[ad_1]

The Energy Select Sector SPDR ETF (NYSE:XLE) tracks the performance of S&P 500 energy sector stocks. XLE allows investors to take a strategic or tactical exposure by isolating sector performance. Energy stocks have historically been correlated to changes in commodity prices, particularly oil and gas. On May 23rd, 2019, crude oil prices fell nearly 6% on growing global demand concerns amid rising tensions from the ongoing U.S.-China trade dispute while global production is at record levels. Energy sector stocks suffered larges losses on the day, pulling XLE to its lowest level since January. The ETF is down 21% over the past year, effectively in a bear market yet still up 7% YTD. This article highlights the performance of XLE components and looks at trends in multiple based valuation metrics.

XLE price chart. source: Finviz.com

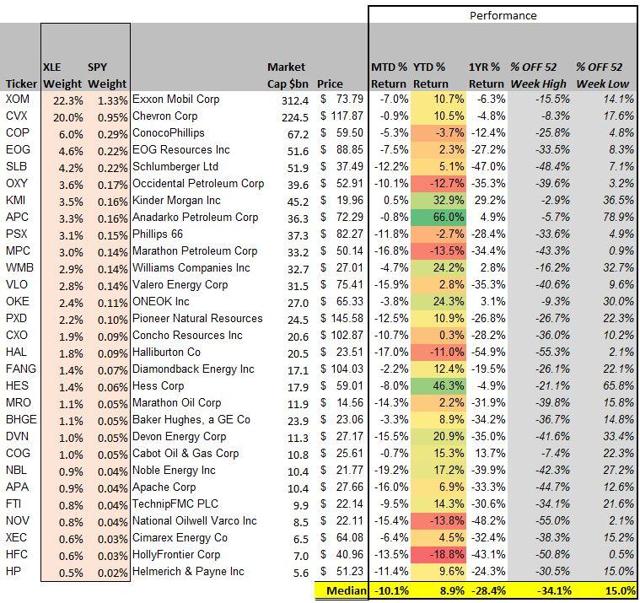

XLE Holdings Performance

All 29 stocks in the fund are either production companies, or equipment and services providers. May has been a particularly weak month for the group, with the large and mega cap stocks down on an average (median average) 10.1%. Year to date among the top 10 holdings, the biggest winner has been Anadarko Petroleum Corp. (NYSE:APC) up 66%. Shareholders got a big win following an apparent bidding war between Chevron Corp. (NYSE:CVX) and Occidental Petroleum Corp. (NYSE:OXY), with the latter acquiring the company for $38 billion. Coincidentally, the market reaction for OXY has been less than optimistic as its shares are down 12.7% YTD with weakness on the announcement. Fellow Seeking Alpha contributor Laura Starks has an excellent article on the acquisition with more deal information.

XLE holdings performance data. Source: data by YCharts/author table

While most XLE stocks have still posted positive returns YTD, the fall from their respective 52-week highs have been massive. Indeed, 20 of the 29 stocks are down more than 20% over the past year. Schlumberger Ltd. (NYSE:SLB) is among the biggest losers from the top 10 holdings, down 48.4% from its 52-week high.

WTI oil futures price reached a high above $76 per barrel in October and is now down 14% since despite the 22% move higher off the lows in December. I’d argue that the higher crude oil prices this year have merely been a technical bounce from the extreme market volatility in Q4 while market fundamentals remain poor and are again trending lower. The sector performance going forward is really going to require improved sentiment and a sustained higher trend of oil prices. All eyes are on China not only for developments from the ongoing trade dispute but also cyclical growth trends. Emerging signs of a global demand slowdown while supply and production continues to reach new records is just one of many factors pressuring crude oil prices now.

Crude Oil Futures price chart. Source: Finviz.com

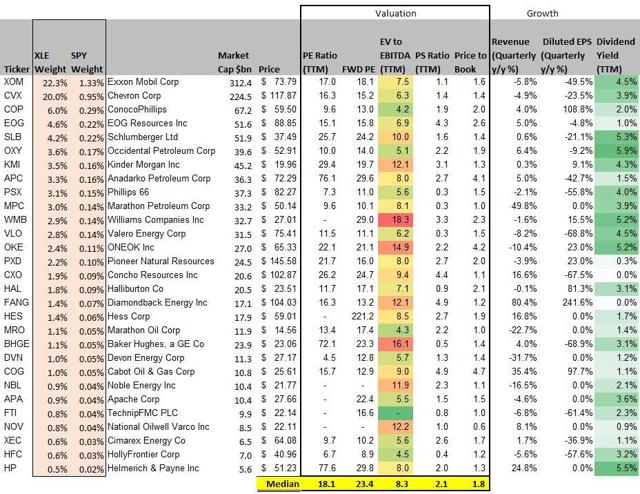

XLE Holdings Valuation Metrics

Observing growth and fundamentals across energy, the first thing to note is that revenue and earnings fell on a year-over-year basis for the top two mega cap holdings Exxon Mobil Corp. (NYSE:XOM) and Chevron Corp. XOM actually missed both top and bottom line consensus estimates in its last earnings release back in April that set the tone of the entire sector. 14 of the 29 companies reported declines in quarterly revenues for the last period on a year-over-year basis consistent with lower energy prices.

Among valuation metrics, the median price to earnings (PE) ratio for the group on a trailing twelve-month basis is 18.1. A higher forward PE at 23.4 implies most companies are expected to report weaker EPS for the year ahead. ETF valuation metrics are typically expressed as a weighted average that will differ slightly from the median below. Based on enterprise value to EBITDA, ConocoPhillips (NYSE:COP) at 4.2x is apparently the least expensive stock in energy by this measure. The company reported 4% revenue growth in the last quarter with higher than expected production figures.

XLE holdings valuation multiples. Source: data by YCharts/author table

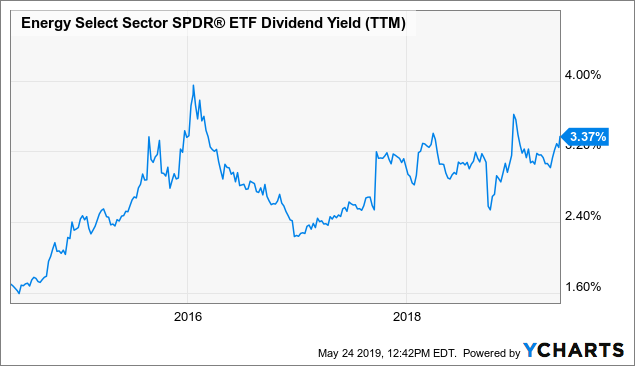

Observing dividend yields, the average from the stocks is 2.8%, although stocks with higher yields have a larger weighting in the ETF. XLE’s dividend yield over the trailing twelve months is 3.37%, keeping in mind that a number of these stocks are dividend growers so the forward yield is likely higher.

Data by YCharts

Data by YChartsETF Analysis

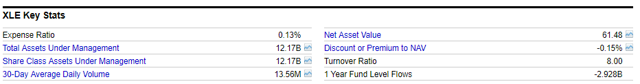

I like the family of sector select SPDRs because it provides investors a highly liquid vehicle to get a diversified exposure to the sector. XLE is the largest of energy sector specific exchange-traded funds with $12.2 billion in AUM. The expense ratio of 0.13% is only 4 bps more than SPY.

XLE ETF key stats. Source: data by YCharts

The outlook for XLE and the related crude oil price is really going to come down to a bet on global macro. The individual companies will be exposed to changes in the commodity price that will implicate cash flows and internal rates of invested capital. Traders and investors here need to take a position based on views on how the dynamics of global growth will interact with current record and increasing production. I am bearish on XLE over the near term because I view more downside to oil prices and am generally more pessimistic on the global growth outlook. A positive and faster resolution to the U.S.-China trade dispute saga should be positive for global risk asset sentiment sending commodity prices and XLE higher.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News