[ad_1]

Godji10

This article is intended to factual and helpful to biotech investors, and is not intended to be an article promoting any political agenda or party.*

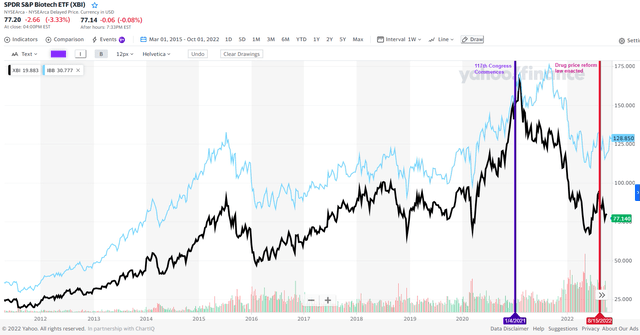

As we previously reported, it is probably not a coincidence that the fall of biotech stocks started at around the time the current Congress and president took office (Jan 2021) (FIG. 1). NYSEARCA:XBI reached its all-time high at ~$166 on Jan 31, 2022, less than 1 month after the current Congress and president took office. At its closing price today, the day after mid-term elections, it is down ~53% since the start of the current Congress, closing at $77.20. Although there have been some excursions above $85/share, our prediction in July 2022 that XBI would hover between $75 and $85/share has held true.

FIG. 1 Biotech sector stock prices since 2011, as represented by XBI and IBB. Vertical purple bar – Jan 4, 2021, day after current Congress began. Red vertical bar – Aug 15, 2022; the day before drug price reform legislation was passed into law.

Biotech sector stock prices since 2011 (Yahoo Finance)

Why does the make-up of Congress affect biopharma stocks? Because drug price control legislation has a major impact on the potential value of current and future drugs, and thus have a major impact on the value of pharma/therapeutics companies. Table 1 lists the major factors that affect the stock price/value of pharma/therapeutics companies. These factors affect biotech stock prices between key readouts for an individual company. Thus, whether a Congress and president are more or less likely to enact drug price controls, is a major factor that affects the value of biopharma companies.

Table 1. Key factors that affect the therapeutics stock sector

1) Present biotech valuations vs. historical valuations

2) Biotech M&A activity

3) U.S. drug pricing reform discussions/progress

4) High profile clinical trial readouts

5A) Concerns about the economy/broader market (more economic concerns relatively better for biotech than most other sectors)

5B) Interest rates (lower interest rates = higher micro-cap and small-cap biopharma valuations)

It became clear going into the current Congress especially with a drug-price reform president taking office, that drug-price reform was much more likely than in the prior Congress. That fact combined with over-inflated pharma/biopharma stock prices in January 2021, were major factors that set up the biotech bear market that began in Feb 2021, a month after the current Congress and president took office. On Aug 16, 2022 President Biden signed the Inflation Reduction Act into law, which includes provisions that are aimed at controlling prices for certain drugs*. Although the Act was not good for biopharma, it could have been much more far-reaching and harmful to biopharma valuations.

Based on the current election results, although it appears that there will not be a huge increase in the number of Republicans vs. Democrats in Congress, Republicans should have at least a majority of the House of Representatives. Thus, it is highly unlikely that further drug price reform legislation will be enacted into law in the next Congress. On the other hand, without a large Republican majority in either the senate or the House, it is also highly unlikely that the drug reform law of 2022 will be repealed.

So what does the future hold? Well, none of us have a crystal ball. However, overall, going forward into 2023, a major overhang of the pharma/therapeutics stock sector has been lifted. Thus, in our view the mid-term election results will be seen as a long-term positive factor for biotech stocks. Now, the fate of the biotech sector during this upcoming Congress will be more affected by the other factors listed in Table 1.

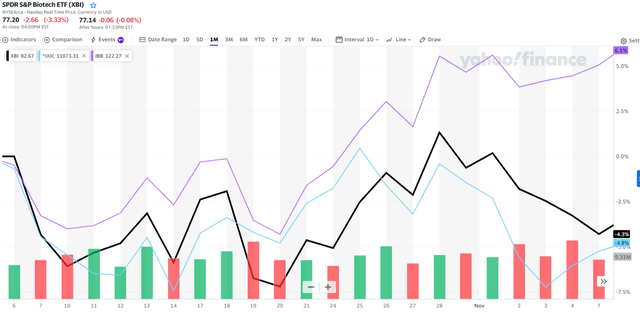

From our perspective at BPIQ/Amp, we are bullish on the biopharma sector moving forward into 2023. More precisely, we are more bullish on mid and large-cap biopharma than small and micro-cap biopharma because of the challenging current economic conditions combined with increasing interest rates. That is why although our tracking funds focus on micro, small and mid-cap (“smid-cap) biopharma, last month, for the first time, in our smid-cap biopharma Value fund we added a position in IBB, which is more heavily loaded with mid and large-cap biopharma than XBI, in addition to our position in XBI. Thus far, that has been prudent, as shown in the 1 month charts of IBB vs. XBI or the broader Nasdaq (IXIC)(FIG. 2). In our view, IBB is set up exceptionally well currently. However, in all of our funds, we will try to keep them as close to fully invested as possible based on their smid-cap biopharma strategies, especially as XBI hovers in the $70s/share, a historically low value.

FIG. 2 Performance of XBI vs. IBB and Nasdaq (IXIC) over past 30 days

Performance of XBI vs. IBB and Nasdaq (IXIC) over past 30 days (Yahoo Finance)

Our bullishness on biopharma moving forward into 2023 is supported by other factors besides a less drug-price control-focused Congress. For example, the uptick in biopharma M&A activity last month gives us more confidence that it is a good time to be invested in biopharma as opposed to staying on the sidelines with cash. In the coming months, there could be excursions of the volatile XBI into the $60s, but there is much more upside with XBI currently, than downside. Accordingly, there seems to be a reasonable chance of XBI moving back above $90/share (+17%), as it did in early August with some major biopharma M&A news, and possibly even over $100/share (+30%) in the next 12 months, than below the mid $60s/share (-13%).

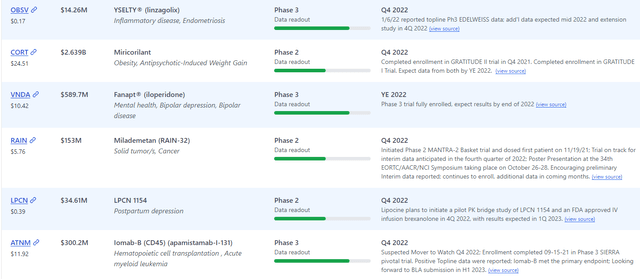

The fate of the biopharma sector, especially smid-cap biopharma, will depend on a continued uptick in M&A activity and the outcome of high-profile clinical readouts, of which there are many teed up for later this year and next. Our BPIQ.com catalyst calendar shows over 100 Phase 2, Phase 3 or PDUFA readouts expected by the end of the year, which is typically the busiest time of year for catalyst readouts (See FIG. 3). Finally, with the annual JPM Morgan Healthcare Conference approaching in early January, attention on biotech and biopharma M&A activity is more likely to increase, especially since we are going into this key time in the annual biotech/biopharma cycle without drug-price reform hanging over the sector.

FIG. 3 Screenshot of some of the upcoming Phase 2/Phase 3 readouts by the end of the year (Source – BPIQ.com catalyst calendar).

Upcoming FDA clinical trial catalyst readouts (bpiq.com)

*This article is intended to be factual in nature. There are many factors that influence your and our political viewpoints and Congress and the President’s stance on drug price reform is only one of many factors.

**The Inflation Reduction act for the first time authorizes Medicare to negotiate the prices of some high-cost prescription drugs with pharmaceutical companies, put s an annual $2,000 limit on how much Part D prescription drug plan members will have to pay out of pocket for their medications, and levies tax penalties on drugmakers that increase product prices by more than the rate of inflation. The new law also caps the cost of Medicare-covered insulin at $35 a month and eliminate s out-of-pocket costs for most vaccines under Medicare.

[ad_2]

Source links Google News