[ad_1]

imaginima/iStock via Getty Images

With inflation running rampant, many investors are looking to find asset classes that will hedge against inflation eating away their investment returns. Energy stocks have been a popular choice due to their theoretical correlation with commodity/oil prices which have a theoretical correlation with inflation.

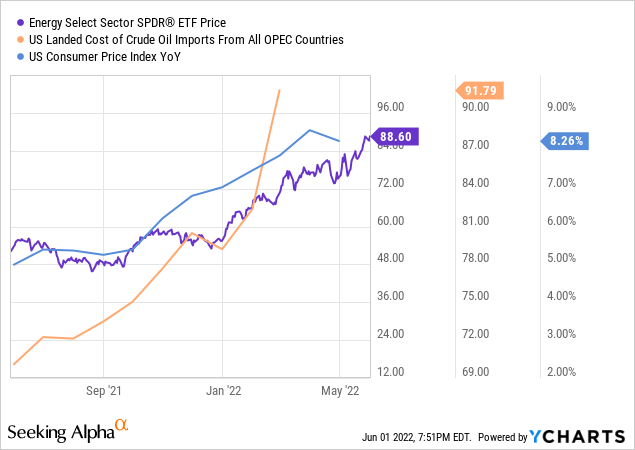

In the past year, this relationship has been accurate. Taking the Energy Select Sector SPDR ETF (NYSEARCA:XLE) which represents the energy sector of the S&P 500 as representing “energy stocks”, we see that the performance has been strongly correlated with U.S. oil import prices and inflation over the past year.

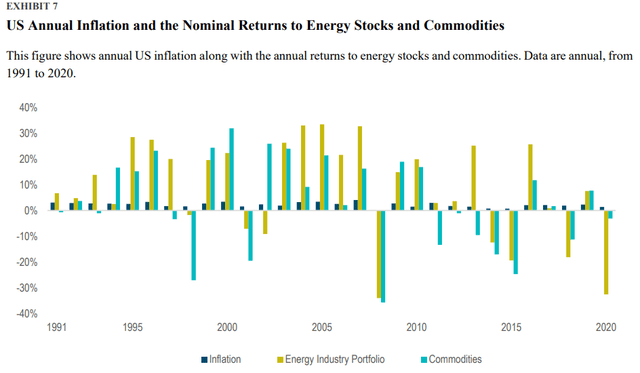

Over an even longer study period of 1991 to 2021, Dai and Medhat find that energy stocks have a positive correlation with both expected and unexpected inflation. In contrast, most other asset classes did not have any positive correlation and typically performed worse in real returns during periods of high inflation.

So given this result, why isn’t investing in XLE a reliable inflation hedge? Unfortunately, while XLE returns may provide some positive correlation with inflation, there are also many significant risk factors an investor should consider before piling in and considering themselves hedged.

Concentration Risk

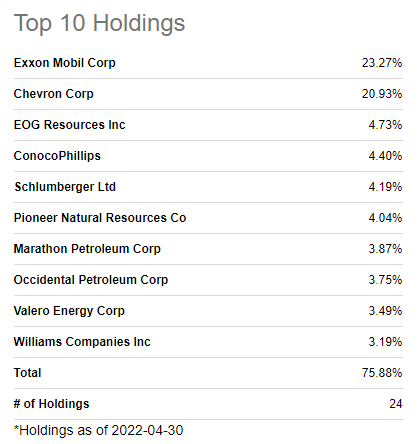

XLE is an incredibly concentrated ETF. It only holds 24 companies, with the 10 making up 75% of the weight. The top two companies, Exxon Mobil (XOM) and Chevron Corp (CVX), make up 45% of the index, nearly half. Diversification remains one of the best portfolio practices an investor can take as you are not compensated with higher expected returns for holding a concentrated portfolio. XLE’s concentrated holdings bring on significantly more risk.

Seeking Alpha

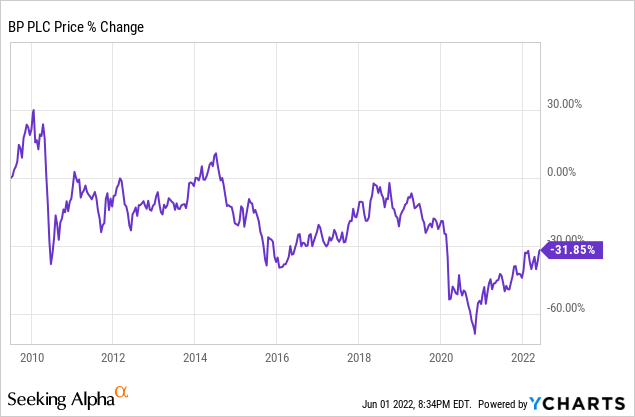

Proponents of “big oil” may say that the industry is safe and so are individual holdings, given how much society relies on oil. However, it’s very possible that XOM or CVX have a 2010 BP spill-like event and drop drastically in the future. With such high concentration in two companies, this can tank XLE significantly. BP dropped over 50% in a matter of months after the major 2010 spill and has never recovered since.

Volatility

While Dai and Medhat find in their paper that energy has a positive correlation with inflation, they note that the volatility of energy stocks and commodities is significantly higher than inflation and make them not reliable hedges in periods even over long time periods such as the period studied (30 years). The variance of energy stocks was over 20x that of inflation. Less than half (42%) of the energy stocks return variance was explained by inflation. A truly good inflation hedge should have a significantly higher proportion of return variance explained by inflation alone.

Dai and Medhat 2021

This also makes theoretical sense. Energy stock prices are not only impacted by inflation but by the price of oil. The price of oil is notoriously volatile and can change on a whim. They can suffer from supply shocks as OPEC, a cartel of oil producing nations, controls 40% of the world’s output. It can also suffer from demand shocks, such as the COVID lockdowns in 2020, collapsing demand and nearly causing the collapse of the U.S. Oil ETF (OIL).

Riskier Overall and Recession Performance

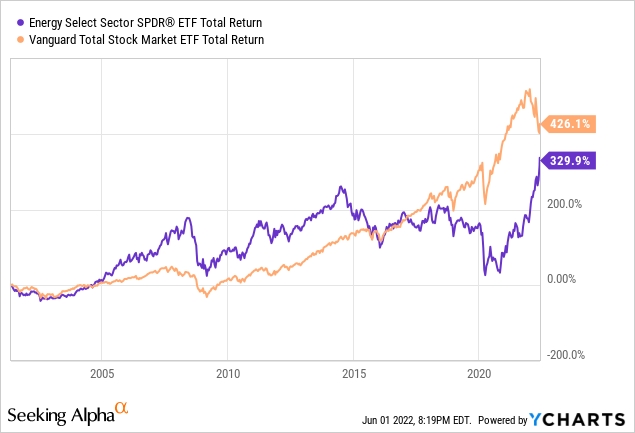

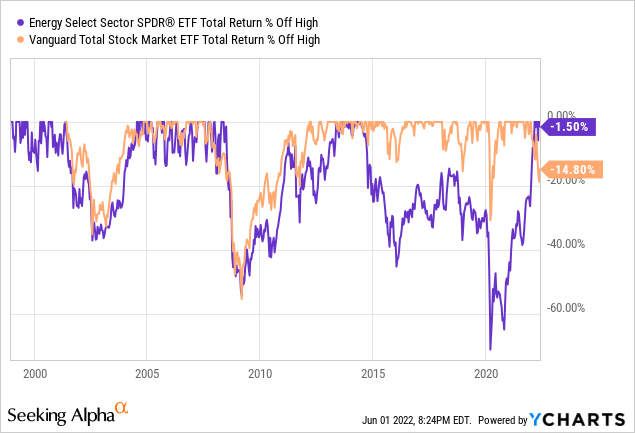

While XLE may have some positive benefit from inflationary periods, it has overall slightly underperformed the Vanguard Total Stock Market ETF (VTI) while bringing on more volatility, higher drawdowns, and thus a lower overall risk adjusted ratio. Over this time period, XLE had a .56 Sharpe Ratio compared to .41 for VTI.

In addition, we often see inflation correlated with rising interest rates and thus higher recession risk. The stagflation periods of the late 70s and early 80s saw this. XLE has performed significantly worse than VTI in the past few recessions. Holding XLE now to hedge inflation may seem like a good choice looking at the past few months, but the tables may turn if we head towards a recession, as many economists are forecasting.

In most recessions/declines, XLE dipped further than VTI and took longer to recover. Near the end of 2014, XLE continued to drop for many years and did not recover until this year, boosted by the growth in oil prices. Holding on to a negative asset for 8 years would be painful for most investors, especially while seeing the general market set all-time highs year after year.

Conclusion

XLE and other energy stocks have positive but weak correlation with inflation, but the high volatility, concentration, and risk make them not a great inflation hedge. Investors with lower risk tolerances may opt for investing in the general market which still provides positive real returns in periods of high inflation, with less sector specific risks attached.

[ad_2]

Source links Google News