[ad_1]

imaginima

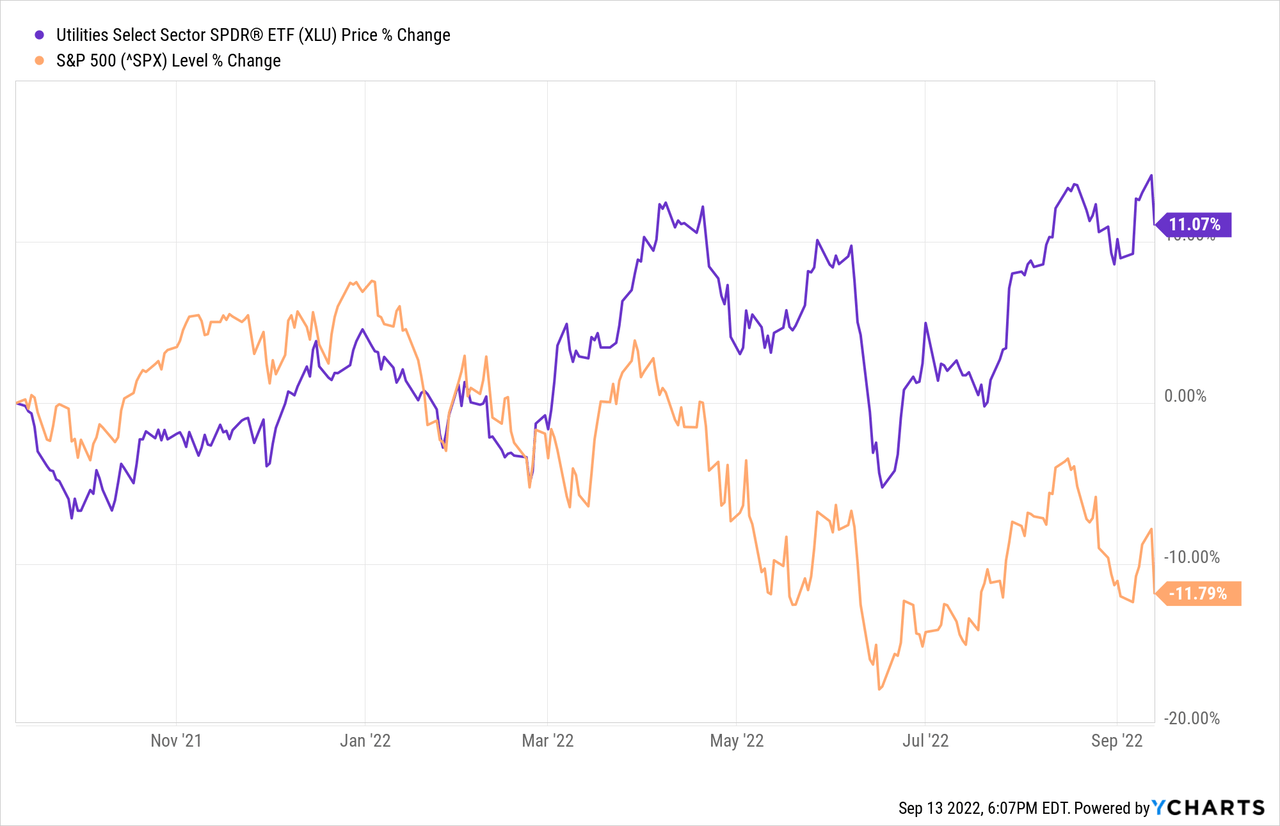

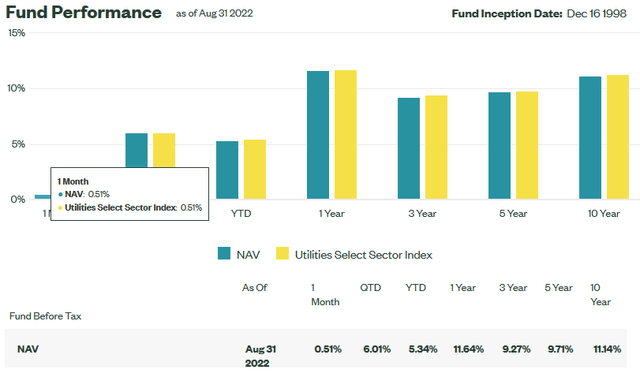

As most of you know, the 2022 bear market has investors scurrying away from growth toward more defensive oriented “value” sectors that can deliver some decent income. That being the case, you should not be surprised that the Utilities Select Sector SPDR ETF (NYSEARCA:NYSEARCA:XLU) has outperformed the S&P 500 by a whopping 22%+ over the past year (see graphic below). However, in my opinion, the Utilities Sector still has further to run due to a number of positive catalysts which I will discuss below. Meantime, XLU is a fairly cost-efficient ETF (expense fee = 0.10%) and throws off a 2.64% yield as compared to 1.63% for the S&P 500.

XLU is a BUY.

Investment Thesis

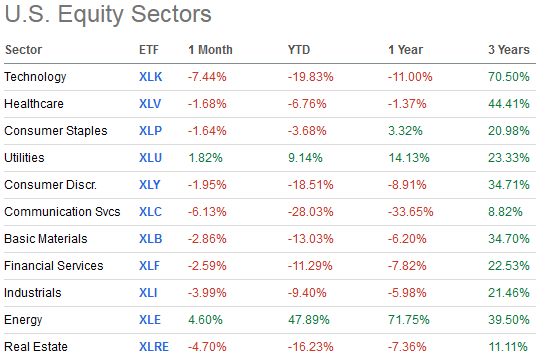

As most of you know, the market has several so called “defensive” sectors that tend to outperform in times of high market volatility, recessions, and/or high inflation. These includes sectors like the Consumer Staples (XLP), Healthcare (XLV), and – the subject of this article – the Utilities Sector. Indeed, each of these sectors have out-performed the broad market indexes (i.e. the DJIA, S&P 500, and Nasdaq-100 which are down 6.4%, 7.7%, and 17.5%, respectively) over the past year:

Seeking Alpha

This is one reason why I always advise long-term investors to build and maintain a well-diversified portfolio in order to smooth out the ups-n-downs of the broad market. That said, one look at the right-hand column of the graphic above (i.e. 3-year returns) shows investors the value of not giving up on sectors like Technology.

Regardless, today the topic is the Utilities Sector and I would like to point out at least three positive catalysts going forward:

- Global warming is now and will continue to cause increased electricity demand). See the NASA Earth Observatory’s report “A July Of Extremes”.

- Greater adoption of EVs will cause increased electricity demand. The global EV market is expected to grow at a CAGR of 21.7% from 2022-2030 and will be boosted by longer ranges, government incentives, and a larger selection of more affordable models.

- The Biden administration’s ability to pass both Clean Energy & Infrastructure legislation (i.e. funding for transmission and the grid)

Meantime, despite its recent out-performance, the Utilities Sector still trades at a significant discount to the S&P 500 in terms of price-to-book (2.5x versus 3.9x) while throwing off more income to boot (2.64% versus 1.63%).

That being the case, today I am going to take a close look at the XLU Utilities ETF and see how it has positioned investors for success going forward.

Top-10 Holdings

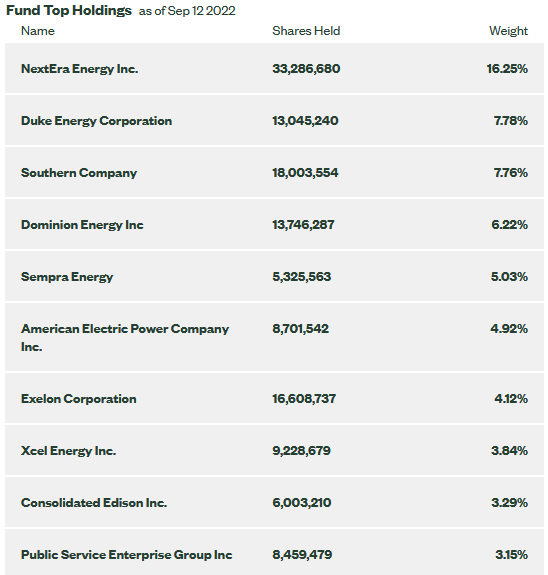

The top-10 holdings in the XLU ETF are shown below and equate to what I consider to be a relatively concentrated 62% of the entire 29 company portfolio:

State Street Global Advisors

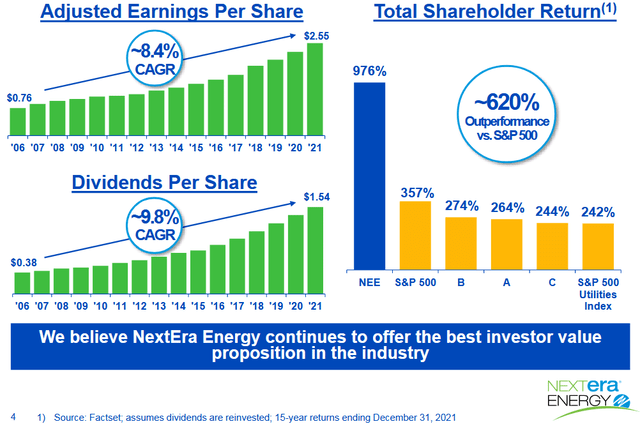

Not surprisingly, the #1 holding is the largest utility company in the United States (market-cap of $176.6 billion): NextEra Energy (NEE) with a 16.25% weight. NEE became the largest utility company in the US by being an early adopter of wind and solar power generation (and nat gas) and, as a result, is now the world leader in clean energy power generation. That has also led to a very strong track record of delivering total returns for shareholders and greatly outperforming the broad S&P 500 Utility Index:

NextEra

NEE currently trades with a forward P/E = 31x and yields 1.87%. Those metrics indicate that NEE is still in “growth” mode, and the company will likely be a beneficiary of the recent Clean energy legislation passed by the Biden Administration and Democrats (without a single republican vote) as well as the previously passed Infrastructure Act, which includes more than $65 billion targeted for investments in clean energy transmission and the electrical grid. All things considered, the relatively high weighting of XLU in NEE appears to be more than justified.

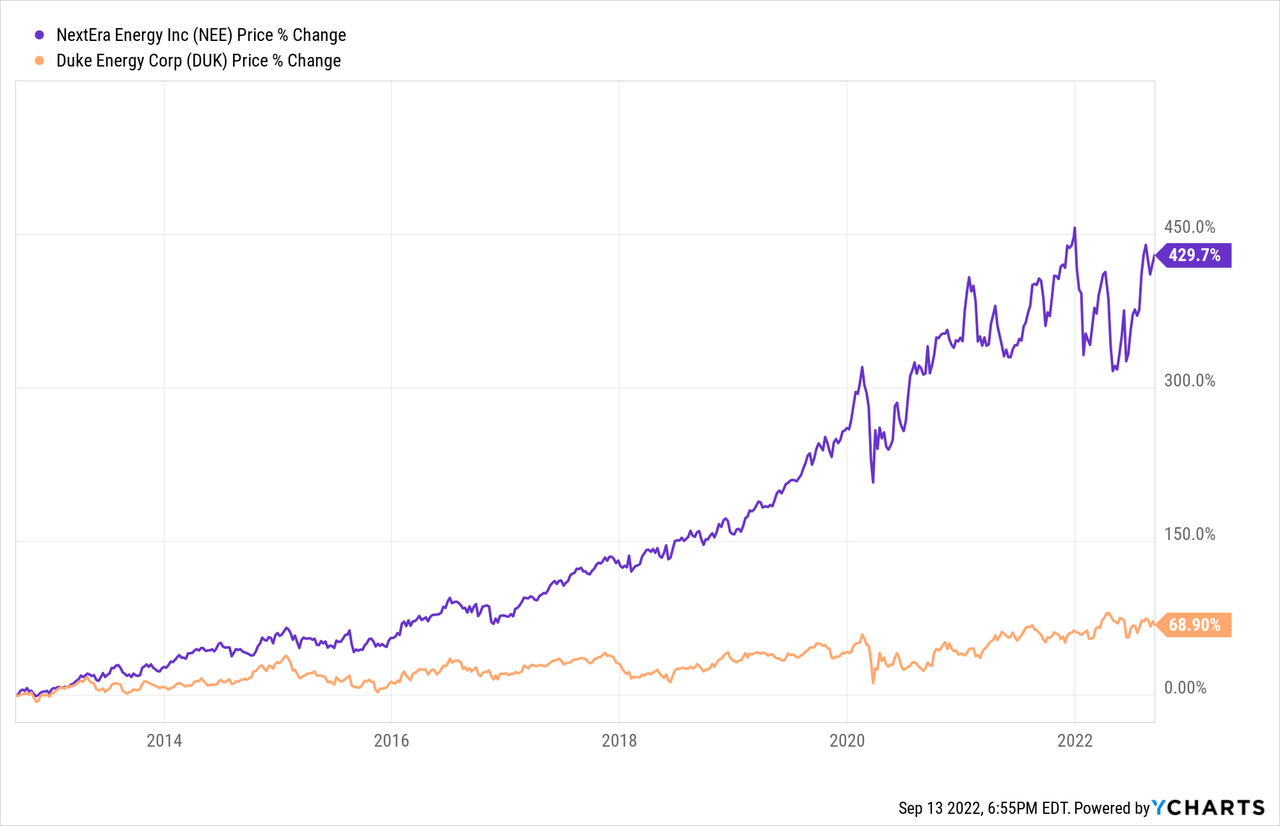

Duke Energy (DUK) is the #2 holding with a 7.8% weight. Duke is a diversified utility company that owns and operates two of the nation’s top-10 largest nuclear energy plants: the Oconee Nuclear Station (with a capacity of ~2.62 GW) and the McGuire nuclear power plant (with a capacity of 2.38 GW). Duke Energy stock is up 5.3% over the past year and yields 3.6%.

The #4 holding is Dominion Energy (D) with a 6.2% weight. In addition to its regulated gas utility business, Dominion also owns and operates four nuclear power plants. The stock is up 7.5% over the past year, yields 3.17%, and trades with a forward P/E of 20.4x.

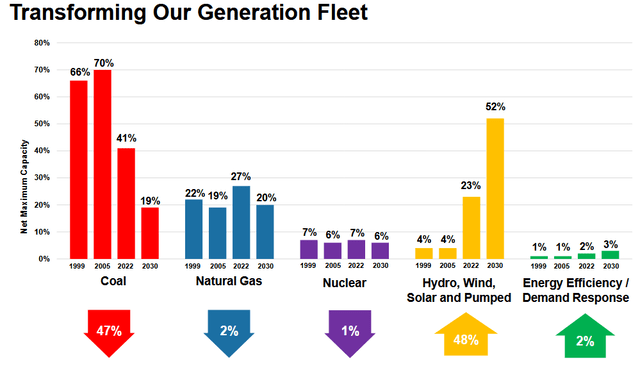

American Electric Power (AEP) is the #6 holding with a 4.9% weight. AEP is one of the largest regulated utility companies in the US with 26GW of power generation capacity, 5.5 million customers across 11 states, and 40,000 miles of transmission lines. The company has been rather slow to transition away from coal toward clean-energy, but the company has reduced coal from 70% of its total generation capacity in 2005 to an estimated 41% this year while raising its renewable energy capacity to 23%:

AEP

However, that was a much slower transition to renewables as compared to NextEra, and the resulting 10-year stock price chart shows the results:

Consolidated Edison (ED) is the #9 holding with a 3.2% weight. ConEd is considering selling its green energy unit – of which it operated ~3 GW of utility-scale renewable projects as of the end of last year – including solar farms in Texas and California and wind farms in Nebraska, South Dakota and Montana. Last month, Bloomberg reported that the assets were attracting interest from European energy giants TotalEnergies (TTE) and RWE (OTCPK:RWEOY) and could sell for up to $3 billion. ED has a market-cap of $35.8 billion, trades with a forward P/E = 22.6x, and yields 3.1%. ED shares are up 32.8% over the past year.

Performance

The XLU ETF has an excellent long-term performance track record, delivering a 10-year average annual return of 11.1%:

State Street Global Advisors

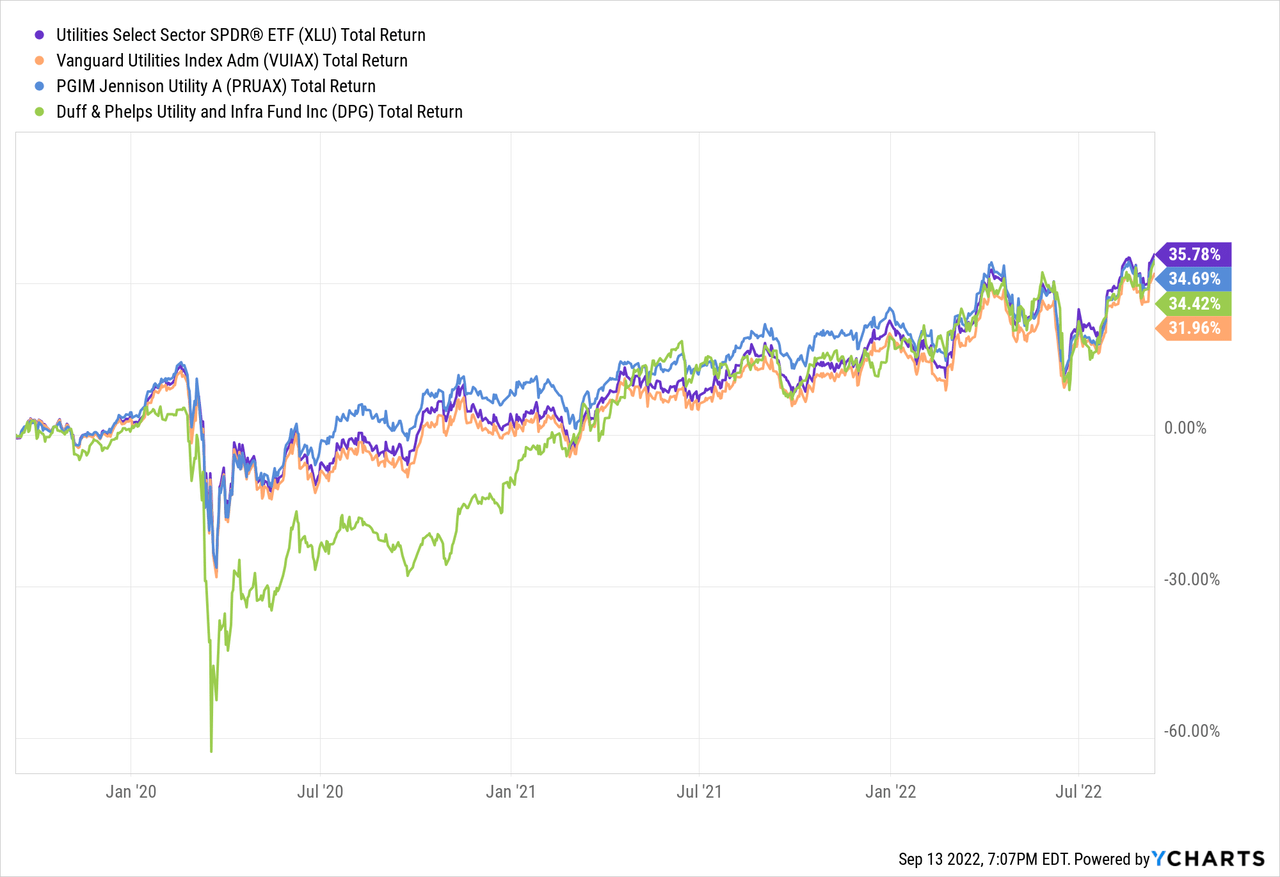

The following graphic compares the 3-year total returns of the XLU ETF with that of some of its peers: the Vanguard Utilities Index Admiral Fund (VUIAX), the Jennison Utility A Fund (PRUAX), and the Duff & Phelps Utility & Infrastructure Fund (DPG):

As you can see, the XLU is the leader of the pack.

Risks

Utility companies are not immune to the current macro-headwinds: high inflation, higher interest rates, the continuing impact of covid-19 shut-downs and supply-chain disruptions, and the reverberations of Putin’s horrific war-of-choice on Ukraine that has effectively broken the global energy & food supply chains. Any or all of these could lead to a global economic slowdown and/or a recession, perhaps even a severe one. A recession would likely result in lower electric power demand from industry and consumers and would thereby potentially negatively impact utility billing.

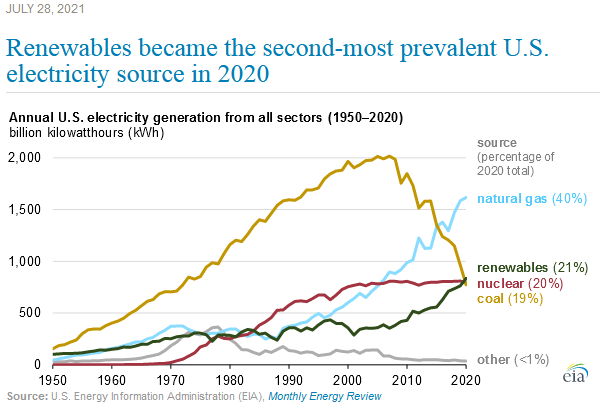

Higher natural gas prices mean higher input cost for the U.S. utility power generation sector. I say that because natural gas power generation has taken over from “king coal” and is now – by far – the largest source of electric power in the U.S. (~40%):

EIA

That being the case, and the fact that Putin has cut-off Europe’s primary source of natural gas, demand-pull for US-sourced LNG for the EU has caused natural gas prices to rise here at home (NYMEX gas has gone from $5.30 MMBtu one year ago to $8.40). Of course utilities get rate adjustments that let them pass-on much of that cost to consumers, still, it is an unwelcome development and could cause consumers to cut-back on the AC and heat in order to save money.

Summary & Conclusions

The Utility Sector has significantly outperformed the broad-averages during the 2022 bear-market. Given the hot inflation report on Tuesday, that out-performance should continue going forward as the Federal Reserve will be pressed to continue raising rates to tamp-down inflation. The Biden administration was able to get clean-energy and infrastructure bills passed through Congress and they both will be long-term positive catalysts for the Utility Sector – as will increased demand due to global warming and greater EV adoption. Meantime, investors should consider allocating some capital to a sector that – despite the recent rally – still trades at a substantial discount to the S&P 500 while throwing off more income (XLU yields 2.64%). The XLU ETF is a BUY.

[ad_2]

Source links Google News