[ad_1]

In this article, we examine the significant weekly order flow and market structure developments driving XLU price action.

As noted in last week’s XLU Weekly, the highest probability path for this week was for price discovery higher, provided key support held. This week’s auction was a bit of both sides of the coin as key demand, 58s-57.75s, failed as support early week, driving price lower to 57.10s at/near the next key support below. Buying interest emerged there, driving price higher back to test the key resistance in Friday’s auction where a buy-side breakout attempt developed to 58.90s ahead of the week’s close, settling 58.49s.

NinjaTrader

NinjaTrader

18-22 March 2019:

This week saw last Friday’s late sellers hold the auction as last week’s pullback support failed into Tuesday’s auction. Buyers trapped, 57.65s-57.68s, early in Tuesday’s trade as sell-side continuation developed, achieving a stopping point low, 57.10s. Buying interest emerged, 57.11s-57.32s, into Tuesday’s close within prior key demand.

Tuesday’s late buyers held the auction as price discovery higher developed into Wednesday’s trade through Thursday. The market achieved a stopping point, 58.19s, before selling interest emerged, 58.12s-58.05s, into Thursday’s close. Thursday’s sellers failed to hold the auction as a gap higher open developed in Friday’s trade, driving price higher to test key resistance, 58.74s. A minor probe higher developed, achieving the stopping point high, 58.90s, where selling interest emerged, 58.88s-58.78s, halting the buy-side sequence, driving price lower to 58.48s ahead of Friday’s close, settling at 58.49s.

NinjaTrader

NinjaTrader

This week’s auction saw the primary expectation of buy-side activity play out after an early week pullback to key demand, ultimately resulting in price discovery to new all-time highs. Price discovery higher developed to 58.74s in Thursday’s auction where sell excess developed, halting the buy-side sequence at new all-time highs.

Looking ahead, the focus into next week will center upon market response to this week’s buy-side breakout area, 58.70s-58.50s. Sell-side failure at the buy-side breakout area would target new all-time highs. Alternatively, buy-side failure at this key support area would target key demand clusters below, 58.20s-58s/57.40s-57.10s. The week’s buy-side breakout through last week’s key resistance implies potential for further price discovery higher. From a structural perspective, the highest probability path into next week remains buy-side, provided this week’s buy-side breakout area holds as support. It is also worth noting XLU has closed higher in eleven of the last eleven weeks. Within this near-term context, the intermediate term (3-6 month) has shifted buy-side with acceptance above 57.32s. Market behavior in this area in coming days and weeks is structurally significant.

NinjaTrader

NinjaTrader

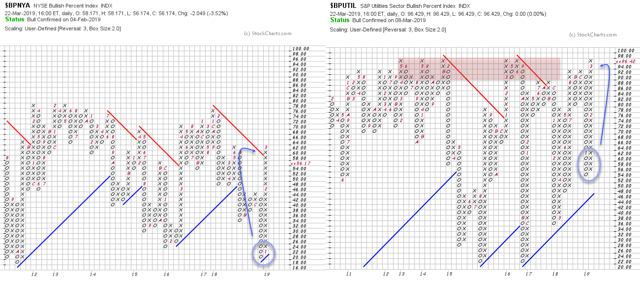

It is worth noting that sentiment based on the S&P Utility Sector Bullish Percent Index now reflects a bounce from the levels of neutral sentiment developed into early January. Stocks more broadly, as viewed via the NYSE, have also seen rising bullish sentiment from the December 2018 low. Asymmetric opportunity develops when the market exhibits extreme bullish or bearish sentiment with structural confirmation. Within the context of December 2018’s correction, the market developed a stopping point low within prior key demand. Subsequently, price discovery higher back to major resistance and new all-time highs have developed. The market has auctioned from levels of neutral sentiment to extreme optimism as price makes new all-time highs. This development warrants caution regarding further buy-side potential for utility shares. While higher prices continue, the bullish sentiment in this sector stands at extreme optimism, raising the question: from where will the “greater fools” come next?

StockCharts

StockCharts

The market structure, order flow, and sentiment posture will provide the empirical evidence needed to observe where asymmetric opportunity resides.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News