. Even if supply comes back, it won’t likely be enough to satisfy long-term demand growth – unless countries around the globe give up on their climate goals.

For now, however, I think XOP has run hot. The outperformance is remarkable, and oil close to $110 is wild. XOP holdings will make a killing in terms of free cash flow. That’s the problem. Right now, there’s a huge need for higher production from politicians and even oil executives are starting to consider it.

With oil above $110, some larger players will start producing more. It could trigger a domino effect as companies want to benefit from higher prices AND higher volumes. Eventually, it could cause oil prices to settle below $100. Also, if the war in Ukraine doesn’t escalate further (let’s hope that happens), investors will start taking profits on commodities, including oil.

Do not sell your long-term oil holdings used for dividends, but with oil prices this high, and given the need to boost production, I recommend selling some XOP (and its components). If I’m right and oil comes down, I will reassess the situation again using XOP to see if production has come down indeed.

The chart looks like XOP wants to rise to $150. It’s possible in the long term, but I think we will encounter selling for the reasons mentioned in this article.

FINVIZ

For now, it just feels good to sell some as the fundamental risk/reward is turning against traders at these prices.

One last thing: note that I gave XOP a neutral rating. I only give sell ratings if I expect a longer-term decline. And I do NOT advise people to sell long-term investments in oil aimed to generate dividends.

(Dis)agree? Let me know in the comments!

[ad_2]

Source links Google News