[ad_1]

Schroptschop/E+ via Getty Images

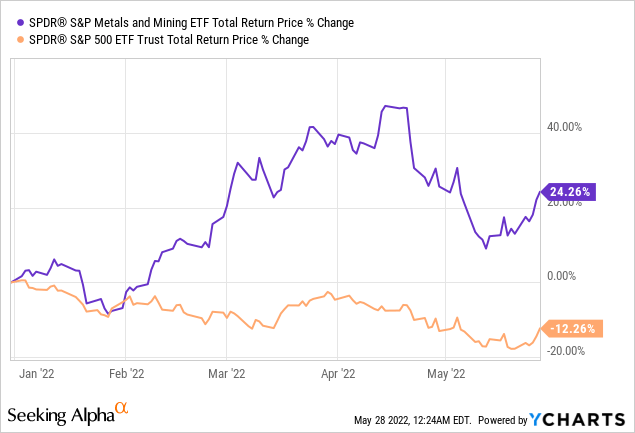

Surging commodity prices have boosted the revenues and earnings of most mining companies, leading to significant capital gains and outperformance for their shareholders. There are several ways to profit from these trends. Investing in the SPDR S&P Metals and Mining ETF (NYSEARCA:XME), a U.S. metals and mining industry index ETF, is a particularly simple, effective way to do so. XME provides investors with broad-based exposure to the U.S. metals and mining industry, has seen strong earnings growths these past few months, sports a cheap valuation, and has significantly outperformed YTD. The fund is a buy, and particularly appropriate for equity investors looking to profit from surging inflation.

XME only yields 0.50%, and so is a broadly ineffective income vehicle. Investors looking for income and metals and mining ETFs could consider the iShares MSCI Global Metals & Mining Producers ETF (PICK) instead. PICK is a similar fund, focusing on global metals and mining companies, and yields 5.4%, a reasonably good amount.

XME – Basics

- Investment Manager: State Street

- Underlying Index: S&P Metals & Mining Select Industry Index

- Expense Ratio: 0.35%

- Dividend Yield: 0.53%

- Total Returns CAGR 10Y: 4.58%

XME – Quick Overview

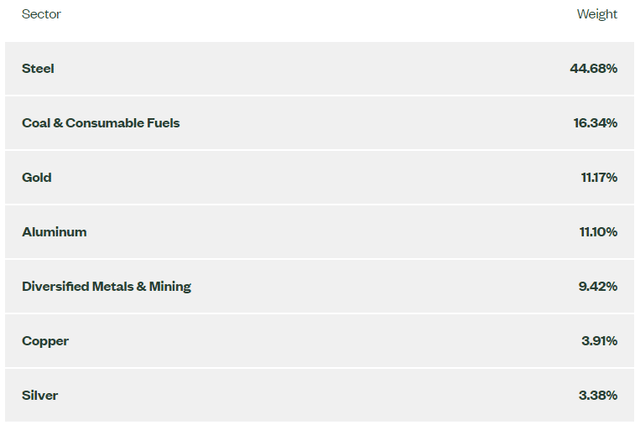

XME is a U.S. metals and mining equity index ETF. It tracks the S&P Metals & Mining Select Industry Index, an index of these same securities. It is a relatively simple index, including all relevant U.S. metals and mining equities, as per the Global Industry Classification Standard (“GICS”). It is an equal-weighted index, to ensure a modicum of diversification (this is a relatively small, concentrated industry). Sector weights and largest holdings are as follows.

XME Corporate Website

XME Corporate Website

Besides the above, nothing much else stands out about the fund’s underlying index. It is a simple index, accurately tracking the U.S. metals and mining industry. Doing so has several important benefits and drawbacks. Let’s have a look at these, starting with the benefits.

XME – Benefits

Moderately Effective Inflation Hedge

XME’s holdings mostly produce simple, basic commodity products. When inflation is high and commodity prices are rising, the revenues, earnings, and cash flows of these companies tend to increase, leading to rising share prices, strong total returns and outperformance. Doing so makes the fund a reasonably effective inflation hedge, an important benefit for shareholders.

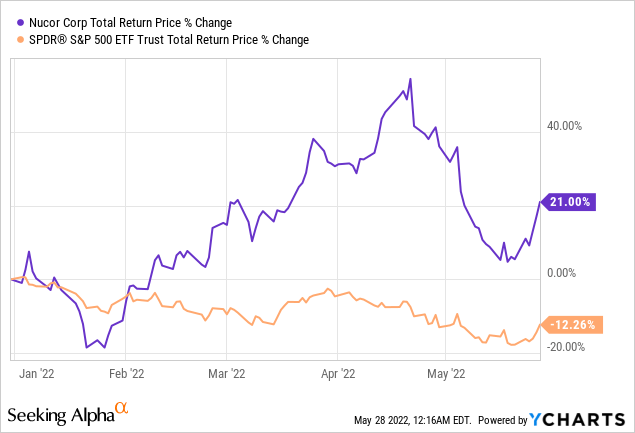

Let’s run through a quick example of the above, using Nucor (NUE), one of the fund’s larger holdings, and representative of the fund. NUE is a steel manufacturer, whose revenues, earnings, and cash flows are strongly dependent on steel prices. When demand is strong, inflation high, and commodity prices are surging, steel prices tend to increase too elevated levels, boosting the company’s financials. Steel prices have about tripled since their pandemic lows, causing earnings to quintuple, while share prices have doubled. NUE has significantly outperformed these past few months of surging inflation, as expected.

In general terms, XME’s holdings are all quite similar to NUE, and so tend to outperform when commodity prices are high and inflation is elevated, a benefit for the fund and its shareholders.

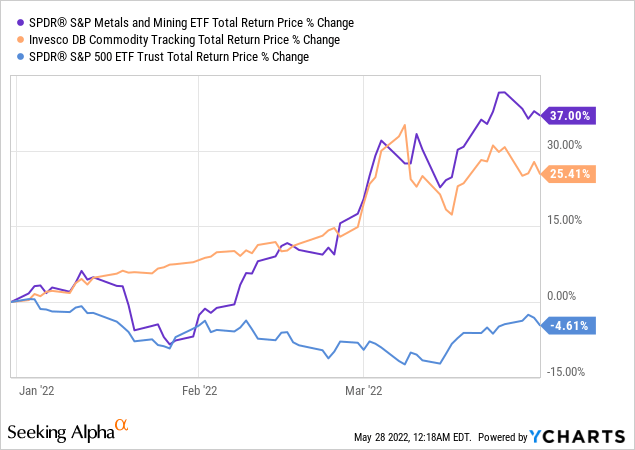

On a more negative note, the fund’s effectiveness as an inflation hedge is indirect, and dependent on market sentiment and forces. One could imagine a situation in which inflation increases, the fund’s holdings see rising earnings, but share prices crater as sentiment turns bearish. As an example, the fund suffered moderate losses during January 2022, in-line with broader equity indexes, even as commodity prices increased. Sentiment was quite bearish at the time, investors were selling their equities somewhat indiscriminately, and so XME and its underlying holdings saw lower share prices. Markets reassesed the situation in February, so these were short-lived losses. By March, XME was outperforming relative to the S&P 500, consistent with fundamentals. There is, however, no guarantee that markets will be quick to act next time. Markets can remain irrational longer than you can remain solvent, as they say.

Due to the above, XME is only a moderately effective inflation hedge. It should outperform when inflation is high, and this has been the case before, but results are dependent on fickle market sentiment, and not guaranteed.

Strong Growth

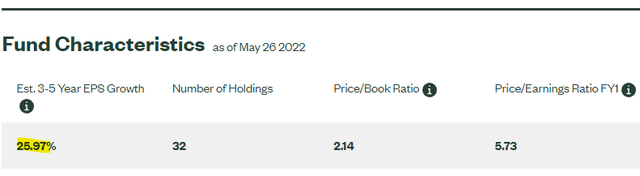

Rising inflation and commodity prices have boosted the revenues, earnings, and cash flows of most of XME’s underlying holdings. Most have seen incredibly strong, triple-digit growth this past year or two, in part due to favorable comparisons from 2020, when the pandemic was in full swing. Growth is currently averaging / forecasted to be 29% per year, a strong figure.

XME Corporate Website

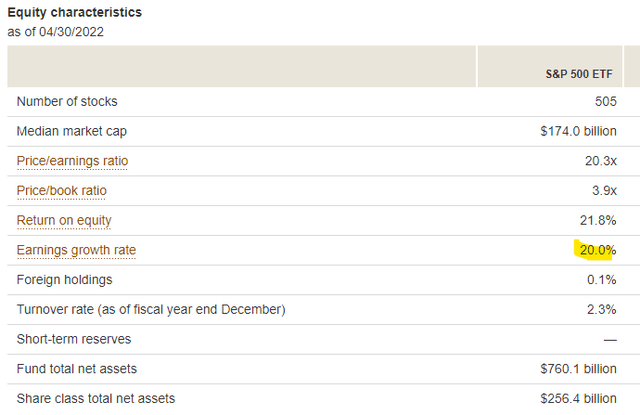

XME’s growth is quite a bit higher than the stock market average of 20%.

Vanguard Corporate Website

XME’s strong growth is a significant benefit for the fund and its shareholders and could easily lead to market-beating returns in the coming months.

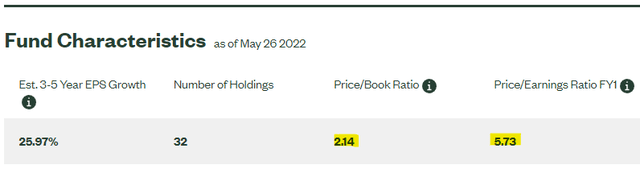

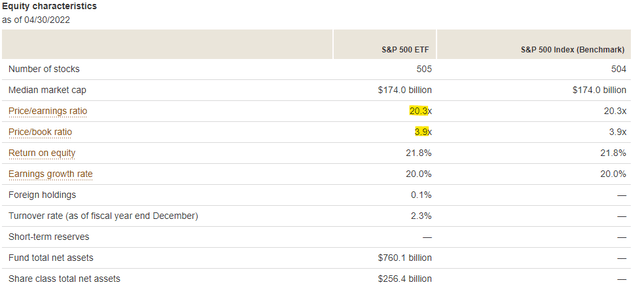

Cheap Valuation

Growth funds and stocks tend to trade with premium valuations, but that is not the case for XME. The fund currently trades with a PE ratio of 5.7x, extremely low, and quite a bit lower than the equity average of 20.3x. The fund’s PB ratio of 2.1x is also quite a bit lower than the equity average of 3.9x.

XME Corporate Website

Vanguard Corporate Website

XME’s cheap valuation could lead to significant, market-beating returns if market sentiment improves and valuations normalize. Which brings me to my next point.

Potential, and Realized, Outperformance

XME’s strong growth and cheap valuation are an incredibly potent combination. Cheap valuations mean potential capital gains and returns are quite high, and strong growth rates act as a catalyst for these. Investor sentiment surrounding value, old economy, and commodities, have been quite strong all year, so conditions are set for significant outperformance. That has been the case YTD, as expected.

Importantly, the conditions that led to XME’s strong performance these past few months remain unchanged. Inflation remains elevated, revenues and earnings are skyrocketing, and valuations remain cheap. Insofar as conditions remain as they are, further outperformance is likely, in my opinion at least.

XME – Risks and Negatives

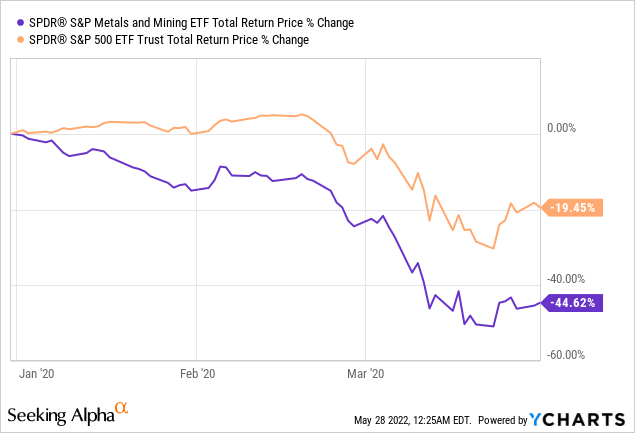

XME’s potential returns are quite high, but so are the fund’s risks. Commodity producers tend to fare quite badly when demand weakens, as they lack the pricing power / moat to sustain prices or sales. Expect significant losses and underperformance during downturns and recessions, as was the case during 1Q2020, the onset of the coronavirus pandemic.

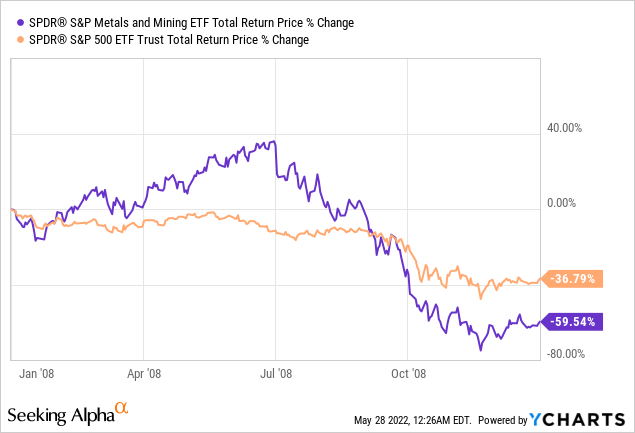

The fund also underperformed during the past financial crisis, as expected.

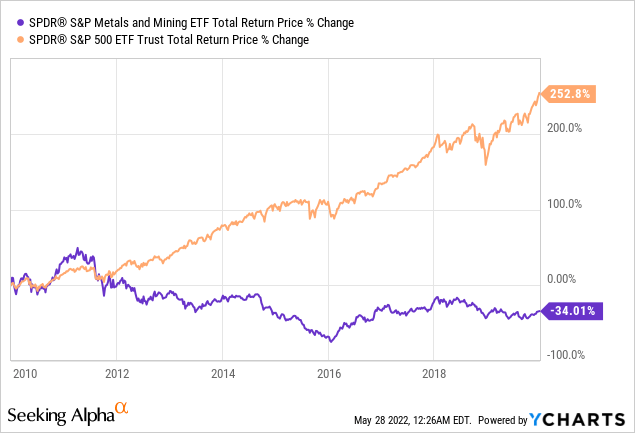

XME outperforms when commodity prices increase, underperforms when these decrease. Commodity prices are cyclical and go through long periods of declines, so long periods of underperformance are to be expected. As an example, commodity prices were quite low during the 2010s, following the financial crisis and attendant weak economic recovery. XME posted moderate losses during said time period, while broader equity indexes posted sizable gains.

XME is a relatively risky investment and will almost certainly significantly underperform during future downturns, recessions, and commodity price crunches. Although these scenarios do not seem terribly likely under current market conditions, conditions are continuously evolving, and significant underperformance during future time periods is extremely likely. Although all funds and equity investments are risky, XME is definitely riskier than average. Decades-long periods of significant underperformance as above are somewhat rare, and incredibly negative for shareholders. As such, the fund is only an appropriate investment for more aggressive investors.

Conclusion – Buy

XME’s effectiveness as an inflation hedge, strong growth, cheap valuation, and recent / potential outperformance, make the fund a buy.

[ad_2]

Source links Google News