[ad_1]

zhengzaishuru/iStock via Getty Images

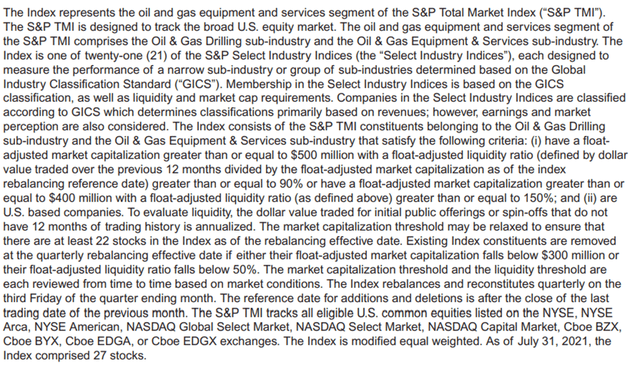

The SPDR S&P Oil & Gas Equipment & Services ETF (NYSEARCA:XES), or the “Fund,” seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P® Oil & Gas Equipment & Services Select Industry® Index (the “Index”).

The Fund has benefited from the oil price surge this year. The 12-month return was down 3%, as compared to a 12% loss in the SP500TR, as of this price chart snapshot. But that is a poor performance as compared to numerous other oil-related investment funds and equity shares.

Seeking Alpha

The Fund’s 10-year return was -78%. That compares to a return of +235% for the SP500TR, a huge underperformance. The Fund was listed in June 2006.

Seeking Alpha

The subsector of the oil industry has suffered because investors have lost interest in the long-term viability of oil and gas production in a world that will be transitioning to renewables to address climate change issues.

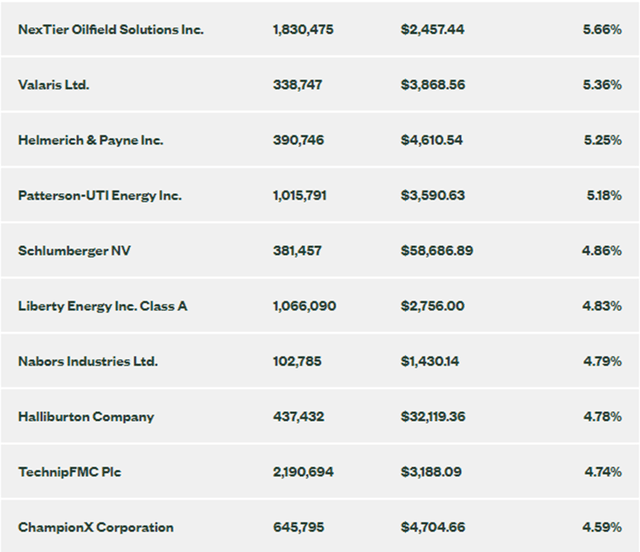

The Fund’s top holdings are listed below. They include two large oilfield services companies, Schlumberger (SLB) and Halliburton (HAL), but the index is a modified equal-weighted one, which provides industry exposure across large, mid-, and small-cap stocks.

SSGA

SSGA

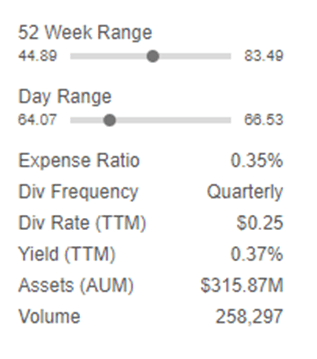

The Fund charges an Expense Ratio of 0.35% and has Assets Under Management of about $315 million. State Street Global Advisers (“SSGA”) are the investment adviser to the Fund.

Seeking Alpha

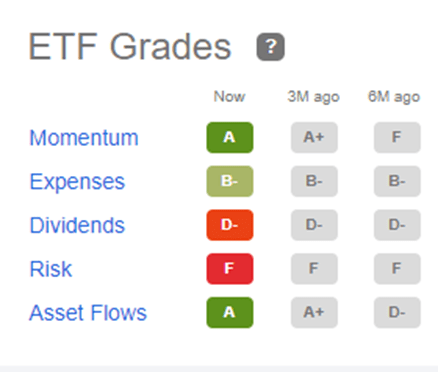

Seeking Alpha grades the ETF as a “B” for expenses and an “F” for risk.

Seeking Alpha

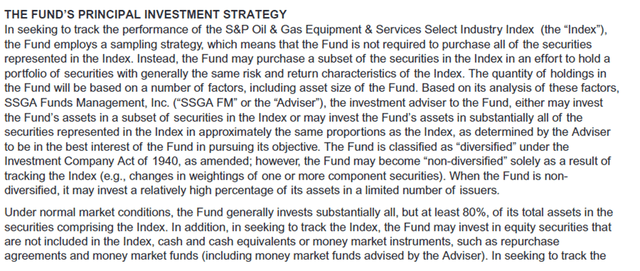

SSGA provided a more detailed description of its investment strategy in its Prospectus.

SSGA

SSGA

SSGA

The Index’s top holdings are listed below.

SSGA

SSGA

Market Fundamentals

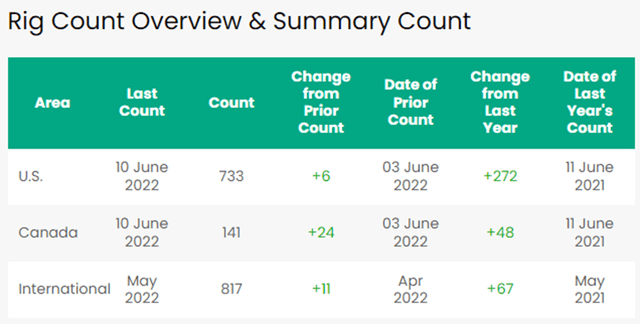

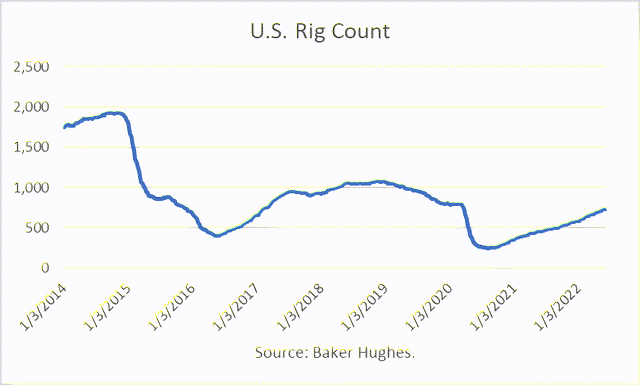

One proxy measure relevant to the Fund’s investments is the rig count for the drilling industry and its suppliers. According to Baker Hughes,

“when drilling rigs are active they consume products and services produced by the oil service industry. The active rig count acts as a leading indicator of demand for products used in drilling, completing, producing and processing hydrocarbons.”

The rig counts in the U.S., Canada, and Internationally (ex-Canada, U.S.) have rebounded over the past year, as shown below, given the recovery in oil prices.

Baker Hughes

However, the U.S. Rig Count remains far below its 2014 level, when oil spikes had last been above $100/bbl.

Baker Hughes

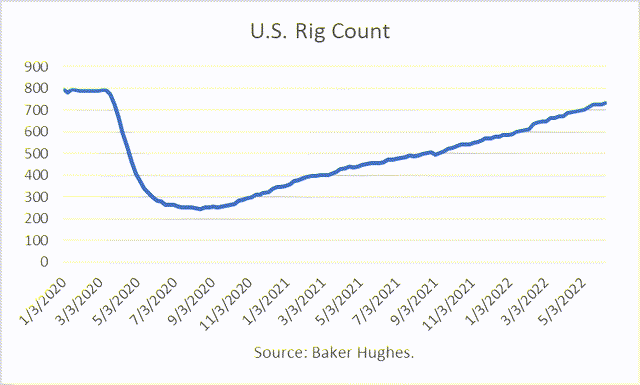

It has only returned to 2020 levels, just prior to the collapse in oil prices.

Baker Hughes

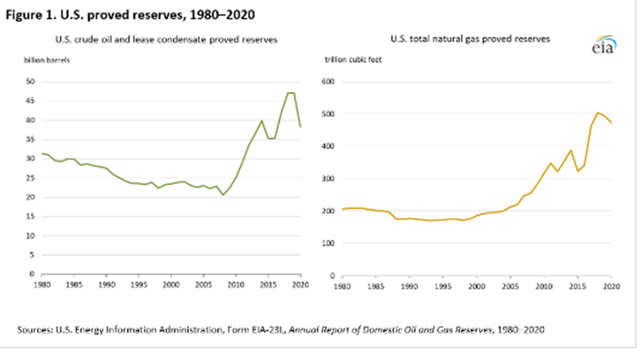

Notwithstanding the large drop in the U.S. Rig Count since 2014, U.S. proved reserves were trending much higher through 2019, before a dip in 2020. Proved reserves are defined as those that can be produced under prevailing technological and economic conditions, and so the collapse in oil prices naturally reduced proved reserves in 2020.

EIA

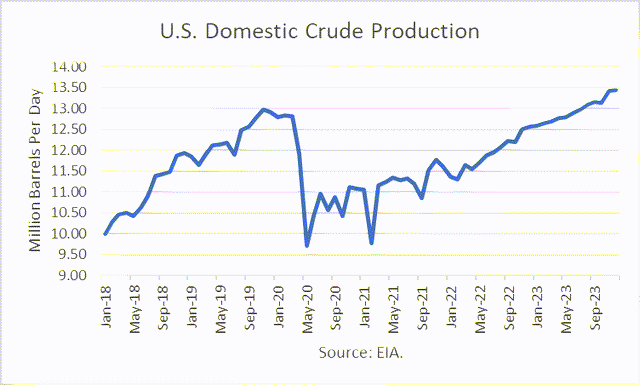

Since 2020, U.S. domestic crude production has also been recovering, and the EIA projects that it will rise to a new all-time high over its forecast horizon in 2023.

EIA

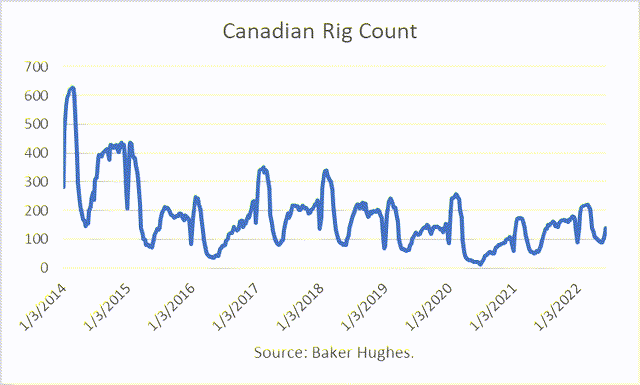

The Canadian Rig Count has also dropped substantially since 2014.

Baker Hughes

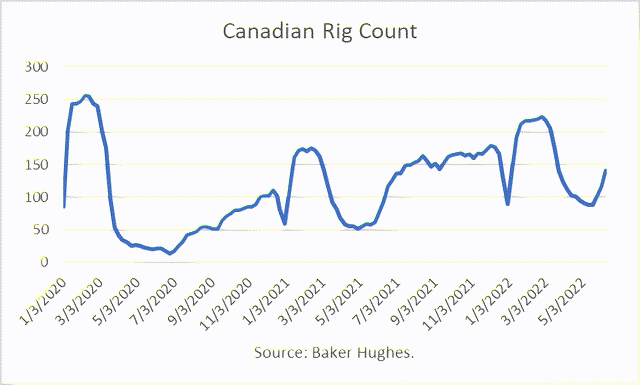

But it has recovered since its depths in 2020.

Baker Hughes

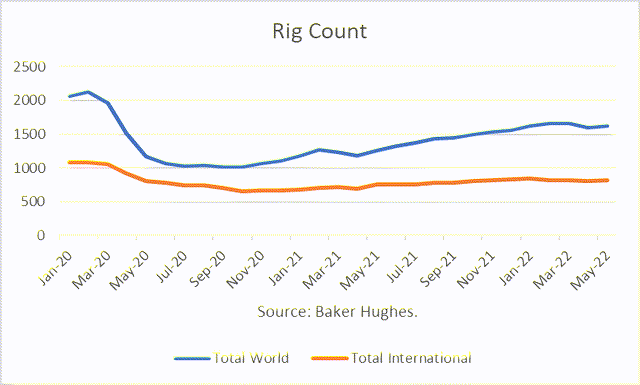

The International Rig Count (ex-Canada and U.S.) was not quite as sensitive to oil prices as the U.S. and Canadian Rig Counts. But the Total World Rig Count remains below where it was in early 2020.

Baker Hughes

Outlook

The International Energy Agency (“IEA”) projected in early June that non-OPEC+ countries are “set to lead world supply growth through next year, adding 1.9 mb/d in 2022 and 1.8 mb/d in 2023.”

OPEC+ includes Russia, and so its total oil output depends on boycotts and sanctions shut on Russian exports. The U.S. has banned all Russian oil imports and the EU announced a partial ban. “This immediately covers more than two-thirds of oil imports from Russia,” according to European Council chief Charles Michel. The ban will apply to 90 percent of Russian oil imports by the end of the year.

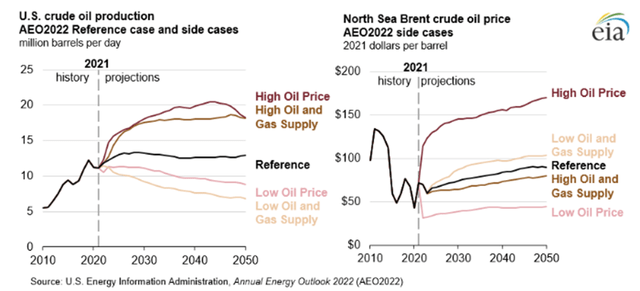

The EIA released its Annual Energy Outlook in early March 2022. It projects that U.S. crude oil production will peak in the late 2020s and remain near that peak through 2050, in its Reference Case. Oil prices are projected to remain high enough in the Reference Case “to maintain investment at steady crude oil production levels but not high enough to elicit increasing volumes from those levels of investment.”

EIA

Olivier Le Peuch, CEO of SLB, recently stated at the Bernstein 38th Annual Strategic Decisions Conference, June 1, 2022:

Let me share with you our latest view of the industry environment, which is one of the most compelling outlooks I have seen in over 35 years I’ve been with this industry…In essence, we enter this new cycle as a more investable, more efficient, and a more sustainable industry, better aligned with our customers, our shareholders, and all of our stakeholders to deliver higher value and lower carbon.”

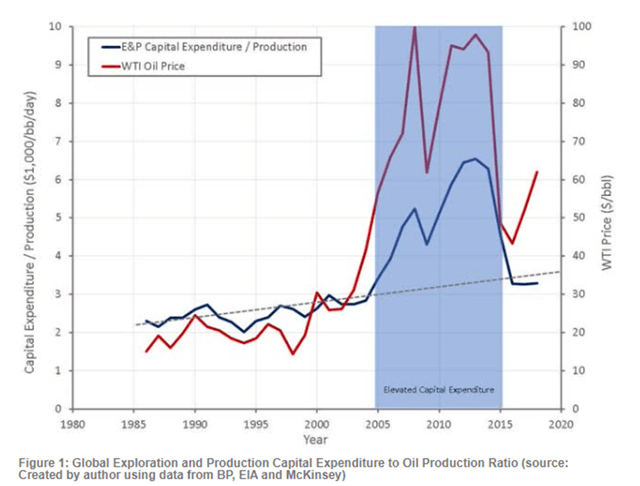

But another expressed in the article, Halliburton: This Time Is Not Different, states:

The period between 2005 and 2015 was characterized by extreme overinvestment that flooded the market and has taken many years to be digested. Much of this spending was also directed towards exploration in risky projects, often with long timelines. Due to ESG concerns and a lack of investor appetite, CapEx in the current cycle is likely to be directed towards increasing current production, which should lead to more production per dollar of CapEx.”

Richard Durant

In a research report, Mark Lewis, the Global Head of Sustainability Research for BNP Paribas Asset Management, concluded “that oil needs a long-term breakeven price of USD 10 – 20/barrel to remain competitive in mobility.”

The economics of renewables are impossible for oil to compete with when looked at over the cycle

Renewable electricity has a short-run marginal cost of zero, is cleaner environmentally, could readily replace up to 40% of global oil demand

The oil industry should remember the fate of utilities.”

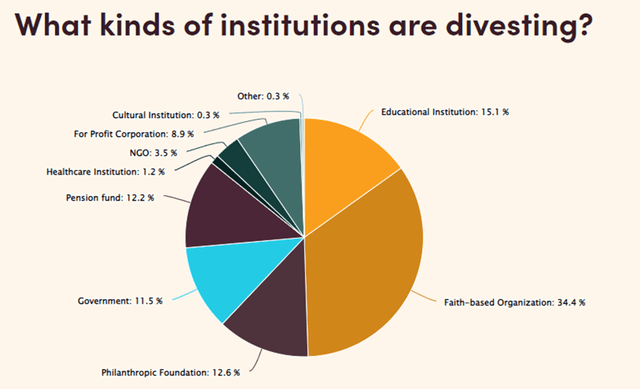

ESG Investors

Environmental, Social, and Governance (“ESG”) concerns are guiding investment selection for a growing group of investors, and the oil industry has been targeted for divestment. For example, in 2019, the Nordic Government Pension Fund Global, one of the world’s largest funds, was given the go ahead to divest in fossil fuels.

It is estimated that $40.43 trillion has been targeted for divestment across 1508 institutions.

Divestment Database

In addition to the Norwegian Sovereign Wealth Fund, a host of notable institutions have joined the divestiture movement, as shown below.

Divestment Database

Conclusions

Contrary to the quote above that the outlook for oilfield services “is one of the most compelling outlooks” in over 35 years, the tide has turned against the future of the oil and gas industry. For climate reasons, the energy transition to renewable fuels is still in its early stages but could replace fossil fuels over the coming decades to provide energy for transportation, which is about 40 percent of the oil market.

The current spike in oil prices is a reminder that the world is still dependent on oil, but most investors take a longer-term view. They prefer investments in electric vehicle companies, such as Tesla (TSLA), much more so than oilfield service companies.

The price spike did relatively little to lift XES. The data does not support a rise in the demand for oilfield services longer-term. And XES is a long-term play, not one that is highly influenced by short-term oil prices, unlike other ETFs that are based on futures prices. So the rise in XES is an opportunity to short it rather than buy it.

[ad_2]

Source links Google News