[ad_1]

In this article, we examine the significant weekly order flow and market structure developments driving XLF price action.

As noted in last week’s XLF Weekly, the highest probability path for this week was for sell-side activity within a potential corrective phase developing. This primary expectation did play out after a probe of key resistance to 27.10s met with selling interest, halting the breakout and driving price lower to 25.23s ahead of Friday’s close, settling at 25.34s.

NinjaTrader

15-22 March 2019:

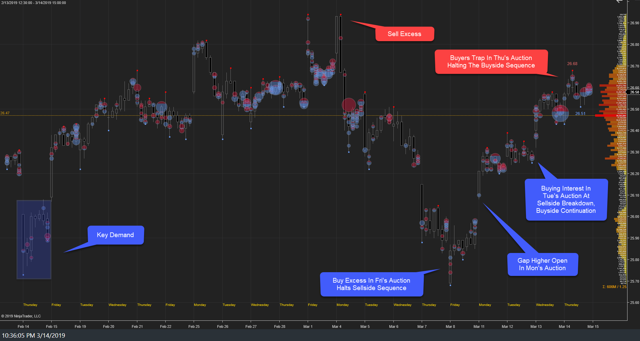

This week saw narrow, two-sided trade in last Friday’s auction, 26.43s-26.71s, before buying interest emerged, 26.55s-26.63s, ahead of Friday’s close. Friday’s late buyers held the auction into Monday as price discovery higher developed, achieving a stopping point, 26.98s, at/near last week’s key resistance. A minor probe higher then ensued early in Tuesday’s trade, achieving the stopping point high, 27.10s. Minor sell excess developed there as buyers trapped, 27.01s-27.05s. A sell-side sequence then ensued through Wednesday’s auction, achieving a stopping point, 26.11s. Buying interest emerged, 26.13s/26.14s, into Wednesday’s close attempting to halt the auction.

Wednesday’s late buyers failed to hold the auction as a gap lower open developed in Thursday’s trade. Price discovery lower continued, achieving the stopping point low, 25.78s, within the prior key demand cluster. Buying interest emerged there amidst a buy excess, halting the sell-side sequence, driving price higher in retracement to 26.17s late in Thursday’s trade. Buyers emerged, 26.06s, into Thursday’s close. Thursday’s late buyers failed to hold the auction as a gap lower open developed in Friday’s auction, driving price lower, achieving a stopping point, 25.23s, ahead of Friday’s close, settling at 25.34s.

NinjaTrader

NinjaTrader

This week’s auction saw minor probe of key supply early week where sell excess developed. Price discovery lower then ensued as the expectation for sell-side activity played out. The failure at prior resistance likely serves as a structural stopping point high. Within the broader context, the development of a stopping point high within key supply implies a more significant resistance area is potentially developing.

Looking ahead, the focus into next week’s auction will center upon market response to this week’s unsecured low, 25.23s. While repair of the unsecured low is likely, the highest probability path into next week is for buy-side activity within a developing corrective phase, following this week’s stopping point high. Buy-side failure at this prior demand area will result in further near-term price discovery lower toward key demand clusters below, 24.60s-24.10s/23.80s-23.50s, respectively. Alternatively, sell-side failure at this prior demand area will result in retracement higher to challenge key supply overhead, 25.80s-26.20s/26.30s-26.70s, respectively. The larger intermediate term bias (3-6 month) is now neutral between, 25.34s and 27.47s.

NinjaTrader

NinjaTrader

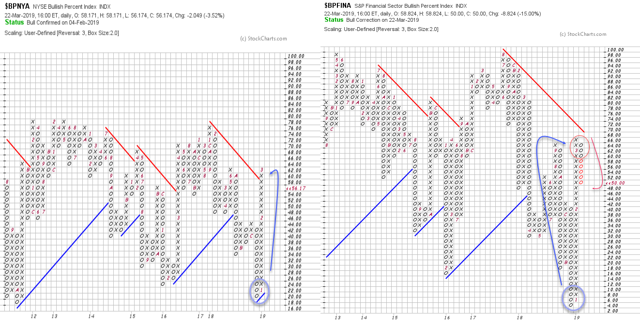

It is worth noting that sentiment based on the S&P Financial Sector Bullish Percent Index now reflects a bounce from the levels of extreme pessimism developed into early January. Stocks more broadly, as viewed via the NYSE, have now also seen a bounce from a similar level. Asymmetric opportunity develops when the market exhibits extreme bullish or bearish sentiment with structural confirmation. Following the momentum low of November 2018, the market developed a stopping point low which now serves as meaningful support. While broad market sentiment continues to move higher, sentiment in financials now sees its first decline since the new year’s low area. While not yet at extreme optimism, key supply, 25.90s-27.50s, will be the first area of real challenge for the buy-side and could become more structurally significant should optimism wane without price confirmation higher.

StockCharts

The market structure, order flow, and sentiment posture will provide the empirical evidence needed to observe where asymmetric opportunity resides.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News