[ad_1]

metamorworks/iStock via Getty Images

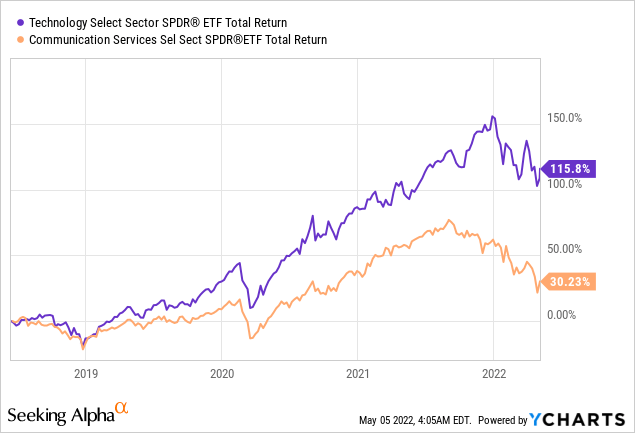

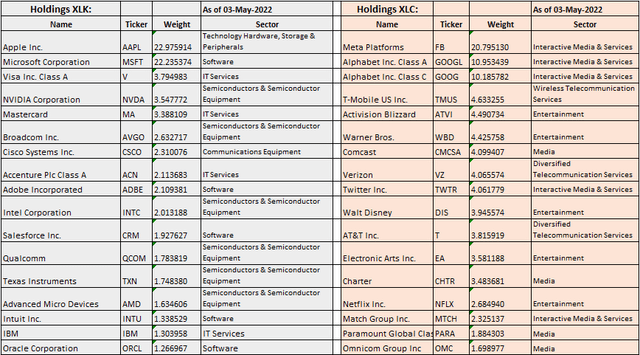

Big techs which form part of the Technology Select Sector SPDR ETF (NYSEARCA:XLK) rely heavily on the network infrastructures of telecom operators whose stocks are held by the Communication Services Select Sector SPDR Fund (NYSEARCA:XLC). Despite this reliance, it is the tech ETF that has outperformed by over three times since 2018, according to a comparison of the total returns which includes both the share price performance and dividends (chart below).

Therefore, the balance of power has been pretty much on big tech’s side. Now, there have been some recent developments in Europe that point to the fact that service providers should be paid more for their communication infrastructure by the big techs which use them. At the same time with rising interest rates and the Federal Reserve due to start tightening the money supply in June-July which will essentially mark the end of the era of cheap money, the growth strategy which has guided the markets during the last ten years may be supplanted by the inflation one.

The objective of this thesis is to assess whether the balance is shifting in favor of communication services providers (CSPs), and I start by providing insights as to why tech has outperformed.

High-growth tech vs telco’s dumb pipes

In addition to their distinctive business models, the double-digit or even triple-digit revenue growth witnessed by stocks in the technology sector has been powered mostly by acquisitions at a time when interest rates were low. Cheap money has also helped them to sustain long periods of providing free services before finally being able to monetize their platforms through product bundling and advertisement revenues.

Moreover, whether it is Apple (AAPL) or Microsoft (MSFT), these need effective communication channels to distribute their content to and interact with end-users all over the world. Now, these companies do pay for the connectivity which runs from their hyperscale datacenters to the internet service providers (“ISPs”). However, in many cases, the network usage fees they pay are not commensurate with the high level of data traffic they generate compared to normal voice and messaging applications telcos provide.

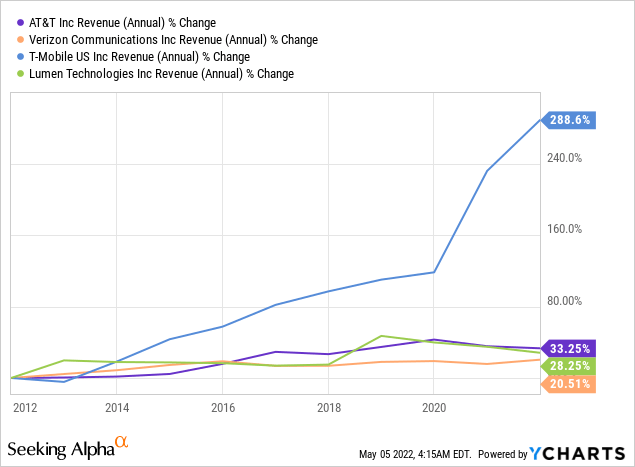

To provide investors with an idea of traffic growth, mobile data traffic has grown by about 1000% from 2016 to 2022. This should normally have boosted the revenues obtained by AT&T (T) or Verizon (VZ) who in addition to fixed-line services have MNO (mobile network operator) licenses. However, as shown in the chart below, with only 20%-33% of growth over a long period of time of ten years, this is far from being the case. Lumen Technologies (LUMN) has a large fiber network, whereas T-Mobile (NASDAQ:TMUS), which is a wireless service provider, growth has also been powered by the Sprint acquisition.

Thus, service providers have not been able to capitalize on traffic growth to generate revenues in the way tech companies have and, it is precisely for this reason that telcos are sometimes referred to as “dumb pipes”.

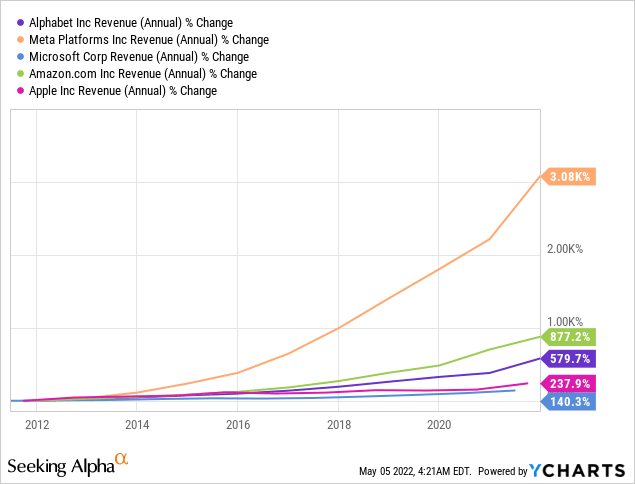

To make my point, the chart below shows how big techs have been able to monetize telcos’ pipes to drastically inflate their revenues. The one which has been able to grow the most is Meta Labs (NASDAQ:FB) which as an Interactive Media & Services company forms part of XLC’s holdings, but it also qualifies as a big tech. The same applied to Alphabet (NASDAQ:GOOG) and as such, these two companies have a broad presence in the communications ecosystem, namely with their participation in fiber cable projects. However, unlike these two, most of XLC’s holdings are CSPs.

Coming to Microsoft and Apple which form part of XLK, by vertically building a sticky product portfolio over the communications infrastructures of others, they have been able to generate 10-15 times more growth. Just think for one minute about how they are dependent on telcos’ pipes for anything from new product installations to security updates.

This said telcos have evolved and become smarter too and are no longer the vertically-integrated behemoths they once were.

Monetization of assets by telcos and valuations

One of the ways to monetize their extensive infrastructure was disposing of tower assets some ten years back. In this way, they were able to reduce debt and continue to pay dividends but they were not rewarded by the stock market. Instead, investors were more allured by the tower companies, possibly because they owned the more passive infrastructures just like real estate companies which entails more predictable cash flows.

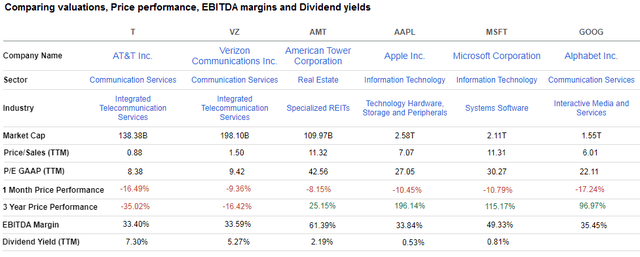

This is illustrated by the high valuations of American Tower (AMT) in the table below and confirms the market’s love for real assets which act as inflation hedges. Market sentiment is so bearish against telcos that even AT&T’s spin-off of Warner Media (NASDAQ:WBD) failed to cushion its share price decline.

Comparison table (www.seekingalpha.com)

Two reasons which can help to explain this are high capital expenses and regulations.

First, left with the active infrastructures (mobile and fiber networks) requiring high investments, telcos have to devote a significant portion of their capital expenses (as far as 80% of total mobile cellular) to the implementation of 5G. To exacerbate matters, contrarily to the shift from 3G to 4G where subscriber adoption was rapid, they now have to give away free mobile phones because of the competition.

Second, telco’s ability to charge more for their services is limited by the fact that they are heavily regulated with one example being that they cannot just increase tariffs of subscribers in rural areas to cover expensive fiber or radio access equipment deployments. Instead, they have to go through regulatory approval.

In this respect, the association of European telecommunications network operators (ETNO) has become more aggressive in its attempt to make tech giants contribute more to the upgrade of telecom networks. In this context, the Digital Markets Act, a law put in place by EU regulators aims to bring more competition by creating more space for new entrants to emerge.

This ultimately amounts to bringing regulatory oversight to the tech world, promoting competition, and increasing the number of customers for telcos’ enterprise businesses. These European laws can also be adapted on this side of the Atlantic Ocean where lawmakers have constantly been scrutinizing big techs on unfair competition grounds.

In the meantime, market sentiment towards communications services plays seems to be changing as per the difference in price performance over a one-month and three-year period (above table).

Changing relationships

This price action essentially shows that as a result of high inflation, it is the tech stocks that form part of the Nasdaq which are more adversely impacted, and conversely, that lower valuation telco stocks which have decent EBITDA margins and pay dividends are being relatively less harmed. This trend should accentuate in the future as aggressive share buy-backs prove counter-intuitive in a volatile market with shareholders prioritizing dividend distributions flowing directly to their bank accounts.

In addition to potential favorable regulatory changes and lower valuations, my optimism for the communication services sector also stems from the fact that they have increasingly adapted to the cloud-based technologies that big techs are so famous for, namely to strengthen their enterprise businesses. Additionally, new technologies like Open RAN pave the way for less capital-intensive 5th generation wireless networks. Going one step further, telcos are also establishing partnerships with big tech for private 5G and edge services as part of the wider Industry 4.0 or the fourth industrial revolution.

Thus, CSPs now have the opportunity to unlock value from their active infrastructures by partnering with big techs instead of just serving them. For this purpose, XLC has an extensive portfolio of media, wired, wireless, entertainment, and telecom plays.

Table built using data from (www.ssga.com)

I also like the fact that, beyond competing with each other for market share, XLC’s holdings do have pricing power as demonstrated by AT&T increasing rates on certain mobile plans recently. Other holdings are showing a propensity to collaborate.

Conclusion

Thus, after being confronted in a court case over bandwidth usage back in 2014, Netflix and broadband provider Comcast (CMCSA) now have a “normal” business relationship due to the fact that the video streamer works closely with ISPs to ease network congestion. Along the same lines, the T-Mobile – Lumen partnership makes possible the mutualization of expensive mobile and fiber assets.

Finally, as the dust settles, and new market conditions are in place driven mainly by inflation concerns, the more value-oriented CSPs are likely to start outperforming big tech. This in turn will shift the balance of power in favor of XLC. For this purpose, its price-to-earnings ratio of 16.7x is much less than XLK’s 23 which means that its holdings do not have to increase their earnings by as much as tech plays to justify their valuations, as the cost of doing business increases. Thus, the communication services ETF with pays a dividend yield of 1% has a better chance to stay at the current $60-61 level.

[ad_2]

Source links Google News