[ad_1]

peshkov/iStock via Getty Images

Rather than trying to find a tech or stay-at-home stock that has bottomed on this recent correction, this may be an opportunity to rotate on over to oil and gas. The energy sector has underperformed for quite a while, but it appears its time may finally be here. If this is the case, the Energy Select Sector ETF (XLE), and many of its constituents, probably deserve a closer look.

Coming price increases appear to be caused by classic economic forces, where supply is not keeping up with demand. Capital expenditure within the petroleum business has been reducing for several years, along with investment in the energy sector. This has contributed to the supply issue, but capacity it is also being affected by current disruptions due to Covid-19.

Last week, the International Energy Agency released an updated view of the oil market, where it claims that “If demand continues to grow strongly or supply disappoints, the low level of stocks and shrinking spare capacity mean that oil markets could be in for another volatile year in 2022.”

Oil prices have now had five consecutive weekly gains, with both WTI (CL1:COM) and Brent (CO1:COM) reaching their highest valuations since October of 2014. Still, both Morgan Stanley (MS) and Goldman Sachs Group (GS) are forecasting for over $100 oil, while Bank of America (BAC) asserts $120 is possible this summer.

This strong demand and reduced supply appears to be following what might end up being the final capitulation in oil and gas investing. Trends like ESG have not been friendly to petroleum-based energy assets, and it appears to be the least loved sector within the market. As a result, it is likely to be among the most undervalued.

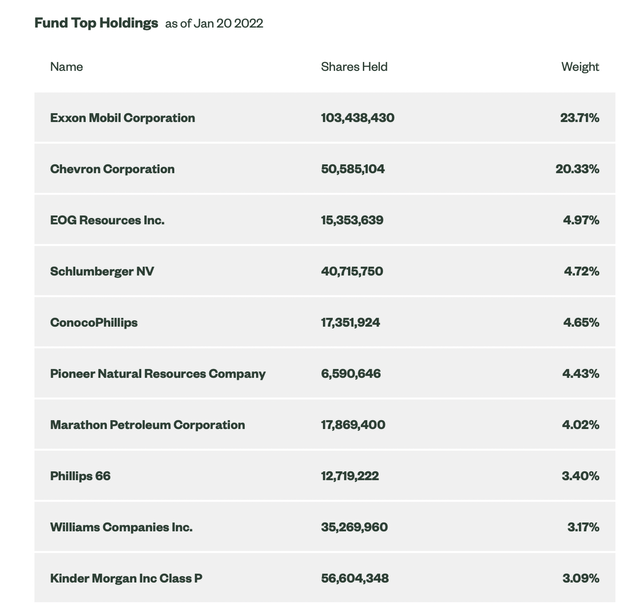

XLE includes most of the largest and best known domestic oil and gas companies, including energy equipment and services companies. The two largest companies within the fund, by far, are Exxon Mobil Corporation (XOM) and Chevron Corporation (CVX), with each making up over 20 percent of the ETF.

XLE holdings

State Street Advisors XLE info page

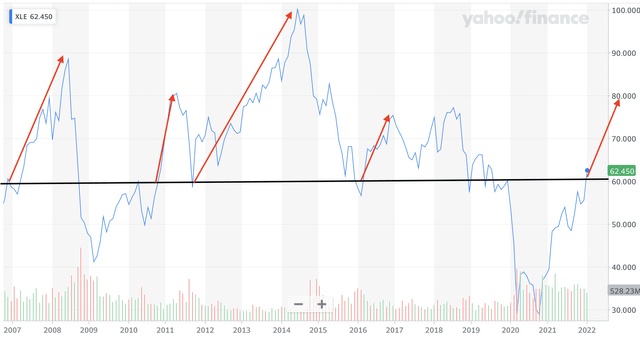

The XLE has a history of melting up after breaking out of its current trading range. This is at least partially because commodities tend to be highly volatile, but also due to investor rotation. Here, it could be the case that we experience both a commodity spike and investor rotation back into energy.

XLE 15-year chart with breakouts

Yahoo! Finance with mark ups by Zvi Bar

Oil and gas stocks also have the potential to act as a hedge against certain geopolitical issues. It is often the case that when an oil producing nation is involved in some sort of conflict, that conflict has an effect upon supply. Current tension between Russia and the NATO nations regarding Ukraine has the capacity to push around equity prices, but most equities will only get pushed down. To the contrary, such geopolitical concern has the potential to increase certain commodity valuations, including oil and gas, as well as the equities related to them.

Risk

Energy equities may be undervalued, but they could easily stay undervalued for a long period of time. They already have stayed undervalued for quite a while. In fact, it is probable that any significant outperformance by energy within 2022 is to be followed by a correction. This is exceptionally common within industries involved in commodities.

The rise of ESG investing means portfolios are being purged of petroleum companies, among other things. If this trend continues, there could be a corresponding lack of investment in oil and gas capacity, as well as a lack of multiple expansion.

Commodity valuations are capricious, as are the equities within the business. Any serious spike down in energy commodities could create a significant drawdown in energy equities.

Conclusion

It appears that many sectors and industries that were in style over the last few years are now falling out of fashion. It also appears that energy equities may be trending higher, just like the underlying commodities. If this apparent rotation into value continues, XLE is likely to outperform in 2022.

[ad_2]

Source links Google News