[ad_1]

In this article, I am going to discuss one of my favorites ETFs. The SPDR S&P Metals & Mining ETF (XME) contains some of the biggest global miners and producers of industrial metals. This ETF is a great tool to track global economic growth without having to buy volatile miners. That said, we are currently witnessing a scenario which is incredibly hostile and unfavorable for investors in the mining industry. In this article, I will tell you why you currently should stay away and why it makes sense to buy XME in a future economic uptrend.

Source: EY

High Risk, High (Potential) Reward

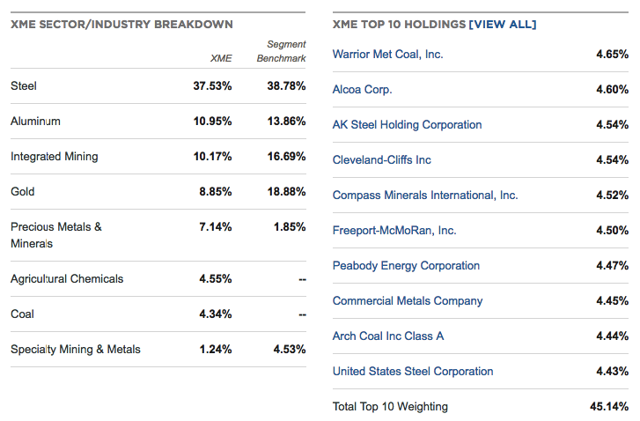

First and foremost, let’s look at the holdings of this ETF. The top 10 holdings have a total weighting of 45.1% without any major holdings that have a major impact on the ETF. Moreover, the top 10 holdings are very well diversified with companies from industry segments like steel and iron ore production, coal companies, and copper producers. Steel accounts for roughly 38% of the ETF with aluminum coming in second with a weighting of 11%. One negative side of the ETF is its coal exposure which can be considered to be an energy investment. Nonetheless, the coal exposure is below 5% and coal tends to follow steel prices quite well and all companies are part of the metals and mining sector classified by GICS.

Source: ETF.com

With that in mind, I don’t think there are any doubts about the cyclical behavior of this ETF. Between December of 2015 and January of 2018, this ETF gained more than 220%. Since that peak, the ETF is down 25%.

Before I go any further, I think it adds a lot of value to talk about the 2016-2018 rally. This rally was fully supported by a synchronized global growth rally. China’s economic rebound fueled demand of cyclical commodities while the US and Europe both entered an economic environment which pushed up rates and favored central bank rate increases. Note that only the US started a hiking cycle back then.

The graph below displays the Euro Area manufacturing PMI. This indicator tells us what we can expect in terms of economic growth over the next 3-6 months. Between the start of 2016 and the end of 2017, the Euro Area started a massive growth trend. See the similarities? XME gained more than 220% in that period as I already discussed.

Source: TradingEconomics

This also might explain why the ETF is down by 25%. The most recent data (released on 03/22) shows that the PMI has fallen to 47.6 which is well below the neutral level of 50.0. Besides that, this is bad news for miners, it is a bad sign for the global economy in general.

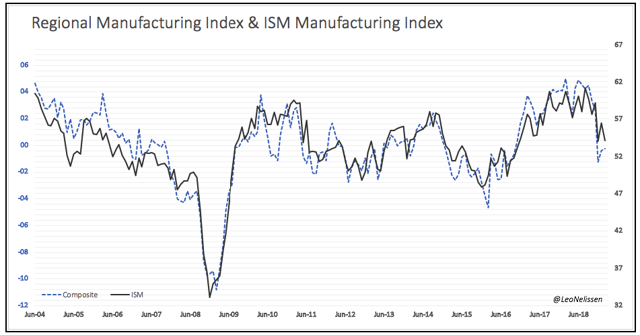

Nonetheless, I think we are lucky that XME is down only 25%. The simple reason is economic strength in the US. Yes, the trend is down, but growth is still much higher than in Europe as you can see below. Note that the ISM manufacturing has more or less the same methodology as the European manufacturing PMI.

Source: Article

As much as that is good news, it is also a reason to stay cautious as the trend in the US is down as well. In other words, expectations are likely to fall even further. This could very likely hit raw steel production growth numbers that already declined to 6%. Yes, that number is not bad, but steel production growth is following leading indicators like the ones I just showed you.

For example, XME is down 8.4% on a monthly basis despite the S&P 500 being up 0.66% in the same period. After it happens, it’s easy to predict, but I still have to say that this divergence does not surprise me.

Source: FINVIZ

That being said, another driver is the US dollar. Generally speaking, a weak US dollar is supportive of higher commodity prices as a lot of emerging markets have dollar-denominated debt. A lower dollar eases this debt load and makes buying dollar-denominated commodities much more interesting.

The graph below compares XME (black line) to the inverted dollar (red line). One of the problems XME has is that the dollar is not weakening. Economic uncertainty is pushing money towards the safe dollar while not even a dovish Fed is able to talk the dollar down. The reason sounds simple: major currencies like the euro are in much bigger trouble if global economic growth continues to decline.

Source: TradingView

Takeaway

XME is a dangerous place to be. Stay away. There is no other way of putting it. Global growth is weakening, the dollar is not, and ‘hard’ economic data like steel production might soon be a headwind for steel companies.

Personally, my strategy is to be on the sidelines until every negative indicator I just mentioned is starting to bottom. That would require global growth to bottom which is more than likely to result in a weaker dollar as well. At that point, it makes sense to buy XME. Personally, I might buy a component from this ETF, but I would encourage everyone who wants to invest in steel and mining companies to take a look at XME as it still delivers a ton of alpha during economic upswings without the risks of having to pick a single company.

Stay tuned!

Thank you for reading my article. Please let me know what you think of my thesis. Your input is highly appreciated!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: This article serves the sole purpose of adding value to the research process. Always take care of your own risk management and asset allocation.

[ad_2]

Source link Google News